Why Investors Should be Optimistic About Vietnam’s Healthcare Industry

- Greater demand for healthcare services combined with strained government public resources provide opportunities for a growing healthcare industry in Vietnam.

- The EVFTA and the amended Law on Investment will benefit foreign producers and suppliers wishing to enter the Vietnamese market, which still largely relies on imported medical equipment and medicines.

- COVID-19 has accelerated created greater demand for technology-enabled services, a phenomenon that is likely to continue in the next decades with the arrival of Industry 4.0 innovations.

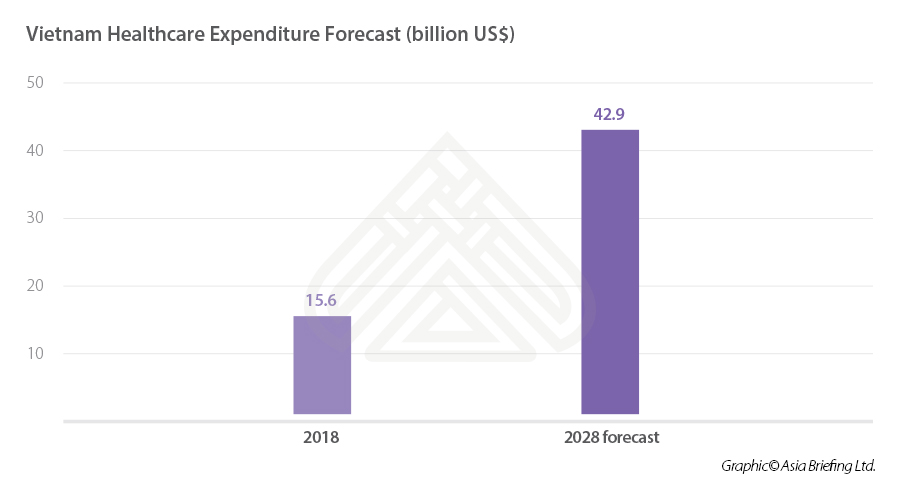

Vietnam is currently undergoing economic and demographic transformations that provide great potential for its healthcare industry. In 2019, Vietnam’s healthcare expenditure was approximately US$17 billion, equivalent to 6.6 percent of its GDP according to Fitch Solutions. The firm also expects that healthcare spending will reach US$23 billion in 2022 at a compound annual growth rate (CAGR) of 10.7 percent.

The COVID-19 outbreak certainly dampened economic activity in Vietnam, but it is unlikely to reverse ongoing socioeconomic changes. Rather, health stands firmly as the top priority and concern for both the Vietnamese people and the government.

We provide an overview of the opportunities for the healthcare industry in light of the current developments in Vietnam and survey three key sub-sectors: medical equipment and devices, pharmaceuticals, and digital healthcare.

Changes in society create opportunities and challenges

Fast-growing middle class and aging population

The healthcare sector in Vietnam has a lot of potential due to the demographic and socioeconomic changes currently underway. Vietnam’s rapid economic development has boosted demand for higher quality and specialized healthcare services, especially among the growing middle class.

The COVID-19 outbreak has proven that health is, and will certainly continue to be, a priority for most Vietnamese. Moreover, growing concerns over food safety, pollution, and unsafe living and working conditions have also made people more willing to spend on medicines and healthcare.

According to the United Nations Population Fund (UNFPA), the country has entered the “aging phase” since 2011. It is expected that by 2038, 20 percent of Vietnamese people will be over 60 years old. As more women join the workforce, a declining fertility rate will accelerate the aging of the population, straining the social welfare system.

Expansion of health insurance and hospital system

Social health insurance is the main public financing method for healthcare in Vietnam. With 87 percent of the population currently covered under this scheme according to the World Health Organization (WHO), the government continues to work towards achieving universal healthcare coverage.

Under a new document issued by the Ministry of Health (MoH), provincial departments of health and Vietnam Social Security branches are asked to encourage participation in and implementation of health insurance across the country. The government has also recently set new social insurance, employment insurance, and health insurance contribution rates that apply to both national and expatriate workers and employers.

To prevent overcrowding and ensure that both urban and local patients can access medical services, the government continues to finance the construction of new hospitals. Since public hospitals rely on a government budget, the country will need to mobilize various sources of investment to upgrade its medical facilities. Further, the healthcare system also suffers from a shortage of qualified physicians, especially those in specialized fields.

