Vietnam Airlines IPO to Finally Go Ahead

HCMC – After more than two years of bureaucratic struggles, perennial no show on the IPO circuit, Vietnam Airlines, is rumored to finally be months away from beginning its equitization process. The IPO comes along as part of the Vietnamese government’s efforts to restructure the economy and attract more foreign investors. The plan calls for the privatization of many of the state-owned enterprises (SOEs). By the end of next year, more than 400 SOEs are expected to issue IPOs.

HCMC – After more than two years of bureaucratic struggles, perennial no show on the IPO circuit, Vietnam Airlines, is rumored to finally be months away from beginning its equitization process. The IPO comes along as part of the Vietnamese government’s efforts to restructure the economy and attract more foreign investors. The plan calls for the privatization of many of the state-owned enterprises (SOEs). By the end of next year, more than 400 SOEs are expected to issue IPOs.

Among the potential IPOs, Vietnam Airlines has received the most attention from foreign investors since, as Alan Pham, chief economist at VinaCapital Group has pointed out, it is one of the few large SOEs in the country that is profitable. There is still no firm date for the IPO, but Vietnam Airlines expects to be listed on the Ho Chi Minh Stock Exchange within three months from the government’s approval.

RELATED: Dezan Shira & Associates’ Pre-Investment, Market Entry Strategy Advisory Services

RELATED: Dezan Shira & Associates’ Pre-Investment, Market Entry Strategy Advisory Services

Last year, Vietnam Airlines earned VND549.4 billion (US$25.8 million) before tax. This year, Vietnam Airlines reported that its pre-tax profit for the first quarter was VND478.7 billion (US$22.4 million). This recent figure shows the substantial growth that Vietnam Airlines, and the air industry in general, is experiencing.

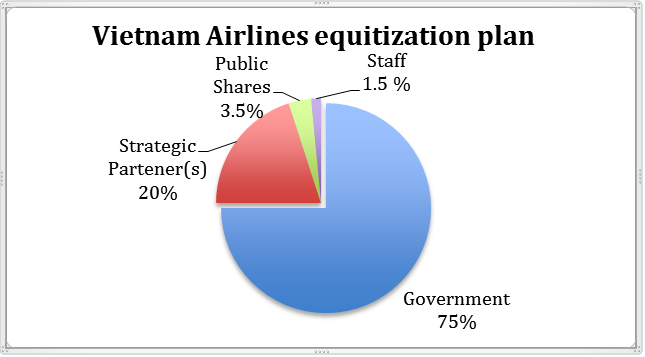

In the first phase of Vietnam Airlines’ equitization plan, the government will retain 75 percent of the company while selling 20 percent to a strategic partner(s); 3.5 percent of the shares will be sold to the public, while 1.5 percent of the shares will be reserved for staff members. In the second phase, if the IPO goes well, the government will decrease its share amount. However, the government has stated that it will not reduce its ownership level below 65 percent.

Vietnam Airlines is seeking to raise US$51 million by offering 49 million public shares, equivalent to 3.5 percent of the company, at a price of VND22,300 (US$1.05) per share. However, the price is not yet final as it is still waiting for government approval.

RELATED: Vietnam’s Airline Industry Takes Off

According to the Ho Chi Minh Securities Corporation, the goal of selling 3.5 percent of the shares to the public is more about letting the market determine the price before Vietnam Airlines sells 20 percent of the shares to its strategic partner(s).

RELATED: Sky-High Competition: Vietnam’s Budget Airlines

The Ministry of Transport will set the standards for the strategic partner(s) and it is most likely that the strategic partner(s) will have to be members of the Sky Team Alliance. However, this will depend on negotiations with potential investors/partners. According to the government, no more than three strategic partners will be allowed.

If the government approves the equitization plan, Vietnam Airlines will receive a number of concessions, these include:

- Vietnam Airlines will get to keep its name after the IPO;

- The number of employees is expected to remain the same at 10,180 people;

- The company gets to keep the entire share premium after the IPO and will be able to use that that sum to fund the purchase of more airplanes; and

- It will also receive the government’s guarantee that it will provide 100 percent loans which will be used to buy A350 and B787 planes without the use of mortgages.

The total cost for the equitization process is expected to reach VND57.2 billion (US$2.7 million), VND45 billion (US$2.1 million) of which will go to financial advising services. Key advisors for the IPO include the Ho Chi Minh Securities Corporation, Citigroup, and Morgan Stanley.

While offering an interesting opportunity for certain types of investors, the proposed deal has received criticism domestically and internationally. Many analysts claim that Vietnam Airlines is asking for too many government concessions – thus making the privatization process useless. There is little room for the free market to play its role in determining the course of the airline and little way for non-governmental investors to exercise control over the company.

Only time will tell if Vietnam Airlines can be successful as a “semi” public company and if the government will allow it to swim by itself in the seas of the free market.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Developing Your Sourcing Strategy for Vietnam

Developing Your Sourcing Strategy for Vietnam

In this issue of Vietnam Briefing Magazine, we outline the various sourcing models available for foreign investors – representative offices, service companies and trading companies – and discuss how to decide which structure best suits the sourcing needs of your business.

Ho Chi Minh City Cracks Down on Work Permits

Choosing the Right Sourcing Model in Vietnam

Vietnam Airlines IPO Set for Late 2013

Vietnam’s Retail Banks Seek to Entice New Customers

- Previous Article Vietnam’s Retail Banks Seek to Entice New Customers

- Next Article Japan and Vietnam to Grow Agricultural Development Cooperation