IFRS and VAS Part 1: Introduction to Vietnamese Accounting Standards

Contributed by Lukas Lindemann

In part one of this three-part series, Vietnam Briefing introduces the differences between IFRS and VAS.

International Financial Reporting Standards (IFRS) are global accounting standards issued and regulated by the International Accounting Standard Board (IASB) to guide the preparation and presentation of financial reports. Vietnam uses IFRS as a basis for its own system, the Vietnamese Accounting Standards (VAS), yet there are key differences between the two.

As all foreign and local companies operating in Vietnam are obliged to conform to VAS, foreign investors should be well aware of unique fundamental characteristics of VAS to fully comprehend compliance requirements and make informed investment decisions.

Vietnam’s government currently has 26 VAS accounting standards based on IFRS. To provide guidance for local and foreign enterprises in Vietnam on these standards, the Ministry of Finance (MoF) recently issued Circulars, No. 200/2014/TT-BTC and No. 202/2014/TT-BTC, which enhance the comparability and transparency of corporate financial statements and bring the two systems closer.

Key differences between IFRS and VAS include terminology, applied methods or presentation scope. Below are several critical differences between the two financial reporting systems.

Presentation of financial statements

A complete set of financial statements based on IASB’s International Accounting Standard (IAS) 1 includes the following:

- Balance Sheet;

- Income Statement;

- Cash Flow Statement;

- Statement of Changes in Equity; and

- Notes, including a summary of significant accounting policies and other notes.

The components of financial statements under VAS are:

- Balance Sheet;

- Income Statement;

- Cash Flow Statement; and

- Notes.

According to VAS 21, the Statement of Changes in Equity is enclosed in the Notes, rather than as a primary component of the financial statement. Furthermore, VAS does not require disclosure of management’s key judgments, assumptions about the future and sources of estimation uncertainty.

Cash flow statements

Under IFRS 7, cash flow statements are based on the balance sheets from the first and final period accounting reports and can include some information from the ledger. IFRS stipulates that receivable accounts and trade payables can be separated from receivable accounts and payables on the sale of fixed assets or long-term assets; hence, cash flow from business is distinct from cash flow from financial investment.

Based on VAS 24, cash flow statements are taken from the cashbook and ledger bank deposits corresponding to the side account. VAS 24 gives guidance on setting up cash flow statements using the indirect method starting from pre-tax profits plus or minus the adjustment including differences of payables excluding payables related to financial investment activities.

Chart of accounts

Vietnam’s Ministry of Finance issued a uniform chart of accounts for enterprises’ financial statements. Circular No. 200/2014/TT-BTC introduced new accounts, including corporate restricting funds (Account 417) and prize stabilization funds (Account 357), while some are omitted or amended.

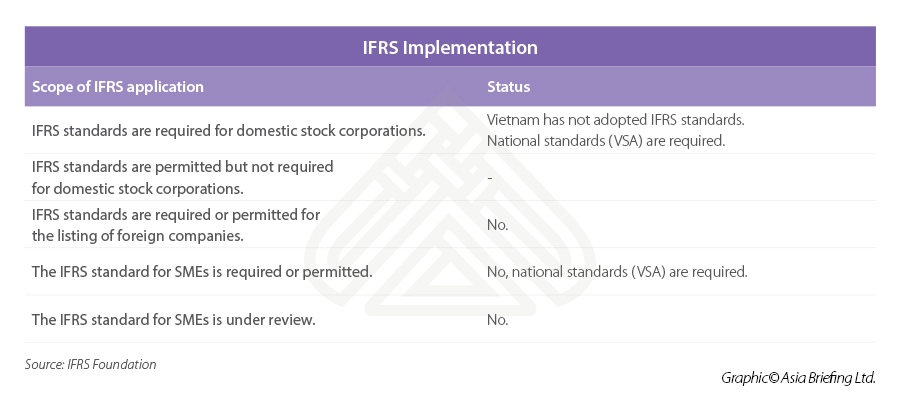

Introduction of IFRS in Vietnam

In the future, however, VAS will be replaced by IFRS and promote international conformity in the field of accounting.

3 stage roadmap

The MoF is responsible for the introduction of IFRS in Vietnam. In March 2019, the MoF published a draft IFRS roadmap before it was submitted to the Prime Minister for approval. The roadmap divides the IFRS implementation into three stages:

Stage 1 (2019-2021): The MoF makes necessary preparations for the implementation of the roadmap, such as the publication of the Vietnamese translation of IFRS standards, training and the preparation of guidelines for IFRS implementation. Companies that will adopt IFRS from 2022 onwards will receive special support.

Stage 2 (2022-2025): The MoF selects certain pilot companies, in particular state-owned enterprises, listed companies, and (large) non-listed companies, to implement IFRS in practice. Foreign companies can adopt IFRS for their individual financial statements on a voluntary basis.

Stage 3 (from 2025): IFRS will be mandatory for the consolidated accounts of all state-owned companies, listed companies, and (large) non-listed companies. All other companies can adopt IFRS for their individual financial statements on a voluntary basis.

Outlook

The adoption of IFRS will be mandatory for state-owned enterprises (SOEs), listed companies and large, unlisted public companies after 2025.

Trinh Duc Vinh, Deputy Director of the AAPD at the Ministry of Finance, said the application of IFRS in Vietnam should overcome the limitations of the VAS, perfecting the legal framework for accounting and increasing the transparency of financial information. It also aims to promote corporate accountability by facilitating Vietnamese companies’ access to more sources of capital and listing in the international market so that Vietnam is internationally recognized as a full-fledged market economy.

Note: This article was first published in August 2015 and has been updated to include the latest developments.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Vietnam’s Business License Tax Exemption: Highlights of Decree 22

- Next Article Einführung der IFRS in Vietnam – ein Überblick