Why Vietnam’s Expanding Digital Economy Presents Opportunities for Investors

- Vietnam’s on-going regulatory focus on digital transformation is expected to result in a 16 percent growth in the digital economy in 2020. By 2025, Vietnam’s digital economy could reach US$52 billion.

- Sub-sectors of the digital economy such as e-commerce, digital financial services, online gaming, and Industry 4.0 are likely to benefit from an increasing number of firms and consumers opting for digital products and services.

- Many regulations that govern the digital economy are nascent and investors should therefore study the regulations carefully before entering the market.

Vietnam’s digital economy is expected to reach US$14 billion in 2020, a year-on-year increase of 16 percent, and will likely reach US$52 billion in 2025, re-accelerating to nearly 29 percent in compound annual growth rate (CAGR).

This rapid growth is underpinned by a broader digital transformation in the country. Vietnam’s National Programme for Digital Transformation is aimed at ensuring more than 80 percent of households have access to fiber-optic infrastructure by 2025. The program also entails that the digital economy forms 10 percent of every sector which could result in annual productivity increases of 7 percent.

The COVID-19 pandemic has helped this transformation through a permanent and significant digital adoption spurt, with more than one in three Southeast Asian digital service consumers (36 percent of digital consumption in Southeast Asia) new to the service.

Vietnam Briefing discusses this shift and opportunities for investors in Vietnam’s digital economy.

Sub-sectors in Vietnam’s digital economy

E-commerce

A study found that Vietnam’s e-commerce market is likely to reach US$15 billion by 2025, up from 2.8 billion in 2018. This growth is motivated by increasing internet access, a relatively young population, and an expanding number of local businesses opting for e-commerce as a distribution channel. COVID-19 has accelerated the adoption of e-commerce solutions for businesses and consumers alike.

According to a recent market survey, online shopping frequency increased by 14 percent in 2020, indicating that a growing number of consumers are shifting their consumption patterns. The rise in the proportion of online consumption is highest in food and beverage, cosmetics, sports goods, fashion, and stationery. Popular e-commerce channels include Shopee, Lazada, and Tiki.

Regional foreign-owned platforms dominate the Vietnamese e-commerce market. Lazada and Shopee for instance are owned by Alibaba (China) and SEA Ltd. (Singapore). However, local firms such as Tiki have signaled expansion plans during the pandemic. The e-commerce market is also of policy relevance in the quest for a digital transformation; the National Digital Transformation Program actively promotes e-commerce adoption by local enterprises.

Digital financial services

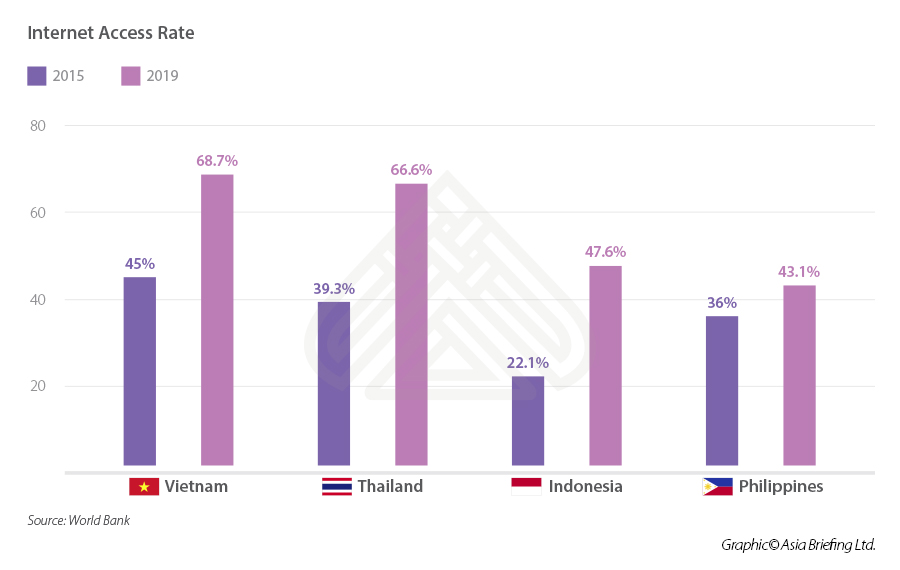

Cash payments remain the mode of choice in Vietnam. In 2019, just 41 percent of adults in the country had bank accounts, with a majority of them located in cities. However, there are indicators that the demand for digital financial services is likely to rise. According to World Bank data, only 45 percent of the Vietnamese population had access to the internet. This figure rose to 68.7 percent in 2019.

