The telecommunications industry is a key driver behind Vietnam’s digital transformation. Telecommunications and other sectors in the information and communications technology (ICT) sector generated up to 8.2 percent of Vietnam’s GDP in 2021. As the country moves to implement the fourth industrial revolution, the telecommunications industry will play a vital role in the process.

The Vietnam telecommunication market size was worth US$6.3 billion in value in 2021, with a CAGR forecast of approximately 1 percent for the 2021-2027 period. The industry is set to scale further up as the digital transformation of businesses coupled with the pandemic has boosted soaring demand for internet and telecommunication services.

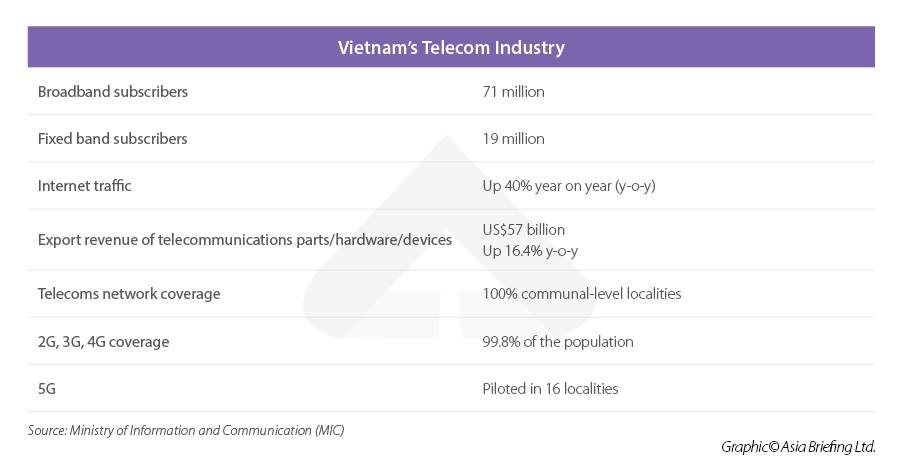

In 2021, 71 million mobile broadband subscribers and nearly 19 million fixed band subscribers were recorded, up by 4 percent and 14.6 percent respectively year on year. Meanwhile, an increase of 20 percent in the proportion of businesses utilizing the Internet of Things (IoT) was also reported in 2021, reaching 88.67 percent.

The overall performance of the telecommunications industry in Vietnam in 2021 can be observed in the following table.

The legal framework governing the telecommunications industry has been updated to promote the digital transformation of Vietnam. In January 2022, the Ministry of Information and Communications (MIC) updated Directive No.01/CT-BTTTT on the development strategy of the ICT industry, with specific goals for the telecom sector, for the 2022-2025 period.

The 2022-2025 goal of the telecommunications industry is as follows:

|

Annual goal |

2022 |

2023 |

2024 |

2025 |

|

Total revenue of the telecoms industry |

US$19.3 billion |

US$21 billion |

US$22.9 billion |

US$25 billion |

|

Contribution to GDP |

4.9% |

5% |

5.1% |

5.2% |

|

5G coverage (percent of the population) |

8% |

14% |

20% |

25% |

|

The rate of households with fiber optics |

75% |

84% |

93% |

100% |

|

Mobile broadband subscribers (on 100 people) |

85 |

90 |

95 |

100 |

|

Internet users (percent of the population) |

74% |

76% |

78% |

80% |

|

IPv6 users (percent of the population) |

52% |

57% |

65% |

70-80% |

The National Assembly has also approved the revised Law on Telecommunications and included it in the Law and Ordinance Development Program in Resolution No. 50/2022QH15.

The good news is, according to the representative of the Vietnam Internet Center, by June 2022, the rate of IPv6 had already reached 50%, achieving 96% of the goal as stated in the table. This has thus made Vietnam the country with the second highest IPv6 user rate in the ASEAN region and 10th worldwide.

Current competition in the telecommunications industry

Viettel Group, MobiFone, FPT, and VNPT are the current giants in Vietnam’s telecoms industry.

Since 2017 - the peak year in revenue for all telecoms players, only Viettel Group showed steady revenue growth. In 2021, the group generated VND 21.4 trillion (US$913 million), compared to a low of VND 4.3 trillion in 2017 (US$183 million). Meanwhile, MobiFone witnessed a fall from VND 940 billion (US$41 million) in 2017 to VND 710 billion (US$30 million) in 2021. The same pattern applied to the revenue of FPT as the corporation’s consolidated revenue peaked in 2017 at VND 42 trillion (US$1.7 billion) before dropping to VND 35 trillion (US$1.4 billion) in 2021.

This drop was attributed to the fact that traditional sectors in the telecommunications industry in Vietnam are shrinking, making way for new sectors. Viettel, on the other hand, foresaw the transition in the telecoms industry and was quick to adjust to the changing industry, which explained its revenue growth.

Recently, in April 2022, Viettel installed an undersea cable called the Asia Direct Cable (ADC) in Quy Nhon City, which will be in commercial use by 2023 to accelerate internet connection.

Other telecom giants are also preparing to step up their operations in the era of digital transformation.

