Vietnam's machinery and equipment industry has been growing significantly, contributing to increased GDP and sub-sector industries. Vietnam Briefing takes an in-depth look and highlights key trends and opportunities for foreign investors in the industry as Vietnam pushes ahead with its growing economy.

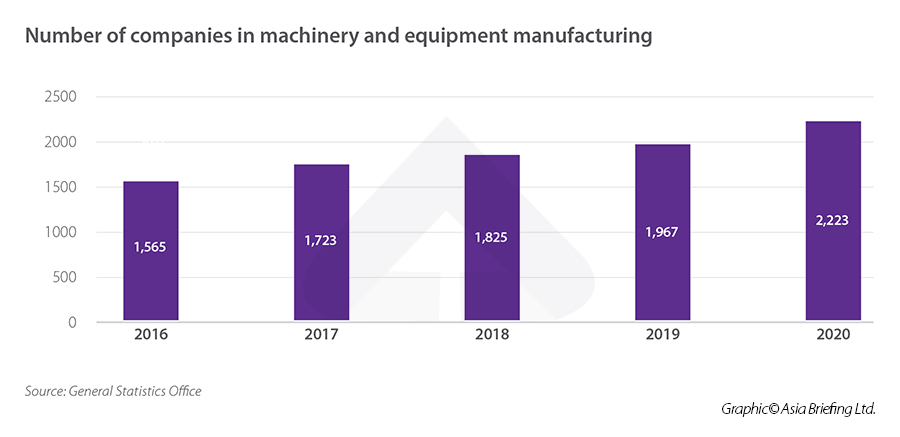

Vietnam’s machinery and equipment sector has expanded substantially in the last decade. This is proved by the net revenue recorded by companies operating in this industry increasing at a compound annual growth rate (CAGR) of 14.3 percent between 2010 and 2019. Until 2020, there were over 2,200 companies specializing in the production of machinery and equipment in Vietnam, earning total revenue of US$4.6 billion.

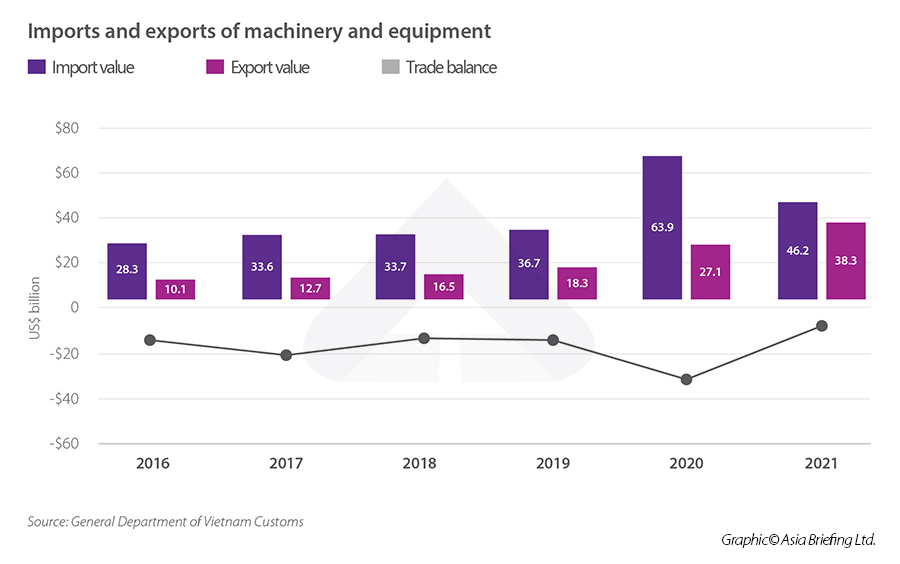

Despite a promising market, domestic machinery manufacturers have not been able to fulfill market demand. Only 32 percent of demand is supplied by local companies, according to the Vietnam Association of Mechanical Industry (VAMI). The remaining 68 percent of market demand is supplied by imported products due to significant demand and outdated production technology by domestic suppliers.

