Vietnam’s Economic Report Card for 2024: GDP, Trade, FDI

Despite navigating a mix of challenges and opportunities in 2024, the Vietnam economy demonstrated resilience and potential for sustained GDP growth. As the country enters 2025, its investor prospects shine bright, bolstered by optimistic growth forecasts from global experts and institutions.

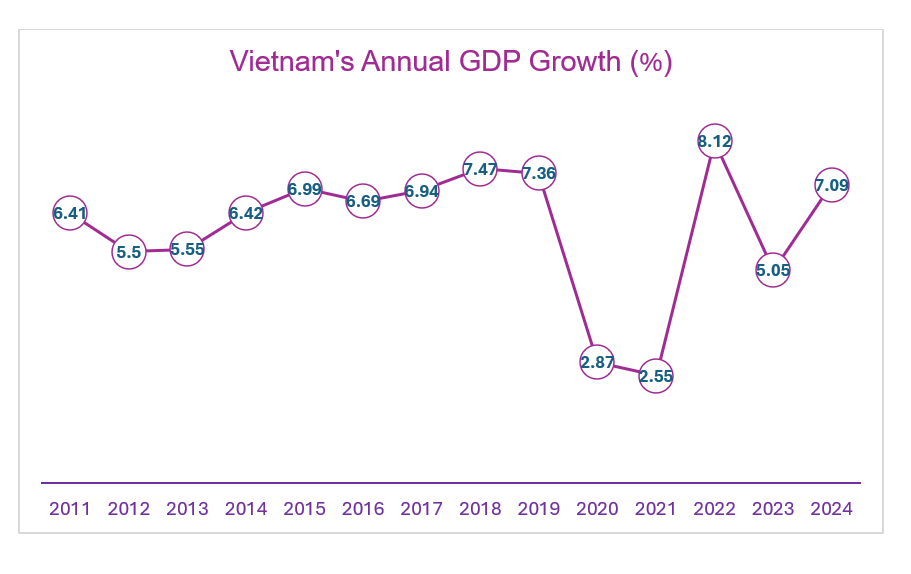

In 2024, the Vietnam economy showed remarkable resilience, marked by a positive GDP growth of 7.09 percent. Despite facing external challenges and the adverse impact of Typhoon Yagi, the country’s economic rebound highlighted its robust recovery and adaptability.

With a steadily increasing per capita GDP and strong trade dynamics, Vietnam is a standout performer in the ASEAN region.

Vietnam GDP in 2024

According to Vietnam’s General Statistics Office (GSO), the country’s GDP expanded at a rate of 7.09 percent in 2024 despite external volatilities and uncertainties. Although this growth rate is slightly lower than the peaks seen in 2018, 2019, and 2022, it still represents an impressive rebound of the economy and positions Vietnam as a bright spot in the region.

In 2024, the economy showed gradual recovery through consistent quarterly improvements. The growth trajectory increased from 5.98 percent in Q1 to 7.25 percent in Q2, reaching 7.43 percent in Q3, and climbing to 7.55 percent in Q4.

In 2024, the economy showed gradual recovery through consistent quarterly improvements. The growth trajectory increased from 5.98 percent in Q1 to 7.25 percent in Q2, reaching 7.43 percent in Q3, and climbing to 7.55 percent in Q4.

Sectoral trends

Sector-wise, the main growth drivers for Vietnam in 2024 were:

- Services sector: This sector emerged as the primary growth driver for the entire year, contributing 49.46 percent to the overall GDP growth with an expansion of 7.38 percent compared to the previous year.

- Industrial and construction sector: This sector contributed 45.17 percent to GDP growth, with an increase of 8.24 percent.

- Agro-forestry-fishery sector: This sector accounted for 5.37 percent of the country’s GDP growth, with an increase of 3.27 percent.

These sectors contributed to Vietnam’s GDP reaching over VND11.51 quadrillion (US$476.3 billion) in 2024, with per capita GDP rising to US$4,700, an increase of US$377 from 2023.

|

Vietnam’s Economic Structure (% of GDP) |

||

|

Sector |

2024 |

2023 |

|

Service |

42.36 |

42.3 |

|

Industrial and construction |

37.64 |

37.58 |

|

Agro-forestry-fishery |

11.86 |

11.86 |

|

Source: GSO |

||

Typhoon Yagi: Challenges and opportunities

Typhoon Yagi was one of the most impactful events to affect Vietnam’s economy in 2024. It disrupted socio-economic activities in northern Vietnam, leading to nationwide repercussions on production and supply chains. A recent study by the United Nations Development Programme (UNDP) has comprehensively outlined the typhoon’s financial and economic toll.

Key findings from the UNDP Report:

- Total damage: Estimated at nearly US$1.5 billion (approximately 0.62 percent of 2023 GDP).

- Overall losses: Exceeded US$1.77 billion (approximately 0.74 percent of 2023 GDP).

- Provincial impact: Affected 26 provinces, with 11 experiencing severe economic damage.

