E-Invoice Compliance in Vietnam: Regulations, Requirements, and Best Practices

Vietnam mandates the use of e-invoice (electronic invoice) for all taxpayers. This article provides essential guidance and notes the step-by-step compliance requirements for businesses implementing e-invoicing.

Vietnam’s provisions on e-invoices are promulgated under Law on Tax Administration 2019, Decree 123/2020/ND-CP, and Circular 78/2021/TT-CP.

Starting July 1, 2022, all enterprises, economic organizations, household businesses, and individuals paying tax under the declaration method in Vietnam must use e-invoices, except for certain cases.

Types of e-invoices in Vietnam

According to Article 8 of Decree no.123/ND-CP, invoices are classified into the below types:

- Value-added tax (VAT) invoice: This may be used by organizations that make VAT declarations using the declaration method.

- Sales invoices: Used to record revenue from the sale of goods or provision of services that declare VAT under the direct method.

- Invoices for public property sales: Used to record revenue from the sale of public property by state agencies, public non-business units, and socio-political organizations.

- Electronic sales invoices on national reserve goods: Used when a state reserves agency or unit sells national reserve goods in accordance with regulations and laws.

- Other documents that are treated as invoices: These include tickets, cards, delivery and internal transfer notes, and delivery notes for goods sent to sales agents.

What information must be contained on the e-invoice

As per Article 10 of Decree 123/2020/ND-CP, an eligible e-invoice must contain the following information:

- Name of e-invoice, serial of e-invoice;

- E-invoice number;

- Name, address, and tax code number of the seller;

- Name, address, and tax code number of the buyer;

- Electronic signature by the seller and buyer;

- E-invoice date;

- Signature date;

- Name and tax code of e-invoice provider; and

- Transaction details, including the description of goods or services on quantity, unit price, total amount, and any applicable taxes.

E-invoices must be stored and archived according to the regulations to ensure they are accessible for future reference and tax audit.

The invoiced text must be in Vietnamese. If foreign language text is needed, it should be placed in parentheses (_) to the right or below the Vietnamese text and formatted in a smaller font. When omitting diacritics in Vietnamese, care must be taken to avoid misinterpretation.

Numbers on the invoice must use Arabic numerals: 0, 1, 2, 3, 4, 5, 6, 7, 8, 9.

