Choosing the Correct VAT Calculation Method in Vietnam

Value-added Tax (VAT) is a broadly-based consumption tax assessed on the value added to goods and services arising through the process of production, circulation, and consumption. It is applicable to the majority of goods and services bought and sold for use in Vietnam.

VAT is an indirect tax on domestic consumption applied nationwide rather than at different levels such as state, provincial or local taxes. It is a multi-stage tax which is collected at every stage of the production and distribution chain and passed on to the final customer.

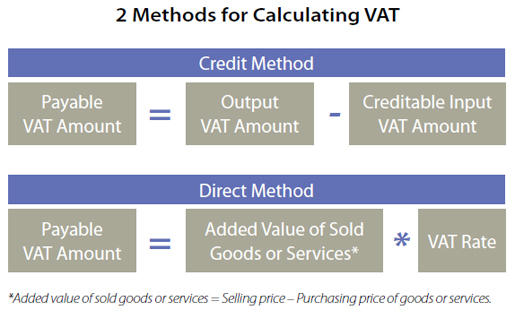

There are two methods for calculating VAT:

RELATED: Dezan Shira & Associates’ International Tax Planning Services

RELATED: Dezan Shira & Associates’ International Tax Planning Services

Credit method

Most businesses are required to use the credit method, which applies to business organizations established under the Law on Enterprises, foreign invested enterprises and foreign parties to business cooperation contracts.

The output VAT amount is the total amount of VAT on sold goods and services as indicated in the VAT invoices. The creditable input VAT amount is the total VAT amount on goods or services purchased, and on imported goods as indicated in VAT invoices and other relevant documents proving VAT payment.

In order to claim the input VAT, taxpayers must obtain proper VAT invoices from suppliers. In addition, the following conditions must be met:

- The VAT invoices from the purchase of goods and services are legal;

- There is evidence of payment via a bank for the purchased goods and services, except where the total value of the purchase of goods and services is below VND 20 million.

The invoices must be filled out fully and properly, displaying all surcharges and additional charges. Where the VAT invoices do not indicate the VAT amounts, the output VAT will be the payment price indicated on the invoice multiplied by the VAT rate.

Payment and declaration of VAT is made on a monthly basis, where the taxpayer adds and subtracts the input and output VAT, and pays or claims the balance to the relevant bodies. As the situation is normalized every month, no annual VAT finalization is required at the end of the year.

Companies will be given a grace period of six months to correct errors in the declaration and deduction of input VAT. Where the taxpayer’s input VAT is not credited for three or more consecutive months, it can claim a refund from the tax authorities. In certain cases, exporters with excess input VAT credits exceeding VND 200 million may be granted a refund on a monthly basis.

Direct method

The direct method applies to business establishments and foreign organizations or individuals without resident offices, but which generate income in Vietnam and have not implemented the Vietnamese Accounting System (VAS). The direct method also applies to gold, silver and gem trading activities.

According to this method, VAT depends on total revenues, which is not known with certainty until the end of the accounting year. As such, the monthly payments are just provisional and the total amount of VAT may be different at the end of the year. Therefore, when using the direct method of calculation, tax finalization procedures must be done within three months following the end of the year.

Taxpayers adopting the VAT direct method should use sales invoices instead of VAT invoices.

This article is an excerpt from the February 2014 edition of Vietnam Briefing Magazine, title “A Guide to Understanding Vietnam’s VAT.” In this issue of Vietnam Briefing, we clarify the entire VAT process by taking you through an introduction as to what VAT is, who and what is liable, and how to pay it properly. We first take you through the basics of VAT in Vietnam before taking you deeper into the topic. Additionally, we provide updates on the new changes to the VAT process and explain how they will impact your business. The magazine is out now and will be temporarily available as a complimentary PDF download on the Asia Briefing Bookstore until the end of April.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam, in addition to alliances in Indonesia, Malaysia, Philippines and Thailand, as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email vietnam@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Vietnam by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Vietnam Issues New VAT Regulations

Vietnam’s VAT Law for the Financial Sector

Calculating Value-Added Tax in China

Implications of the VAT Reform in China

- Previous Article Vietnam’s State Social Insurance Fund

- Next Article Jumpstarting Tech Development and Startups in Vietnam