Vietnam’s School Education Sector: Foreign Investment Scope and New Regulatory Changes

Vietnam’s school education sector presents strong foreign investment potential, fueled by rising demand, supportive policies, and tax incentives. Decrees 124 and 125, effective November 20, 2024, enhance oversight and operational and investment considerations. Foreign education institutions and business stakeholders in the sector must conduct thorough market research to understand updated capacity needs, capital thresholds, and eligibility criteria for setting up in the country.

Vietnam’s government aims to boost private sector participation in the education industry. In 2019, the government issued Resolution 35/NQ-CP (“Resolution 35”), focusing on mobilizing social resources for investment in education and training development from 2019 to 2025. Under this resolution, Vietnam targets non-public educational institutions to make up 8.75 percent of all institutions by 2020 and 13.5 percent by 2025.

|

Targeted Proportion of Private Educational Institutions in Vietnam’s Educational System by 2020 and 2025 (%) |

||

|

Education categories |

2020 |

2025 |

|

Preschool education |

20 |

25 |

|

General education |

2.3 |

2.7 |

|

Higher education |

28 |

30 |

|

Vocational training |

28 |

30 |

|

Total |

8.75 |

13.5 |

Source: Resolution 35

To achieve this goal, the government has outlined steps to improve the investment environment in education, including facilitating visa and work permit processes to attract foreign intellectuals, businesspeople, and enterprises, both local and international.

However, experts are now calling for accelerated implementation to meet the targets with less than two years remaining before the deadline. For example, according to the Ministry of Education and Training, by early 2022, Vietnam had 67 private higher education institutions, representing 27.68 percent of the total—0.32 percentage points below the 2020 target. This data excludes universities and academies in the security and defense sector.

As the government is expected to intensify its efforts, the unmet goals offer significant opportunities for foreign investment in Vietnam’s education sector.

Private school market dynamics in three major cities in Vietnam

Growing demand

A significant portion of Vietnam’s population is school-aged. According to real estate agency Savills, as of 2019, 39 percent of Hanoi’s population was school-aged, while Ho Chi Minh City (HCMC) and Binh Duong had 36 percent and 38 percent, respectively. The influx of foreign direct investment (FDI), along with the national economy’s positive growth, has fueled demand for education, particularly as over 50 percent of international school students are foreign nationals.

Additionally, rising incomes and the expansion of the middle class—projected to grow by 36 million by 2030—are increasing disposable income, driving higher spending on services like private education and training. From 2014 to 2020, average annual incomes saw significant growth across major cities, further supporting this trend.

In the 2022 Global Innovation Index (GII), Vietnam achieved impressive rankings, placing second among lower-middle-income countries, just behind India, and 48th globally. However, its performance on the Human Capital Index (HCI) was less favorable, ranking 80th. To meet its goal of becoming an innovative, high-tech economy, Vietnam faces significant pressure to address potential skills shortages in the future, with increased support from the private sector seen as crucial to this effort.

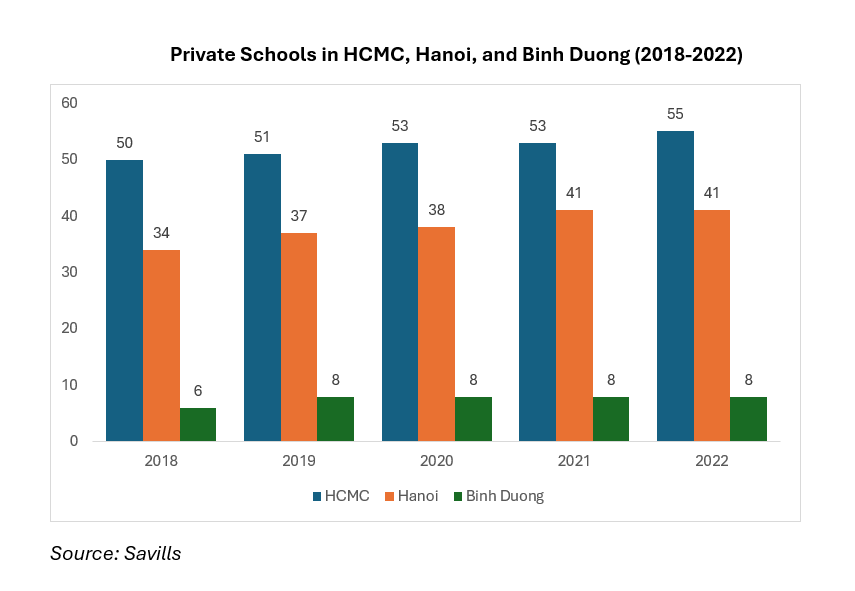

Current supply of private schools

As of 2022, the number of private schools in Vietnam remained significantly lower than public schools. For example, in Hanoi, only 41 out of 2,801 schools were private, while Binh Duong had 8 out of 715, and Ho Chi Minh City (HCMC) had 55 out of 2,346. Most private schools in Hanoi and HCMC were either pre-schools or compulsory schools, with kindergartens representing the largest share in Binh Duong.

