Vietnam’s GDP Grows in First Half but Economic Headwinds Pose Concerns

Vietnam’s GDP grew 7.72 percent in the first half of 2022 thanks to solid exports and consumer spending. While economic and FDI data showed consistent growth compared to the same period last year, rising fuel prices and shortages of raw materials emerge as challenges. Vietnam Briefing provides a half-year report card of the country’s FDI and GDP data recently released by the government.

Vietnam’s economic growth accelerated faster than expected in the second quarter, as a recovery in exports and manufacturing helped offset risks from the pandemic as well as rising oil prices.

As per the General Statistics Office (GSO) in a recent report, the country’s gross domestic product (GDP) rose 7.72 percent in the April-June period from a year earlier, faster than a revised 5.05 percent in the first quarter. This surpasses the median estimate for a 5.9 percent expansion as per Bloomberg.

The performance helped lift growth in the first half to 6.42 percent from a year ago, beating GSO’s forecast of 5.5 percent.

As per the report, exports rose 20 percent in June compared to a year earlier while consumer prices went up by 3.37 percent in June year on year. In addition, the government plans to cap the rising inflation rate at 4 percent in 2022.

The gains in momentum coincide with Vietnam emerging as one of the alternative destinations for foreign investment amid trade disruptions from China’s lockdowns, the Russia-Ukraine crisis, and lingering tensions between Beijing and Washington.

The economy also benefited from a fiscal stimulus worth about US$15 billion, and an easier monetary policy from the State Bank of Vietnam (SBV)

However, inflation risks associated with the continuing rise in prices of fuels and imports remain the key impediment to the economy’s recovery as per the recent highlight of the World Bank (WB) in its June edition of Vietnam Macro Monitoring, though the government has acted to lower fuel prices to curb inflation.

FDI figures continue on an upward trajectory

The latest figures by Vietnam’s Ministry of Planning and Investment (MPI) give an overview of Vietnam’s FDI performance in the first six months of 2022.

| FDI attraction in Vietnam in first half by years | ||

|---|---|---|

| Year | Total FDI attraction (US$ billion) | FDI disbursement (US$ billion) |

| 2018 | 20.33 | 8.37 |

| 2019 | 18.47 | 9.1 |

| 2020 | 15.67 | 8.65 |

| 2021 | 15.27 | 9.24 |

| 2022 | 14.03 | 10.06 |

Source: Ministry of Planning and Investment

As of June 20, 2022, the total newly registered capital, adjusted and contributed capital to buy shares and buy contributed capital of foreign investors reached over US$14.03 billion, equivalent to 91.1 percent over the same period in 2021. The capital generated by FDI projects was estimated at US$10.06 billion, an increase of 8.9 percent over the same period last year. Of which:

- Newly registered capital: 752 new projects were granted investment registration certificates (a year-on-year decrease of 6.5 percent). The total registered capital reached over US$94 billion (a year-on-year decrease of 48.2 percent).

- Adjusted capital: 487 projects were registered to adjust their investment capital (a year-on-year increase of 5.9 percent). The total additional registered capital reached nearly US$82 billion (a year-on-year increase of 65.6 percent).

- Capital contribution and share purchase: There were 1,707 capital contributions and share purchases by foreign investors (a year-on-year decrease of 8 percent), with the total value of contributed capital reaching over US$27 billion (a year-on-year increase of 41.4 percent).

The realized investment capital of foreign investment projects in the first six months of 2022 achieved the highest increase since the beginning of the year. That shows that enterprises are constantly recovering, maintaining, and expanding production and business activities.

The increase in adjusted investment capital shows that foreign investors continue to believe in the economy and investment environment of Vietnam, thus making decisions to expand their projects.

Additionally, export of the FDI sector increased in the first six months of 2022 but slower than in the first five months. The FDI sector had a trade surplus of over US$15.8 billion (including crude oil) but this cannot offset the trade deficit of US$16.4 billion in the domestic business sector, while the country gains a trade deficit of approximately US$0.6 billion in the first six months of 2022.

Accumulated to June 20, 2022, the whole country has 35,184 valid projects with a total registered capital of over US$427.97 billion. The accumulated realized capital of foreign investment projects is estimated at nearly US$261.66 billion, equaling 61.1 percent of the total valid registered investment capital.

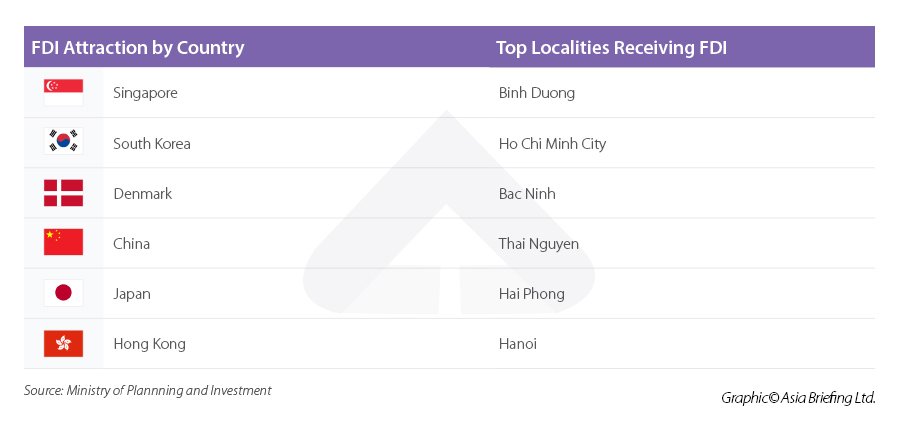

Binh Duong tops FDI list

Foreign investors have invested in 49 provinces and cities in the first six months of 2022. Among these provinces, Binh Duong topped the list with a total registered investment capital of more than US$2.53 billion, accounting for 18 percent of total registered investment capital and up 98.2 percent over the same period in 2021.