The dominant share of foreign suppliers for machinery and equipment in Vietnam has remained steady in the last decade. In 2021, the import value of machinery and equipment hit US$46.3 billion, an increase of 24.3 percent compared to the previous year.

Major suppliers of machinery to Vietnam have been Asian countries including China, South Korea, Japan, and Taiwan. These accounted for around 70 percent of the foreign sources for machinery in the Vietnamese market owing to their competitive prices and prevailing consumer preference. Other notable exporters have been ASEAN nations including Thailand, Malaysia, and Indonesia as well as western nations such as Germany, US, and Italy.

Opportunities for foreign investors in major industries

Agricultural machinery

Agriculture is historically an important economic sector of Vietnam where it contributed to 12.4 percent of the country’s GDP in 2021. However, around 30 percent of farms in Vietnam remain unmechanized.

In recent years, the sector has witnessed a converging trend of scattered small-scale farms towards concentrated large-scale businesses with an increasing focus on mechanization and automation. Accompanied by population growth, urbanization, and higher productivity demand with shrinking agricultural land, the growth in demand for agricultural machinery is expected to be robust in the coming years.

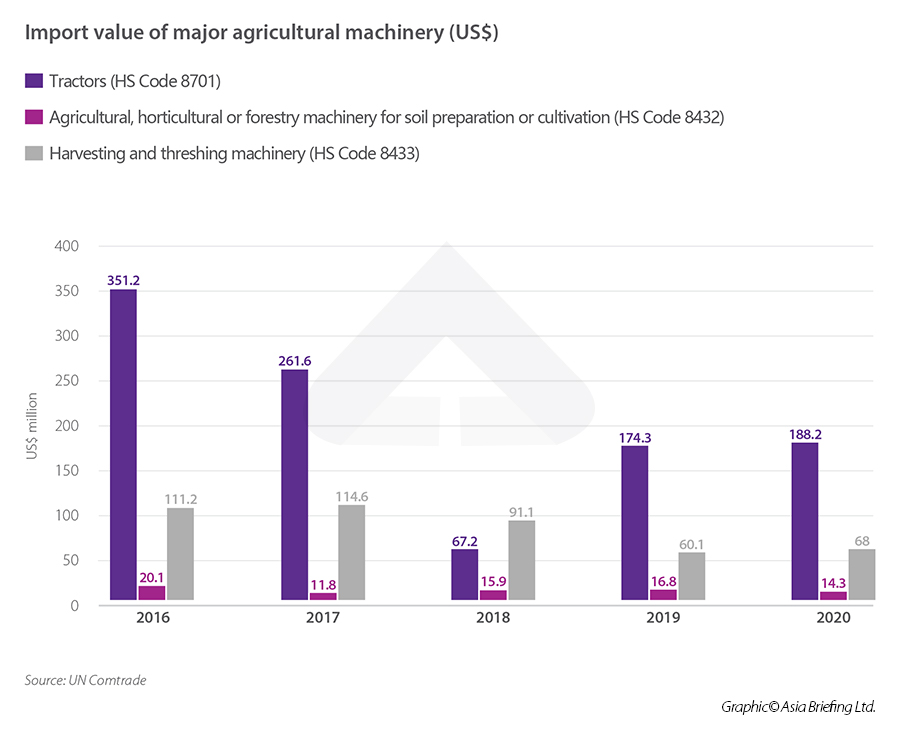

Meanwhile, Vietnam is only self-sufficient for 30 to 40 percent of agricultural machinery with the remaining machinery imported mostly from China and Japan. That said, the agricultural machinery manufacturing segment is growing rapidly and has somewhat offset the gap between domestic supply and market demand. Import value of key products, including tractors, soil preparation, cultivation, and harvesting machines, has declined at a CAGR of 13.5 percent during the 2016 to 2020 period.

