Vietnam Considers E-Invoicing for Livestream Sales: Advisory for Businesses

Vietnam Prime Minister Pham Minh Chinh has instructed the Ministry of Finance (MOF) to conduct a comprehensive study and propose draft amendments on using electronic invoices (e-invoices) in e-commerce and livestream shopping. This directive, issued during an early June conference, underscores the government’s commitment to enhance scrutiny of the booming livestream sales industry and prevent tax violations.

Addressing loopholes in tax regulations impacting e-commerce and livestream sales

At a recent conference, Prime Minister Pham Minh Chinh directed Vietnam’s Ministry of Finance (MOF) to optimize the country’s tax administration in response to the rapid expansion of e-commerce. PM Chinh highlighted the significant loss in tax revenue from livestream sales and e-commerce transactions, instructing the MOF to address these issues in the draft amendments to Decree 123/2020/ND-CP (“Decree 123”).

Decree 123 deals with the management and use of invoices for sale and provision of goods and services; the management and use of records for completion of procedures related to tax, fees and charges, duties, powers and responsibilities of regulatory authorities, organizations and individuals in management and use of invoices and records.

Proposed amendments to Decree 123

The proposed amendments to Decree 123 aim to strengthen regulations on the use of e-invoices in livestream sales and e-commerce transactions, marking a substantial step in the government’s efforts to enhance tax administration.

Concurrently, local authorities have been encouraged to promote e-invoicing among consumers. The Prime Minister also called for stringent penalties for enterprises that fail to issue e-invoices.

Background

During a session on June 4, the National Assembly discussed that Vietnam’s social media livestreamers were generating hundreds of billions of dong daily in business, equivalent to millions of dollars, through their livestream selling activities.

The Ministry of Industry and Trade (MoIT) estimated that e-commerce sales will reach US$30.5 billion by 2025, as Vietnam’s e-commerce sector experiences the fastest growth in Southeast Asia.

Amid these developments, Vietnam officials acknowledged that the country’s present legal framework for regulating e-commerce is inadequate and needs revision to align with evolving practices and to match international standards.

Reviewing existing e-commerce regulations and relevant tax guidelines

Given the gaps in existing regulation, the MoIT has been asked to review and amend related laws and guidelines, such as the Consumer Protection Law and the E-Commerce Development Strategy. This instruction aims to facilitate sustainable growth in Vietnam’s e-commerce sector, protect consumer rights, and prevent the sale of counterfeit and substandard goods.

In tandem with the PM Chinh’s directives, the General Department of Taxation (GDT) issued an official dispatch directing its local departments to tighten their supervision of e-commerce taxes and e-invoices.

Last year, the GDT collected VND97 trillion (US$3.81 billion) in tax from e-commerce, including livestream sales, an increase of 14 percent compared with the previous year. The tax collection already reached VND50,000 billion (US$1.96 billion) in the first five months of 2024, showing potential growth of the sector.

Along with the significant growth, e-commerce also witnessed a notable number of tax evasion cases. In 2023, tax authorities audited over 31,000 entities in e-commerce, penalized more than 22,000 cases, and collected an additional VND3 trillion (USD$118 million) in taxes.

To address the issue, the Director General of Taxation requested the local director of tax departments and the Large Taxpayers Department to implement key assignments:

- Conduct comprehensive inspections of tax declaration, tax payment, and e-invoice usage by organizations, households, and individuals engaged in e-commerce, e-commerce platforms, and affiliate marketing, focusing on online businesses and livestreamers;

- Implement solutions to apply e-invoices generated from cash registers from August 1, 2024, for the following business types: golf course ticket sales and service provision, golf apparel, equipment, accessories, etc.;

- Develop inspection plans for the mentioned business types to ensure compliance and prevent tax revenue losses;

- Disseminate regulations on tax declaration, tax payment, and the use of e-invoices in transactions to each business establishment in e-commerce, golf course business, golf support services, etc.; and

- Reevaluate tax management practices to build a plan for applying e-invoices generated from cash registers for tourism ticket sales and entertainment activities. The competent agencies must report to the GDT before August 1, 2024.

