Vietnam’s Trade Performance in 2024: How to Read the Data

Vietnam’s trade performance in 2024 sees more firms investing in the country as a China+1 production base amid global economic challenges. Vietnam became China’s third-largest export destination for the first time last year showing a rise in its strategic value.

China reportedly achieved a record trade surplus in 2024, reaching US$992 billion—21 percent higher than the previous year—driven by strong exports and weak imports due to sluggish domestic consumption and falling commodity prices. In this context, Vietnam has emerged as a key player in the “China Plus One” strategy, highlighting its significant growth in imports and exports, particularly in components and industrial materials. This article explores this dynamic and its impact on Vietnam’s trade performance.

Vietnam as a key export destination for China

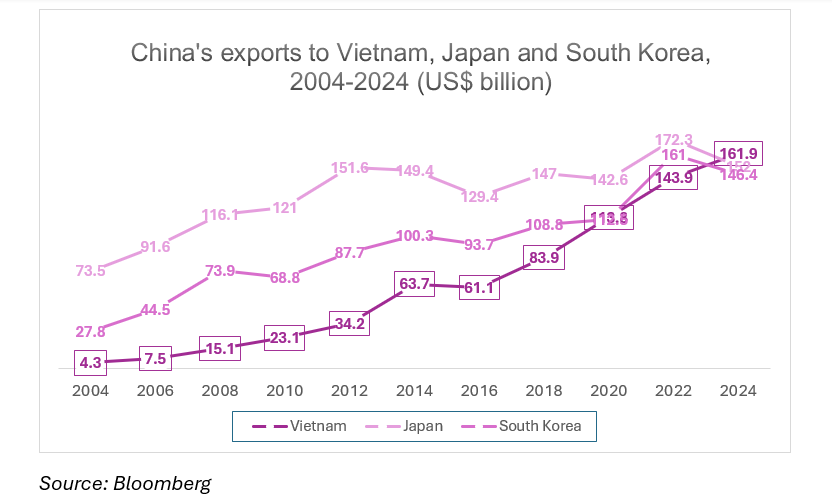

According to data released by China’s customs administration on January 13, 2025, China’s exports to Vietnam grew by about 18 percent to a record US$163 billion in 2024, outperforming the US$152 billion export to Japan.

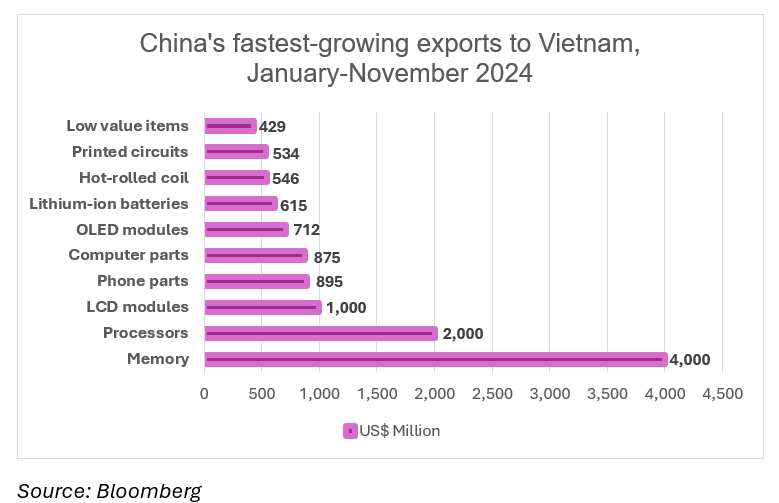

Experts attribute the surge to increased exports of components from China to Vietnam, where they are assembled into final products and re-exported. According to Bloomberg, from January to November last year, eight of the top 10 products with the highest export growth from China to Vietnam were electronic components.