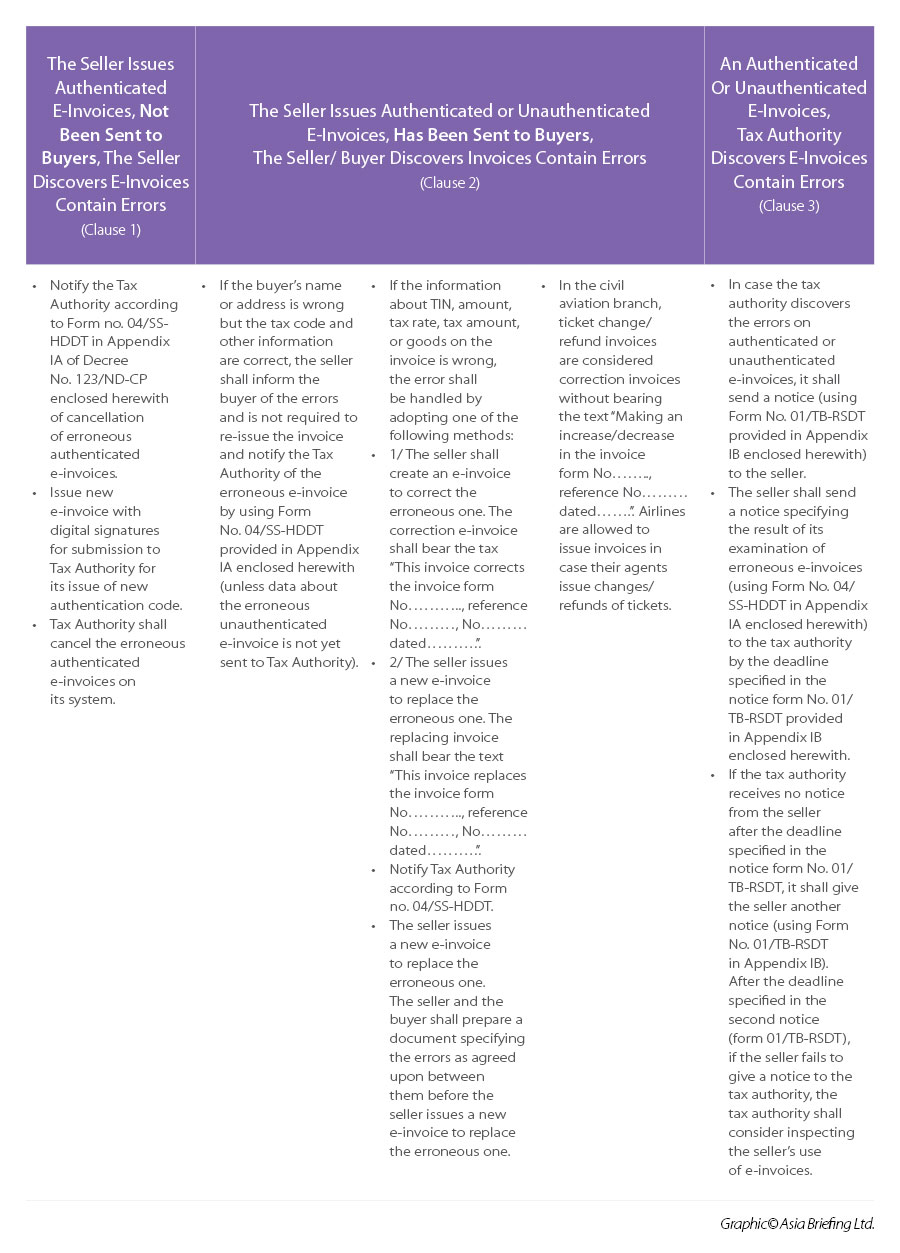

In the event of errors on either authenticated or unauthenticated e-invoices, Article 19 of Decree 123/2020/ND-CP guides on how to address these discrepancies.

Details are summarized in the table below.

E-invoice registration process

For e-invoice registration, enterprises in Vietnam need to follow the steps implemented under Article 15, Decree 123/2020/ND-CP. These are listed below.

Step 1: Applying through e-invoice service providers

Companies must prepare the registration form for using e-invoices according to Form No. 01/DKTD-HDDT in Appendix IA, enclosed with this decree. In this form, the enterprise must specify information about:

- The invoice type (with or without the tax authority’s authentication code);

- An active email address for the tax authorities to send notifications on registration results; and

- Other related information.

Applications for free-of-charge use of authenticated e-invoices may be submitted via the web portal of the General Department of Taxation (GDT) or an e-invoice service provider entrusted by the GDT to provide free-of-charge authenticated e-invoices.

If enterprises transmit e-invoice data directly to tax authorities, they shall apply to using e-invoices via the GDT web portal.

Step 2: Acknowledging the application form

The electronic portal of GDT will send an electronic notification confirming the receipt of the enterprise’s registration for using e-invoices.

Step 3: Obtaining result notification

Within 01 working day from the date of receiving the registration, the tax authority will send an electronic notification according to Form No. 01/TB-DKDT in Appendix IB issued with the decree.

- If accepted, the enterprise proceeds to issue e-invoices.

- If not accepted, the enterprise must adjust and supplement the content as

- required by the tax authority and re-submit according to the above steps.

Please be advised that all the steps above can be taken by the Company or via an e-invoice provider on behalf of the Company.

Key purposes and timing for issuing invoices

There are different times to issue invoices for certain purposes. These are listed below.

For goods sales

Invoices for goods sales shall be issued when the right to own or use goods is transferred to buyers, whether the invoiced amount is paid or not. The goods sales in this category also include the sale of state-owned property, property confiscated and put into state funds, and the sale of national reserve goods.

