The Global Minimum Tax (GMT) is an international tax reform initiative aimed at addressing tax base erosion and profit shifting by multinational corporations. It sets a floor on corporate tax rates globally, ensuring that large companies pay a minimum level of tax regardless of where they are headquartered or operate.

GMT holds significant importance in the global economy as it promotes fair taxation and prevents profit shifting, where companies move profits to low-tax jurisdictions to reduce their tax liabilities.

This article aims to provide a comprehensive understanding of how the Global Minimum Tax is being implemented in Vietnam.

Background of Global Minimum Tax (GMT)

The genesis of GMT can be traced back to efforts by the Organization for Economic Cooperation and Development (OECD) to address aggressive tax avoidance strategies employed by multinational corporations. These strategies often involved shifting profits to low-tax jurisdictions, thereby eroding the tax bases of countries where economic activities genuinely took place. The Base Erosion and Profit Shifting (BEPS) project, launched by the OECD and G20 in 2013, laid the groundwork for GMT. This project aimed to reform international tax rules to ensure that profits are taxed where economic activities and value creation occur.

The culmination of these efforts was the agreement on the GMT framework, formally endorsed by the G20 finance ministers and central bank governors in 2021.

The implementation of GMT has been a collaborative effort involving key stakeholders, including the OECD, G20, and various national governments. The OECD has been at the forefront, providing the technical framework and guidelines for GMT, while the G20 has played a pivotal role in garnering political support and consensus among the world's largest economies.

In Vietnam, the National Assembly of Vietnam announced plans to implement GMT starting January 1, 2024, particularly Resolution 107/2023/QH15 dated 29 November 2023 (“Resolution 107”). This move aligns Vietnam with the global tax reform movement and impacts approximately 100 major foreign-invested companies operating within the country. These companies, which have historically benefited from preferential tax rates, will now be subject to the minimum 15 percent tax rate. Prominent multinational corporations like Samsung, Intel, and LG, which have significant investments in Vietnam, are among those affected by this change.

The Vietnamese government anticipates that the GMT will not only align the country with international tax standards but also potentially increase tax revenues. Companies currently enjoying corporate income tax rates below the GMT threshold will see their tax liabilities adjusted upwards, contributing to the state budget.

Why is Global Minimum Tax important?

Addressing tax avoidance and profit shifting

One of the primary motivations behind the Global Minimum Tax (GMT) is to tackle the widespread issue of tax avoidance and profit shifting by multinational corporations. These practices have allowed companies to exploit gaps and mismatches in tax rules, shifting profits to low or no-tax jurisdictions, thereby significantly reducing their tax liabilities.

By setting a minimum tax rate of 15 percent for large corporations, GMT aims to close these loopholes and ensure that multinationals pay a fair share of taxes in the countries where they generate substantial economic activity and profits. This approach not only protects the tax bases of high-tax jurisdictions but also curtails the incentive for companies to engage in aggressive tax planning strategies.

Ensuring fair tax contributions from multinational corporations

The implementation of GMT is crucial for ensuring that multinational corporations contribute fairly to the economies in which they operate. Historically, some of the world's largest companies have paid minimal taxes relative to their profits, leveraging complex tax structures and the availability of tax havens. This has created an uneven playing field, disadvantaging smaller, domestic businesses that do not have the same capacity for tax avoidance.

By enforcing a global minimum tax rate, GMT levels the playing field, making sure that all businesses, regardless of size or geographical reach, are subject to a baseline tax obligation. This reform promotes fairness and integrity within the global tax system, compelling multinationals to pay their due share of taxes.

Promoting economic equity and sustainability

Beyond addressing tax avoidance, the Global Minimum Tax also plays a pivotal role in promoting economic equity and sustainability. Ensuring that multinational corporations contribute adequately to public finances supports the funding of essential public services such as education, healthcare, and infrastructure.

