Vietnam-Mexico Trade and Investment Relations

Vietnam is Mexico’s second-largest trading partner in Latin America, while Mexico holds the position of being Vietnam’s eighth-largest trading partner in Southeast Asia. Mexico has strategically positioned itself as a key player in numerous free trade agreements, significantly strengthening its global economic connections. This proactive approach has expanded Mexico’s trade networks, including robust ties with Vietnam.

Despite their geographical and cultural differences, Vietnam and Mexico have forged strong economic bonds. Both nations are committed to enhancing trade relations, restructuring import-export dynamics, and expanding market access.

The bilateral partnership between Vietnam and Mexico thrives on complementary economic structures, collaborative engagement in international and regional trade bodies, and mutual aspirations to diversify global economic prospects. Vietnam, in particular, aims to amplify trade and investment across sectors such as energy, telecommunications, advanced agriculture, and high-value industries.

Below we profile the bilateral trade and investment relations between Vietnam and Mexico.

Diplomatic relations

Vietnam and Mexico established diplomatic relations on May 19, 1975. Vietnam set up an embassy in Mexico City the same year, and Mexico opened its embassy in Hanoi in 1976.

Vietnam and Mexico have a longstanding history of cooperation, cemented through various bilateral agreements aimed at fostering collaboration across multiple sectors. Some key agreements, the Agreement for Educational and Cultural Cooperation, the agreement on the Suppression of visa requirements for official and diplomatic passport holders, and a Memorandum of Understanding for the establishment of a mechanism of political consultations, were signed by both nations in 2002.

In 2011, an agreement on Technical and Scientific Cooperation, along with an agreement in Agriculture and Forestry, was signed. Additionally, an agreement on Economic, Trade, and Investment Cooperation was signed in 2016.

These agreements reflect the commitment of both countries to deepen their bilateral ties and enhance collaboration in various fields, paving the way for a more robust and mutually beneficial relationship.

Bilateral trade

The trade relationship between Vietnam and Mexico was bolstered in 2018 when both nations became signatories to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), further integrating their economies and expanding their trade cooperation.

