Vietnam’s Southern Key Economic Region: Opportunities for Investment

- Relocating or supplementing your investment into Vietnam can be challenging for first-time investors looking to manufacture in the country.

- Vietnam consists of four key economic regions that businesses can choose to relocate their production or start new investments.

- Vietnam Briefing highlights the advantages of the Southern Key Economic Region dubbed as an economic powerhouse of the country.

Vietnam has emerged as an important investment spotlight for foreign investors. With GDP growth of 7 percent, import-export turnover of US$518 billion in 2019, and total registered capital of $362.58 billion by the end of 2019, the country continues to thrive in a wide variety of sectors. Social-political stability, a young population, a cost-competitive labor force, and government commitment to reform the regulatory framework has improved the business environment for investors in Vietnam.

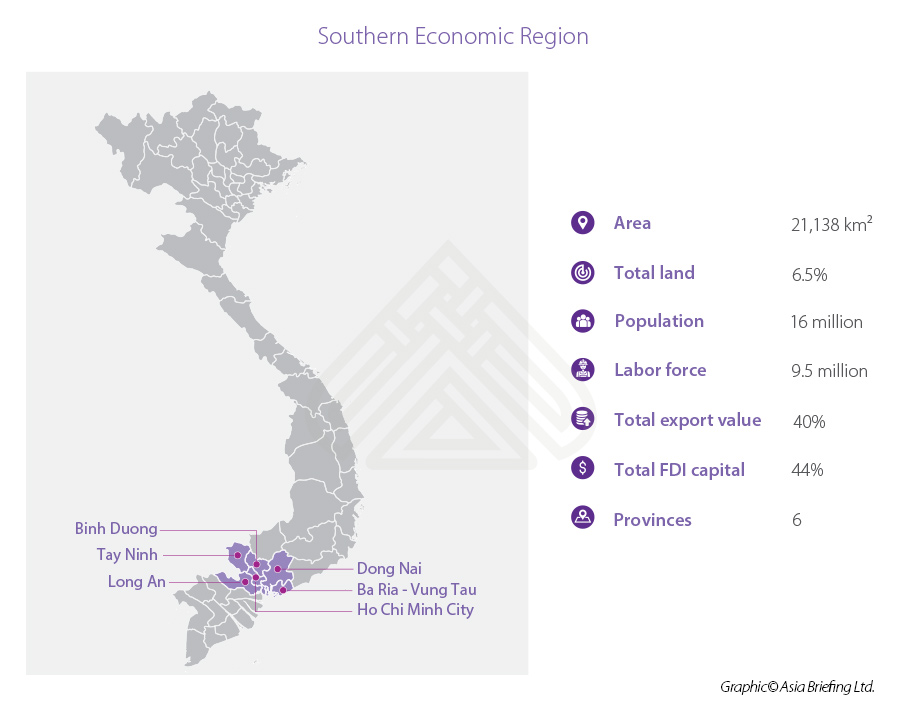

The Southern Key Economic Region

Vietnam can be divided into four Key Economic Regions (KERs). These four KERs consist of the Northern, Central, Southern, and Mekong Delta regions and cover the majority of economic and investment hubs in the country.

The Southern KER is the most important center of economic activity in the country creating 40 percent of the national GDP and accounting for 42 percent of the country’s total FDI stock. This region offers a dynamic and diverse business environment welcoming for both small and medium enterprises (SMEs) and large-scale businesses, as well as the best quality of human resources in the country.

The Southern KER is a leading zone for advanced manufacturing and is encouraging investments in knowledge-based and high-tech industries and services. The key sectors include electronics, software, IT, telecom, hi-tech agriculture production, and processing, which are the primary drivers of future investment. Ho Chi Minh City, the most important financial and trading hub of the whole country, focuses on service sectors such as finance, logistics, tourism, healthcare, and education.

Although the Southern KER is the leading economic center of the country, it still lacks a holistic coordinated plan among the provinces to ensure the linkage between economic development planning and infrastructure investment.

