Why Vietnam is a Promising Contender for Investment Following Myanmar’s Coup

One country’s loss is another’s gain. On February 1, Myanmar’s military took over the country in a coup sending shockwaves throughout the region. The move undermined Myanmar’s progress and economic reforms since 2011 when it first held parliamentary elections. Recent media reports have stated that the military coup in Myanmar has forced investors to re-think their investments in the country and a large part of foreign investment may be headed to Vietnam and Cambodia.

For the purposes of this article, we will focus on Vietnam. The likelihood of this happening is high given that businesses prefer a stable political environment and market-led free trade environments. Vietnam has been at the forefront of this, registering high growth, establishing free trade deals, and liberalizing its economy. This trend however has been ongoing for the past decade with Vietnam recording increasing levels of FDI.

High growth recorded until coup

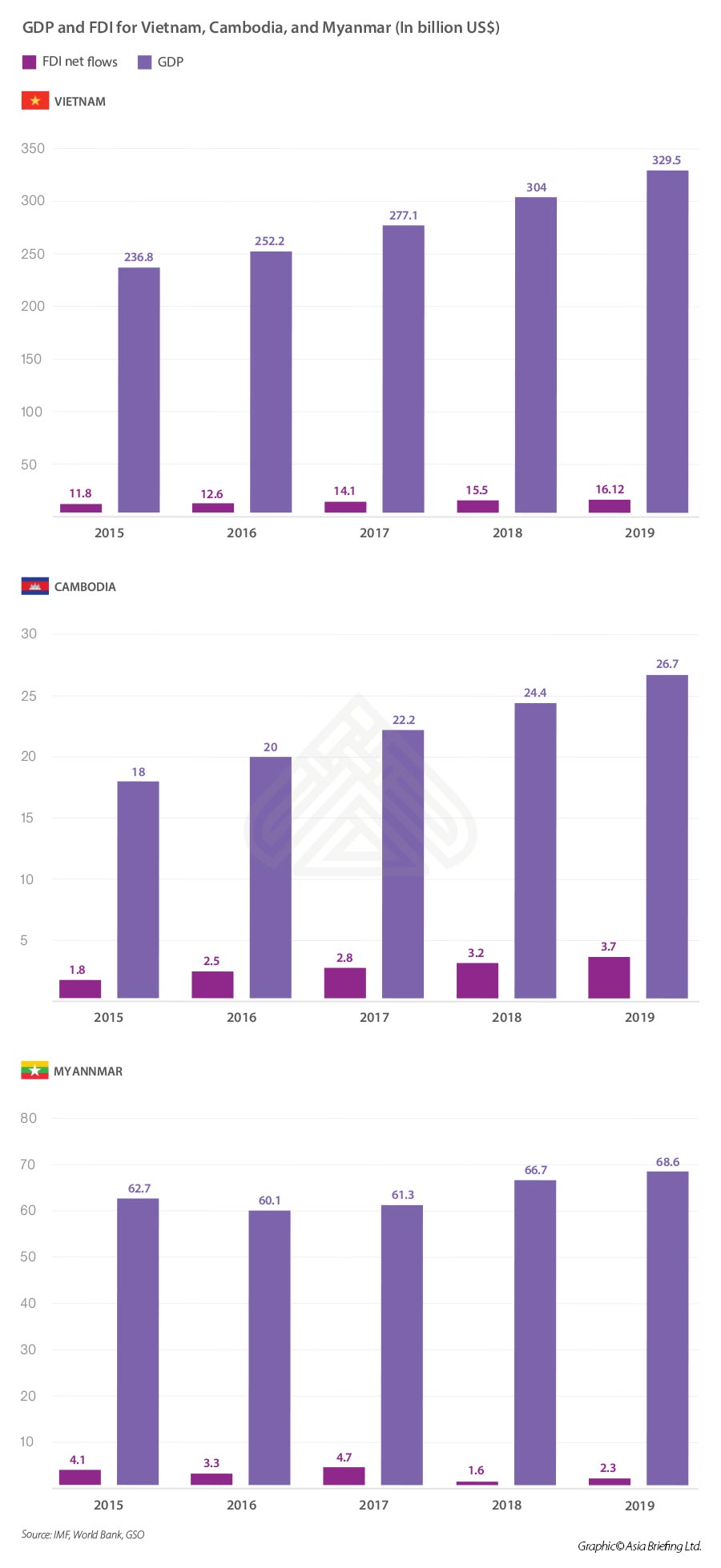

Southeast Asia in general has been recording high growth. More specifically, the Cambodia-Laos-Myanmar-Vietnam (CLMV) subregion has recorded an annual gross domestic product of approximately 6 percent, higher than other parts of Southeast Asia while FDI inflows into the region also grew 6.3 percent in 2019. In fact, Myanmar registered the highest growth at 55.9 percent though Vietnam was the highest in terms of value at US$16.1 billion.