Both foreign and domestic players are active in the agriculture machinery market.

Domestic enterprises play vital roles in this segment since these companies rely more on direct sales rather than distributing products through agents and third-party distributors. Additionally, Vietnamese companies tend to better understand and capture the need of local farmers.

Leading companies in the segment are Vietnam Engine and Agricultural Machinery Corporation (VEAM), Hanoi Agricultural Machinery and Agricultural Extension Company (HAMCO), and Vietnam Institute of Agricultural Engineering and Post-Harvest Technology (VIAEP).

Leading foreign companies operating in Vietnam include Kubota, Iseki and Yanmar (Japan), CNH Industrial (USA-Italy), CLAAS KGaA GmbH (Germany), Buhler (Switzerland), ShanDong Huaxin Machinery (China), and Tong Yang Moolsan (South Korea). These brands depend mostly on their agent and distributor network to enter and expand in the Vietnamese market.

Besides manufacturing and distributing in Vietnam, emerging opportunities for foreign machinery brands lie in technology transfer for local companies and custom hiring in a densely cultivated region.

A notable role model is the cooperation between Truong Hai Auto Corporation (THACO), the local automotive giant, and LS Mtron, the leading agricultural machinery producer from South Korea. THACO recently opened a US$22 million plant in Chu Lai Open Economic Zone (Quang Nam province) to produce agricultural tractors, harvesters, and farming equipment.

The corporation acquired technology and training from LS Mtron. LS Mtron transfers tractor production technology to THACO and assists THACO in training engineers in order to help the Vietnamese producer to reach a regional value content of up to 50 percent.

Another emerging business model is custom hiring of agriculture machinery as the local production of agriculture machinery is inadequate. Agricultural co-operatives and private enterprises are the providers of machinery for hire. Tillage, harvesting, threshing, drying, grain storage, and transportation are handled by companies that provide hiring services. Such businesses are predominantly in the Mekong River Delta and Red River Delta regions.

Industrial machinery

Recently, Vietnam become a major alternative manufacturing destination for businesses that are seeking to diversify their supply chain amid uncertainties caused by the pandemic and the US-China trade war.

In 2020, Vietnam had about 110,000 firms in the manufacturing sector, which was approximately 2.5 times higher than in 2010. Net revenue of manufacturing industries went up from US$100 million in 2010 to nearly US$450 million in 2019.

However, GSO’s survey on manufacturing and business conditions of Vietnamese enterprises in 2021 revealed that the old and underdeveloped production lines of roughly 20 percent of industrial enterprises have a significant adverse effect on their business operations.

Further, businesses are also banned from importing used machinery that is more than 10 years old under Decree No 18/2019/QD/TTg on imports of used machinery, equipment, and technological lines.

