Vietnamese Growth Slows to 5.46% in Q1 2016

By: Maxfield Brown

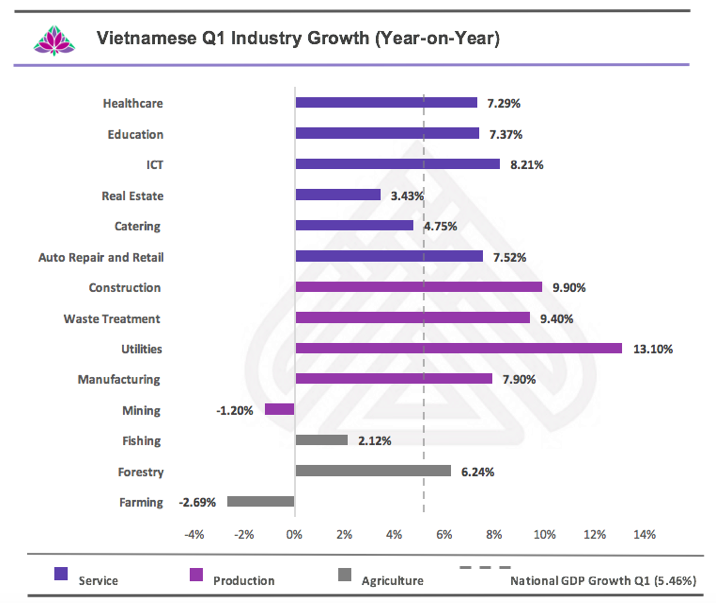

Following explosive growth in 2015, Vietnam’s Q1 economic data shows signs of cooling. Not only has growth slowed, but published figures fail meet the annual targets set out by authorities. Although garnering significant media attention and representing salient risks for particular industries, it is clear that not all sectors face equal exposure. In fact, a closer review of first quarter results points to robust growth in many of Vietnam’s staple and emergent industries.

Decreased Growth in Perspective

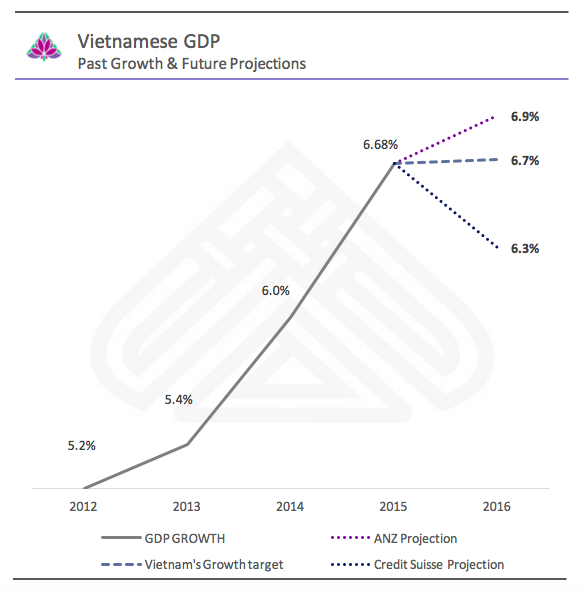

Since 2012, Vietnam’s economy has accelerated rapidly, reaching an annual growth rate of 6.12 percent in 2015. Encouraged by resilience shown the in the face of faltering global demand and commodity pricing, officials have cautiously set an annual growth target of 6.7 percent for 2016. Unfortunately, first quarter figures show a respectable, but underwhelming, expansion of just 5.46 percent. While revisions are commonplace, the significance of these findings should not be discounted.

One of the primary weights on growth is thought to be the decline of Vietnam’s agriculture sector. Comprising just over 10 percent of the national GDP in 2016 – down from 18.4 percent just three years prior – recent years have seen a progressive shift in value away from agriculture related industries and into manufacturing and services. Already weakened by these trends, Q1’s bleak farming conditions resulted in a particularly difficult period for the industry, resulting in a contraction of 2.69 percent.

Amidst falling global commodity prices, mining is another area of the economy which has faced difficulties and may have played a roll in curtailing higher growth. Crucial resources such as bauxite (aluminum) have seen prices drop by 25 percent since 2014, and the prolonged nature of pricing declines has likely reigned in expansion and decreased output. As a result, the value of Vietnamese mining output also decreased by 1.3 percent compared to Q1 2015.

On a macroeconomic level, the continued underperformance of the Chinese economy continues to mute demand from what has traditionally been one of Vietnam’s largest export partners. With 10 percent of Vietnamese exports destined for China in recent years, the dragon nation’s year on year import decline of 18.8 percent in January is likely to have exacerbated declining growth within the agriculture and mining sectors.