The country’s commercial and industrial hub – Ho Chi Minh City followed with a total investment capital of more than US$2.2 billion, accounting for 15.8 percent of the total capital, up 55.2 percent over the same period.

Bac Ninh ranked third with a total registered investment capital of nearly US$1.63 billion, accounting for 11.7 percent of total investment capital and increasing by 3.3 times over the same period in 2021. The next positions belong to Thai Nguyen, Hai Phong, Hanoi, and so on.

In terms of the number of new projects, big cities with good quality infrastructure such as Ho Chi Minh City and Hanoi are particularly appealing to first entrants. Ho Chi Minh City, specifically, led both in the number of new projects (40.4 percent), capital contributions, and share purchases (68.3 percent) while second in the number of projects registering adjusted investment capital at 14 percent, after Hanoi which accounted for 16.6 percent.

Singapore leads in FDI investment while Denmark replaces China for third

There were 84 countries investing in Vietnam in the first six months of 2022. Among these, Singapore led with a total investment capital of more than US$4.1 billion, accounting for 29.5 percent of the total investment capital.

It was followed by South Korea with over US$2.66 billion, accounting for nearly 19 percent of total investment capital (a year-on-year increase of 29.6 percent).

With a large-scale Lego project worth over US$1.3 billion of total investment capital, Denmark ranked third with a total registered investment capital of approximately US$1.32 billion, accounting for 9.4 percent of the total investment capital. Next were China, Japan, Hong Kong, and so on.

Regarding the number of projects, South Korean investors were among the leading ones, accounting for 21.3 percent of new projects, 35.9 percent of adjusted projects, and 36.7 percent of capital contribution and share purchase.

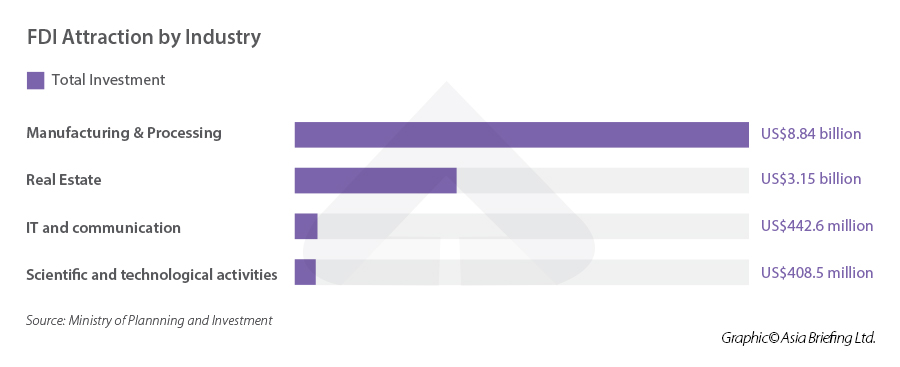

Major sectors attract FDI

Foreign investors have invested in 18 out of 21 sectors in the national economic classification system, of which the processing and manufacturing industry continued to lead with a total investment of nearly US$8.84 billion, accounting for nearly 63 percent of the total registered investment capital.

The real estate sector ranked second with total investment capital of more than US$3.15 billion, accounting for 22.5 percent of total registered investment capital. Next came IT and communication industries, and scientific and technological activities with total registered capital of nearly US$442.6 million and US$408.5 million respectively.

However, in terms of the number of new projects, wholesale and retail; processing, manufacturing; and scientific and technological professional activities were the industries that attracted the most projects, accounting for 30.1 percent, 25.4 percent, and 16.5 percent of the total projects, respectively.

Outlook

Vietnam is expected to continue with robust FDI investment for the rest of 2022 and 2023. In the best-case scenario, Vietnam’s economic growth can go up to 6.9 percent this year, according to the latest report by the Central Institute for Economic Management (CIEM) while the country’s inflation will be expected to average at 3.7 percent, exports will grow up to 16.3 percent, and trade surplus will be around US$2.7 billion.

Many of the factors which could impact Vietnam’s economic prospects in the second half of 2022 include the ability to limit the spread of new COVID-19 variants and other diseases as well as the implementation of the national program on socio-economic recovery and development and macro-economic stability.

While Vietnam will continue to face many challenges including high prices and supply chain disruptions, its economy remains resilient in the long term. As Vietnam further opens up with the government working on business reforms as well as many investment incentives, foreign investors are likely to continue their expansions and production shifts as they diversify supply chains and look at new markets.

In the medium and long term, political conflicts like the Russia-Ukraine crisis could potentially lead to a trend of shifting investment to Asian countries and from China to Vietnam. In these scenarios, Vietnam can gain added benefit from the shift in terms of investment capital.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam’s Coffee Market Faces Challenges Despite Strong Exports, Domestic Growth

- Next Article Vietnam-EU Trade Surplus Underlines Growing Trade, Relations