Meanwhile, private hospitals and clinics have sprung up in major cities to cater to the middle-class segment.

To help it shoulder the burden of rising healthcare costs, the government is increasingly looking at investment from the private sector and international firms. These changes mean that there will be more business opportunities in the healthcare sector in Vietnam in the upcoming years.

Medical equipment and devices

In February 2020, the government enacted Resolution No.20/NQ-CP to license the export of fabric face masks in response to high demand from different markets such as the US, the EU, and Canada. This has helped local businesses, namely textile and garment workers who reported rising orders after the enactment of the resolution. Face masks are not the only products that have been sought after during the pandemic: ventilators, gloves, gowns, and testing kits from Vietnam have also been accepted around the world. As a result, Vietnam shipped a total of 1.37 billion medical face masks as per the General Statistics Office (GSO) in 2020. Facemasks were exported to the US, the EU, Singapore, and South Korea among others

Although the MoH has predicted that the country’s medical equipment market will grow at a rate of 18 to 20 percent from 2016 to 2020, most medical equipment, however, needs to be imported. There are very few local manufacturers of sophisticated and specialized devices that meet international standards. In fact, more than 90 percent of medical equipment is imported from countries such as Japan, Germany, the US, China, and Singapore, while domestic enterprises account for only 10 percent of market share.

In public hospitals across the country, there is a lack of sufficient equipment for surgery and intensive care units. Furthermore, the existing equipment is outdated and needs to be replaced. As such, because local production cannot meet demand, the Vietnamese government encourages the import of medical equipment by setting low import duties and no quota restrictions.

Medical device producers can look forward to opportunities created by trade agreements such as the European Union Vietnam Free Trade Agreement (EVFTA). Improvements in regulatory standards, exchange of information on customs requirements, and the simplification of customs procedures are a few of the anticipated benefits from the implementation of the EVFTA.

Pharmaceuticals

Although the government aims to increase the share of locally produced pharmaceuticals to 80 percent, an average of 55 percent of medicines in Vietnam are imported every year. One of the reasons for Vietnam’s reliance on imports is that most domestic companies lack research and development capabilities, and do not meet the European Union Good Manufacturing Practice (EU-GMP) or Pharmaceutical Inspection Co-operation Scheme Good Manufacturing Practice (PIC/S-GMP) standards required to manufacture high-quality generic drugs.

Further, Vietnam imports more than 90 percent of drug inputs, half of which are from China. With the closure of many Chinese factories due to environmental concerns, the price of raw materials has surged, decreasing the profit margins of Vietnamese companies.

The implementation of the EVFTA will remove tariffs for pharmaceutical products from the EU, and allow foreign companies to import and sell pharmaceuticals to Vietnamese distributors and wholesalers.

Currently, there are only two multinational companies, Sanofi-Aventis (France) and AstraZeneca (Britain-Sweden), that have medicine import licenses. Although the presence of more foreign pharmaceutical companies will improve the supply of high-quality medicines, domestic companies may be negatively affected by the increased foreign competition.

Seventy percent of drugs in Vietnam are sold through hospitals, while the remaining 30 percent comes from pharmacies. The growing number of private hospitals and a greater concern for health among the public has led to an increasing demand for drugs.

Buoyed by increasing demand for medicine amid the COVID-19 pandemic, pharmaceutical companies registered positive results in the first quarter of 2020. The country’s largest pharmaceutical firm, DHG Pharmaceutical Joint Stock Company had a US$5 million profit, which represented a 31 percent year-on-year increase.

Other major firms also saw their profits going up from the same period last year. While it’s clear that the pandemic benefitted the pharmaceutical industry in the short term, firms may have to consider diversifying and importing raw materials from other regions rather than China in case a similar pandemic strikes again.

Hospital system

The hospital network in Vietnam is fairly extensive. There is a total of 1,531 hospitals, 86 percent of which are public and 14 percent are private mostly concentrated in major urban areas such as Ho Chi Minh City, Hanoi, and Da Nang. The 1,318 public hospitals are administered in a decentralized system, classified at the central, provincial, and district or commune level.

Though the system is well-established, Vietnamese hospitals are facing a number of important challenges. Most public hospitals in the country were built more than two decades ago and need to be upgraded.

Hospitals also face an overcrowding issue. The beds-to-inhabitants ratio, or bed occupancy rate in Vietnam far exceeds the threshold occupancy rate of 80 percent recommended by the World Health Organization (WHO).