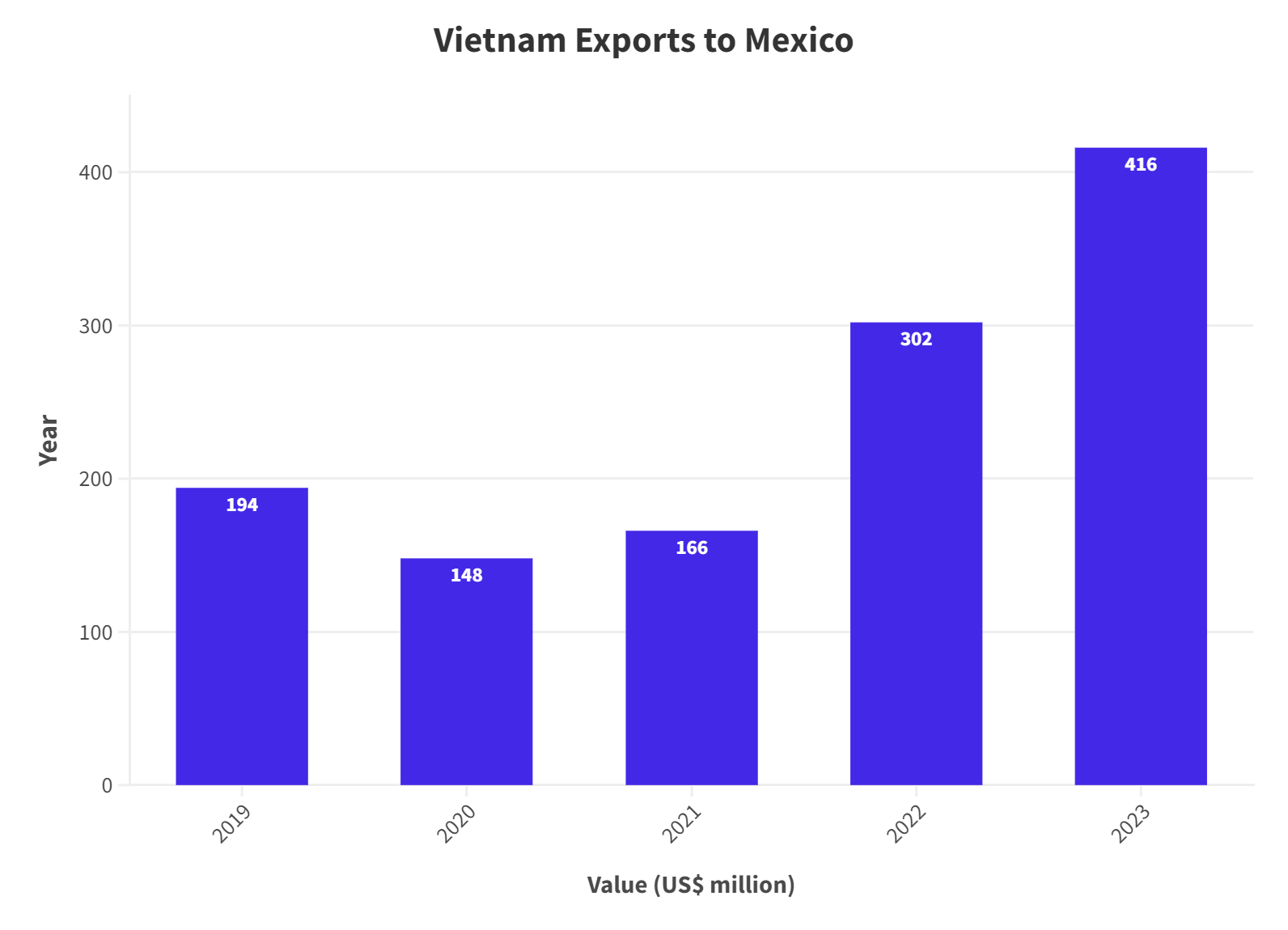

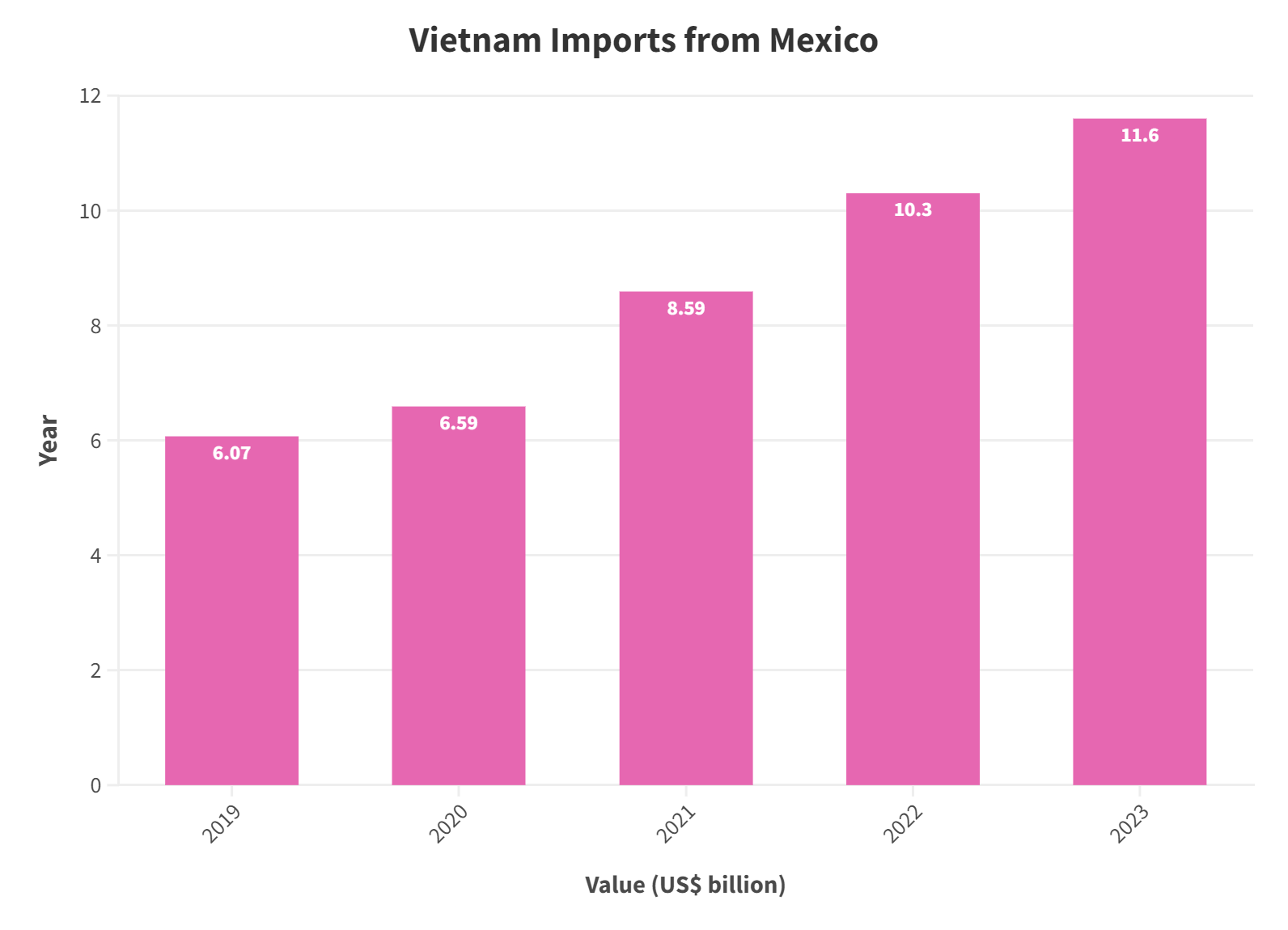

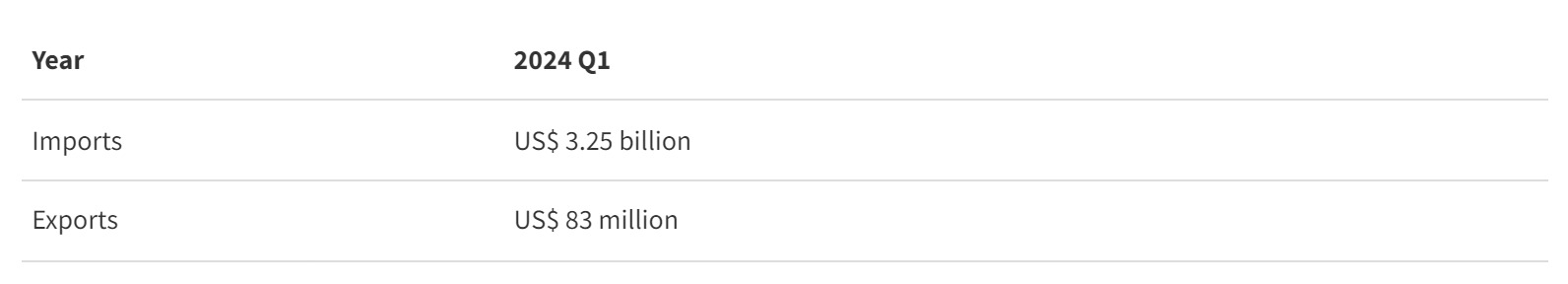

Vietnam’s exports to Mexico account for 0.058 percent of Mexico’s total imports, amounting to US$38 million. Conversely, Vietnam’s imports from Mexico constitute 2.23 percent of Mexico’s total exports, totaling US$3.26 billion. The net trade balance between Mexico and Vietnam in 2024 stands at US$3.18 billion.

Source: Gobierno de Mexico

According to OEC data, in 2022, Mexico exported merchandise worth US$723 million to Vietnam, with the largest categories being integrated circuits (US$85.7 million) and broadcasting equipment (US$25.3 million). Meanwhile, Mexico’s exports to Vietnam expanded at an impressive annualized rate of 418 percent over five years, rising from US$194,000 in 2017 to US$723 million in 2022.