According to Savills, private senior high and secondary schools in these cities charged the highest fees, with tuition exceeding US$20,000 per student per year. Meanwhile, international kindergartens were the most affordable but still averaged US$10,794 per student annually. Bilingual schools tended to be more cost-effective in comparison.

Annual tuition fees of major international and bilingual schools in Hanoi (the School Year 2023-2024)

|

School |

Campus |

Student enrollment in Hanoi by education program |

Average tuition fees by education program |

|||

|

Total (US$) |

International |

Bilingual |

International |

Bilingual |

||

|

United Nations International Schools of Hanoi (UNIS) |

1 |

1,000-2,000 |

100% |

0% |

31,854 |

NA |

|

British International School Hanoi (BIS) |

1 |

1,000-2,000 |

100% |

0% |

30,289 |

NA |

|

St. Paul American School Hanoi |

1 |

500-1,000 |

100% |

0% |

26,686 |

NA |

|

Hanoi International School (HIS) |

1 |

Less than 500 |

100% |

0% |

26,798 |

NA |

|

Singapore International School (SIS) |

3 |

500-1,000 |

45% |

55% |

21,977 |

12,899 |

|

British Vietnamese International School Hanoi (BVIS Hanoi) |

1 |

1,000-2,000 |

100% |

0% |

21,656 |

NA |

|

TH School |

2 |

500-1,000 |

100% |

0% |

21,986 |

NA |

|

Horizon International Bilingual School (HIBS) |

1 |

Less than 500 |

45% |

55% |

19,806 |

11,658 |

|

International School at ParkCity Hanoi (ISPH) |

1 |

Less than 500 |

100% |

0% |

23,498 |

NA |

|

International schools (Total/Average) |

12 |

12 7,127 |

85% |

15% |

24,950 |

NA |

|

Vinschool |

7 |

Over 15,000 |

0% |

100% |

NA |

4,782 |

|

Wellspring |

1 |

1,000-2,000 |

3% |

98% |

18,505 |

8,426 |

|

Olympia |

1 |

1,000-2,000 |

0% |

100% |

NA |

7,127 |

|

Hanoi Academy |

1 |

1,000-2,000 |

0% |

100% |

NA |

5,351 |

|

Alfred Nobel |

1 |

1,000-2,000 |

0% |

100% |

NA |

4,668 |

|

Bilingual schools (Total/Average) |

11 |

24,700 |

0% |

100% |

NA |

6,071 |

Source: Fiingroup

Regulations for foreign investments

Setting up an educational institution in Vietnam requires navigating various regulations and securing necessary approvals. Educational institutions can be public or non-public, with non-public institutions classified as semi-public, individually founded, or private. All institutions must adhere to the national curriculum and comply with Vietnamese laws. In line with Vietnam’s commitments to the World Trade Organization, foreign investors are allowed to establish wholly foreign-owned educational institutions.

Recent updates, particularly under Decree No. 86/2018/ND-CP (“Decree 86”) on Foreign Cooperation and Investment in Education, have increased the limit for foreign program enrollment at the preschool and compulsory education levels to below 50 percent. Foreign-owned companies can also establish various educational entities, including short-term training centers and branch campuses of foreign higher education institutions.

To proceed, investors must acquire an Investment Registration Certificate (IRC) and an Establishment Registration Certificate (ERC). Following this, they need approval to establish the educational facility and a license for educational activities.

Decree 99/2019/ND-CP, effective from February 15, 2020, outlines further requirements for foreign higher education institutions, including a minimum capital investment of US$21.5 million and the formation of a governing board, while also granting these institutions greater autonomy in their operations.

New twin decrees regulate education investments

On October 5, 2024, the Vietnamese Government issued Decree No. 124/2024/ND-CP (“Decree 124”) and Decree No. 125/2024/ND-CP (“Decree 125”). Both decrees took effect on November 20, 2024, and introduced significant updates to the regulations governing foreign and domestic investments in Vietnam’s education sector.

Decree 124 modifies the regulations regarding foreign-invested educational institutions, emphasizing the importance of partnerships with foreign entities and establishing campuses of foreign educational institutions in Vietnam. In contrast, Decree 125 updates the regulatory framework for domestically invested institutions, which includes preschools, universities, and standards for education quality assurance.

Information disclosure

A key difference between these two decrees is that Decree 124 aims to enhance transparency in foreign educational institutions, while Decree 125 seeks to streamline the supervision of domestic entities.

Specifically, Decree 124 mandates foreign educational institutions to publicly disclose comprehensive information about their educational programs, foreign teachers, and the demographics of their students. This information must be clear, complete, accurate and made available on the institutions’ websites to students, parents, and the public. Meanwhile, Decree 125 only requires the basic disclosure of establishment and operational licenses for educational institutions.

Foreign partnerships

Decree 124 stipulates that foreign institutions partnering with Vietnam must be legally established and operational for a minimum of five years. Additionally, these institutions must have quality certification from recognized accrediting bodies. Their teaching programs in Vietnam must align with the educational goals of the country, ensuring consistency in academic standards and preventing an excessive curriculum for students.