Adding to the problem is the inequality of care: patients would rather get treated in overcrowded national level hospitals than provincial or district level ones due to the availability of higher quality medical equipment and staff in the former. Meanwhile, doctors and nurses have to tend to a large number of patients, working long hours under stressful conditions with relatively low wages.

Thus, the Vietnamese hospital system needs an upgrade to its facilities, equipment, and services. The current gaps create opportunities for foreign investment in the construction and management of infrastructure facilities, medical equipment, and vocational training.

Digital healthcare

In light of the current challenges faced by public hospitals in Vietnam and the COVID-19 pandemic, the digital healthcare sector holds a lot of promise.

On April 18, 2020, the MoH in coordination with the Ministry of Information and Communications (MIC) launched a telemedicine program. Developed by Viettel Group, the country’s largest telecommunications service company, the program provides remote healthcare services by connecting patients and doctors through a virtual platform. With 70 percent of the Vietnamese population living in a rural or remote area, telehealth will help improve access to quality healthcare while reducing its costs.

The private sector was also quick to take advantage of the shift towards technology-enabled healthcare services. Many start-ups already present in Vietnam before the COVID-19 outbreak have expanded and optimized their operations.

However, the burgeoning health tech sector is still in its infancy, attracting significantly less investment than other related sectors such as payments or e-commerce. The sector also largely depends on the development of Industry 4.0 technologies such as 5G networks, artificial intelligence (AI), and the internet of things (IoT).

To help the health tech sector sustain the momentum post-pandemic, companies not only have to appeal to investors and consumers but they also have to be integrated with Vietnam’s national health framework. The government will have to play a bigger role in encouraging collaboration between industry players and other stakeholders, provide incentives, and formulate clear policies.

On June 22, 2020, the MoH approved a five-year project on remote medical examination and treatment involving 24 hospitals. Apps and medical services will be developed to manage files and knowledge systems, as well as helping patients find medical information, make their appointments, and consult doctors.

These measures will accelerate the digitalization across Vietnam’s hospital network, which is currently fragmented and mainly implemented in central level public hospitals and private hospitals in major cities.

The private sector was also quick to take advantage of the shift towards technology-enabled healthcare services. According to a YCP Solidiance report, private hospitals have relatively advanced health management systems compared to their public counterparts for several reasons.

Their higher-income patients are more willing to pay for modern and high-quality healthcare services. Seeing digitalization as a competitive advantage, private hospitals have an incentive to invest and upgrade in their digital infrastructure. They also commonly use products and services from leading information and technology companies such as Oracle or SAP and have standardized systems in place across individual hospital branches. Therefore, the implementation of digital tools at private hospitals is less complicated compared with public hospitals.

A number of important barriers still hinder digital adoption in Vietnamese hospitals, both public and private. First, healthcare professionals and patients are reluctant to use digital-based systems due to unfamiliarity with these tools and technological constraints at home.

Second, unclear and complicated administrative processes slow digital adoption. Digital signature for national health insurance reimbursement is a notable example: doctors and nurses who are responsible for their registration need the approval of two different departments, the Electronic Health Administration under the MoH and the Vietnam National Security.

Thirdly, the output of data is not standardized across hospitals, and data security remains a concern for healthcare providers, weakening inter-hospital integration.

The start-up sector in Vietnam, albeit small in size compared to that of other Southeast Asian countries such as Singapore or Indonesia, is also actively contributing to the digitalization of healthcare.

Many start-ups already present in Vietnam before the COVID-19 outbreak have expanded and optimized their operations. Some provide booking services that allow patients to schedule appointments with doctors without visiting hospitals, thereby reducing long queues and minimizing infection risks. Patients are able to discuss their health concerns and obtain answers from healthcare professionals, which is difficult in public hospitals where consultation times are limited.

Though these apps and services contribute to healthier lifestyles, their fees are considerably higher than those at public hospitals. Only a minority of middle to high-income urbanites are willing to pay for more convenience and flexibility. Start-ups also struggle to attract new customers due to limited brand awareness and a lack of engagement with well-known healthcare professionals.

Further, the burgeoning health tech sector is still in its infancy, attracting significantly less investment than other related sectors such as payments or e-commerce. To help the health tech sector sustain the momentum post-pandemic, companies not only have to appeal to investors and consumers but they also have to be integrated with Vietnam’s national health framework.