The combined effects of rising internet access and a booming e-commerce market are likely to create opportunities in digital banking, payments, savings, and other financial services.

In August 2020, Timo Plus, Vietnam’s first ‘digital bank’ announced that it would invest in digital financial services through credit and savings products in a bid to attract depositors who wish to shift away from traditional banking services. Demand for payments also increased in response to COVID-19 with a 76 percent increase in digital payments in the first quarter of 2020.

These changes in financial services consumption have prompted an interest in Vietnamese fintech firms. Fvndit, Kim An Group, Timo, and NextPay are among those that have secured new capital injections from domestic and foreign investors in 2020. Fintech revenues in 2020 are expected to reach US$7.8 billion.

Regulatory trends have also favored FDI in fintech. Earlier this year, the Vietnamese central bank opted to discard the 49 percent ownership limits for fintech in intermediary payment services. The regulatory conviction here is that growth in fintech could be accelerated by expanding access to capital, both domestic and foreign.

Online Gaming

Vietnam’s gaming industry has witnessed a surge in demand in 2020. The e-sport market for instance has grown at 28 percent in a five-year compound annual growth rate (CAGR) since 2015 and online gaming revenues crossed US$10 million. Key drivers of the online gaming industry include Vietnam’s digital transformation and demographics. The country is home to 3.9 million gamers and more than 50 percent of the population has access to a mobile device.

Online gaming, like e-commerce, is dominated by foreign-owned firms with most of them being Chinese. These firms have leveraged not only Vietnam’s demand but also the country’s supply of low-cost skilled labor and a network of local publishing firms.

IT-enabled services and Industry 4.0

Vietnam’s internet economy could witness a 29 percent growth over the next five years. The central pillar underpinning this trend is a digital ecosystem of firms and consumers. Thus, firms that provide IT services to businesses will be key to a successful digital transformation in Vietnam and the digital transformation in turn will create opportunities in IT-enabled services and Industry 4.0.

For instance, the cloud services market in Vietnam is projected to grow to US$291 million by 2024, a five-year CAGR of above 10 percent. Much of this growth is concentrated in the Northern region and foreign firms such as Microsoft, Amazon Web Services, IBM and SAP Asia are key players in the cloud services business.

Vietnamese policymakers have emphasized a focus on Industry 4.0. The goal of improving Vietnam’s ranking in the Global Innovation Index through productivity growth in production processes has sparked policy reform in recent years. A national strategy on Industry 4.0 was released in 2019, which focused on R&D investments, connectivity infrastructure, and digital governance.

Growth in the Vietnamese market for technologies such as big data, cloud services, IoT is therefore contingent on the expansion of a skilled workforce and the provision of high-quality connectivity infrastructure.

In addition, Vietnam’s push for Industry 4.0 has urged foreign firms to locate R&D activities in the country. For instance, Samsung, Panasonic, Bosch, GE, and Piaggio have local R&D activities. This implies that the country’s FDI appeal could undergo a structural shift with investors seeking innovation and a skilled workforce increasingly looking at Vietnam for investment prospects.

Strong growth but regulatory challenges remain

Vietnam’s regulatory landscape for the digital economy is relatively nascent. It is likely that the frequency and content of regulatory interventions could vary by sector.

For instance, in October 2020 the government issued a draft decree signaling likely changes to e-commerce investment regulations. Included in these reforms is a set of conditions for FDI in e-commerce. Conditions include approvals for controlling stakes, the necessary inclusion of foreign investors in a list of ‘globally reputed technology companies’ issued by the government, and conditions on investment exits by foreign investors.

In addition, the Law of Cyber Information Security and the Law on Cybersecurity are also of relevance to the digital economy. These regulations govern data collection, data processing, and data protection. These activities are key tools deployed by digital economy participants particularly in sectors that rely on consumer data processing such as online media. Specifically, data of service users are required to be stored in Vietnam, required foreign companies to comply, and even opening representative offices, which may increase costs.

Nevertheless, in 2020, Vietnam released the revised Law on Investment (LOI), which seeks to offer incentives to firms operating in R&D activities. The LOI states that the government is likely to provide project-specific incentives and investment support for projects where investment capital exceeds VND 3 trillion (US$1.3 billion).

Takeaways

The growth of Vietnam’s digital economy precedes the COVID-19 pandemic but was also been aided by it. Sectors such as e-commerce, digital financial services, online gaming, and Industry 4.0 are poised for growth and offer lucrative opportunities for foreign investors who seek exposure to Vietnam’s digital ecosystem.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Devisenmanagement in Vietnam: Zirkular 6

- Next Article Warum Vietnams expandierende digitale Wirtschaft Chancen für Investoren bietet