- Vietnam’s resilient economy, its control of the pandemic, and export-oriented economy have made investors take note, turning into an effective China plus one destination.

- While Vietnam is not without its share of challenges, it has emerged as one of the most promising ASEAN countries for the Australian wine industry.

- As Australian wine is subject to Chinese tariffs, Vietnam Briefing highlights the reasons why Vietnam is a strong contender for Australian wine producers looking to diversify their market.

Vietnam’s resilient economy and control of the pandemic have made investors note the country’s rising economic stature. Among products that have seen considerable growth in sales over recent years has been wine. Starting from a very low level, the Vietnam wine market is booming, with hotels, restaurants, and retailers now offering a wide variety of wines from around the world.

This has taken further prominence due to China’s recent tariffs of over 200 percent on Australian wine for a five-year period. While this has left Australian winemakers looking for alternative markets, ASEAN countries, such as Vietnam, are emerging as key wine trading partners.

Tackling Vietnam’s burgeoning wine market is one of Australia’s strategies to cope with the losses incurred due to the pandemic. Alongside, it will establish a new, stable, and reliable trade partnership as China reduces its consumption of Australian wine.

The South Australian Wine Industry Association announced in 2020 its plan to look for new partners in ASEAN and diversify exports.

Vietnam Briefing takes an in-depth look at Vietnam’s wine industry and opportunities for Australian investors affected by China's tariffs.

ASEAN countries including Vietnam are emerging as key wine trading partners. In these low-price-sensitive markets, the popularity of Australian wine is growing as it becomes cheaper thanks to customs duties exemptions and free trade agreements. This growth is further supported by the increase of tourism in these regions, which counteracts religion-related factors that could shrink the number of potential consumers.

Recently, Vietnam has become the wine industry’s focus of interest. This transitional and promising alcohol market could become Australia’s strongest trade partner, to compensate for the loss of China, but also to mitigate the effects of the pandemic suffered by the industry.

Cheap beer is highly popular in Vietnam but is increasingly competing with wines, as tastes change, and a growing middle class demands higher quality alcohol.

Wine is now a staple at many social interactions, such as business dinners.

Currently, Vietnam’s local wine market features wines from such areas as France, Italy, Chile, the US, and Australia. The best-selling wines are reds with around 65 percent of the market, followed by whites with 25 percent, and sparkling wines with 10 percent.

Industry Opportunities

Growing middle class with increasing income

Vietnam’s population is projected to reach 101 million by 2025 with the working-age population accounting for 60 percent of the total, and a median age of 30. Further, Vietnam’s middle class is expected to reach 95 million by 2030 – the fastest growth rate in Southeast Asia as per market research firm Nielsen.

Going further, wine producers can target major cities such as Hanoi, Ho Chi Minh City, and Da Nang, which have working professionals that are well-educated and well-traveled.

In addition, corporate gifts represent a key market segment with the most popular occasions being the Vietnamese New Year festival or Tet which can generate up to 80 percent of wine sales. Companies in Vietnam also tend to spend on wine orders as end-of-year gifts for employees as well as partners.

Drinking culture

According to a survey conducted by the Ho Chi Minh City University of Education, most of the respondents agreed that drinking alcoholic products is to well observe social etiquette, exhibit a proper manner at work, and build and maintain social networking and business relationships. This mindset has existed in Vietnamese society for ages. In addition, Vietnamese people can consume alcoholic products for any celebrations.

The drinking culture also reflects on consumer behavior and understanding it is vital. Research conducted by Ipsos UU reveals crucial differences in alcoholic consumption behaviors of people living in the three main regions of Vietnam. Northern Vietnam-based consumers tend to be trend followers and pay strong attention to packaging, especially for gifted products, and have considerable knowledge of different brands.

Central Vietnam-based consumers tend to be reserved, less willing to try new brands, and prefer local brands. The absence of a variety of brands can be a key reason for this trend. By contrast, people living in Southern Vietnam are classified as easy-going consumers who are willing to try new brands and are knowledgeable about different brands.

Foreign brands preferred

Vietnamese people have seen vast improvements in their standard of living and consumer spending power, along with a strong obsession with foreign products, believing them to be of higher quality. Therefore, Vietnamese consumers nowadays are willing to pay more money to try higher quality products, thus creating room for imported products.

In addition, as the retail industry is moving away from traditional to modern retail, it is not difficult for consumers to find imported alcoholic products in supermarkets.

Free trade agreements

Vietnam’s myriad of free trade agreements (FTAs) has helped it further become competitive attracting foreign investors to relocate production or set up operations. The main objective of FTAs is to make an integrated market among country members by substantially reducing or fully liberalizing custom tariffs for imported products. Australian wine producers can make use of two free trade agreements the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA).

