Ford Sees Long-Term Opportunity in Vietnam’s Auto Industry

HCMC – The Ford Motor Company has announced that it is strongly optimistic about the business and investment environment of Vietnam and expects that it will see continued and growing success in the country. According to Ford Vietnam’s Managing Director, Jesus Metelo Arias, the company is “committed to long-term investment and operations in Vietnam thanks to the country’s favorable investment climate.”

Vietnam’s healthy economic growth rate, growing consumer class, and ongoing infrastructure improvements have all helped drive Ford’s success in the country. Arias also cited Vietnam’s simplification and transparency of tax and customs procedures as key reasons for the company’s optimism about the future of its operations in the country.

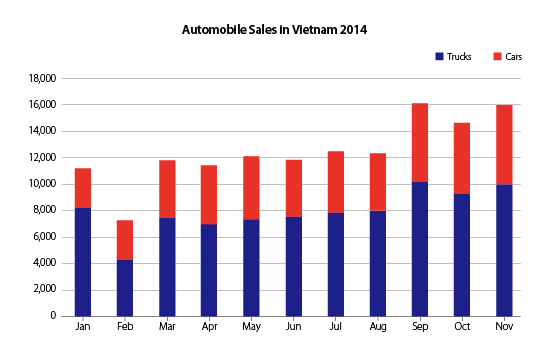

Additionally, auto sales have been climbing in Vietnam due in part to the country’s lowering of interest rates and improved liquidity throughout the economy. Vietnam has a fast growing middle class, with rising wages and a desire to move beyond the more common forms of transportation such as motorbikes. Many analysts believe that the country will go through a period of “automobilization” once annual per capita income rises above US$3,000. Vietnam will soon reach this tipping point – incomes are seeing strong growth year over year.

RELATED: Dezan Shira & Associates’ Pre-Investment and Entry Strategy Advisory

RELATED: Dezan Shira & Associates’ Pre-Investment and Entry Strategy Advisory

Ford was one of the first American companies to invest into Vietnam after the two countries normalized relations in 1995. The global car manufacturer has seen strong growth in its vehicles sales over the previous years, and 2015 is proving to be no exception to this upward trend. In the first six months of this year, Ford sold 8,900 vehicles in Vietnam – a 70 percent increase over the same period last year. The company is now one of the top three selling brands in the country; the Ford Ranger pickup truck is the company’s bestselling product.

Ford is not the only American auto company that has met with success in Vietnam, GM has been operating in the country since 1993, when it started a joint venture with a Vietnamese state-owned enterprise. In addition, despite an increasingly competitive auto market throughout the ASEAN region, Vietnam has stated that it intends to work aggressively to build up its own domestic auto industry. Fueling this decision is the fact that, if the country relies solely upon imports, the foreign exchange balance will be negatively affected. Additionally, the auto industry has the potential to create thousands of jobs for locals and create a strong system of supporting industries.

RELATED: ASEAN Case Study: The Auto Industry and GM

RELATED: ASEAN Case Study: The Auto Industry and GM

In yet another positive sign for foreign auto manufacturers, due to the ASEAN Trade in Goods Agreement, Vietnam will cut its car import tariff incrementally over the next four years for goods originating in ASEAN countries. The current import tariff of 50 percent is expected to be reduced to 35 percent in 2015, 20 percent in 2016, 10 percent in 2017, and will be zero in 2018. However, despite these tariff reductions, Vietnam’s National Assembly has announced that the special consumption tax will remain at current levels.

Ford’s Vietnam website can be viewed here.

Ford’s Vietnam website can be viewed here.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Import and Export: A Guide to Trade in Vietnam

In this issue of Vietnam Briefing Magazine, we provide you with a clear understanding of the current business trends related to trade in Vietnam, as well as explaining how to set up your trading business in the country. We also attempt to give perspective on what will be Vietnam’s place in the Association of Southeast Asian Nations (ASEAN) in 2015, and look at some of the country’s key import and export regulations.

Using Vietnam’s Free Trade & Double Tax Agreements

Using Vietnam’s Free Trade & Double Tax Agreements

In this issue of Vietnam Briefing we explore how Vietnam’s Free Trade Agreements – and especially those via its membership in ASEAN – will affect foreign investment into Vietnam. We also go a step further and examine the specific, bilateral Double Tax Agreements that Vietnam has enacted, and how these can be further used to minimize profits and withholding taxes that would otherwise be levied upon foreign investors.

Developing Your Sourcing Strategy for Vietnam In this issue of Vietnam Briefing Magazine, we outline the various sourcing models available for foreign investors – representative offices, service companies and trading companies – and discuss how to decide which structure best suits the sourcing needs of your business.

Developing Your Sourcing Strategy for Vietnam In this issue of Vietnam Briefing Magazine, we outline the various sourcing models available for foreign investors – representative offices, service companies and trading companies – and discuss how to decide which structure best suits the sourcing needs of your business.

- Previous Article Assessing Foreign Investment Potential in Vietnam Through the Business Optimism Index

- Next Article Vietnam in the UK’s Pivot to ASEAN