Vietnam’s Economic Zones: A Practical Guide for Investors

We discuss the unique advantages of Vietnam’s Economic Zones (EZs), highlighting their appeal to foreign investors drawn by incentives, advanced industrial infrastructure, and logistics connectivity.

In Vietnam, the concept of Special Economic Zones (SEZs) has evolved over many years, generating considerable interest among investors seeking to enter the market. However, as the regulatory frameworks for SEZs are still being finalized, foreign stakeholders are instead directed to the country’s numerous Economic Zones (EZs).

In this article, Dezan Shira & Associates will explore the challenges surrounding SEZ development and highlight the unique advantages that EZs offer to foreign investors.

Special Economic Zones in Vietnam

To attract more foreign investment and foster competition, Vietnam offers tax benefits and leasing incentives in designated areas called Special Economic Zones. The development of SEZs is intended to support Vietnam’s growth by focusing on research and development (R&D), innovative startups, advanced sciences and technologies, high-quality health and education services, as well as luxury resorts and tourism services.

In line with this initiative, the Vietnamese government has decided to develop three SEZs located in the North, Central, and Southern regions of the country: Van Don in Quang Ninh province, North Van Phong in Khanh Hoa province, and Phu Quoc in Kien Giang province. Each SEZ will focus on specific sectors:

- Van Don: Development will center on high-tech supporting industries, ecotourism, cultural tourism, cultural industries, airport services, air logistics, commercial services, and shopping centers.

- North Van Phong: This SEZ will prioritize IT and mechanical engineering, seaport facilities for goods and international passengers, seaport logistics, commerce, and finance.

- Phu Quoc: The focus here will be on resorts and ecotourism, conference and international exhibition services, commercial services, shopping centers, asset management services, health services, and R&D in biotechnology.

Potential amendments to SEZ governance

The idea of establishing SEZs dates back to 2012. However, legal provisions and frameworks governing SEZs are still under review, with the first draft law put on hold in 2014. The current draft law, titled “Law on Special Administrative Economic Units” (Draft Law), aims to provide the legal foundation for SEZs.

This draft has undergone numerous revisions and still has several shortcomings, leaving many aspects open for discussion. As of the publication date of this article, SEZs remain a planned concept, with no active legal documents yet established to regulate their operations in Vietnam. Instead, the country has Economic Zones (discussed below) that offer various incentives for foreign investors, particularly in the manufacturing sector.

Economic Zones (EZs)

An Economic Zone in Vietnam is characterized by a favorable investment scheme of a local/regional government within a specified geographical area. These zones may be organized into functional areas, including non-tariff zones, bounded areas, industrial areas, entertainment areas, tourism areas, residential areas, administrative areas, and export processing zones.

