PIT Update: Vietnam Implements 50 Percent Reduction in Personal Income Tax for Individuals Working in Economic Zones

HCMC – On October 20, 2014, Vietnam implemented a 50 percent reduction in personal income tax (PIT) for individuals who are working in the country’s economic zones. The recent tax change was outlined in the Ministry of Finance’s Circular 128/2014/TT-BTC, replacing Circular 176/2009/TT-BTC.

Economic zones are special areas in Vietnam that possess special economic regulations and provide measures that are conducive to foreign direct investment. These zones are organized into functional areas, such as non-tariff, bonded, export processing, industrial, and tourism.

RELATED: Dezan Shira & Associates’ International Tax Planning Services

RELATED: Dezan Shira & Associates’ International Tax Planning Services

Individuals who can benefit from the new tax rules include:

- Resident or non-resident employees who have employment contracts with businesses located in the economic zones

- Employees who are sent to work in the zones by businesses not located in them

- Individuals working at waste treatment facilities outside the zones

PIT snapshot

According to the PIT Law, PIT is levied on the worldwide income of Vietnam residents and on Vietnam-sourced income of non-residents, irrespective of where the income is paid. The tax calculation and finalization procedure for Vietnamese locals and expatriates is the same, but that for residents and non-residents are different.

![]() RELATED: Tax, Accounting, and Audit in Vietnam 2014-2015

RELATED: Tax, Accounting, and Audit in Vietnam 2014-2015

There are 10 types of earnings which are subject to PIT, these are as follows:

- Incomes from business activities

- Wages received from employers

- Capital investment

- Capital transfer

- Property transfer

- Prizes

- Royalties

- Commercial franchising

- Inheritances in forms of securities, capital contribution in companies or economic organizations, real estate and other assets requiring the registration of ownership or use right

- Gifts in forms of securities, capital contribution in companies or economic organizations, real estate and other assets requiring the registration of ownership or use rights

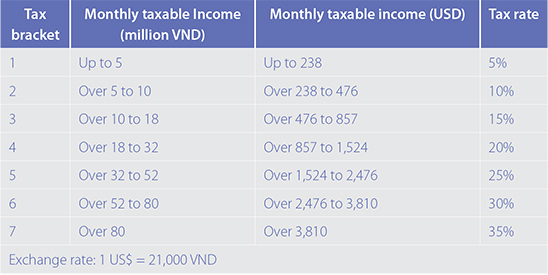

Resident taxpayers are subject to PIT on their worldwide employment income, irrespective of where the income is paid or earned, at progressive rates from five percent to a maximum of 35 percent. Employment income includes salaries, wages, allowances and subsidies, remuneration in all forms; benefits earned for participation in business associations, boards of directors, control boards, management boards and other organizations; premiums and bonuses in any form except those received from the State.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Vietnam: A Guide to HR in Asia’s Next Growth Market

Vietnam: A Guide to HR in Asia’s Next Growth Market

In this issue of Vietnam Briefing, we attempt to clarify human resources (HR) and payroll processes in Vietnam. We first take you through the current trends affecting the HR landscape and then we delve into the process of hiring and paying your employees. We next look at what specific obligations an employer has to their employees. Additionally, we guide you through the often complex system of visas, work permits, and temporary residence cards. Finally, we highlight the benefits of outsourcing your payroll to a “pan-Asia” vendor.

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition) provides readers with an overview of the fundamentals of investing and conducting business in Vietnam. Compiled by Dezan Shira & Associates, a specialist foreign direct investment practice, this guide explains the basics of company establishment, annual compliance, taxation, human resources, payroll, and social insurance in the country.

- Previous Article Understanding How to Hire and Pay Staff in Vietnam

- Next Article Navigating Personal Income Tax in Vietnam