Investors interested in the Southern KER should consider infrastructure development such as waterways, railway, and expressway construction, and optimization of land and natural resource to enhance the competitiveness of their investment.

To understand more about the Southern KER, we take a look at six economic hubs in the region primed for investment.

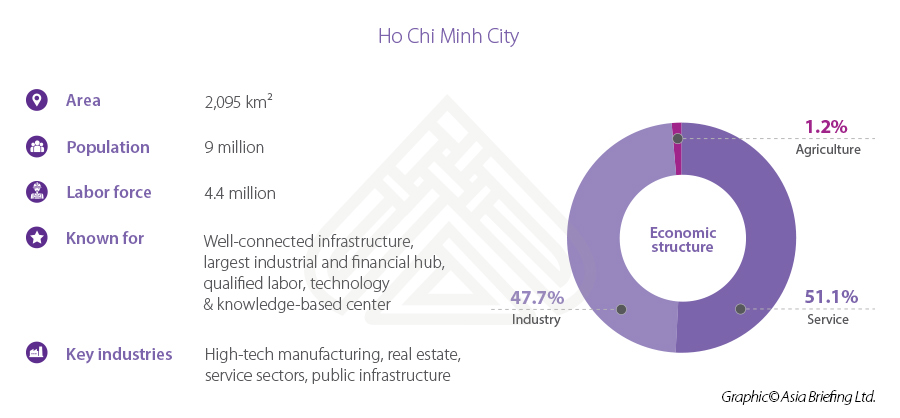

Ho Chi Minh City

Overview

Divided into 24 administrative district units, Ho Chi Minh City (also known as Saigon) is home to more than 9 million people, making it the largest city in Vietnam. With a strong economy supported by the most dynamic human resources in the country, the city holds the leading role in driving the economic and social development of the whole country.

Economy

Ho Chi Minh City has experienced robust growth in all economic sectors with an average annual growth of 8.3 percent in 2019. The service sector is the largest contributor to the city’s output at 57.8 percent followed by industrial production and construction. There are nearly 150,000 enterprises in the city, from startups, SMEs to big international corporations, employing approximately 2.5 million people.

Infrastructure

Ho Chi Minh City has well-developed infrastructure supporting industrial production and international trading. Cat Lai port handles more than 121 million tons of cargo annually. Tan Son Nhat International Airport is the largest airport in Vietnam serving 38 million passengers per year. Ho Chi Minh City also has excellent access to the Mekong Delta region via the HCMC – Can Tho expressway, to Vietnam’s Central region through HCMC – Dau Giay expressway, and to Cambodia through National Road No 22.

There are a total of 19 industrial zones (IZs) including three export processing zones, 14 industrial parks, and two hi-tech parks. Given the attractiveness of the location and the limited available industrial land, the local government is more focused on green, high-tech, and high value-added projects. Industrial zones in Ho Chi Minh City also have the highest leasing rates in Vietnam.

Foreign Investment

Up until 2019, Ho Chi Minh City licensed 9,173 FDI projects valued at US$47.3 billion. South Korea, Japan, and Singapore were the top three investors. Leading foreign projects include Intel (US), Samsung (South Korea), Toshiba, Isuzu, and Nidec (Japan).

In addition, Samsung has poured US$1.4 billion to build an R&D center for audio-visual devices and provide warranty services at Saigon Hi-Tech Park. Intel has invested US$1 billion in a plant for chip assembly and testing. Another significant FDI project is the US$6 billion ecological urban system, Saigon Peninsula Project, jointly invested by Malaysian and Vietnam investors.

