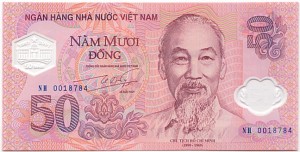

Vietnam Devalues Currency, Raises Interest Rates

HANOI, Nov. 25 – The central bank has announced that it would devalue the Vietnamese currency and raise benchmark base interest from 7 percent to 8 percent beginning next month.

HANOI, Nov. 25 – The central bank has announced that it would devalue the Vietnamese currency and raise benchmark base interest from 7 percent to 8 percent beginning next month.

This is the third time since since 2008 that the dong has been devalued. The central bank said that one-time devaluation will see the currency’s midpoint weakened by 5.44 percent. Inflation rates also hit a sharp note this month reaching 4.35 percent from 2.99 percent in October.

RELATED: Dezan Shira & Associates’ Pre-Investment, Market Entry Strategy Advisory Services

RELATED: Dezan Shira & Associates’ Pre-Investment, Market Entry Strategy Advisory Services

The latest central bank move will make the currency’s trading band against the U.S. dollar smaller to 3 percent from 5 percent.The dong has been unable to hold strength has against the dollar because of long-standing speculation on the currency and gold prices in Vietnam.

The country’s dollar reserves have also been affected by the slower pace of foreign investment and remittances from overseas workers. Vietnamese businesses also have a tendency to prefer quoting prices in dollar as opposed to dong. When shopping for souvenirs in Hanoi, it is common to see prices quoted in dollars.

Morgan Stanley said that the country’s devaluation “could create expectations of further devaluations, leading to more local holdings of dollars and resulting in the central bank needing to hold more reserves to support the currency.”

Vietnam’s foreign exchange reserves dropped to almost US$16.5 billion in August from US$23 billion at the end of 2008 according to World Bank data.

- Previous Article Vietinbank to Offer Online Remittance Transfer Services

- Next Article Virtual Offices Concept Face Government Resistance