Vietnam Issues Penalties for Violations in Tax and Invoicing: Decree 125

- The government issued Decree 125/2020/ND-CP on penalties and fines for violations in tax and invoicing.

- The Decree will take effect on December 5, 2020, and any violation committed before the effective date will be governed by the other relevant regulations at the time.

- Investors should study the decree carefully and be compliant before the effective date to avoid any penalties.

The Vietnamese government issued Decree 125/2020/ND-CP (Decree 125) on October 19 listing several penalties and administrative fines for breaches in tax and invoicing regulations. The Decree will come into effect on December 5, 2020.

Any violation that is committed prior to such effective date will continue to be implemented by Decree No 129/2013/ND-CP, Decree 109/2013/ND-CP, and Decree 49/2016/ND-CP.

While the Decree lists several fines, we highlight the main ones below:

Banks subject to fines for withholding tax

Banks will be subject to fines which is equal to the tax amount that is owed, including penalties and interest if they fail to withhold tax from a taxpayer’s account and remit to the State Budget as requested by the tax authority. We assume that this requirement is based on the Law on Tax Administration 2019 which guides banks to withhold tax on behalf of overseas e-commerce suppliers.

This is still a grey area, as banks are still unsure how to do this in practice. The Ministry of Finance (MoF) is expected to issue a Circular to provide official guidance on implementation in practice.

Delay in tax returns will incur higher fines

Tax returns are typically expected to be submitted within 90 days. As per present regulations delays were subject to a penalty of VND 2 million (US$85) to VND 5 million (US$215). As per the new Decree, the fine range has been raised between VND 15 million (US$644) to VND 25 million (US$1,073).

Large scale violations

Another important thing to note is the definition of large-scale violations. These violations are described as violations which involve a tax amount of at least VND 100 million (US$4,314) or if the value of goods/services is at least VND 500 million (US$21,569), or where the number of invoices are at least 10. Such large violations may be subject to a higher penalty.

Further, taxpayers will not be subject to penalties if the IT system of the tax authorities is prone to technical errors.

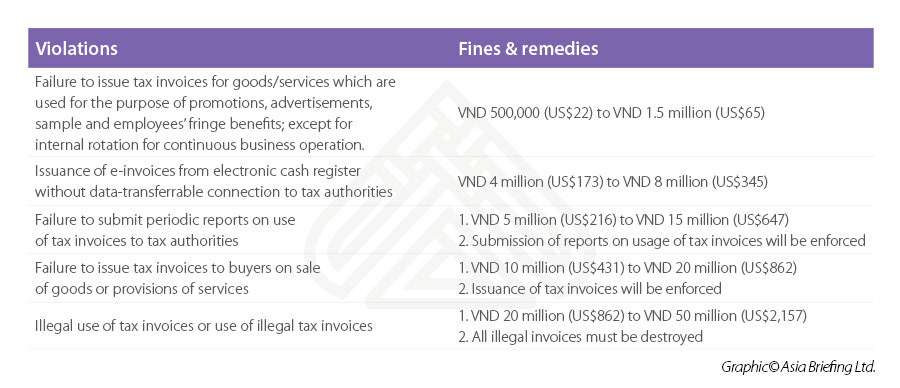

Violations in administration and e-invoicing

In addition, the tax authorities have listed 72 for violations in administration and e-invoicing for several e-invoicing violations. The most common violations which are typically committed by businesses during their operations are as follows:

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Q&A: M&A – Mergers & Acquisition Möglichkeiten und -Prozesse in Vietnam

- Next Article Erneuerbare Energien in Vietnam: Aktuelle Chancen und Zukunftsaussichten