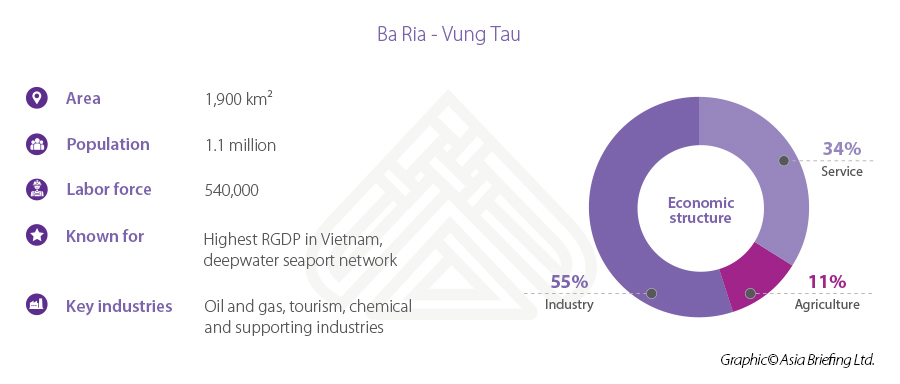

Ba Ria Vung Tau – The oil and gas hub

Overview

Ba Ria – Vung Tau (BRVT) is a coastal province in Southern Vietnam. It shares borders with Ho Chi Minh City, Dong Nai and Binh Thuan provinces. The province has two cities and six districts with a population of approximately 1.1 million.

Economy

BRVT is the hub of oil and gas and related services in Vietnam. It also hosts a strong metalworking and machinery industry linked to the shipping and oil industry. With most of the revenue coming from this industry, BRVT has the highest Real Gross Domestic Product (RGDP) per capita in Vietnam. However, due to the recent downturn of the oil industry, the province has shifted its focus to seaports and logistics services.

In addition, tourism is another key contributor to the provincial budget. With over 300-km of coastline and well-known beaches such as Bai Truoc, Bai Sau, Long Hai, Ho Tram, and Ho Coc, the province is one of the main tourist destinations in Southern Vietnam, attracting around 15 million visitors every year. In 2019, the provincial GDP grew 7.65 percent while industrial output increased 8.89 percent.

Infrastructure

The HCMC – Long Thanh – Dau Giay expressway and National Highway 51 has shortened the distance between BRVT and other Southern provinces. It takes only one and a half hours to travel from Ho Chi Minh City to BRVT – a distance of 125 km.

The port system in BRVT serves as an international transshipment gateway in the Southern area and can accommodate vessels up to 200,000 deadweight tonnage (DWT). There are 28 operating ports in the area with a total capacity of 98 million tons per year. Goods from Cai Mep-Thi Vai ports in this area can be shipped directly to Northern America and Europe.

There are 15 industrial zones in BRVT with total industrial land of 8,510 hectares that are close to 51 highways as well as the only deep-water port in Southern Vietnam – Cai Mep – Thi Vai international port.

Foreign investment

BRVT has lured around 466 FDI projects with total registered capital of more than US$31 billion in 2019, ranked 5th in Vietnam. The US is the biggest investor country, followed by Canada, Thailand, Korea, and Japan. One of the largest investors is the Asia Coast Development Company, which developed the US$4billion Ho Tram resort project. Another remarkable FDI project is an investment of $1.1 billion in a steel plant by South Korea’s Posco. Hyosung Corporation (South Korea) has registered capital of US$1.2 billion to establish a polypropylene factory and take part in oil and gas project (LPG storage), promoted by the government.