This shows that both Myanmar’s and Vietnam’s economic growth were rapid in recent years as FDI poured in. Myanmar’s coup, at least in the short-term, will halt this growth. DealStreetAsia reported that several foreign businesses that had plans to invest in Myanmar will rethink their plans of investing with countries around the region benefitting from Myanmar’s crisis.

Foreign investors obligated to reconsider investment

US-based Capria Ventures which was scheduled to make an almost US$8 million investment in Myanmar is set to go to Vietnam while also looking at Bangladesh, Cambodia, and Nepal. In addition, Japanese and Singaporeans firms are also seen to terminate contracts with companies linked to the Myanmar military.

Japan has been a large investor in Myanmar with companies including Toyota and Mitsubishi having operations there, however they may now look at options in Vietnam. Recently the Japanese government encouraged Japanese companies to diversify their supply chains out of China with government-provided incentives. With Vietnam’s government encouraging the automotive industry in Vietnam, Japanese auto manufactures can use this opportunity to further their presence in Vietnam.

Myanmar also risks sanctions by western nations with might further scare investors. At present sanctions have been imposed on the military. In addition, the US Commerce Department has imposed trade sanctions restricting exports on Myanmar’s Ministry of Defense and Home Affairs as well as two businesses associated with the military. Any further violence could further deteriorate the situation which is not something investors will be comfortable with.

Vietnam remains a strong contender in the medium to long term for global investment firms as it has already benefitted from companies moving or diversifying operations from China and is thus high on their radar.

As per the World Bank, Singapore was the largest investor, followed by Hong Kong in 2020 in Myanmar. Due to the pandemic, the figures might be even lower this year. Investors have also indicated their plans to divest their investment in Myanmar firms. Businesses are also under pressure for activist groups to cut ties with businesses linked to Myanmar’s military.

Is Chinese investment an option?

Another option is that if investors flee in droves, Chinese investment could move in as Myanmar would need investment and sets its sights on FDI elsewhere. However, this can be tricky as China may have apprehensions about countries that have political uncertainty. In addition, at least 10 Chinese-financed factories were set on fire by protesters recently in Myanmar, putting China in a dilemma.

There is a caveat however; the military has stated it will remain in a period of power for a year following which it will arrange new elections. If a civilian government is appointed after this period, we could see investments back on track. Nevertheless, the chances of this happening at this stage are low.

Factors supporting FDI from Myanmar to Vietnam

While Vietnam is consistently on track to record high economic growth, we look at factors that are likely to come into play for investors having a rethink on Myanmar and looking at countries like Vietnam.

Governance: One of the top reasons for investors moving to Vietnam is its strong governance. The country has a relatively stable government that provides strategic direction and decides on all major policy issues. It hasn’t seen any coups and remains a market-oriented economy.

Proximity to China: Vietnam’s close proximity to China is further helping it to become a manufacturing base while being viewed as a China plus one destination.

Transport networks: Vietnam’s location close to regional shipping routes and position in Asia allows manufacturers entering Vietnam to focus on exports.

It has an approximately 3,200 km long coastline with around 114 seaports. The three largest seaports in Vietnam are in Hai Phong (North), Da Nang (Central), and Saigon (South).

Free trade agreements: Over the past few years, Vietnam has been active in signing bilateral trade agreements with countries throughout the world.

Its membership in the Association of Southeast Asian Nations (ASEAN) also makes it a party to several FTAs that the regional bloc has signed while the recently signed EVFTA and UKVFTA allow it to expand as an exporting base.

GDP and FDI inflows: Over the last few years Vietnam’s GDP and FDI inflows have been increasing rapidly. It recorded one of its lowest GDP of 2.91 percent in 2020 due to the pandemic, but this was still a net increase beating China. Myanmar’s FDI and GDP fluctuated and had a record high in FDI investment in 2015 but since fluctuated with market reforms not keeping pace with the level of investment.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Unternehmensstrukturen in Vietnam: ROs, BOs, FOEs, JVs und PPPs

- Next Article Political Considerations When Choosing Your China+1 Alternative: Thailand and Vietnam