Vietnam in 2017: Spotting Opportunities for FDI

By Mike Vinkenborg

2016 has been a successful year for Vietnam, continuing its emergence as both a leading ASEAN economy and a global player. Falling commodity and energy prices and severe water shortages early in the year caused Vietnam’s failure to reach its goal of 6.7 percent GDP growth, but with a year-on-year growth of 6.2 percent the country still managed to outpace most of its neighbors.

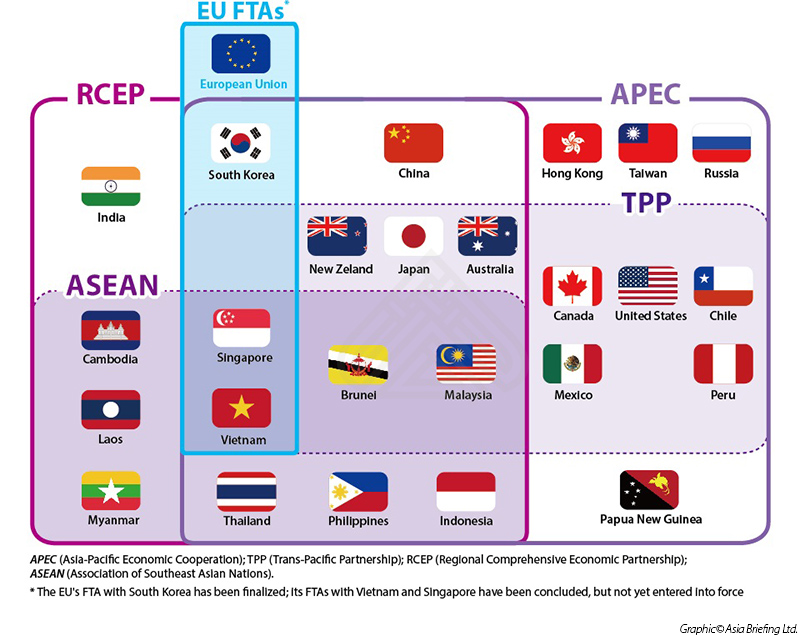

For 2017, the government has set Vietnam’s GDP growth target at 6.7 percent, while growth levels for the following years are expected to reach levels of at least seven percent. For a large part, this growth will be fueled by increased trade. Last year, Vietnam signed a free trade agreement with the European Union (EVFTA), eliminating trade tariffs by 2018, among other provisions. While the presidency of Trump resulted in a setback due to US’ abolition of the Transpacific Partnership (TPP) agreement, Vietnam continues to diversify its economic partners, such as through increased ASEAN integration, the proposed Regional Comprehensive Economic Partnership (RCEP, covering 3.4 billion people and which may emerge as the alternative to the TPP), and the EVFTA.

The country is becoming increasingly more attractive for foreign investments as Vietnam keeps giving new reasons to invest. Following last year’s outlook by Vietnam Briefing, this article analyzes Vietnam’s trade in 2016 and spots trends and opportunities for foreign investments in 2017.

Breakdown of FDI in 2016: numbers and partners

FDI inflows reach new heights

As Vietnam is becoming increasingly accessible to foreign investments, FDI inflows have seen a steady and strong increase over the previous years. In 2016, these climbed to to US$24.4 billion, indicating a nine percent growth compared to 2015. Of these, US$15.1 billion flew to 2,556 newly registered projects, 1,225 existing projects added a total of US$5.76 billion to their capital, and foreign investors purchased stakes in 2,547 companies for a total value exceeding US$3.4 billion.

![]() RELATED: Dezan Shira & Associates’ Corporate Establishment Services

RELATED: Dezan Shira & Associates’ Corporate Establishment Services

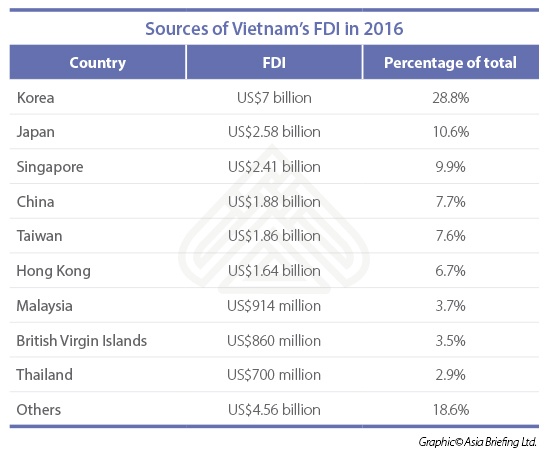

FDI sources: Pan-Asian investments

The Republic of Korea was the main provider of FDI in 2016. Largely due to investments by LG, the country invested over US$ 7 billion in Vietnam. In total, investors coming from 95 countries capitalized on investment opportunities in Vietnam. Most investments came from within Asia; the only non-Asian country in the top 10 of FDI providers are the British Virgin Islands.

Trade surplus in 2016: EU, US main export destinations

Looking at international trade, Vietnam managed to grow exports by 8.6 percent year-on-year, following the impressive 29 percent growth rate in 2015. Consequently, it turned its trade deficit into a surplus in 2016, totaling US$2.1 billion, the highest in six years. With the increased trade – exports and imports totaling US$176.57 billion and US$174.47 billion, respectively – the country’s export-to-GDP ratio is currently standing around 90 percent; one of the highest in the world.

Top export destinations for the first seven months of 2016 were the US (22 percent), China (11.2 percent), ASEAN (9.9 percent), Japan (8.2 percent), and South Korea (6.2 percent), while imports were mainly coming from China (28.9 percent), South Korea (18.5 percent), ASEAN (14 percent), and Japan (8.6 percent). The EU as a bloc is one of the largest export markets as well; similar to the country’s trade with the US, Vietnam’s trade balance with the EU is highly positive.

