- Ben Tre was the 8th most competitive province for doing business in Vietnam in 2020, despite ranking 46 out of 63 provinces in terms of GRDP.

- In addition to its traditional strengths in agriculture production, food processing, garment, and packaging, Ben Tre has recently become an attractive investment destination for the renewable energy sector.

- With a lower rate for corporate income tax (CIT), land rentals, and labor costs, Ben Tre is poised to become the next leading investment destination in Vietnam’s Mekong Delta region.

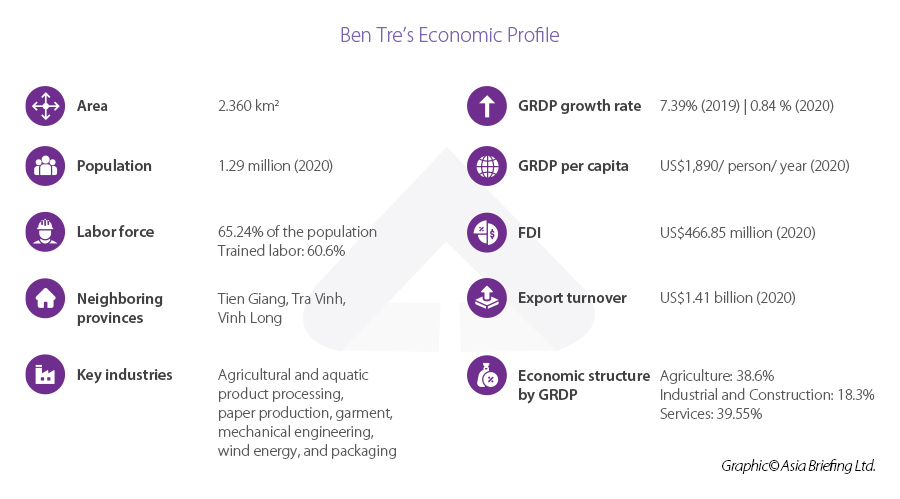

Ben Tre province is an isle wedged between the two main branches of the Tien Giang River, which is one of the two main branches of the Mekong River. The province has a natural area of 2,360 square kilometers with the South China Sea to its east and the provinces of Tien Giang, Tra Vinh, and Vinh Long bordering the west and south sides of the locality. The province is 86 km away from commercial center Ho Chi Minh City and 120 km away from Can Tho - the center of the Mekong Delta region.

Ben Tre is home to above 1.29 million people as of 2020, with 65.24 percent in the working-age and about 60.6 percent of the labor force as trained workers.

As the province is rising as an attractive investment destination in the Mekong Delta region in Southern Vietnam, we examine the investment climate of Ben Tre and key factors that make it considerable for investors.

Ben Tre statistics

In 2020, Ben Tre’s gross regional domestic product (GRDP) reached US$2.4 billion, recording a growth of 0.84 percent despite the impact of COVID-19. The regional GDP per capita stood at US$1,890 per person per year.

Its GRDP bounced back to 6.47 percent in the first half of 2021 with the production of agriculture and industrial activities rising by 7.29 percent and 10.59 percent respectively. Before the pandemic, the GRDP growth rate of the province consistently stood above 7 percent.

Agriculture

Like any province in the Mekong Delta, the agricultural, forestry, and fishery sector remains a key driver of Ben Tre’s economy, accounting for 38.6 percent of its GRDP in 2020.

As the ‘Kingdom of Coconuts’ in Vietnam, Ben Tre has more than 73,987 hectares for coconut farming with an output of 645 billion coconuts per year and above one hundred businesses operating in this field. This has created a million-dollar industry for Ben Tre with the export turnover of coconut-based products reaching roughly US$346 million last year, accounting for almost 25 percent of the provincial total export turnover.

Additionally, leveraging on its diverse ecological features with various water resources including salt-, saltish-, and fresh-water, and plenty of seafood resources, the locality is a major producer of rice, fruits, flowers, and plants, as well as aquatic products in the South of Vietnam.

In 2020, the total output of aquatic products in the province hit 533,788 tons, an increase of 4.72 percent compared to the previous year. Catfish, white shrimps, and black tiger shrimps are the most popular products with a total output of 174,790 tons, 68,930 tons, and 1,860 tons respectively. The key export markets for Ben Tre’s aquatic products are the US, EU, Japan, China, and Taiwan.

Industry and service sector

Together with agriculture and aquaculture, the service sector is also a major contributor to Ben Tre’s GRDP. As this sector has grown significantly in recent years, it overrode agriculture to become the largest component of the provincial economic structure, taking up 39.55 percent. This made the industrial and construction sector, despite seeing steady growth, the smallest economic area with a proportion of 18.3 percent.

Despite its modest contribution to the regional GDP, the industrial and construction sector of Ben Tre has grown vastly in recent years. Agricultural and aquatic product processing, paper production, garment, mechanical engineering, wind energy, and packaging are among the most developed industries and play a vital role in attracting foreign direct investment.