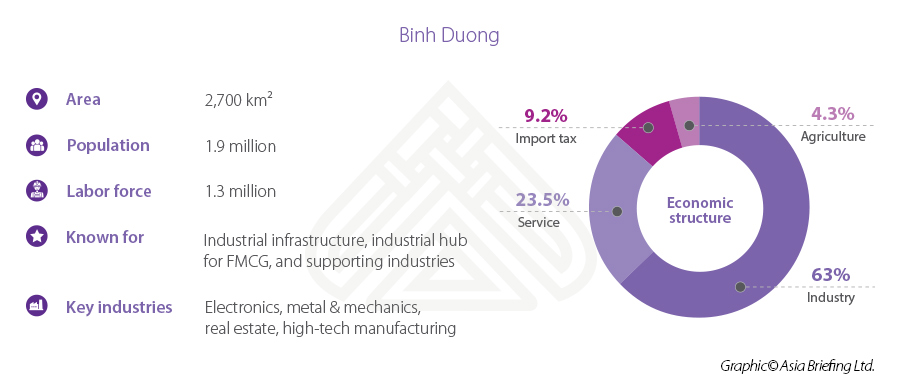

Binh Duong

Overview

Located north of Ho Chi Minh City, Binh Duong is one of the most developed industrial hubs in Southern Vietnam, along with Ho Chi Minh City and Dong Nai. The province has nine administrative units including the provincial capital of Thu Dau Mot. There are approximately 1.9 million inhabitants in the area.

Economy

The province’s economy is dominated by industrial activities, which account for two-thirds of the provincial GRDP. The provincial GRDP increased by 9.5 percent in 2019. There are approximately 42,269 enterprises in Binh Duong. The majority of manufacturing plants are in furniture and apparel and textile, wood products, metal, and plastic.

Infrastructure

Binh Duong leads the country in terms of infrastructure quality. Given its proximity to Ho Chi Minh City, the province has quick access to a major seaport, international airport, and is a business services hub serving Ho Chi Minh City. There are 22 operating industrial zones in the province with more than 70 percent of industrial land already occupied.

Foreign investment

Binh Duong ranks second as a destination for FDI inflow into Vietnam, only after Ho Chi Minh City. For the last 30 years, Binh Duong has attracted 3,772 FDI projects with registered capital of US$34.4 billion. Taiwanese investors have invested US$5.8 billion, which accounts for nearly one-fifth of total FDI investment, followed by Japanese, Singaporean, and South Korean investors with registered capital of US$5.2 billion, US$2.7 billion, and US$2.6 billion respectively.

Some of the biggest FDI projects from Taiwan investors are Cheng Loong Vietnam Paper Factory with an investment of US$1 billion, and Far Eastern Polytex Factory with registered capital of US$760 million. Another large real estate FDI project is the Binh Duong Tokyu Urban Zone Project in new Binh Duong city, a joint venture between Japan’s Tokyu Corporation and Vietnam’s Becamex IDC Corporation, worth more than US$1.2 billion

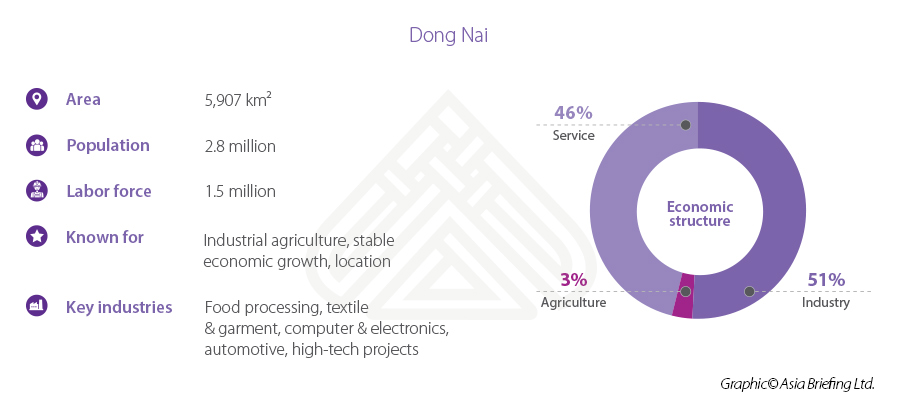

Dong Nai

Overview

Dong Nai is one of the most dynamic industrial centers in Vietnam. Adjacent to Ho Chi Minh City in the south, this province has 12 administrative districts with a population of 2.8 million.

Economy

Dong Nai continued its impressive economic growth of 8 percent in 2019, with industry being the main driver. The export revenue reached US$20 billion, growing at 12 percent annually.