Opportunities and entry barriers for foreign investors

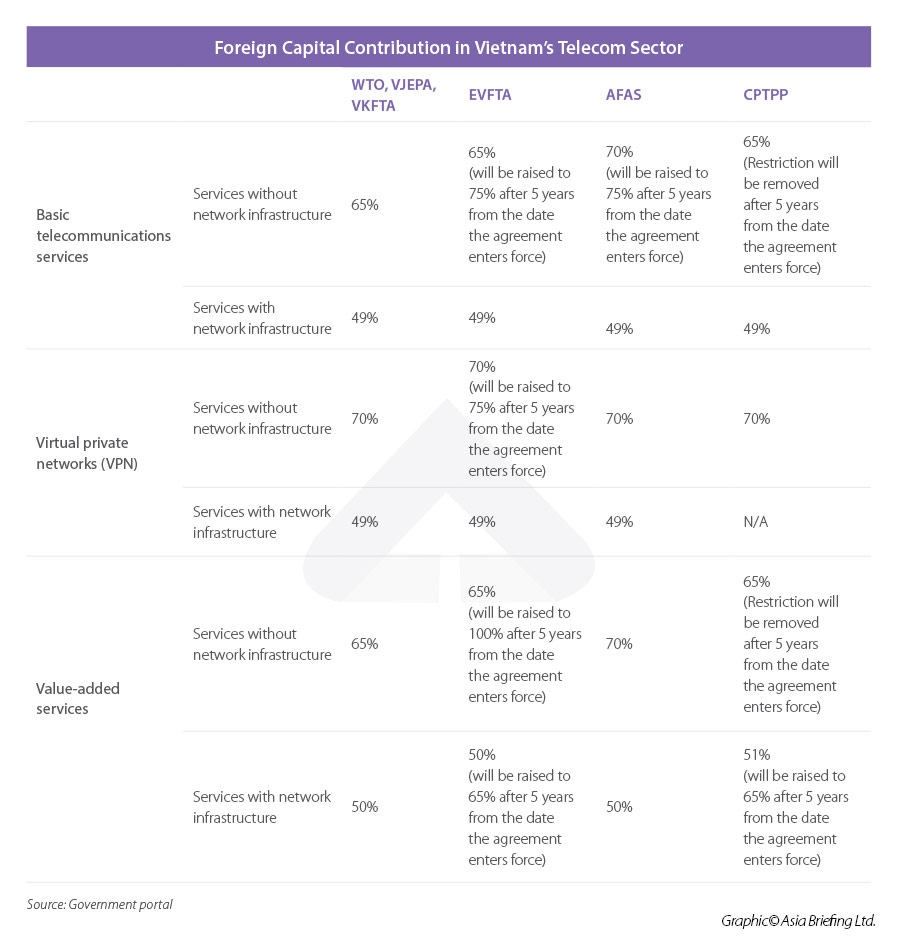

Due to high entry barriers, the telecoms industry in Vietnam is currently dominated by domestic players like FPT, NetNam, Viettel, and CMC, though CMC has 45 percent of shares owned by a Malaysian firm.

The Vietnamese government only allows foreign investment in the telecoms industry in the form of:

- Joint ventures, partnerships, or buying shares for basic telecommunications services;

- Purchase of shares, partnerships, joint ventures with telecommunications enterprises in Vietnam that have been licensed to establish a network infrastructure for services with network infrastructure

Any organization or individual that already owns more than 20 percent of the charter capital of a telecoms enterprise is not entitled to own more than 20 percent of the charter capital of another enterprise in the same segment.

However, foreign investors are allowed to own up to 100 percent of the undersea fiber optic cable transmission capacity ashore at the fiber optic cable station in Vietnam and can sell that capacity to any licensed telecommunications network operator in Vietnam.

The table provides the maximum percentage of foreign capital contribution allowed in the telecoms industry:

Incentives for telecoms firms

In December 2020, the government issued Decision No. 38/2020/QD-TTg, approving the list of high technologies and products eligible for incentive policies. The telecom industry enjoys incentives for the following segments:

- Advanced network technology including 4G, 5G, 6G, NG-PON, SDN/NFV, SD-RAN, SD-WAN, LPWAN, IO-Link Wireless, Network slicing, next-generation optical network;

- The Internet of Things (IoT) technology;

- Integrated systems of telecommunications;

- Equipment, software, modules, platforms, IoT integration solutions, and IoT platform services;

- New-generation signal encoding and decoding equipment; equipment for encapsulating and transmitting signals on the Internet platform, via next-generation telecommunications networks (4G, 5G, 6G); hybrid television equipment and systems (HbbTV), interactive television; and

- Operating systems for specialized computers and a new generation of mobile devices.

It should be noted that technologies that are currently not included in the list but meet the requirements in clause 3 Article 5, clause 1 Article 6 of the Law on High Technologies and are vital to socio-economic development, can seek a decision from the Prime Minister via the Ministry of Science and Technology.

Segments included in Decision 38 that are eligible for the following incentives as stated in Decision No. 13/2019/ND-CP:

- Land rental reduction or exemption for up to 15 years. In prioritized projects, the exemption can be for an indefinite time;

- Corporate Income Tax (CIT) exemption for up to 4 years, followed by 9 years of 50 percent CIT reduction;

- Preferential tax rate of 10 percent within 15 years, which can be extended for another 15 years depending on the decision of the Prime Minister or the Management Board of high-tech parks;

- Import duty exemption for imported goods, raw materials, supplies, and components that have not been produced domestically within five years;

- Can apply for financial aid from the National Hi-tech Development Program’s funding and other governmental funding;

- Preferential credit terms for certain science and technology enterprises; and

- Exemption from charges for use of machines and equipment in national laboratories for research and trial production.

Takeaways

In the context of digital transformation, the telecommunications industry in Vietnam is seeing major transitions and competition. With the issuance of Decision 38 and the implementation of different trade agreements, Vietnam’s telecoms industry is looking more attractive for businesses. Investors should look to channel investment into this dynamic market to enjoy preferential policies and a favorable business environment.

For more information on how best to tap into the growing telecoms industry in Vietnam, investors can contact our experts to discuss market entry and solutions for entry barriers.