Vietnam’s Trade Position in Asia in 2015

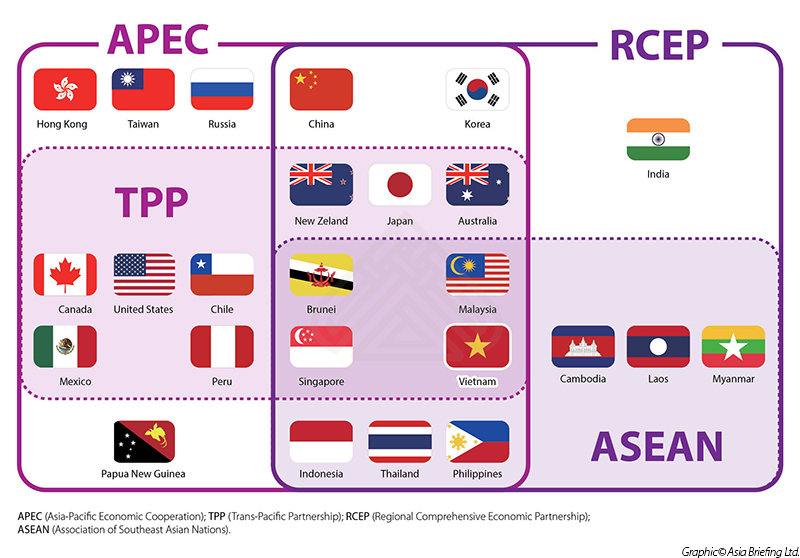

HCMC – Vietnam sits in a prime position in Asia vis-à-vis free trade agreements (FTAs) and trade organization memberships. Very few other countries in the region are included in such a plethora of trade agreements. See below for a visual representation of Vietnam’s position.

Looking briefly at the key FTAs for Vietnam, if they were all to be ratified then Vietnam would have FTAs in place with the world’s three largest economies, as well as five more economies within the

top fifteen in GDP. By joining all of these agreements, Vietnam is positioning itself to become a key hub for future global commerce.

RELATED: Dezan Shira & Associates’ Global Services

RELATED: Dezan Shira & Associates’ Global Services

If successfully ratified, the Trans-Pacific Partnership (TPP) will significantly decrease trade barriers between the U.S. and Vietnam. The TPP comprises a region with US$28 trillion in economic output, making up around 39 percent of the world’s total output. The agreement will remove tariffs on almost US$2 trillion in goods and services exchanged between the signatory countries. If enacted, the Regional Comprehensive Economic Partnership (RCEP) would provide Vietnam with tariff free access to China, India, Australia, Japan, and South Korea. The EU-Vietnam FTA will cut at least 90 percent of the tariff lines on Vietnamese exports to the EU.

ASEAN is made up of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. Collectively, ASEAN represents a market of some 600 million people, with a combined GDP of about US$2.5 trillion and upwards of US$1.5 trillion in trade flowing throughout the region. Vietnam is well located geographically to take advantage of this market.Vietnam has recently signed the following FTA deals: the Vietnam-Korea Free Trade Agreement and the Vietnam-Customs Union of Russia, Belarus, and Kazakhstan Free Trade Agreement.

![]() RELATED: An Introduction to Vietnam’s Import & Export Industries

RELATED: An Introduction to Vietnam’s Import & Export Industries

Vietnam is also currently studying the potential benefits of a number of other FTAs, such as the East Asia Free Trade Area (ASEAN +3) and the Comprehensive Economic Partnership for East Asia.

This article is an excerpt from the December 2014 edition of Vietnam Briefing Magazine, titled “Import and Export: A Guide to Trade in Vietnam“. In this issue, we provide you with a clear understanding of the current business trends related to trade in Vietnam, as well as explaining how to set up your trading business in the country. We also attempt to give perspective on what will be Vietnam’s place in the Association of Southeast Asian Nations (ASEAN) in 2015, and look at some of the country’s key import and export regulations. Finally, we analyze Vietnam’s important free trade agreements and its World Trade Organization obligations.

This article is an excerpt from the December 2014 edition of Vietnam Briefing Magazine, titled “Import and Export: A Guide to Trade in Vietnam“. In this issue, we provide you with a clear understanding of the current business trends related to trade in Vietnam, as well as explaining how to set up your trading business in the country. We also attempt to give perspective on what will be Vietnam’s place in the Association of Southeast Asian Nations (ASEAN) in 2015, and look at some of the country’s key import and export regulations. Finally, we analyze Vietnam’s important free trade agreements and its World Trade Organization obligations.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

A Guide to HR in Asia’s Next Growth Market

In this issue of Vietnam Briefing Magazine, we provide you with a clear understanding of the current business trends related to trade in Vietnam, as well as explaining how to set up your trading business in the country. We also attempt to give perspective on what will be Vietnam’s place in the Association of Southeast Asian Nations (ASEAN) in 2015, and look at some of the country’s key import and export regulations.

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition)

An Introduction to Doing Business in Vietnam 2014 (Second Edition) provides readers with an overview of the fundamentals of investing and conducting business in Vietnam. Compiled by Dezan Shira & Associates, a specialist foreign direct investment practice, this guide explains the basics of company establishment, annual compliance, taxation, human resources, payroll, and social insurance in the country.

- Previous Article Vietnam FDI and Economic Roundup for January 2015

- Next Article Privatization of Vietnam’s Port Infrastructure to Boost Efficiency and Lower Prices