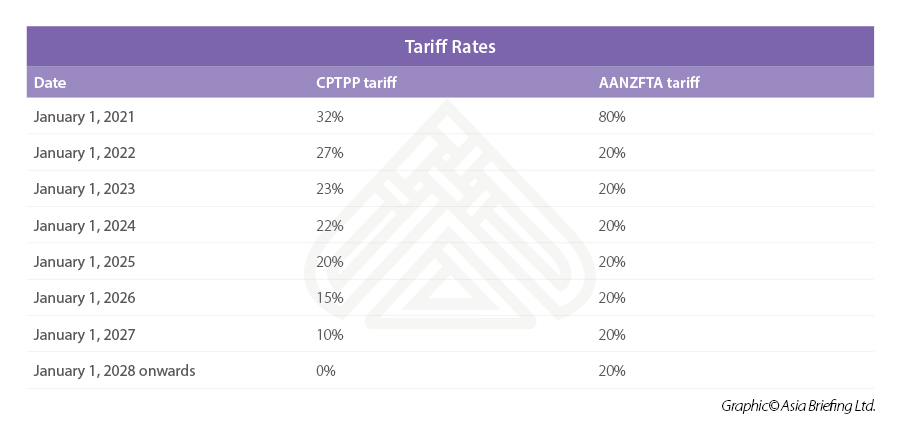

Investors should study the specific FTA that would best suit their market entry. For example, wine of fresh grapes (HS Code 2204) sees a tariff rate of 27 percent as per the CPTPP and 20 percent as per the AANZFTA by January 2022. However, by January 2026, as per the CPTPP, it would decrease to 15 percent lower than AANZFTA’s 20 percent and by 2028 it would go down to zero. (See below).

Industry Challenges

While Vietnam is open to foreign investment and has an open market policy, the government is known to protect the domestic industry. Exporters should be aware of frequent regulatory changes as well as the three district regions of the North, Central, and South. Investors should consider these factors when planning for market entry.

While there have been positive developments in the wine industry Vietnam still uses a range of protectionist policies that raise costs such as customs duties, excise duties, and value-added tax.

Market entry

There are several options for Australian investors to enter the Vietnamese wine market. Common market entry strategies can be to partner with a local partner, use a trader, distributor, or agent. Investors may also import products and distribute them to wholesale and retail channels. Investors can also choose between several office structures when entering the market, for example, a representative office (RO) offers a low-cost entry for companies seeking to gain a better understanding of the Vietnamese market.

Most recently, mergers and acquisitions (M&A) have become an increasingly popular route for investors looking to begin operations in Vietnam. With an M&A, investors can enjoy pre-existing access to consumers, locations, and distribution channels.

This local knowledge can prove critical to successful operations within Vietnam’s vibrant but rapidly changing investment environment. Investors that find it challenging to enter the Vietnamese market may find that the M&A route provides a unique solution to several obstacles.

What are the tariffs and compliances applicable to exports to the Vietnamese market?

There are several tariff and compliance regulations that suppliers should be aware of. These are:

- A US$50,000 import license for selling wine in Vietnam. The authorities grant liquor distribution and wholesaling licenses based on quotas.

- Advertising for the sale of wine is strictly regulated, as products with an alcohol content overcoming 15° cannot be mass-advertised and under 15° is restricted.

- Certificates and documents must be provided to public authorities to allow the import of wine in Vietnam – namely, but not only, a health certificate, a technical standard certificate, and a certificate of origin, in addition to product checking.

- A 50 percent import tax applies to all types of wines coming from Australia, resulting in preferential tariffs granted by the AANZFTA. Still, the CPTPP – to which Vietnam and Australia are signatories – will reduce tariffs to 20 percent in January 2022 and then to zero percent from 2028.

- A 65 percent Special Sales Tax (SST) is applied for wines with an alcohol content above 20 Any concentration under this is obligated to pay a 35 percent SST.

- A 10 percent Value Added Tax (VAT) on all kinds of liquor, including wines, sold on the Vietnamese territory.

Wine imports are regulated by Vietnam’s customs laws and other relevant regulations. Imported wine must also be inspected before clearing customs with import declarations either submitted before or 30 days after arrival. The product must also come with a certificate of origin which is used to determine the preferential tax rates. Duties are required to be paid before the delivery or shipment.

In addition, imports are subject to Vietnam’s labeling regulations, meaning that the product name/brand must be shown in Vietnamese.

Why Vietnam is an attractive wine market?

The Vietnamese wine market represents a significant opportunity for Australian importers and producers to tackle. Currently, it is said to be mainly held by French brands (at 35 percent) and Chile (at 25 percent), closely followed by Italian and Australian brands. The market brought US$5.3 million to Australia in 2020.

The alcohol competition in Vietnam is tough: wine competes with beer, which is cheap and very popular among all social categories. According to Vietnam Credit, nearly 75 percent of the population drinks beer.

At the same time, Vietnam’s consumption of alcohol increased by 95 percent from 2010 to 2020, meaning market growth is solid, and opportunities are multiplying.

Vietnamese lifestyles have certainly not yet integrated wine into their consumption habits but tastes and preferences are progressively westernized as the middle-class grows – three million people joined this group between 2014 and 2016. Vietnam already accounts for the third-largest ASEAN wine consumer market, as its consumption accounted for 15.3 million liters in 2020. According to the World’s Top Exports data, from 2018 to 2019, wine consumption increased by 173.6 percent.

Takeaways

Despite its difficulties, Vietnam offers an exciting opportunity for those involved in the wine industry. There is significant room for growth and growing interest amongst the public towards wine. The consumption of alcohol is a daily event for many Vietnamese, and with the nation’s growing consumer class, the number of consumers available over the coming years should be significant.

However, as with any emerging market, opportunity comes with risk. Investors should factor in several issues depending on the product and market size and do their due diligence when entering this vibrant market.