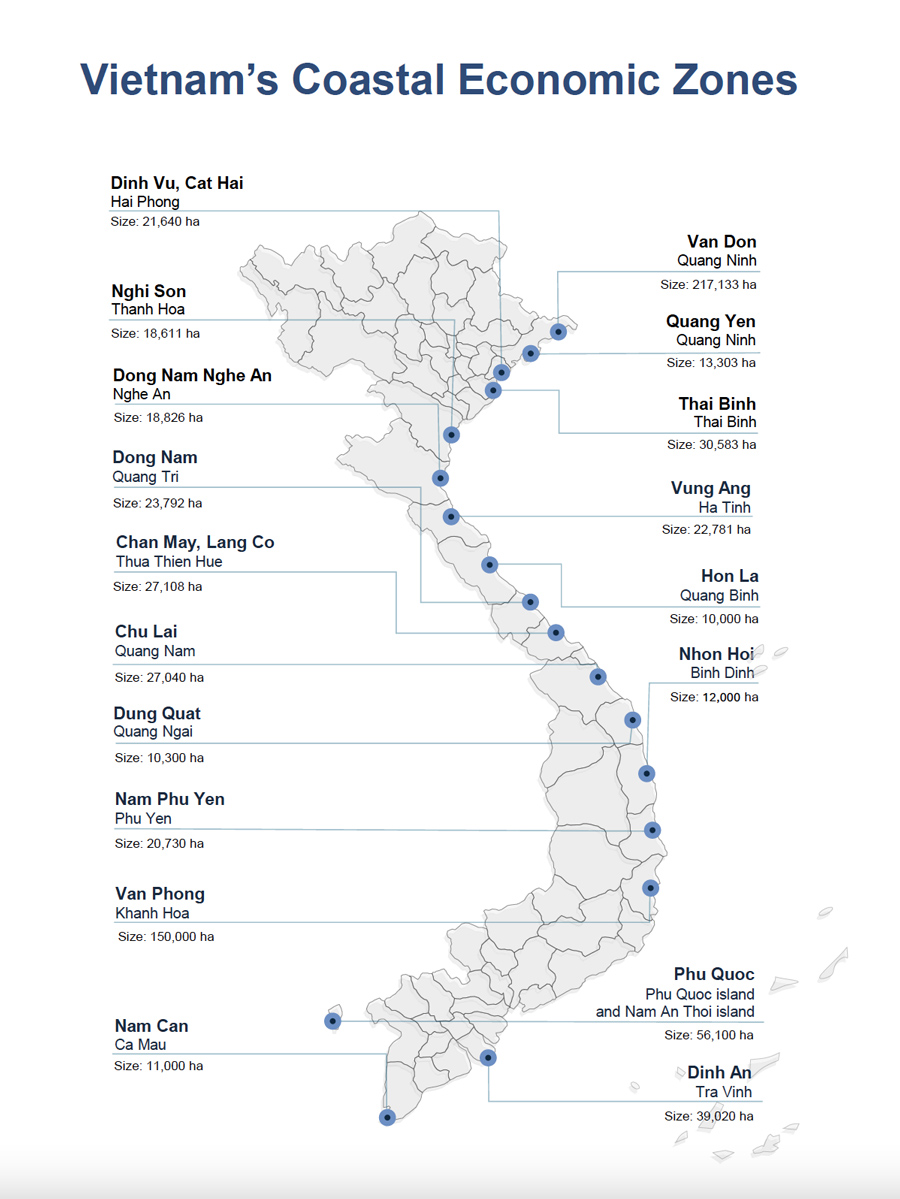

According to the Ministry of Planning and Investment, Vietnam currently has 44 economic zones, comprising 18 Coastal Economic Zones and 26 Border Gate Economic Zones.

Coastal Economic Zones are located in coastal areas and adjacent regions, covering a total area of 857,000 hectares, of which approximately 568,000 hectares is land. There are 39 industrial parks situated within these Coastal Economic Zones.

Border Gate Economic Zones, on the other hand, are established in land border areas and adjacent regions with international or main border gates, encompassing a total area of 766,000 hectares. These zones presently contain only 8 industrial parks.

In particular, Coastal Economic Zones in Vietnam have attracted several large-scale projects from foreign investors, including numerous investments exceeding US$1 billion. For instance, LG Group’s electronics manufacturing project in the Dinh Vu – Cat Hai Economic Zone (Hai Phong city) has a total registered capital of US$7.24 billion, while Formosa Group’s steel production project in the Vung Ang Economic Zone (Ha Tinh province) is valued at US$10 billion.

Foreign investors in Economic Zones in Vietnam are entitled to various incentives, including:

- Corporate income tax (CIT) incentives: A preferential CIT rate of 10 percent for the first 15 years, exemption from CIT for the first 4 years, and a 50 percent reduction in CIT for the subsequent 9 years.

- Import duty incentives: Exemption from import duties on goods imported to establish fixed assets, as well as raw materials and components necessary for the implementation of an investment project.

- Incentives relating to land rental and land use tax: Exemption or reduction of land rental and land use tax.

To legally operate in an EZ, the entity must obtain the Investment Registration Certificate (IRC) and Enterprise Registration Certificate (ERC).

Key takeaways

Vietnam’s Economic Zones provide foreign investors with sector-focused opportunities and tax incentives. Coastal Economic Zones like Dinh Vu – Cat Hai in Hai Phong attract large-scale manufacturing with robust infrastructure and tax breaks, while Border Gate Economic Zones near international borders offer supply chain efficiency for export-oriented companies. Investors benefit from corporate tax relief, duty exemptions, and land tax reductions, with necessary licenses including the Investment Registration Certificate and Enterprise Registration Certificate. These zones enable cost-effective, strategic entry into Vietnam’s market and broader ASEAN access.

Also Read: An Introduction to Vietnam’s Leading Import and Export Industries

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, China, and India. For editorial matters, contact us here and for a complimentary subscription to our products, please click here. For assistance with investments into Vietnam, please contact us at vietnam@dezshira.com or visit us at www.dezshira.com.

Dezan Shira & Associates assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. We also maintain offices or have alliance partners assisting foreign investors in China, Hong Kong SAR, Dubai (UAE), Indonesia, Singapore, Philippines, Malaysia, Thailand, Bangladesh, Italy, Germany, the United States, and Australia.

- Previous Article Tax Obligations for Resident and Non-Resident Property Owners in Vietnam

- Next Article Female Workers in Vietnam: Legal Rights and Gender Equality Targets