The GDT oversees around 123,800 taxpayers in the e-commerce sector, including over 88,100 individuals and 35,100 businesses selling goods through e-commerce platforms. It also manages over 360 enterprises that own these platforms, 24 major companies that advertise online, and 96 foreign suppliers that are not physically present in Vietnam.

Current regulations on e-invoicing for livestream sales

Vietnam does not have specific regulations or law provisions pertaining to the use of e-invoices in livestream sales. However, businesses shall refer to the legal documents below to learn about the current mandates while awaiting updates.

Per Law 38/2019/QH14 on Tax Administration ( “Law on Tax Administration”) and Decree 123, e-invoices are mandatory for:

- Enterprises that are established and operate under Vietnamese law;

- Branches and representative offices of foreign enterprises operating in Vietnam;

- Cooperatives and unions of cooperatives;

- Households and individual businesses, and artels;

- Public service units that sell goods and provide services; and

- Entities that are not enterprises but have business operations.

Circular 78/2021/TT-BTC provides directive on certain e-invoice matters, including authorization to issue e-invoices, form numbers, serial numbers, conversion into e-invoices with verification codes, handling e-invoices issued with errors, and storage of e-invoices, etc. The circular guides certain provisions of the Law on Tax Administration and Decree 123 on invoices and documents.

Furthermore, taxpayers shall examine Circular 80/2021/TT-BTC, which elaborates on some articles of the Law on Tax Administration, to learn about taxation on e-commerce and digital-based transactions in Vietnam. The circular also mandates the use of e-invoices in tax refund procedures in Article 28, Chapter V.

Consumer trends in Vietnam’s e-commerce market

Vietnam’s e-commerce market is projected to reach approximately US$24 billion by 2025, with a compound annual growth rate (CAGR) of 22 percent. According to data from consultancy firm NIQ, around 60 million people in Vietnam use e-commerce platforms, generating an average of 3.5 million daily visits to online shopping channels.

These platforms have effectively leveraged Vietnamese customers’ social-oriented tendencies to drive growth. Vietnamese shoppers often prefer to learn about the community’s evaluations and recommendations of a product on social media before making a purchase decision.

NIQ also revealed that nearly 90 percent of users surveyed indicated they would maintain or increase their online shopping frequency on e-commerce platforms by 2025. Convenience has become the most influential factor in consumer shopping patterns, favored by 92 percent of consumers over price reductions and special deals. This trend highlights the importance for firms to enhance the user experience on their e-commerce platforms, facilitating simple and quick shopping experiences on mobile devices.

Social commerce becomes a global phenomenon

Venture capitalist David Beisel first coined the term “social commerce” in a 2005 blog post, and it quickly became a widely adopted concept, gaining significant traction nearly a decade later. According to Facebook, social commerce is defined as “buying and selling that takes place on social media and other networking sites.” This new shopping method enables consumers to stay engaged and purchase goods within their familiar social media environments.

Future Market Insights predicts the global social commerce market will reach US$945.92 billion in 2023 and surpass US$13.04 trillion by 2033. The demand for social commerce is expected to grow at a CAGR of 30 percent from 2023 to 2033.