Furthermore, the additional tax revenues generated from GMT can be reinvested into sustainable development initiatives, driving long-term economic stability and resilience. By supporting a fairer distribution of tax burdens, GMT not only enhances fiscal sustainability but also contributes to the broader goal of economic justice.

GMT Implementation in Vietnam

Vietnam's current tax system is characterized by a relatively moderate corporate income tax (CIT) rate, set at 20 percent. However, to attract foreign direct investment (FDI), the country has historically offered generous tax incentives to multinational corporations, particularly in the manufacturing and processing sectors. These incentives have often reduced the effective tax rate for foreign-invested enterprises (FIEs) to below 15 percent, with some enjoying rates as low as 12.3 percent. As a result, FIEs contribute significantly to Vietnam’s CIT revenues, accounting for 39-41 percent of total CIT collections, which themselves make up 18-21 percent of the state budget.

The country is a member of the Organization for Economic Cooperation and Development (OECD) Inclusive Framework on BEPS (Base Erosion and Profit Shifting), which aims to implement consistent and fair tax policies worldwide. By embracing GMT, Vietnam supports the OECD’s Pillar Two initiative, which establishes a minimum effective tax rate of 15 percent for large multinational corporations.

To implement GMT, the new tax regime has been taking effect since January 1, 2024.

The Vietnamese authorities have also been proactive in assessing the broader economic implications of GMT. They have highlighted that the additional tax revenue generated from this reform could support various public investment projects and enhance the country's fiscal capacity.

Key components of Vietnam’s GMT framework

Tax rate and coverage

Vietnam’s implementation of the Global Minimum Tax (GMT) involves a mandatory minimum tax rate of 15 percent for multinational enterprises (MNEs). This tax rate targets MNEs with global revenues exceeding EUR 750 million (USD 812 million) in at least two of the last four fiscal years. The scope of this framework is designed to encompass large corporations that have traditionally leveraged low-tax jurisdictions to minimize their tax obligations.

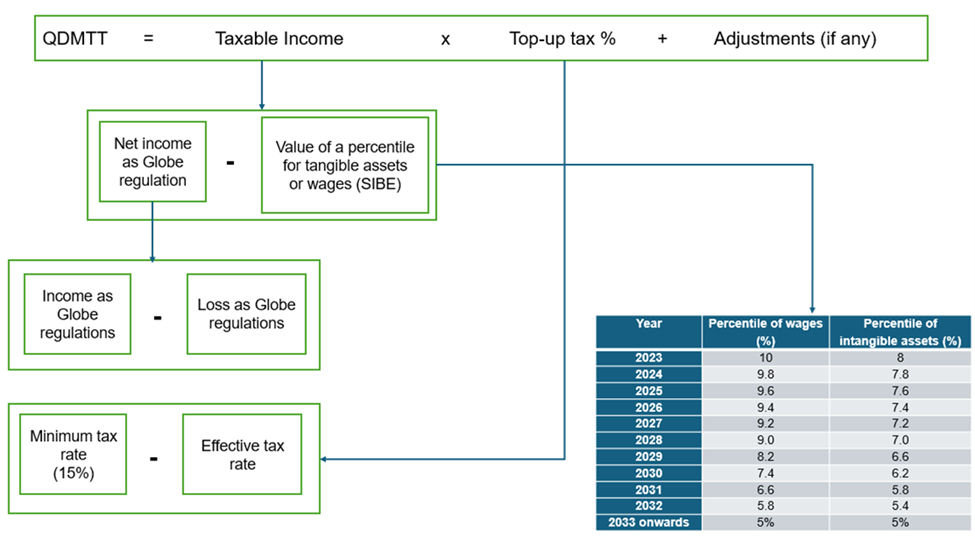

Income Inclusion Rule (IIR) and Qualified Domestic Minimum Top-Up Tax (QDMTT)

Central to Vietnam’s GMT framework are the Income Inclusion Rule (IIR) and the Qualified Domestic Minimum Top-Up Tax (QDMTT). The IIR is a mechanism that requires ultimate parent entity, partially-owned parent entity, intermediate parent entity, directly or indirectly owns an ownership interest in low-taxed constituent entities located in other jurisdictions under the GloBE rules at any time during the fiscal year to pay the difference between the effective tax rate paid by its subsidiaries and the 15 percent minimum rate, if the subsidiaries' tax payments fall below this threshold.