Infrastructure

The construction of the Ho Chi Minh City – Long Thanh – Dau Giay Highway and National Highway 1A has significantly reduced transit time from Dong Nai to other South-Eastern provinces. In addition, Dong Nai has great logistic advantages with proximity to two of the largest seaport systems in the South, in Ho Chi Minh City and in BRVT province.

The future development of Bien Hoa – Vung Tau railway and expressway and the upcoming Long Thanh International Airport would make Dong Nai more attractive to foreign investors. The province has a very well-developed industrial infrastructure with 32 IZs occupying 10,240 hectares. Besides, it has in-place infrastructure systems supplying power, water, gas, and wastewater treatment to facilitate industrial needs.

Foreign Investment

Dong Nai ranks fourth in attracting FDI inflow in Vietnam, only after Ho Chi Minh City, Binh Duong, and Hanoi. As of 2019, the province has attracted 1,659 FDI projects with a total investment of US$31.2 billion. Taiwan, South Korea, and Japan are the leading investors in the province.

Dong Nai is a destination for big multinational corporations in both light and heavy industries. Companies such as Formosa, Nestle, Bosch, and 3M have all made investments. Formosa has invested US$1 billion in establishing Hung Nghiep Formosa – a plastic plant while Nestle has invested US$450 million in three food plants in Dong Nai to produce coffee and beverages. With a total investment of US$372 million in producing automotive parts, transmissions and control engineering, and packaging technology, Bosh Vietnam is projected to transform its manufacturing facilities into smart factories.

Foreign investors in Dong Nai are mainly involved in food processing, footwear, textile & garments, plastics, computer electronic products, and automobiles.

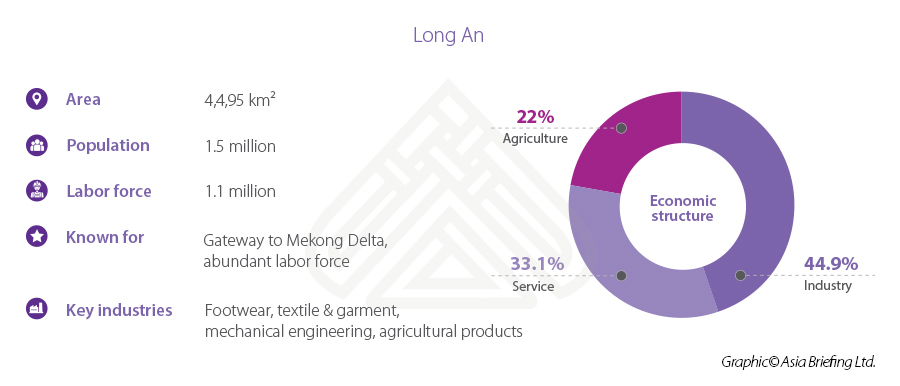

Long An

Overview

Long An serves as a bridge between Ho Chi Minh City in the north and the 12 provinces in the Mekong Delta in the South. With one city and 14 districts, the province is home to 1.5 million people.

Economy

Long An remains an agricultural-based province in which agricultural land accounts for 71 percent of the total land in the province. Geological position and natural conditions have enabled the province to grow agricultural products such as rice, watermelon, dragon fruit, sugar cane, and other vegetables. However, the provincial economic structure is moving toward industrial activities with industrial outputs increasing to 14.45 percent in 2019, compared with 6.96 percent growth in the service sector and 1.19 percent in the agricultural sector. The 2019 GRDP grew 9.4 percent, with more than 10,000 companies operating in the province.

Infrastructure

Long An has 26 operating IZs with an occupancy rate of more than 70 percent. In addition, 12 additional IZs have been planned to drive new investments. Long An has zoned off some 13,500 hectares for industrial development by 2020.

The Ho Chi Minh City – Trung Luong Expressway and the National Road 1A are the key inland thoroughfares in the province. However, the province still lags far behind Ho Chi Minh City in terms of urban development, public infrastructure, and industrial facilities (wastewater treatment, gas supply, electricity, etc.).