Interpreting Vietnam’s rise

While shifting supply chains from China may result in cost increases for companies and consumers, this trend is currently benefiting Vietnam, which has seen a surge in investments. Major electronics manufacturers, including Samsung Electronics, Luxshare Precision Industry, and Hon Hai Precision Industry, have recently committed billions to assembling products like AirPods and MacBooks in Vietnam.

The rise of artificial intelligence (AI) and U.S. export restrictions on AI chips have further accelerated investments in Vietnam, while simultaneously strengthening China’s position. Notably, Hon Hai began manufacturing Nvidia’s AI graphics cards at its subsidiary in Vietnam last year, utilizing key components sourced from China. Most of the finished products were shipped to U.S. customers, contributing to a record trade surplus for Vietnam with the United States. This dynamic may draw the attention of President-elect Donald Trump, who has previously criticized Vietnam for its trade imbalances.

Vietnam’s notable growth in component imports

Vietnam’s total import turnover has seen significant growth. According to the General Statistics Office (GSO), in 2024, the total value of imported goods reached US$380.76 billion, representing a 16.7 percent increase compared to the previous year. The domestic economic sector accounted for US$140.11 billion, up 19.5 percent, while the foreign-invested sector reached US$240.65 billion, a rise of 15.1 percent.

Vietnam’s 2024 imports primarily served industrial production

In 2024, 46 imported items to Vietnam exceeded a value of over US$1 billion, representing 93.1 percent of the total import turnover. Among these, six items surpassed US$10 billion, accounting for 54.0 percent of the total.

The majority of these imports were driven by Vietnam’s demand for raw materials and equipment essential for industrial production. The country sourced a significant amount of production materials from foreign suppliers, including steel, crude oil, and chemicals, as well as industrial machinery and equipment for the manufacturing, electronics, and automotive sectors.

Notably, there was a significant increase in imports of medical supplies and electronic components, reflecting the strong development of the domestic medical and technology industries.

Structure of Vietnam’s imported goods in 2024

According to the GSO, the structure of Vietnam imported goods in 2024 is broken down as follows:

Consumer goods

These goods’ value stood at US$24.33 billion, accounting for 6.4 percent of the total imports.

Production materials

The category of production materials amounted to US$356.43 billion, accounting for 93.6 percent of total imports. Of these:

- Machinery, equipment, tools, and spare parts represent 47.4 percent of the total imports; and

- Raw materials, fuels, and materials comprise 46.2 percent of the total imports.

Leading imported items

Vietnam’s leading imported goods experienced significant increases compared to the previous year. Overall, these imports reflect a robust growth trend in Vietnam’s economy.

|

Vietnam’s Leading Imported Items in 2024 |

||

|

Category |

Amount (US$ billion) |

Change from 2023 (%) |

|

Electronics, computers, and components |

107.1 |

+21.70 |

|

Machinery, equipment, tools, and spare parts |

48.9 |

+17.60 |

|

Fabrics |

14.9 |

+14.50 |

|

Iron and steel |

12.6 |

+20.60 |

|

Plastics |

11.8 |

+11.80 |

|

Phones and components |

10.4 |

+18.90 |

|

Source: GSO |

||

Vietnam enjoyed a trade surplus in 2024

In 2024, Vietnam’s trade balance reported a substantial trade surplus. Despite a significant increase in imports, exports continued to grow, which helped preserve the surplus.

The country’s merchandise trade surplus in 2024 reached US$24.77 billion, down from US$28.4 billion in the previous year. Vietnam’s officials attribute this achievement to stable export growth and a reduction in imports of non-essential goods. This marks the ninth consecutive year that Vietnam has maintained a trade surplus in goods.

Notably, the domestic economic sector recorded a trade deficit of US$25.52 billion, while the foreign-invested sector, including crude oil, achieved a trade surplus of US$50.29 billion.