The QDMTT complements the IIR by allowing Vietnam to impose its own top-up tax on domestic subsidiaries of foreign MNEs if their effective tax rate is below 15 percent. This ensures that Vietnam captures additional tax revenue domestically before it is collected by the parent company's home country under the IIR. The QDMTT helps maintain tax equity and retains fiscal benefits within Vietnam, supporting national development goals.

Following the Article 4 and 5 of Resolution 107, it provides some specific guidance as below

Compliance requirements

- Multinational enterprises subject to the GMT must submit their tax returns annually.

- Returns must include comprehensive details on global income, taxes paid, and calculations for additional tax due under GMT rules.

- Clear guidelines on documentation and reporting are provided to facilitate compliance.

- The General Department of Taxation (GDT) oversees enforcement to ensure accurate reporting and tax obligation fulfillment.

- QDMTT and IIR payments are required within 12 and 15 months after the end of the fiscal year, respectively, with an extension available to 18 months for the initial year.

- Significant penalties are imposed for failure to comply with the new regulations.

The time limit for submission of declarations of QDMTT, top-up tax enclosed with a written explanation for differences between financial accounting standards and payment of top-up tax is 12 months after the end of the fiscal year.

Below is a summary of compliance requirements for ease of tracking:

|

|

QDMTT |

IIR |

|

Effective date |

From 01 Jan 2024 onwards |

From 01 Jan 2024 onwards

|

|

Minimum tax rate |

15% |

15% |

|

Submission deadline |

12 months after the end of a tax year (first declaration and payment at the end of 2025) |

18 months after the end of a tax year for the first year of declaration (first declaration and payment at the end of Q2.2026)

15 months after the end of a tax year for the subsequent years |

|

Declaration forms |

|

|

|

Special submission case |

|

|

Impact of GMT on businesses in Vietnam

The implementation of the Global Minimum Tax (GMT) will significantly impact multinational enterprises (MNEs) that have benefited from Vietnam's corporate income tax incentives. These incentives have traditionally allowed many MNEs to enjoy effective tax rates below the new GMT threshold of 15 percent. As a result, these companies will now face higher tax liabilities, which could affect their cash flow and profitability.

Additionally, MNEs will need to navigate new administrative challenges, including the complex calculations for annual effective tax rates (ETR) and top-up taxes. Compliance with these new requirements will necessitate enhanced tax reporting and documentation processes, potentially increasing operational costs and administrative burdens.

While the GMT primarily targets large multinational corporations, its implementation may also have implications for domestic businesses in Vietnam. Companies that currently benefit from preferential tax rates will need to adjust to the new tax landscape, potentially facing increased tax burdens. This shift may require businesses to revisit their financial strategies and tax planning to ensure compliance with the new regulations.

The introduction of the GMT will have varied effects across different industries in Vietnam. Sectors heavily populated by foreign direct investment (FDI), particularly high-tech manufacturing and processing industries, are expected to be the most affected. Companies like Samsung, Intel, and LG, which have substantial investments and benefit from Vietnam’s tax incentives, will face increased tax obligations. These industries will need to evaluate the financial implications of the GMT and consider strategies to mitigate its impact.

On the other hand, sectors that rely less on tax incentives may experience minimal direct impact from the GMT. However, the overall business environment could shift, as the government might introduce new investment incentives or support measures to maintain Vietnam's attractiveness as an investment destination. These could include cost-based incentives such as grants for research and development (R&D), infrastructure investment, and workforce development, aimed at offsetting the increased tax burdens and promoting sustainable growth.