Foreign investment

Up to 2019, Long An has attracted 1,164 FDI projects with a total registered capital is US$7.9 billion. The FDI projects are mainly in footwear, textile and apparel, and other labor-intensive industries.

Taiwan, South Korea, Singapore, Japan, Hong Kong, and the US are the top investors in the province. Huafu Textile Factory from Hong Kong with a registered capital of US$260 million is one of the largest FDI projects in Long An. Trillions Company, a member of Fushan Group, has invested US$330 million in building a new textile factory.

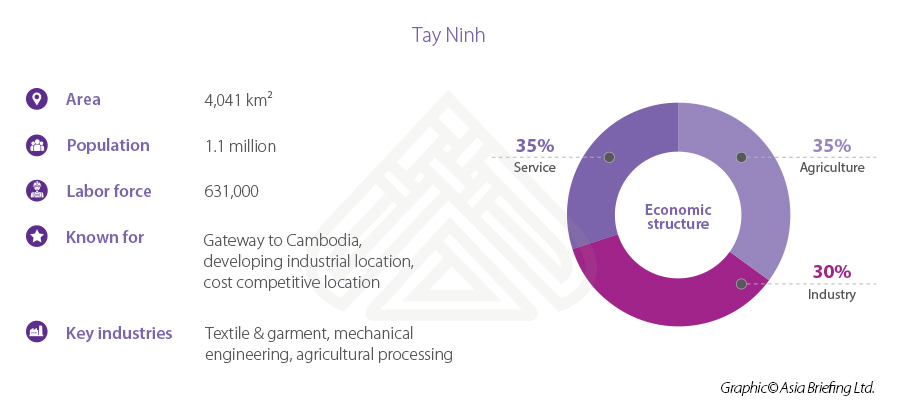

Tay Ninh

Overview

Tay Ninh shares its border with Cambodia, playing an important role in connecting Ho Chi Minh City with the Cambodian capital of Phnom Penh. The province has one city and eight districts with a total population of 1.1 million people.

Economy

The provincial RGDP in 2019 recorded an annual growth of 8 percent. Textile, rubber (tires) and plastics, leather, and related products are the main outputs. There are more than 5,000 companies operating in the province employing approximately 664,000 people.

Infrastructure

Tay Ninh has five industrial parks, two economic zones, and 18 industrial clusters. Moc Bai and Xa Mat are two international border gate economic zones, and international trade centers, promoting cooperation and development between Vietnam and Cambodia and other ASEAN countries. Special investment incentives are also offered to new investments in Moc Bai and Xa Mat economic zones.

The National Road No 22 in Tay Ninh province is the main and shortest road connecting Ho Chi Minh City and other major economic centers in Southern Vietnam with Cambodia. The construction of Ho Chi Minh City – Moc Bai Expressway has been approved by the Central government and is expected to be started in 2021.

Foreign Investment

By the end of 2019, Tay Ninh attracted 324 FDI projects with total registered capital of US$6.9 billion. China is a leading investor with total investment capital of US$2.3 billion, followed by South Korea and Taiwan. Garment and textiles is the dominant industry attracting the most FDI investors in Tay Ninh. The Viet Luan Tire manufacturing plant with US$400 million investment capital is one of the largest FDI projects in Tay Ninh. Another large investment project from a Chinese investor is Brotex – a garment and textile material manufacturing plant. Ilshin Company from South Korea has opened a US$177 million textile fiber plant in the Phuong Dong Industrial Park.

While Tay Ninh’s IZs are cost-competitive in terms of both rental rates and labor costs compared with other provinces in the Southern economic region, recruiting skilled workers in fields such as mechanics, electronics and high professional levels remains a challenge for investors.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Italian Investment in Vietnam – How to Leverage the EVFTA

- Next Article The EVFTA: Understanding Rules of Origin