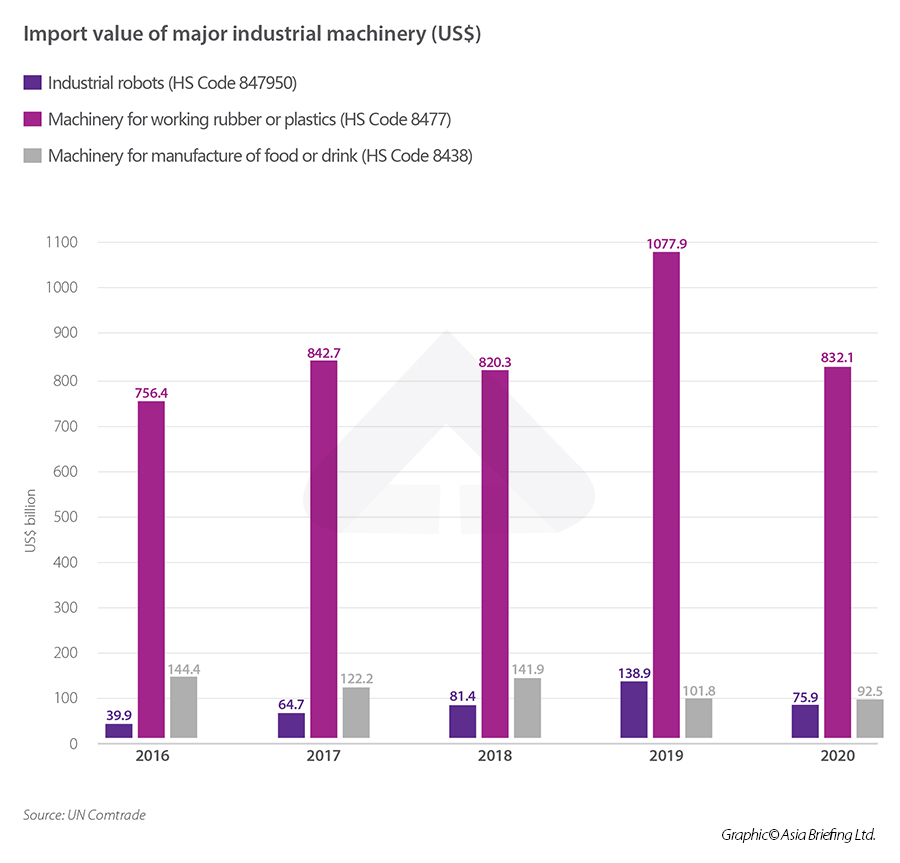

Accompanied by a rising number of new businesses joining the market, there is an increasing demand for new industrial machinery, especially in the food, pharmaceutical, plastics, and chemical industries.

Major machinery, especially high-tech and complex ones, are still imported.

Going forward, the most promising segment for foreign businesses is robotics and automation. According to a survey by the Provincial Competitiveness Index (PCI), from 2018 to 2020, 67 percent of both foreign and domestic investors automated a part of their operations, while 75 percent plan to automate new tasks during the next three years.

In 2021, the robotics and automation market in Vietnam was estimated to be worth US$184.5 million. The market is dominated by foreign brands, including ABB, Yaskawa, Fanuc, Kawasaki, Kaku, Universal Robot, etc. These leading brands' customer base in Vietnam are mostly large-scale foreign-invested and private corporations with sufficient budget for investment in automation. They work closely with the authorized distributors and dealer networks in Vietnam to expand their footprint.

Construction machinery

The Vietnam construction equipment market has grown in recent years, owing primarily to its expanding construction and infrastructure development projects.

There were over 91,000 contractors operating in Vietnam as of 2020, with around a half specializing in residential construction. However, Vietnam does not possess advanced construction equipment manufacturing capability and therefore depends almost exclusively on imported machinery.

Vietnam mainly imports machines from Japan, China, and the US with well-known brands like Komatsu (Japan), Hitachi (Japan), Kobelco (Japan), Doosan (Korea), Hyundai (South Korea), Daewoo (South Korea), and Caterpillar (US).