Also Read: Education in Vietnam: Opportunities and Challenges

Requirements for foreign-capitalized educational institutions

|

School type |

Capital requirements |

Infrastructure requirements |

Staffing and enrollments |

|

Pre-school institutions |

– Minimum investment of about VND 30 million (approx. US$1,200) per child (excluding land tenancy expenses).

|

– Minimum land area for campus: 8m² per student in urban and suburban areas and 12m² per student in rural areas. – Must be located in a suitable environment (safe water supply, food safety, playground, walls, trees). – All constructions and materials must ensure safety for kids. |

– The teachers must have at least college degrees in preschool pedagogy or equivalent. – Specific requirements for the maximum number of kids within a group or a class by age and per teacher.

|

|

Compulsory schools (K-12) |

– Minimum investment of about VND 50 million (approx. US$20,000) per student (excluding land tenancy expenses) and must be more than VND 50 billion (approx. US$2 million). |

– Minimum land area for campus: 6m² per student in urban and suburban areas and 10m² per student in rural areas. – Areas for learning must be at least 2.5m² per student. |

– Teachers shall hold at least a bachelor’s degree in pedagogy or equivalent. – Compulsory ratios of teachers per class for elementary, secondary, and high schools. – Student limits for elementary, secondary, and high schools. |

|

Higher educational institutions |

– Minimum investment of about VND 1 trillion (approx. US$39.3 million) excluding land tenancy expenses. |

– Minimum land area for campus: 25m² per student. – Minimum land area for buildings: 9m² per student, including 6m² for the study area and 3m² for the living area. – Minimum administration area: 08 m2 per person.

|

– Lecturers must have at least a master’s degree or higher. – The proportion of lecturers with a doctorate degree must not be less than half of the total number of lecturers, except for special training majors. – Promulgated maximum ratio of students to lecturers by art majors, science and technology majors, or social science, humanities, and economics majors – business administration major. – The higher educational institution shall have enough permanent lecturers to undertake at least 60 percent of the program of each discipline. |

|

A branch campus of higher education institutions |

– Minimum investment of about VND 500 billion (approx. US$19.7 million) excluding land tenancy expenses. |

||

|

Short-term training centers |

– Minimum investment of about US$800 per student (excluding land tenancy expenses). |

– Classes must have appropriate teaching materials and at least 2.5m² per student. |

– The teachers must have college degrees or equivalent in the profession suitable to their teaching subjects. – Foreign teachers teaching foreign language skills must have a college degree or equivalent or higher and meet the Ministry of Education and Training requirements. – The maximum ratio of students to teachers shall be 25:1. |

Sources: Decree No. 86/2018/ND-CP; Decree No.124/2024/ND-CP

Notes:

- The total minimum capital is calculated based on the institution’s maximum estimated education capacity.

- For foreign-invested educational institutions using leased facilities or facilities contributed by a Vietnamese partner, the investment must cover at least 70 percent of the capital specified in Decree 86.

- Foreign-invested educational institutions must secure facility leases for a minimum of five stable years and ensure that the facilities meet all stipulated requirements.

- Only foreign higher educational institutions ranked in the global top 500 over the last three years are eligible to establish branch campuses in Vietnam.

Investment incentives

Foreign investments in educational institutions shall benefit from incentives under Vietnam’s Law on Corporate Income Tax (CIT) and Law on Value-added Tax (VAT), as below:

- 10 percent CIT rate on investment incomes.

- CIT exemption for undistributed incomes retained for investment.

- VAT incentives are available for most education-related goods/services.

Outlook

Investing in Vietnam’s education sector offers promising returns but also requires navigating stringent regulations related to capital, infrastructure, and operations. Foreign investors should carefully assess their target location, considering factors such as competitor tuition rates, demographics, and local human resource training plans.

Looking ahead, experts predict the following key trends in Vietnam’s private education sector that investors should consider:

- Continued growth in investments in kindergartens and K-12 schools, including new establishments, mergers and acquisitions (M&A), and private equity transactions.

- Increased focus on investment in higher education and vocational training.

- A shift toward training tailored for the new technology era.

- The rise of online training as a complementary method to traditional education models.

(This article was originally published October 14, 2024. It was last updated November 26, 2024.)

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, China, and India. For editorial matters, contact us here and for a complimentary subscription to our products, please click here. For assistance with investments into Vietnam, please contact us at vietnam@dezshira.com or visit us at www.dezshira.com.

Dezan Shira & Associates assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. We also maintain offices or have alliance partners assisting foreign investors in China, Hong Kong SAR, Dubai (UAE), Indonesia, Singapore, Philippines, Malaysia, Thailand, Bangladesh, Italy, Germany, the United States, and Australia.

- Previous Article Vietnam-UAE Comprehensive Economic Partnership Agreement (CEPA): Key Details

- Next Article 2024 Vietnam-South Korea Investment Forum Seeks Greater SME Engagement, R&D Collaboration