Key export markets for Vietnam

The growing trend of production diversification is clearly seen in Vietnam’s major export markets. Vietnam’s increase in exports is largely directed at its major trading partners, which include the U.S., the European Union (EU), Japan, South Korea, and China. Notably, the U.S. is Vietnam’s largest export partner for electronics, textiles, footwear, and agricultural goods.

In 2024, while the majority of Vietnamese products were primarily consumed by Asian countries, including China, Japan, and Korea, both the U.S. and the EU emerged as significant markets as well.

Another notable highlight for 2024 is the increase in exports to African and South American markets. Vietnamese agricultural products, processed foods, and consumer goods have shown impressive results in these regions, and Vietnam’s exporters are aiming to expand further to these promising markets.

According to the GSO, in 2024, the following countries were key trading partners for Vietnam based on total turnover:

- China maintained its position as the most significant bilateral trading partner for Vietnam, with a total trade volume of US$204.9 billion, a 19.2 percent increase compared to 2023.

- The U.S. ranked second, with a total trade value of US$134.6 billion, a 21.5 percent rise.

- ASEAN reached US$83.9 billion in total trade with Vietnam, up 14.7 percent.

- South Korea’s trade value with Vietnam reached a total of US$81.8 billion, representing a 7.6 percent growth.

- The EU market reached US$68.8 billion in total trade with Vietnam, up 11.8 percent.

- Japan reached a total of US$46 billion in trade with Vietnam, a slight decrease of 1.2 percent.

|

Vietnam’s Trade Balance with Key Trade Partners in 2024 |

||

|

Region/country |

Trade balance (US$ billion) |

Change from 2023 (%) |

|

Trade surplus |

|

|

|

United States |

104.6 |

+25.6 |

|

European Union (EU) |

35.4 |

+23.2 |

|

Japan |

3.2 |

+91.9 |

|

Trade deficit |

||

|

China |

83.7 |

+69.5 |

|

South Korea |

30.7 |

+5.9 |

|

ASEAN |

9.9 |

+18.9 |

|

Source: GSO |

||

Takeaways

In 2024, China’s exports to Vietnam reached a record US$163 billion, largely due to companies relocating supply chains to mitigate risks. This shift has attracted significant investments from major electronics manufacturers to assemble products in Vietnam. Additionally, Vietnam also performed impressively in other regions, with new potential in African and South American markets.

To maximize export success while operating in Vietnam, businesses should adopt strategic approaches beyond expanding into the markets of China and the U.S. Key strategies include:

- Market diversification: To reduce dependency on traditional markets, companies should explore and target emerging markets, such as Africa, the Middle East, and South America.

- Halal certification: The Halal market represents a new opportunity for Vietnam’s exports to Muslim-majority countries. Businesses should seek Halal certification to access this growing sector and stay up to date with evolving certification standards.

- Regulatory compliance: To avoid trade barriers, it is crucial to understand and adhere to strict quality and safety regulations in key markets, such as the U.S. and EU.

- Leverage free trade agreements (FTAs): Businesses should use free trade agreements, like the EU-Vietnam Free Trade Agreement (EVFTA), to enhance market access and reduce tariffs.

- Enhance e-commerce capabilities: To reach wider audiences, companies should expand their online sales channels, particularly on e-commerce platforms.

- Cultural adaptation: Marketing strategies should be customized to align with the cultural preferences and behaviors of target markets.

- Invest in technology and sustainability: Upgrading production processes and adopting environmentally friendly practices are essential for meeting international standards.

- Competitive development: Focus on staff training and collaboration with industry groups to improve overall productivity and compliance.

- Risk management: Establishing a robust risk management plan is vital for addressing financial and political uncertainties in new markets.

- Emphasize sustainability and corporate social responsibility (CSR): Implementing sustainable practices and engaging in CSR initiatives can enhance brand reputation and meet market expectations.

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com

- Previous Article Vietnam’s Economic Outlook for 2025: Push for Digitalization and Sustainability

- Next Article Commuting During Tet: Strategies for Businesses in Vietnam