Vietnam Implements Social Insurance Updates

By: Dezan Shira & Associates

Editor: Chau Pham

Vietnam’s social insurance scheme is undergoing a series of changes influencing both the statutory contribution rates required of enterprises as well as the types contracts triggering liability. With rate reductions applied from June 2017 and introduction of a wider liability for social insurance contributions scheduled for early 2018, foreign and domestic companies alike will be required to adjust compliance procedures in the near future.

RELATED: Dezan Shira & Associates’ Payroll and Human Resources Services

RELATED: Dezan Shira & Associates’ Payroll and Human Resources Services

Understanding social security in Vietnam

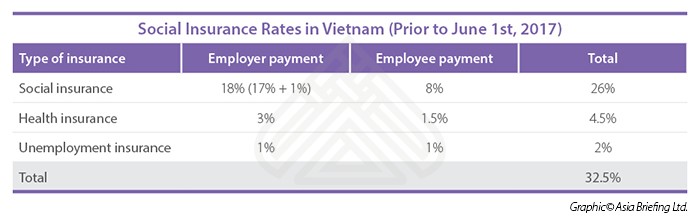

As a quick review, there are three elements in the Vietnamese social security system that employers are required to cover: social insurance (SI), unemployment insurance (UI) and health insurance (HI). For social insurance, employers are obligated to contribute a sum calculated at the rate of 17 percent of an employee’s salary plus an additional 1 percent which goes to the occupational accident and disease insurance fund. Health insurance and unemployment insurance, which are calculated on the same basis, are applied at rates of 3 percent and 1 percent respectively.

Social and unemployment contributions are required to be made on behalf of Vietnamese nationals only. Health insurance, on the other hand, is applicable to all labor contracts that are issued by entities incorporated in Vietnam. This precludes companies from social or unemployment obligations for their expatriate staff. Furthermore, foreign companies employing expatriate workers can often minimize their tax exposure in Vietnam by contracting their expatriate staff with their parent office rather than their Vietnamese subsidiary.

Reduced social insurance rates applied from June, 2017

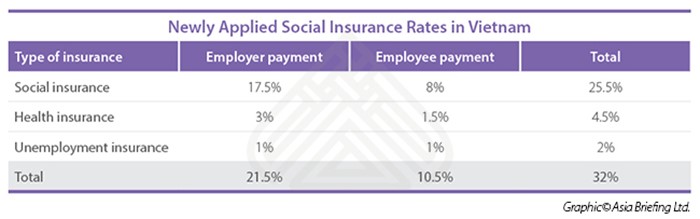

A new rate of contribution to the occupational accident and disease insurance fund will be required from employers under Decree No. 44/2017/ND-CP passed on April 14 2017. According to Decree No. 44/2017/ND-CP, from the 1st of June, 2017, employers have to pay only 0.5 percent of employee’s salary instead of 1 percent for contributions to the occupational accident and disease insurance fund. Through the application of revised guidelines, the rate that employers are required to pay for social insurance is reduced from 18 percent to only 17.5 percent. From the 1st of June 2016, employers and employees are required to pay 21.5 percent and 10.5 percent respectively for insurance in Vietnam.

![]() RELATED: Social Security in Vietnam: Understanding Your Obligations

RELATED: Social Security in Vietnam: Understanding Your Obligations

Social insurance required of foreign employees from 2018

In addition to changes in the rates of social insurance required, the Ministry of Labor, Invalids and Social Affairs (MOLISA) is also working on a draft for a new Decree detailing and guiding the implementation of the Law on Social Insurance. Under the current draft, from the 1st January of 2018, social insurance will be compulsory for foreign employees signing a labor contract with any company or agency in Vietnam.

The draft suggests that all foreign employees in Vietnam with work permits, practices certificates or practice licenses issued by local authorized agencies are to be covered for all five compulsory social insurance regimes (illness, maternity, labor accidents and occupational diseases, retirement and survivorship allowance). The rate will be the same as for Vietnamese employees (8 percent from employees and 17.5 percent from employers). This raises some major concerns related to the cost of doing business in Vietnam, especially for companies who have to hire foreign staffs to manage their business based in Vietnam. The draft Decree is now pending for opinions and will enter into force on 1st of January 2018 if adopted.

|

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Eurasia, including ASEAN, China, India, Indonesia, Russia & the Silk Road. For editorial matters please contact us here and for a complimentary subscription to our products, please click here. Dezan Shira & Associates provide business intelligence, due diligence, legal, tax and advisory services throughout the Vietnam and the Asian region. We maintain offices in Hanoi and Ho Chi Minh City, as well as throughout China, South-East Asia, India, and Russia. For assistance with investments into Vietnam please contact us at vietnam@dezshira.com or visit us at www.dezshira.com

|

![]()

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in Vietnam 2017

An Introduction to Doing Business in Vietnam 2017

An Introduction to Doing Business in Vietnam 2017 will provide readers with an overview of the fundamentals of investing and conducting business in Vietnam. Compiled by Dezan Shira & Associates, a specialist foreign direct investment practice, this guide explains the basics of company establishment, annual compliance, taxation, human resources, payroll, and social insurance in this dynamic country.

Managing Contracts and Severance in Vietnam

Managing Contracts and Severance in Vietnam

In this issue of Vietnam Briefing, we discuss the prevailing state of labor pools in Vietnam and outline key considerations for those seeking to staff and retain workers in the country. We highlight the increasing demand for skilled labor, provide in depth coverage of existing contract options, and showcase severance liabilities that may arise if workers or employers choose to terminate their contracts.

- Previous Article Lower Taxes Proposed for Profitable SMEs in Vietnam

- Next Article Pharmacy Law Guidance Scheduled for July Implementation in Vietnam