RELATED: Dezan Shira & Associates’ Corporate Establishment Services

RELATED: Dezan Shira & Associates’ Corporate Establishment Services

Sectors Bucking the Decline

While contractions outlined in the sectors above present challenges, these shortcomings have done little to damper rapidly emerging opportunities within other sectors such as manufacturing and services. Not only have industries within these sectors remained unaffected by downturns within Vietnam and abroad, many are often far outpacing the average growth rate of the national economy.

Manufacturing

As Vietnam continues its transition away from agriculture, manufacturing has been a major benefactor. The reduction of agricultural jobs has led to increased levels of urbanization and provided investors with a plentiful source of cost competitive labor – a factor that has not gone unnoticed by investors seeking to relocate production away from rising costs in China. In conjunction with dynamic labor, recent trade agreements including the TPP and Vietnam’s agreement with the EU are likely to provide a further upside to profit margins and boost growth within manufacturing above its current level of 7.9 percent.

A major side effect of the transition towards manufacturing has been a substantial rise in the income of average Vietnamese citizens. Compared to agricultural employment, manufacturing jobs offer higher wages that often prove more stable than the seasonally dependent farming employment. As a result, when compared to 2010 where GDP per capita stood at US $1,232, incomes have risen by 66 percent to US $2,052 per person in 2014. For many Vietnamese citizens, rising wages have opened access to a variety of consumer products and services that were previously beyond the threshold of affordability. With unprecedented access to disposable income, the provision of basic utilities has outpaced all other areas of the Vietnamese economy with a growth rate of 13.1 percent.

Services

As Vietnamese consumers continue to experience rapid wage growth, the provision of basic utilities will likely be surpassed by additional spending within the service sector – a trend observed within many successfully developing and developed countries. Already, many services outpace both the average growth rate of the Vietnamese economy in Q1 as well as targets set by the Vietnamese authorities. The quick adoption of liberal spending habits is a positive sign and will likely be amplified by the implementation of trade agreements slated to come into force in the near to medium term.

While services are without a doubt a salient opportunity for investment, the potential for profit and most effective method of market entry differ substantially between industries. For more information on Vietnam’s fastest growing service sectors, please refer to the following industry spotlights:

RELATED: Vietnam’s FDI Outlook for 2016 – Trends and Opportunities

RELATED: Vietnam’s FDI Outlook for 2016 – Trends and Opportunities

What to Expect in 2016

While differing in term of specifics, a variety of projections concur that the Vietnamese economy faces limited exposure to a sustained slowdown. Australia and New Zealand Banking Group (ANZ) estimates that Vietnam will accelerate growth to 6.9 percent in 2016, while Vietnamese authorities and recent projections released by the Asian Development Bank place growth at 6.7 percent. Even those with a more conservative outlook such as Credit Suisse’s expectations of 6.3 percent growth in 2016 expect growth at a level far exceeding figures posted in Q1.

Ultimately, Vietnam’s strong showing in manufacturing and services bodes well for the country’s long term potential. It is likely that as the economy continues its transition away from farming and into services and industry, growth will begin to accelerate and regain levels comparable to growth targets articulated by authorities. Unlike other developing economies, often attempting this transition under normal market conditions, the impending implementation of trade agreements such as the TPP and the EU-Vietnam Free Trade Agreement are set to create strong incentives for both investors and workers alike.

Further Support from Dezan Shira & Associates

For more information on Vietnamese growth and its impact upon specific lines of production, please contact our business intelligence specialists at vietnam@dezshira.com or visit us online at www.vietnambriefing.com

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Annual Audit and Compliance in Vietnam 2016

In this issue of Vietnam Briefing, we address pressing changes to audit procedures in 2016, and provide guidance on how to ensure that compliance tasks are completed in an efficient and effective manner. We highlight the continued convergence of VAS with IFRS, discuss the emergence of e-filing, and provide step-by-step instructions on audit and compliance procedures for Foreign Owned Enterprises (FOEs) as well as Representative Offices (ROs).

Navigating the Vietnam Supply Chain

Navigating the Vietnam Supply Chain

In this edition of Vietnam Briefing, we discuss the advantages of the Vietnamese market over its regional competition and highlight where and how to implement successful investment projects. We examine tariff reduction schedules within the ACFTA and TPP, highlight considerations with regard to rules of origin, and outline the benefits of investing in Vietnam’s growing economic zones. Finally, we provide expert insight into the issues surrounding the creation of 100 percent Foreign Owned Enterprise in Vietnam.

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

This edition of Tax, Accounting, and Audit in Vietnam, updated for 2016, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate Vietnam’s complex tax and accounting landscape in order to effectively manage and strategically plan their Vietnam operations.

- Previous Article Vietnam Market Watch: Mobile Gaming, Garment Industry, and S&P Growth Projections

- Next Article Remitting Profits from Vietnam – New Publication From Vietnam Briefing