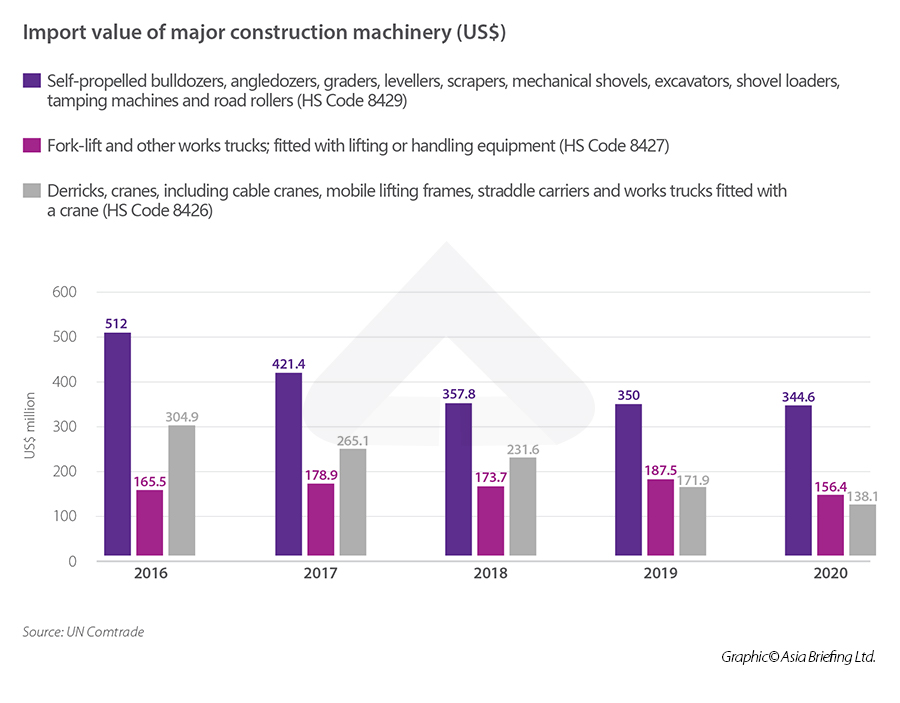

In terms of equipment types, earthmoving equipment leads the overall Vietnam construction equipment market, primarily due to the country's expanding public infrastructure facilities. Cranes and material handling equipment are also seeing growth in the market.

Overall, the Vietnamese market for construction equipment is especially attractive to machinery rental businesses. New equipment comes with substantial investment while renting used machinery reduces significant investment as well as transportation, storage fees, interest on loan amounts, registration, insurance, and tax on new equipment for contractors.

Key success factors for foreign rental firms in the market include appropriate pricing strategy, diverse and updated product portfolio, qualified operator crew, and strong partnership with other stakeholders in the market.

Market entry strategy

The machinery and equipment market in Vietnam is relatively open to foreign investors. Market access conditions are mainly in terms of environmental protection for investment in manufacturing. Additionally, 100 percent foreign-owned companies are allowed in the manufacturing and trading business of machinery and equipment.

The optimal market entry strategy for foreign businesses will vary depending on multiple factors, including the budget for investment and the development of supporting industries in Vietnam.

However, establishing a subsidiary in Vietnam or collaborating with a partner, either through a distributor or an original equipment manufacturer (OEM), are two of the most common options for multinational machinery brands.

Investing in the machinery sector

Foreign machinery companies considering opening a manufacturing and trading facility in Vietnam to produce and distribute their products locally as well as export to other markets should take into account a significant investment as well as the feasibility of structuring a stable supply chain for the Vietnamese factory. Even though Vietnam's mechanical engineering sector is rapidly expanding, only a small percentage of manufacturers are able to generate products that achieve international quality standards.

Establishing a trading company to import and distribute the machinery of the parent company is a suitable option for investors with a limited budget or who are unable to find adequate local suppliers for parts and components. Employing a local team under the parent company has also proven to be efficient in terms of branding and managing the dealer network.

Connecting with local partners

Some foreign enterprises with a limited investment budget that would like to test the market may choose to work with local partners such as machinery distributors and dealers, as well as original equipment manufacturers (OEMs). Even if they are not physically present in the target market, collaboration with a local firm is an economical market entry strategy.

Local firms serving as authorized distributors are a beneficial business channel due to their in-market experience and high-value network of dealers and users, which will help new businesses reach their potential clients within a shorter timeframe and with less effort.

Collaboration with OEMs can be a successful model for some brands. However, this strategy depends largely on the type of machinery. Local producers have proven their strong capability in terms of agriculture machinery lines while being less competitive at complex industrial equipment and heavy construction machines.

Regardless of the market entry strategy, foreign brands should consider and focus on one vital factor, which is a well-developed dealership network. These dealers contribute to brand awareness and provide a comprehensive sales and service network that support their products.