For service provisions

Invoices for service provisions shall be issued upon completion of the provision of services, whether the invoiced amount is paid or not. If a service is provided with payments collected in advance or during the service provision, an invoice shall be issued when each payment is made.

This requirement of invoice issuance excludes payments of deposited amounts or advance payments, which are made to ensure:

- Execution of contracts for the provision of accounting, audit, financial consulting, or taxation services;

- Valuation services;

- Technical survey and design services;

- Supervision consulting services; and

- Investment construction project formulation services.

For multiple deliveries

In cases where multiple deliveries are required, or each goods item or service phase is accepted, it shall be mandatory to issue an invoice showing the quantity and value of goods or services for each respective delivery or acceptance.

For specific cases

- In cases where a service is provided regularly and in large quantities, and needs time for checking and verifying figures between the service provider and its clients/partners, such as air transport support services, supply of aviation fuel to airlines, supply of electricity (except the case prescribed in Point h of this Clause), supply of water, television services, postal and delivery services (including agency services, cash collection and payment services), telecommunications services (including value-added telecommunications services), logistics services, IT services (except the case prescribed in Point b of this Clause) which are periodically provided, invoices shall be issued upon completion of figures checking and verification between the parties but no later than the 07th of the month following the month in which the service is provided or within 07 days after the end of a cycle. This cycle shall be agreed upon between the service provider and the buyer.

- With regard to telecommunications services (including value-added telecommunications services) and IT services (including intermediary payment services provided on telecommunications or IT platforms) of which the payments require checking and verification of data connections between the service providers, invoices shall be issued upon completion of service charge data under economic contracts signed between service providers but within 2 months following the month in which connection service charges arise.

Above are two common cases in practice. Clause 4, Article 9, Decree 123/2020/ ND-CP details 13 specific cases for invoicing timings that businesses must refer to.

Suspension of e-invoice use

According to Article 16 of Decree 123/2020/ND-CP, enterprises, business entities, organizations, or individual businesses must suspend the use of authenticated and unauthenticated e-invoices in the following circumstances:

- The entity’s Tax Identification Number (TIN) has been invalidated.

- The entity is not operating at the registered location, as confirmed by the tax authority.

- The entity has submitted a notification of business suspension to a competent authority.

- The tax authority has prohibited using e-invoices to enforce tax debt payments.

- E-invoices are utilized to sell smuggled, banned, counterfeit goods or goods violating intellectual property rights as reported by competent authorities.

- E-invoices are used for fraudulent short selling of goods or services as detected and reported by competent authorities.

- A business registration authority or relevant authority has requested the suspension of operations in a conditional business line due to non-compliance with legal business conditions.

Penalties for violations related to e-invoice issuance

Penalties for violations of regulations on issuing invoices upon the sale of goods or provision of services are provided under Article 24 of Decree 125/2020/ND-CP.

|

Penalty |

Violation |

|

Penalty cautions |

|

|

Fines from VND500,000 to VND1,500,000 (about US$20-60) |

|

|

Fines from VND3,000,000 to VND5,000,000 (about US$118-197)

|

|

|

Fines from VND4,000,000 to VND8,000,000 (about US$157-315)

|

|

|

Fines from VND10,000,000 to VND20,000,000 (about US$392-784)

|

|

(With inputs from Mia Pham, Corporate Accounting Services, Dezan Shira & Associates Vietnam.)

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, China, and India. For editorial matters, contact us here and for a complimentary subscription to our products, please click here. For assistance with investments into Vietnam, please contact us at vietnam@dezshira.com or visit us at www.dezshira.com.

Dezan Shira & Associates assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. We also maintain offices or have alliance partners assisting foreign investors in China, Hong Kong SAR, Dubai (UAE), Indonesia, Singapore, Philippines, Malaysia, Thailand, Bangladesh, Italy, Germany, the United States, and Australia.

- Previous Article Vietnam’s Natural Resource Tax 2024

- Next Article Special Consumption Tax in Vietnam 2024