Foreign direct investment

Until June 2021, Ben Tre has a recorded 61 foreign direct investment (FDI) projects with a total registered capital of above US$1.71 billion. Most investors in the region come from China, the EU, Thailand, South Korea, Japan, the Netherlands, and Taiwan with most of the investment pouring into agricultural and aquatic products processing, supporting technology for automobiles, leather shoe production, garment, and renewable energy.

Renewable energy by far has been a key engine for FDI attraction to Ben Tre. In 2020, five out of eight FDI projects in the province were for wind power development, increasing provincial FDI by more than 97 percent compared to 2019. Marshal Global Renewable Power Private Limited, Mekong Wind Power Joint Stock Company, Panda Green Energy Group Limited, JR Energy Limited are the major players in this sector.

To fully develop its potential and advantages for economic growth, the local authorities have prioritized hi-tech agriculture, hi-tech food processing, renewable energy, education, healthcare, industrial park construction, urban development, and eco- and cultural tourism as key areas for investment attraction. In addition, the Government also encourages more projects into shrimp value chains and fishery logistics to boost the provincial production and export capacity.

Investors interested in opening investment opportunities in the province can visit the Investment Promotion Center – South Vietnam portal for further details.

Infrastructure

With an interlaced network of rivers and canals, transportation in Ben Tre relies a good part on its waterway system. The province has three seaports including Binh Thang Port, An Thuy port, An Nhon Port, and a river port named Giao Long. Among these, the Giao Long river port – with a capacity of over 200,000 tons per year – plays a crucial role in the connectivity between Ben Tre and major economic centers of the country.

While the river system is convenient for the waterway traffic, it causes a certain level of difficulty for the roadway connecting the province with other cities. As the province is separated by the Tien Giang river, Rach Mieu and Co Chien bridge are currently the only two main gateways connecting the province with the Southern key economic region and the neighboring provinces in the Mekong Delta.

Although local authorities have made a prime focus on developing the road infrastructure of the province, it would take time and resources to accomplish its plans until the roadway travel time and distance between Ben Tre and other provinces can be shortened. However, this also creates opportunities, as the provincial authorities have called for public-private partnerships (PPP) to develop its infrastructure; investors operating in the construction and urban development area can seize these opportunities to invest in the province.

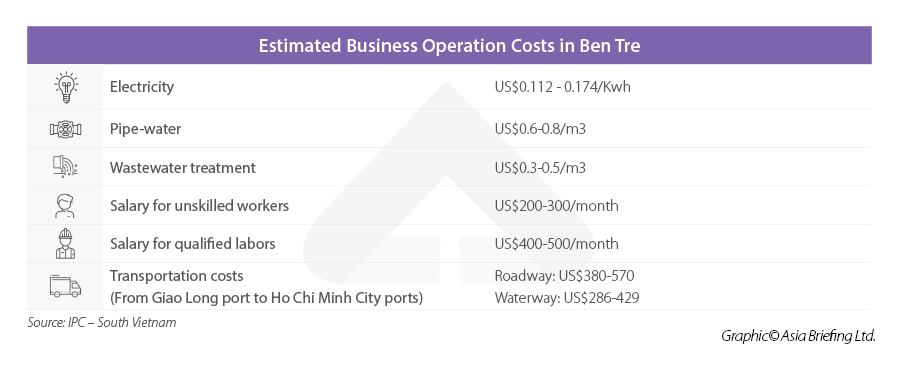

In terms of industrial development, as of 2020, Ben Tre had 10 industrial clusters with a total area of 347.3 hectares under establishment. Nine out of 10 clusters already have a detailed execution plan, among which 234.45 hectares will be used for industrial activities. As of now, only 23.3 percent of the sum is occupied. As the province’s potential for industrial activities has not yet been fully explored, the operational costs for production in Ben Tre remain relatively low.

Investment incentives

Despite ranking 46 out of 63 provinces in Vietnam in terms of GRDP, Ben Tre was the 8th most competitive province for doing business in Vietnam according to the Provincial Competitiveness Index 2020.

In addition to the incentives stipulated by the State, Ben Tre province offers a variety of incentives and policies to attract investment, including a lower rate for corporate income tax (CIT) and land rentals, a longer period of exemption for land leasing fees, and support in site clearance as well as worker training.

Besides, the low labor cost, one-price policy for electricity, water, and telecommunications to all domestic and foreign investments, combined with the proactive support from the local authorities are among the key incentives for investors to develop a business here.

However, investors looking to running a business in Ben Tre should be prepared to cope with the typhoon season and the saline intrusion that may affect their business operations as the province is one of the most vulnerable areas to climate changes in the Mekong Delta.

Seizing opportunities

While challenges remain, Ben Tre has many advantages to become one of the leading investment destinations in the Mekong Delta.

As the province aims to become a well-developed body by 2025 and of the whole country by 2030, investors can take advantage of its growing momentum to stay on top of the various emerging opportunities posted in the province.

For further advice on a particularly suitable location for your potential investment and how to effectively establish a business in the province, investors can talk to our experts to position themselves for success and minimize any risks that may expose them to business operations here.