Vietnam ‘All In’ as Casinos, Service Industry Bet on Ba Ria-Vung Tau

By Joe Drury

Jun. 3 – The winds of change are sweeping across Ba Ria-Vung Tau Province in Vietnam’s booming southeast economic region, and they are fragrant with the scent of gambled winnings and Dom Pérignon.

Traditionally an industrial center of Vietnam, a recent flood of service sector investment hopes to transform the local economy into an international tourist’s dream of luxurious living and gambling.

RELATED: Dezan Shira & Associates’ Global Services

RELATED: Dezan Shira & Associates’ Global Services

What is happening in Ba Ria-Vung Tau’s is happening in the rest of Vietnam, where nearly 77 percent of total foreign direct investment is now committed to the service sector, a drastic shift from the steady 7 percent ratio in the last decade.

But the government leviathan has reared its head in response to this market disruption. Unclear FDI standards and difficulties clearing land have led to capital disbursement delays, forcing many projects to a standstill and imperiling the province’s future.

Ba Ria-Vung’s predicament provides a cautionary test for this country’s former centralized economy as it strives to avoid the extremes of muddling bureaucracy and laissez faire free-for-all.

Welcome to fabulous Ba Ria-Vung Tau

Vietnam’s southeast economic region is the powerhouse of the country’s invigorated economy. Thanks to a coordinated infrastructure replete with highways, railroads, ports and airports linking Vietnam’s special economic zones and industrial parks to the outside world, the region produces 47.4 percent of the country’s industrial output and is responsible for 61 percent of total foreign invested projects in Vietnam.

Vietnam’s southeast economic region is the powerhouse of the country’s invigorated economy. Thanks to a coordinated infrastructure replete with highways, railroads, ports and airports linking Vietnam’s special economic zones and industrial parks to the outside world, the region produces 47.4 percent of the country’s industrial output and is responsible for 61 percent of total foreign invested projects in Vietnam.

An important player in this activity is Ba Ria-Vung Tau Province. With an area of 1,982 square kilometers and a population of 995,000, it shares the border with Dong Nai Province to the north, Binh Thuan Province to the east and Ho Chih Minh City to the west.

Ba Ria-Vung Tau connects Vietnam to the world with a developed network of deep seaports, and fires its industry with an extensive natural gas supply system. Not surprisingly, the province’s key industrial sectors are those heavy industry and gas consuming ones, including petroleum, steel, electricity, fertilizer, mechanical manufacturing and construction materials.

The coastal city of Vung Tau is a hub for Vietnam’s rich offshore oil industry and is conveniently located next to ports with shipping lines zipping directly to the United States. Within the Tan Thanh industrial park, the Phu My electricity plants generate 40 percent of the nation’s electricity and construction on Vietnam’s largest steel mill recently broke ground.

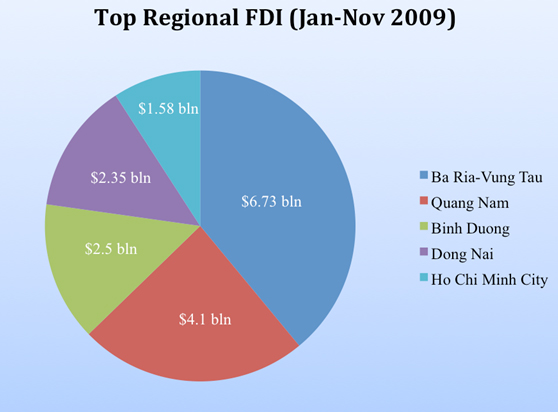

It is no great surprise then that the province attracts a lot of attention from international investors. In the first 11 months of 2009, Ba Ria-Vung Tau boasted the largest foreign investment of any province or city in Vietnam, with US$6.73 billion in newly registered capital and increased capital, far ahead of second place Quang Nam Bing Duong at US$4.1 billion.

The province has so far managed to repeat this success in the current year. According to Vietnam’s Foreign Investment Agency, Ba Ria-Vung Tau attracted US$2.16 billion of FDI for 20 projects in Jan-May 2010, 30 percent of Vietnam’s total and the highest of any province in Vietnam.