Like pharmaceuticals and medical devices, health tech start-ups operate in a highly regulated sector where there are still many uncertainties in the regulatory landscape. The government will have to play a bigger role in encouraging collaboration between industry players and other stakeholders, provide incentives, and formulate clear policies.

Thus, though there is still a lot of room for the health tech sector to grow, the digital transformation of healthcare in Vietnam is already well underway.

Opportunities: What do investors need to know?

Market access

Though the health sector in Vietnam is very attractive, policy barriers and a weak legal framework continue to make it challenging for inexperienced foreign investors. The industry is strictly regulated, yet investment procedures are still not very clear and specific.

The Law on Pharmacy sets out the legal framework for the registration, sale, and distribution of pharmaceuticals. Circular No. 32/2018/TT-BYT specifies the procedure regarding the registration of pharmaceutical products. Investors have expressed concerns over the ill-defined roles and responsibilities of foreign and domestic companies, and the cumbersome administrative process, which can delay access to the Vietnamese market.

Similarly, medical devices are subject to requirements set by the MoH. Foreign suppliers often work through local distributors or agents, as only companies with a legal business entity in Vietnam and an import license can distribute medical equipment. Imported devices, unlike those manufactured in Vietnam, are not required to be registered and only need a Certificate of Free Sale from the Embassy of Vietnam in the originating country.

In the digital healthcare sector, administrative complexity and an unintegrated system create a challenging environment for existing and prospective industry players. Furthermore, the future of digital health hinges on the availability of enabling technologies and infrastructures, such as high-speed networks, big data, Internet of Things (IoT), and cloud computing.

Mergers and acquisitions

Keen interest from private and foreign investors has benefited Vietnam’s healthcare industry. Private hospitals and healthcare providers such as Tam Tri Medical and Vietnam Integrated Medical Services received major investments from private equity firms.

Many major pharmaceutical companies such as Abbott (USA), Taisho Pharmaceutical Co., Ltd. (Japan), and Sanofi (France) have been in Vietnam for several years, and some even decades. Not only have their products become available across the country, but they have also invested new plants and research and development (R&D) facilities.

Over recent years, there has been a growing number of mergers and acquisitions (M&A), with many foreign investors purchasing large amounts of shares in Vietnamese companies. These moves ease market access for foreign firms and help them avoid restrictions on foreign direct investment. For domestic companies, the integration creates more R&D opportunities and allows for the sharing of expertise and best governance practices, as well as access to foreign markets.

Amended Law on Enterprise and Law on Investment

The passing of the new Law on Investment (No. 51/2020/QH14) effective January 2021, incentivizes investment in five key sectors including healthcare. Projects in these sectors will benefit from preferred enterprise income tax, exemption or reduction of land lease fee, and credit support.

Previously, an ineffective private-public partnership (PPP) agreement made investment attraction difficult. However, the new law puts forth changes that eases risks for investors. It offers guarantees to PPP projects, including access to land, provision of civil service, right to the mortgage of property, revenue risk sharing, and foreign currency balance-ensuring scheme among others. The law also specifies the total investment capital requirement for a PPP project depending on its type and location. A project’s value must be at least around US$8.6 million, but the threshold of healthcare projects is half that.

The law also requires projects to apply to an open bidding process for the selection of preferred investors except for those in priority areas. Foreign investors will be able to compete in good faith to win the bids of major projects.

The new law also lowers the foreign investor threshold from 51 percent to 50 percent. Foreign investors holding a majority equity stake in a company are treated as “foreign investors” for purposes of licensing and investment activities. This determines the conditions and procedures of establishing subsidiaries or acquiring shares or other equity interests, which are different and more cumbersome than for those considered “domestic investors”.

Regarding M&As, the law removes the need for approval if the transaction does not increase the foreign investor’s ownership ratio in the target company. The M&A approval requires a number of documents to be notarized and legalized by consular authorities in the foreign investor’s home jurisdiction, thus taking up a significant amount of time in the pre-completion process.

Overall, these measures confirm the Vietnamese government’s commitment towards creating a favorable business environment, especially to meet demands in the growing healthcare industry.

Note: This article was first published in August 2020, and has been updated to include the latest developments.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Vietnam’s Solar Industry: Bright Prospects for Investors

- Next Article Vietnam’s Medical Devices Industry: Key Market Entry Considerations