Similarly, Vietnam exported goods worth US$2.91 billion to Mexico in 2022, with top exports including broadcasting equipment (US$716 million), broadcasting accessories (US$547 million), and integrated circuits (US$532 million). Vietnam’s exports to Mexico climbed at an annualized rate of 227 percent over five years, increasing from US$7.81 million in 2017 to US$2.91 billion in 2022. Notably, in 2022, no services were exchanged between the two countries.

|

Top 5 Mexican Exports to Vietnam in 2022 |

|

|

Mexico exports to Vietnam |

Value (US$ million) |

|

Electrical, electronic equipment |

110.25 |

|

Machinery, nuclear reactors, boilers |

32.86 |

|

Optical, photo, technical, medical apparatus |

28.88 |

|

Raw hides and skins (other than fur skins) and leather |

22.99 |

|

Vehicles other than railways & tramways |

14.07 |

|

Source: Trading Economics |

|

|

Top 5 Vietnamese Exports to Mexico in 2022 |

|

|

Vietnam exports to Mexico |

Value (US$) |

|

Electrical, electronic equipment |

2.24 billion |

|

Machinery, nuclear reactors, boilers |

432.78 million |

|

Footwear, gaiters, and the likes |

411.80 million |

|

Iron and steel |

185.51 million |

|

Vehicles other than railways, tramways |

172.63 million |

|

Source: Trading Economics |

|

In 2023, Vietnam’s chief export to Mexico continued to be electronic integrated circuits, amounting to US$2.63 billion. The principal Mexican destinations for these imports were Ciudad de México (US$3.13 billion), Chihuahua (US$3.07 billion), and Nuevo León (US$1.41 billion).

Interestingly, Mexico’s primary export to Vietnam was also electronic integrated circuits, valued at US$97.5 million. The main Mexican states exporting to Vietnam were Chihuahua (US$108 million), Jalisco (US$82 million), and Puebla (US$45.5 million).

Membership to the CPTPP

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) was signed in Santiago, Chile, on March 8, 2018, and became effective for Vietnam on January 14, 2019. The CPTPP includes Vietnam, Mexico, Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Peru, New Zealand, and Singapore. Together, these member countries represent about 13 percent of the global GDP, totaling approximately US$10.6 trillion. The agreement aims to eliminate most tariffs on goods and services among its members. Beyond tariff reductions, the CPTPP addresses non-tariff trade barriers by decreasing the time needed for exports to clear customs, reducing compliance costs, and enhancing the predictability of other economies’ processes.

The CPTPP mandates that member nations reduce import taxes on 97 to 100 percent of tariff lines originating from Vietnam. Consequently, most Vietnamese goods imported into CPTPP countries are subject to zero percent import tariffs immediately after the agreement’s implementation. Specifically, Mexico committed to eliminating import duties on 77.2 percent of tariff lines, equivalent to 36.5 percent of Vietnamese exports to Mexico, when the agreement took effect. Furthermore, import duties on 98 percent of tariff lines will be zero after 10 years.

The CPTPP’s provisions cover nearly all sectors and facets of trade, including tariffs, rules of origin, customs procedures, and intellectual property protection. The CPTPP emerged from the original Trans-Pacific Partnership (TPP), which was signed in 2016 but did not come to fruition due to the United States’ withdrawal under the presidency of Donald Trump.

Conclusion

The trade and investment partnership between Vietnam and Mexico demonstrates strong economic cooperation despite geographical and cultural differences. Both countries have strengthened their bilateral connections through diplomatic agreements and international trade organizations, with a notable focus on the electronics sector, particularly in electronic integrated circuits.

Looking forward, the CPTPP offers significant opportunities for both countries to diversify their supply chains – tapping into supplier networks in each other’s markets, besides facilitating trade and lowering tariff and non-tariff barriers. Continued collaboration in energy, communications, high-tech agriculture, and high-value industries is expected to further improve this partnership.

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com

- Previous Article Vietnam Government Extends Tax and Land Rental Payment Deadlines in 2024

- Next Article Foreign Technology Firms in Vietnam: Tax Payments Highlight Growing Commercial Presence