Key ASEAN Industries in Vietnam for Foreign Investors

HCMC – As Vietnam experiences greater integration into the ASEAN community, the country is seeing strong growth in a number of industries. Among the key business areas are electronics, information and communications technology, textiles and apparel, and medical devices. Foreign investors seeking to find the next manufacturing destination after China, would be well advised to look closely at this dynamic country. In this article we provide a snapshot into each industry in Vietnam and provide context within the wider ASEAN region.

RELATED: Dezan Shira & Associates’ Asia Business Model Comparison Services

RELATED: Dezan Shira & Associates’ Asia Business Model Comparison Services

Electronics

The electronics sector has long been a major force in ASEAN’s rapid economic development, and continues to rise. Traditionally it was China, with its vast and cheap labor force, where parts supplied by other countries would be assembled and shipped to the rest of the world. However, China’s recent move up the export market value chain from mass manufacturing to more high-tech products, as well as its rising labor costs, have resulted in a shift of FDI to ASEAN’s Mekong countries (Myanmar, Thailand, Cambodia, Vietnam).

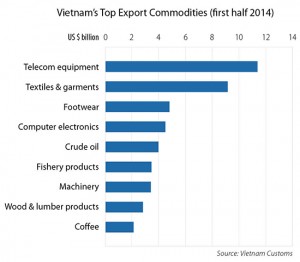

In particular, Vietnam has emerged as an important electronics exporter, with electrical and electronic (E&E) products overtaking coffee, textiles and rice to become the country’s top export item in 2012, as well as capturing a six percent share of the computer and telecom equipment market, up from zero. The country has recently attracted substantial investments from multinational giants such as Samsung and Mitsubishi, and analysts predict that once Thailand moves up the value chain, Vietnam will take its place.

Information and Communications Technology (ICT)

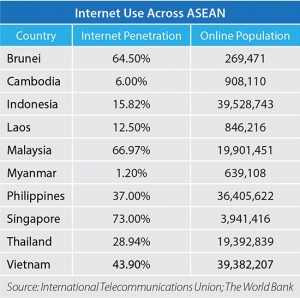

Historically, the information and communications technology (ICT) sectors have remained some of the most closed to foreign investment in ASEAN. However, as ASEAN marches ever closer to total economic integration in 2015, great strides are being taken to both further regional cooperation between the group, with members at varying degrees of ICT development, and to open up the sector to the rest of the world.

One such initiative is the ASEAN ICT Masterplan 2015 (AIM2015), which seeks to expand the reach of services (such as broadband and telecommunications infrastructure), further develop innovation capacity, and encourage FDI. Since its launch in 2011, around 60 related projects have been undertaken, ranging from capacity building and training workshops to the development of regional frameworks for cooperation and coordination in areas such as e-government, cyber security, and policy and regulations. The industry has been developing at a remarkable pace and currently employs over 11.7 million people across the region, contributing more than US$32 billion, or over three percent, of ASEAN’s GDP.

RELATED: ASEAN Investment Horizons: Key Industries for AEC 2015

The region’s large, young, tech-savvy population is shifting from feature phones to smart phones, which currently make up about 66 percent (and rising) of ASEAN’s mobile market. Despite this, the market (largely dominated by Android devices) remains far from saturation, with mobile commerce opportunities continuing to increase.

Textiles and Apparel

Another industry to watch for foreign investment opportunities in the lead up to AEC 2015 is textiles and apparel. Long a bulwark of China’s manufacturing sector, textiles and apparel represent a fast-rising sector in the greater ASEAN economy, where it is the largest industrial employer in the majority of member states. Early on, the importance of textiles to the ASEAN economy was marked by its inclusion as one of 11 sectors selected for accelerated regional integration as part of the Vientiane Action Program (2004).

Within ASEAN, Vietnam is the strongest competitor for inheriting low value-added textiles and apparel manufacturing from China. In contrast to other leading textile exporters in the region (Indonesia, Thailand, Malaysia), the share of Vietnam’s textile exports against its total exports has grown in recent years, based on WTO figures. As of 2012, there were over 3,800 companies in the industry in Vietnam, the majority of which are cut-and-sew enterprises. The industry’s comparative lack of upstream suppliers, where various fabrics and accessories must be imported from outside Vietnam, makes it a prime candidate for regional integration.

Textiles consistently rank among Vietnam’s leading export industries, employing upwards of 1.3 million workers in directly related jobs and more than two million with auxiliary work included. The country’s voracious demand for cotton (400,000 megatons consumed in 2012) is primarily fed by the U.S., India, and South Africa.

Vietnamese-produced yarn is then exported to buyers in China, Korea, and Turkey. Vietnam has set targets for 2020 of increasing investment capital in its textiles industry to US$25 billion and the related workforce to three million.

Overall, challenges remain for creating an intra-ASEAN comprehensive supply chain for the textiles industry capable of competing on a global footing. Such is the aim of the Source ASEAN Full Service Alliance (SAFSA) established in 2010 by the ASEAN Federation of Textile Industries (AFTEX). Within the region, the Thai and Vietnamese apparel industries are already very closely tied: bilateral trade in garments reached US$160 million in the first half of 2014, which was heavily weighted toward imports into Vietnam.

Medical Devices

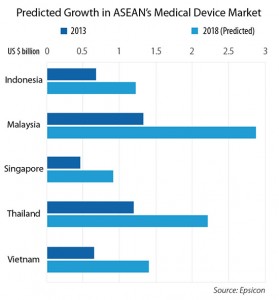

A rapidly expanding middle class and, for some, the beginnings of a greying population, has been driving the boom in trade of medical devices in the region. ASEAN’s medical device market, which was worth about US$4.6 billion in 2013, is expected to double to US$9 billion by 2019, according to Pacific Bridge Medical.

Local medical device markets within the region have been charting double digit growth rates in recent years, and will likely continue to do so. With the increased demand for better healthcare, encouraged by governmental focus on healthcare as a priority sector for trade and service liberalization under the AEC Blueprint, the upside market potential for medical devices in the region is immense.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Vietnam: A Guide to HR in Asia’s Next Growth Market

Vietnam: A Guide to HR in Asia’s Next Growth Market

In this issue of Vietnam Briefing, we attempt to clarify human resources (HR) and payroll processes in Vietnam. We first take you through the current trends affecting the HR landscape and then we delve into the process of hiring and paying your employees. We next look at what specific obligations an employer has to their employees. Additionally, we guide you through the often complex system of visas, work permits, and temporary residence cards. Finally, we highlight the benefits of outsourcing your payroll to a “pan-Asia” vendor.

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition) provides readers with an overview of the fundamentals of investing and conducting business in Vietnam. Compiled by Dezan Shira & Associates, a specialist foreign direct investment practice, this guide explains the basics of company establishment, annual compliance, taxation, human resources, payroll, and social insurance in the country.

- Previous Article Asia Briefing Ltd. Announces New Logo for Vietnam Briefing

- Next Article Vietnam Loosens Housing Laws for Foreign Investors