- Cultural and tourism sector: Incurred the highest losses, estimated at US$310 million. Net output loss was US$323 million, reducing the national growth rate by 0.31 percentage points.

- Agriculture sector: Suffered losses of US$226 million. Net output loss totaled US$160 million, impacting growth by 0.62 percentage points.

- Industrial sector: Recorded losses of US$96 million. Net output loss was US$83 million, reducing growth by 0.1 percentage points.

- Export decline: Estimated at US$502 million (approximately 0.21 percent of 2023 GDP), though the overall trade balance is expected to remain stable.

Despite the impact of Typhoon Yagi, Vietnam’s economy managed to sustain robust growth in 2024. Additionally, the recovery process has created opportunities for various sectors. Industries such as construction materials, retail, and logistics are poised to benefit from heightened demand driven by rebuilding and recovery efforts.

Inflation under control

In 2024, the Consumer Price Index (CPI) rose by 3.63 percent, which is in line with the National Assembly’s target. In December, the CPI increased by 0.29 percent compared to the previous month, primarily due to rising prices in healthcare services, rental housing, and fuel.

The key contributors to the CPI increase in December included:

- Healthcare services: +2.19 percent;

- Transportation: +0.57 percent;

- Housing, electricity, water, and construction materials: +0.53 percent; and

- Clothing and footwear: +0.28 percent.

Conversely, two categories experienced price decreases:

- Postal and telecommunications services: -0.03 percent; and

- Food and beverage services: -0.13 percent.

Core inflation, which excludes volatile items such as food and energy, rose by 2.71 percent in 2024, which is lower than the average CPI increase.

Trade – the cornerstone of Vietnam’s economic success

Trade has been crucial in driving Vietnam’s economic growth. According to the GSO, in 2024, the country’s total trade reached an impressive high of over US$786.29 billion, up 15.4 percent year-on-year, with a trade surplus of US$24.77 billion.

Imports

Vietnam’s imports increased by 16.7 percent to reach US$380.76 billion. Accounting for this performance was:

- the domestic sector, which rose by 19.5 percent to US$140.11 billion; and

- the foreign-invested sector, which saw a 15.1 percent rise, totaling US$240.65 billion.

Exports

In 2024, Vietnam’s exports saw impressive growth, increasing by 14.3 percent to reach a total value of US$405.53 billion. Key points to note here:

- The domestic sector contributed US$114.59 billion, reflecting a 19.8 percent increase and accounting for 28.3 percent of Vietnam’s total exports.

- The foreign-invested sector, which includes crude oil, generated US$290.94 billion, an increase of 12.3 percent, representing 71.7 percent of Vietnam’s overall exports.

A total of 37 key export items each generated over US$1 billion, collectively making up 94.3 percent of the total export value. Notably, eight among these items surpassed the US$10 billion-mark, contributing significantly to 69 percent of the combined export value.

This growth marks a substantial recovery from the 4.6 percent decline observed in 2023. With this increase in export activity, Vietnam is now outpacing many regional counterparts, including China, South Korea, Thailand, and Indonesia, which reported export growth rates ranging from 1.33 to 12.7 percent during the same period. On average, Vietnam’s monthly export turnover was around US$30 billion in 2024.

The agriculture sector has been a crucial driver of Vietnam’s export growth. Despite facing challenges, such as natural disasters, pandemics, and fluctuating global markets, agriculture-based industries achieved remarkable results in 2024. Exports from the agriculture, forestry, and fishery sector reached US$62.4 billion, an 18.5 percent increase from 2023.

|

Vietnam’s Key Agricultural Exports |

|

|

Export product |

Highlights |

|

Coffee |

– Generated US$5.5 billion in revenue, representing a year-on-year growth of 28.9 percent, mainly due to a 50 percent increase in average export prices. – Provided generous income for farmers as the price of coffee beans highly ranged from VND 100,000 to VND 134,000 (US$3.94-5.28) per kilogram. |

|

Rice |

– Hit record levels with 9.01 million tons valued at US$5.8 billion. – Grew by 10.9 percent in volume and 23.1 percent in value, achieving the highest figures since Vietnam commenced rice exports in 1989. |

|

Fruits and Vegetables |

– Soared to US$7.2 billion, significantly surpassing the US$5.6 billion recorded in 2023. – Durian exports alone contributed US$3.5 billion, an increase from US$2.3 billion the previous year.

|

|

Source: Vietnamnet |

|

Vietnam’s double-digit trade growth with ASEAN and flourishing investment ties

Vietnam’s trade with other ASEAN member states exceeded US$76.3 billion between January-November 2024, reflecting a 13.9 percent increase compared to the same period in the year prior. This figure ranks Vietnam behind only China, the U.S., and South Korea in terms of trade volume.

Of this total, Vietnam’s exports amounted to US$33.8 billion, while imports reached US$42.4 billion, according to the General Department of Vietnam Customs. Thailand emerged as Vietnam’s largest trade partner within ASEAN, with a total trade volume of US$18 billion.

