Why You Should Invest in Vietnam’s E-commerce Industry

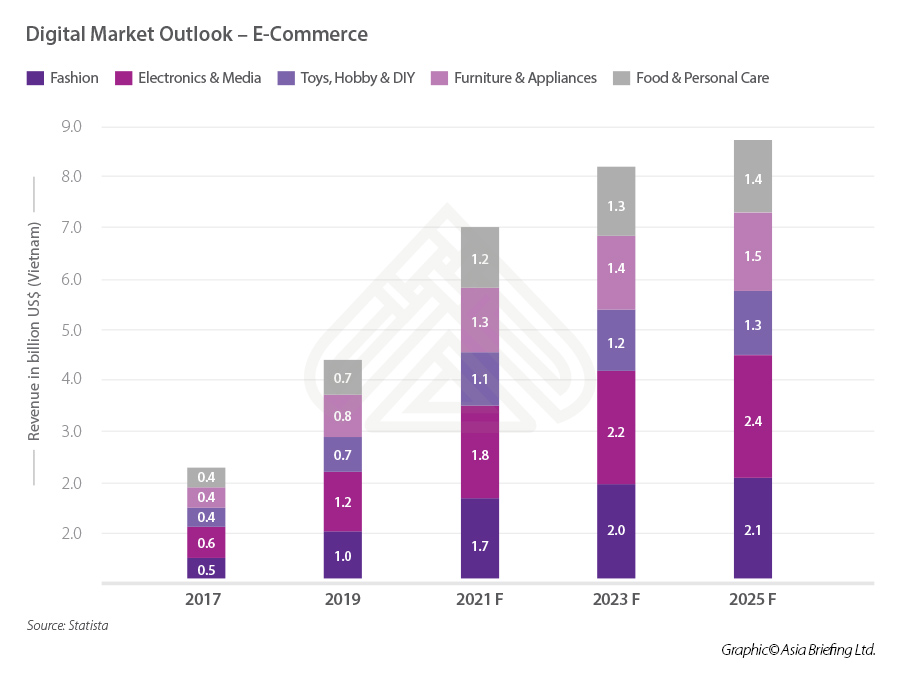

- Vietnam’s rising e-commerce industry is expected reach close to US$9 billion by 2025 representing significant opportunities for investors.

- Electronics, fashion, toys, and furniture represent some of the fastest-growing sub-sectors in the e-commerce industry in Vietnam.

- With room for further growth, investors should consider the opportunities in e-commerce in this fast-growing, vibrant economy.

Vietnam’s e-commerce industry is rapidly expanding, thanks to increasing foreign investments, a favorable regulatory environment, and enhanced internet access. By 2025, online sales are projected to constitute nearly a tenth of the country’s overall goods and services sales.

E-commerce on an upward trajectory

Vietnam’s flourishing digital economy and its vibrant e-commerce space make it a conducive place to tap into new business opportunities. Recently, it has been receiving considerable attention from both domestic and foreign investors.

Untapped potential

E-commerce has been on the rise in Vietnam, increasing from about 28 percent in 2017 to nearly half of the population in 2020. By 2025, over 70 percent of Vietnam’s 100 million population is expected to be using e-commerce transactions. As per Statista, the country’s e-commerce revenue will cross US$6 billion by the end of 2020, with projections closing in near US$9 billion by 2025.

Vietnam’s place within ASEAN e-commerce

Vietnam’s e-commerce is quickly catching up with its ASEAN peers, ranking 86 in the 2020 United Nations E-Government Survey. The country moved up two places among 193 nations, and it is aggressively improving its e-governance, aiming to be among the top four Southeast Asian nations by 2025. Its 40 million online shoppers annually spend US$210 on an average to make it the region’s second-largest e-commerce market. With rising internet access, wider adoption of smartphones, and increasing confidence in online shopping, Vietnam’s e-commerce market is expected to continue to grow in the near term.

Foreign investments

The success of several Vietnamese origin e-commerce platforms, such as Tiki, Sendo, and Thegioididong proves Vietnam’s ability to foster e-commerce. Investments from Japan, Germany, the US, South Korea, China, and Singapore have empowered these platforms’ evolution into large e-commerce powerhouses. Recently, Tiki raised US$130 million from NorthStar Group, in addition to a majority stake investment from China’s JD.com. Another example of these investments is the US$51 million deal of Sendo.vn from Japan’s SBI Holdings. Grab and Gojek, the region’s two most valuable startups, are evaluating the terms of a potential merger. This merger has the power to shift market dynamics across Southeast Asia’s e-commerce sector.

Favorable regulatory environment

For establishing e-commerce, Vietnam offers one of the most favorable legal environments in the ASEAN region. The country has enacted five of its six laws meant for the regulation of e-commerce activities. The recent development of the country’s ecosystem of transportation, delivery, and fulfillment services is centered predominantly around the e-commerce sector. As of 2020, Vietnam is part of thirteen free trade agreements (FTAs) that allow the import and export of goods with reduced or zero customs duties.

Revenue by sub-sectors

Vietnam’s total e-commerce revenue has grown by over 2.6 times in the past three years, crossing US$6 billion in 2020. As per Statista’s estimates, this revenue is expected to grow at the rate of over 24 percent annually for the next five years to reach US$9 billion.

Fashion registered a 180 percent increase in revenue over the past three years. As per the projections, it should grow at 24 percent year-on-year for the next five years, to reach US$2.1 billion. Electronics is the largest and fastest-growing segment of Vietnam’s e-commerce industry. This sector maintained a nearly 27 percent yearly revenue growth for the past three years and is forecast to reach US$2.4 billion by 2025.