What happens in Vietnam, stays in Vietnam

As great as its industrial achievements stand, most of Ba Ria-Vung Tau’s foreign direct investment is now channeled into the service sector, with tourism netting the most interest.

As great as its industrial achievements stand, most of Ba Ria-Vung Tau’s foreign direct investment is now channeled into the service sector, with tourism netting the most interest.

“In the service sector, investors are not only developing tourism services but also spending more in financial and banking services,” said Le Kim Huong, director of the province’s Department of Planning and Investment in a 2008 interview with the Saigon Times.

Based on investment trends in 2008, Huong expects the service sector to represent 40 percent of the local economy by 2015, up 30 percent from 2008.

Judging by the numbers, tourism seems poised to lead this transition, as investors are keen to pump more value into Vietnam’s still underdeveloped tourism industry and transform the country into a world-class luxury travel and gambling destination.

In 2009 the province attracted US$4.6 billion in tourism projects according to the Vung Tau Promotion Investment Center, a diverse array ranging from animal parks and tourist complexes to five-star hotels with flower gardens and golf courses.

By April of 2010, the province continued to show strong numbers with a total of 159 tourism projects spread over 6,000 hectares and investment capital reaching US$11.9 billion. Foreign investors finance an overwhelming 94 percent of these projects.

Emblematic of the province’s new economy is the largest of these new developments: the MGM Grand Ho Tram, a luxury Las-Vegas style casino to be located 130 kilometers from Ho Chi Minh City on the pristine Ho Tram beach strip. Vancouver-based Asian Coast Development Ltd. will develop the US$4.2 billion project, whereas MGM Mirage will manage the property after completion.

In 2013, the resort will complete the first phase of development, opening its doors to 550 luxury guest rooms, five-star amenities, and a gaming area of 90 live tables, 500 electric games and VIP facilities. The second phase of development will add 550 guest rooms, 14 high-end private villas and 500 more electronic games.

“I believe firmly that supply has not met demand in Asia,” said Lloyd Nathan, former president of MGM Mirage Global Gaming Development, in an Apr. 2010 interview with Bloomberg. Nathan, tapped to run the new Vietnam resort, argues, “Vietnam is going to thrive as an alternative to Singapore or Macau.”

Aside from the MGM Grand Ho Tram, other ambitious projects include the planned Tung Tau Wonderful World Theme Park by the U.S. company, Good Choice USA-Viet Nam. The theme park will include an 88-story tower, conference center, shopping malls and entertainment centers, a US$120 million Chinese international five-star hotel with 50 luxury villas, and a US$1 billion project by Korea’s JQ Urban Development.

Fear and loathing

Despite these rosy projections, the past two years have exposed weaknesses in Vietnam’s investment system. Many investors in the tourism sector, local and foreign, complain about projects being delayed due to problems of site clearance and land allocation. On the other hand, top-level government officials worry about lax FDI approval and licensing procedures leading to bungled investments and ineptly delayed construction.

These obstacles have resulted in low levels of capital disbursement and construction setbacks, pushing the average completion time for projects in Ba Ria-Vung Tau to eight or nine years. Of the province’s 159 new projects, only ten projects are in operation or fully under construction. 38 projects have just started construction and the rest are in the midst of the licensing procedure or drawing plans for construction.

On a national level, Vietnam seems to be sorting out its capital disbursement problems. The Foreign Investment Agency reported that capital disbursement in foreign invested projects rose by 7.1 percent year on year in the first five months of 2010 to US$4.5 billion.

As Ba Ria-Vung Tau continues to attract more FDI throughout 2010, it remains to be seen whether this national trend will wind its way to this southeastern province. With a better-enforced system of government oversight and land clearance, the region may see its stellar FDI figures drop as quality of investment becomes favored over quantity. But such is necessary to uncork the bottled up slowdown in development, assisting the local market’s transition from oil to champagne.

Related Reading

Vietnam’s Industrial Zones: Haiphong, Danang, Ba Ria-Vung Tau, Ho Chi Minh City

- Previous Article Vietnam’s Maritime Economy to Claim Over 50 Percent of GDP by 2020

- Next Article Vietnam-Pakistan JMC Sees Bilateral Commitments Across Several Sectors