In terms of investment, ASEAN countries invested a total of US$9.52 billion in Vietnam during the first 11 months of 2024, marking a significant year-on-year increase of 51.1 percent. Singapore led as the top investor, contributing registered capital of US$9.13 billion, followed by Thailand with US$178.52 million and Malaysia with US$159.98 million.

Foreign direct investment

Record FDI disbursements

In 2024, Vietnam reported over US$38.2 billion in foreign direct investment (FDI), reflecting a slight decrease of 3 percent compared to the previous year, according to data from the Foreign Investment Agency (FIA) under the Ministry of Planning and Investment.

Key highlights from Vietnam’s FDI in 2024 include:

- Newly registered projects: A total of 3,375 new projects received investment registration certificates, amounting to a total registered capital of US$19.73 billion. This represents a 1.8 percent increase in the number of projects, but a 0.7 percent decrease in capital compared to the previous year.

- Adjusted capital projects: The adjusted capital for 1,539 ongoing projects rose to US$13.96 billion, an increase of 50.4 percent.

- Capital contributions and share purchases: There were 3,502 capital contributions and share purchases, valued at over US$4.54 billion. This figure shows a decline of 48.1 percent compared to the previous year.

Sector-wise investments

In 2024, foreign investments into Vietnam were made in 18 out of 21 economic sectors, distributed as follows:

- Manufacturing and processing: This sector took the lead in terms of FDI attraction in 2023, garnering nearly US$25.6 billion, which accounted for almost 67 percent of total investments. This represented a 1.1 percent increase from the previous year.

- Real estate: This sector received over US$6.31 billion, capturing 16.5 percent of the total investment. It showed a significant increase of 19 percent compared to the same period last year.

- Power generation and distribution: This sector attracted over US$1.42 billion.

- Wholesale and retail: The sector garnered nearly US$1.41 billion.

Top foreign investors in Vietnam

In 2024, Vietnam attracted investors from 114 countries and territories. Key highlights include:

- Singapore was the largest foreign investor, contributing nearly US$10.2 billion, accounting for 26.7 percent of the total investment. This represents a 31.4 percent increase compared to the previous year.

- South Korea ranked second, with nearly US$7.06 billion invested, making up 18.5 percent of the total and showing a significant 37.5 percent increase from the prior year.

- China, Hong Kong, and Japan were also notable investors in Vietnam during 2024.

China held the highest number of newly registered projects at 28.3 percent. Meanwhile, South Korea led in adjusted registered capital with 22.8 percent, along with capital contributions and share purchases at 25.2 percent.

Top regions attracting FDI in Vietnam

The top 10 locations for FDI included Bac Ninh, Hai Phong, Ho Chi Minh City (HCMC), Quang Ninh, Hanoi, Binh Duong, Dong Nai, Nghe An, Ba Ria-Vung Tau, and Hung Yen.

These cities and provinces possess advantages like robust infrastructure, skilled labor, efficient administrative processes, and effective investment promotion efforts.

In 2024, Bac Ninh was recognized as Vietnam’s leading FDI destination, attracting US$5.12 billion, followed by Hai Phong with US$4.94 billion and HCMC with US$3.04 billion.

Moreover, HCMC ranked highest in project numbers, representing 42 percent of newly registered projects, 15.4 percent of adjusted registrations, and 69 percent of capital contributions and share purchases.

Vietnam’s economic outlook going forward

The UK-based Center for Economics and Business Research (CEBR) estimates that Vietnam’s GDP will grow to US$676 billion by 2029, surpassing Singapore.

CEBR predicts robust economic growth for Vietnam, averaging 5.8 percent annually over the next five years and 5.6 percent from 2030 to 2039, with a projected GDP of US$1.41 trillion by 2039, placing it 25th globally and second in Southeast Asia.

Conclusion

Vietnam’s economic performance in 2024 demonstrates resilience and robust growth, achieving a GDP increase of 7.09 percent despite challenges such as the impact of Typhoon Yagi. The services sector emerged as the primary driver of this growth, while trade remains a fundamental component of the Vietnam economy, marked by a significant trade surplus. Inflation was kept under control, indicating effective economic management.

Looking ahead to 2025, the positive momentum and recovery efforts present a promising investment outlook for Vietnam.

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, China, and India. For editorial matters, contact us here and for a complimentary subscription to our products, please click here. For assistance with investments into Vietnam, please contact us at vietnam@dezshira.com or visit us at www.dezshira.com.

Dezan Shira & Associates assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. We also maintain offices or have alliance partners assisting foreign investors in China, Hong Kong SAR, Dubai (UAE), Indonesia, Singapore, Philippines, Malaysia, Thailand, Bangladesh, Italy, Germany, the United States, and Australia.

- Previous Article Hanoi Master Plan 2045-2065: Major Goals and Investment Prospects

- Next Article Decree 163 Implementation: Shaping Vietnam’s Telecom Industry in 2025