Toys, hobby, and DIY saw a near 16 percent growth annually in the past three years. Its growth is expected to slow down to under 15 percent by 2025. Furniture and appliances have shown a promising 18 percent year-on-year growth since 2017 and is expected to maintain a similar pace for the coming five years. Food and personal care have grown over 2.7 times in the past three years and are forecast to grow at a rate of over 16 percent annually for the next half-decade.

Rise of digital payments

The rise of Vietnamese e-commerce as an alternative to brick-and-mortar sales is driving the development of its digital payments sector. Improved reception of digital financial technology (fintech) and the COVID-19 pandemic has facilitated a spike in demand for contact-free and cashless transactions. Nearly a third of Vietnam’s e-commerce transactions rely on cash payments currently, and this share is expected to shrink to a quarter by 2025. A rise in digital payments is likely to take over this seven percent reduction in cash payments.

The booming e-commerce market and favorable regulatory changes are driving the rapid adoption of digital payment modes in Vietnam. E-wallets feature the highest growth projections of all payment modes, with their share to rise by over 15 percent in the next five years, compared to a nine percent estimated growth of other digital payment methods.

The accelerated development of Vietnam’s 4G infrastructure has dramatically brought down its mobile internet costs, making it the 10th cheapest in the world. Affordable mobile internet access has increased the country’s mobile phone base to over 100 million registered subscriptions. This massive internet user base and affordable internet access have been one of the pillars for the rapid adoption of e-commerce and digital payments in Vietnam.

Cash is king but digital wallets gaining popularity

As digital wallets or e-wallets are expected to replace a large portion of cash transactions in Vietnam, there remains significant room for growth. Vietnam has over 13 million e-wallet accounts that are divided among a large number of players. Moca has gained immense popularity after joining hands with Grab in 2018. In terms of capital, Momo is endowed with plenty of funds after gaining a US$133 million investment, and ZaloPay enjoys its presence as the country’s only unicorn.

As per a DealStreetAsia report, the majority stake of WePay, a Vietnamese payments startup, was recently acquired by the Indonesian ride-hailing company Gojek. This deal will help Gojek obtain an e-wallet license, allowing it to expand its digital businesses in the region. Gojek also has gained partnerships with 24 local banks, 1000 merchants, and four international card issuers in this acquisition.

Another e-wallet player, eMonkey, received investments in terms of a majority stake from China-based Ant Financial. Other leading players in this sector include Payoo, AirPay, SenPay, and Viettel.

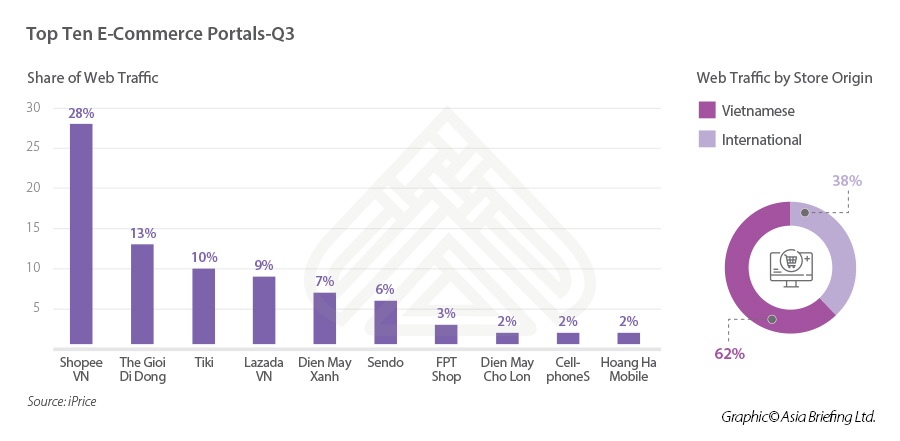

Vietnamese e-commerce sites dominate web traffic

As per iPrice, an e-commerce insights portal, over a quarter of Vietnam’s e-commerce webpage views were from Shopee, making it the country’s most visited e-commerce store in the third quarter of 2020. The top three e-commerce portals, including TheGioiDiDong, and Tiki covered over a half of this traffic together. The leading eight web portals received over four-fifths of Vietnam’s total e-commerce webpage views in the third quarter of 2020.

Vietnamese origin e-stores attracted over three in five page views. The rest of the views were from international players such as Shopee and Lazada, covering about three-quarters and one-quarter of web traffic.

As per the sectors, general e-stores commanded nearly 60 percent of traffic while electronics sites attracted over a third of total views. Fashion, cosmetics, and other sections together represent under five percent of entire webpage views.

E-commerce presents several opportunities but challenges remain

Vietnam’s e-commerce players have encountered challenges, especially in logistics, pricing, and product perception. One fundamental problem is long delivery times, with a survey indicating an average duration of 5.6 days. As fast delivery is an essential requirement for widespread adoption of online shopping, e-commerce players must continue to improve their delivery times.

Another issue faced by investors is damage caused by counterfeit goods, infringing of intellectual property rights, and the sale of banned goods. Factors that deter Vietnamese consumers from online shopping is the disparity between advertisement and actual products, fear of personal data exposure, and high shipping costs.

Key takeaways

The Vietnamese government’s commitment to the economy’s digital transformation has actively driven the development of its e-commerce. Foreign investments in this sector will benefit fueling growth in this sector. Nevertheless, investors should do their due diligence to understand the risks and challenges if entering the e-commerce industry in Vietnam.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Warum Vietnams expandierende digitale Wirtschaft Chancen für Investoren bietet

- Next Article Why Vietnam’s Emergence as a Startup Hub is Promising for Investors