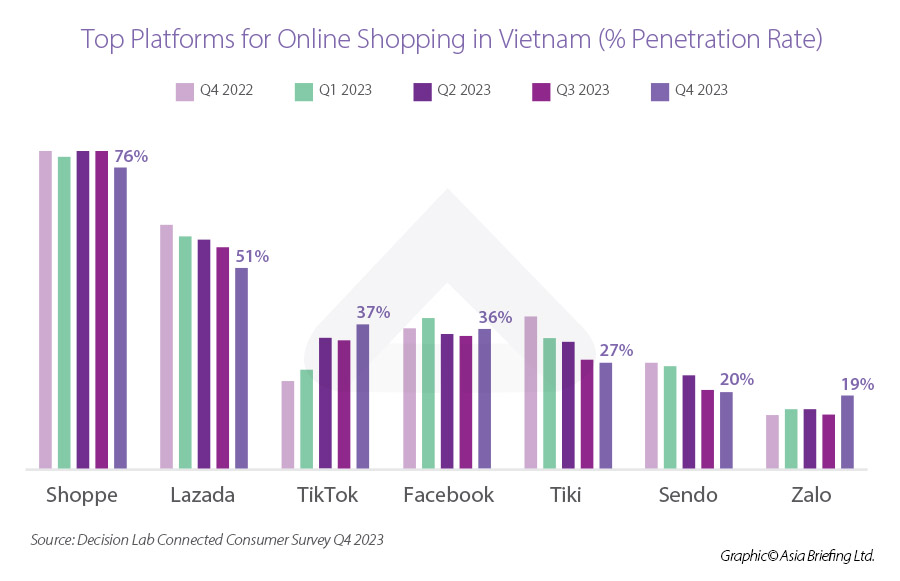

In Vietnam, online shopping is also shifting towards social commerce. According to Decision Lab’s Connected Consumer Survey Q4 2023, while traditional e-commerce sites remain dominant, consumer preferences are gradually moving toward social commerce platforms like Facebook, TikTok, and Zalo. This trend indicates a growing inclination among Vietnamese shoppers to engage in purchasing activities within their social media networks.

TikTok and the rise of livestream shopping

Livestreaming, the real-time or near real-time streaming of video or audio, has become a powerful tool for online selling platforms. Industry data projects that Vietnam’s livestream shopping market will reach US$11 billion by 2026, with an annual growth rate of 11 percent. Over 70 percent of Vietnamese internet users have watched a livestream, and half of them made a purchase during or after the stream. Livestream sales conversion rates can be up to ten times higher than traditional e-commerce.

TikTok has emerged as a formidable player in the livestream shopping space, driven by the popularity of their ‘Shoppertainment’ trend. Over 79 percent of TikTok users make purchases based on seller content rather than sales promotions. TikTok’s e-commerce feature, TikTok Shop, saw a revenue increase of over 239 percent year-over-year in Vietnam in the first five months of 2024.

As livestream shopping continues to rise, TikTok is expected to remain a key player due to its video hosting capabilities, which appeal to the socially oriented consumer. By mid-2024, TikTok Shop had surpassed Lazada in the number of vendors, becoming Vietnam’s second-largest e-commerce platform by revenue, behind Shopee.

Livestream shopping is embraced by sellers and brands of all sizes, as it enhances consumer interactions, provides a seamless shopping experience, and boosts brand credibility through social proof.

Advisory

As more businesses get attracted to the profitable opportunities in Vietnam’s e-commerce landscape, particularly social commerce, through livestreaming – they need to be cognizant of tax rules and legal compliance. Recognizing the lucrative potential of livestream shopping, Vietnam’s government has become keen to regulate this sector, such as by mandating e-invoices and amending existing laws and decrees.

Businesses looking to enter or expand into the online market in Vietnam should closely follow forthcoming changes in the country’s legal framework. As per recent indications from top authorities, the government is keen to strengthen regulations to enhance consumer protections, improve transparent transactions, and address sales of counterfeit goods, besides making tax scrutiny more efficient.

It is recommended that businesses in this space engage proactively with local tax and regulatory authorities to understand specific requirements and changes to compliance procedures. Another strategy is to participate in forums or industry groups to stay updated on best practices and regulatory changes. It is also important for businesses to provide clear information on your platforms about tax-related aspects of transactions. Additionally, conducting regular audits helps to identify and rectify any gaps in your compliance processes.

To avoid non-compliance or the risk of being suspected of tax evasion, it is advisable to partner with local firms or consultants who can provide insights and support in navigating Vietnam’s regulatory environment.

(With inputs from Melissa Cyrill.)

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, China, and India. For editorial matters, contact us here and for a complimentary subscription to our products, please click here. For assistance with investments into Vietnam, please contact us at vietnam@dezshira.com or visit us at www.dezshira.com.

Dezan Shira & Associates assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. We also maintain offices or have alliance partners assisting foreign investors in China, Hong Kong SAR, Dubai (UAE), Indonesia, Singapore, Philippines, Malaysia, Thailand, Bangladesh, Italy, Germany, the United States, and Australia.

- Previous Article Vietnam Calls for Chinese Support in Advancing Rail Projects

- Next Article Vietnam Notifies Decree 80/2024/ND-CP on Direct Power Purchase Agreements: Key Details