Industries and locations

2016 showed the further establishment of Vietnam as a main manufacturing hub, with the large majority of FDI flowing into the manufacturing and processing sector, namely 63.7 percent of FDI (US$15.5 billion). The automobiles and motorbike wholesale (7.8 percent) and real estate sector (6.9 percent) followed suit.

Ho Chi Minh City was the main receiver of Vietnam’s FDI, accumulating US$3.4 billion (14 percent) of total FDI inflows. Other popular destinations were Hai Phong, Hanoi, Binh Duong, and Dong Nai, which received FDI totaling US$3 billion, US$2.8 billion, US$2.4 billion, and US$2.2 billion, respectively.

2017: Emergence of new opportunities

In 2017 Vietnam is poised to continue on its current trajectory. After years of significant growth, Vietnam’s GDP per capita has reached an estimated US$2,215 at the end of 2016, an increase of US$106 compared with the year before. For 2020, the government has set a target of US$3,000 per capita. This follows the general trend within Vietnam, where the middle class is slowly becoming more populous. Standing at 16 million in 2014, the population within or above the middle class is expected to double to 33 million by 2020 according to the Boston Consulting Group. Combining this with a young and large workforce that is more and more becoming high-skilled, there are no signs of Vietnam slowing down in the foreseeable future.

![]() RELATED: Customs Procedures in Vietnam

RELATED: Customs Procedures in Vietnam

Vietnam’s growth pattern shows striking similarities with China’s development a decade ago. Similar to China during that time, new opportunities emerge as the growing emerging middle class has more disposable income at hands. As such, now is a better time than ever to enter the market and capitalize on opportunities arising from increased local consumption. With a large demand for foreign expertise, this brings opportunities in several sectors, including education, healthcare, food and beverages, and e-commerce, among many others. Having said that, it is important to realize that certain sectors have restrictions in place on FDI, while import and export regulations in Vietnam also vary from other countries.

Despite increased domestic consumption, there are still many areas requiring large investments to catch up with regional standards. For example, opportunities prevail in the infrastructure sector. Ho Chi Minh City’s congestion is increasingly becoming more problematic and the city is desperate to improve this situation in the coming years. Another example includes renewable energy, the development of which is expected to lift-off in the coming years. These types of projects are frequently open to private investors through Public Private Partnerships, giving them the opportunity to get involved in public projects through extensive cooperation with public institutes.

However, primarily, Vietnam has definitively established itself as a manufacturing hub. As wages in China have reached a point where manufacturers are moving elsewhere, Vietnam remains highly competitive with minimum wage levels ranging from VND 2,580,000 to VND 3,750,000 (US$113 to US$165), depending on the region. What puts Vietnam a few steps ahead of its competitors is its openness. Besides the country’s integration with ASEAN and the free trade agreements (FTAs) resulting from this bloc, it has also agreed on its own FTA with the EU (EVFTA), deepening its ties with its largest non-Asian trading partner. And while the US pulled out of the TPP, Vietnam is quick to make sure its growth in global trade will not stagnate by shifting its focus to the proposed Regional Comprehensive Economic Partnership (RCEP). As such, it is set to see a continued flow of investment coming into the country’s garment and electronics manufacturing, among others.

![]() RELATED: Introduction to Personal Income Tax in Vietnam

RELATED: Introduction to Personal Income Tax in Vietnam

Setting up manufacturing facilities in Vietnam requires in-depth information on the various regions in the country. With special economic zones in place that often offer incentives to foreign investors, choosing the right location can result in significant tax exemptions. For example, export processing enterprises located within export processing zones are exempt from paying custom duties and VAT on exports, while operating in an industrial zone can also lead to various tax incentives.

Ease of doing business

The trajectory of Vietnam is highly encouraging. As a result, the country’s ease of doing business – while still leaving room for improvement – is developing; according to the World Bank’s “Doing Business in 2017” research, Vietnam ranked 82nd out of 190 countries, up nine positions from 2016. This can largely be attributed to the government’s efforts. Besides its involvement in the mentioned FTAs, it is also actively privatizing its state-owned enterprises (SOEs). A recent study of Baker McKenzie estimates that IPO activity in the coming years will see a surge, steadily rising from US$172 million in 2016 to US$948 million in 2019. Since 2015, nearly 170 companies have been privatized and this trend will continue in the coming years. For example, Sabeco, a beer maker with an estimated value of US$2 billion, is set to be privatized in 2017, and many other large SOEs will follow in the coming years.

While this creates many opportunities to foreign investors, one should always be aware of difficulties when dealing in the country and comply with local laws. As Vietnam is undergoing rapid developments, regulations are frequently updated and it is key to stay abreast of current regulations. That being said, these regulatory updates are more often than not encouraging, not discouraging, more FDI. Over the past years Vietnam kept giving investors reasons to invest in the country; there are no reasons to expect that the country will stop doing so in 2017.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Annual Audit and Compliance in Vietnam 2016

In this issue of Vietnam Briefing, we address pressing changes to audit procedures in 2016, and provide guidance on how to ensure that compliance tasks are completed in an efficient and effective manner. We highlight the continued convergence of VAS with IFRS, discuss the emergence of e-filing, and provide step-by-step instructions on audit and compliance procedures for Foreign Owned Enterprises (FOEs) as well as Representative Offices (ROs).

Navigating the Vietnam Supply Chain

Navigating the Vietnam Supply Chain

In this edition of Vietnam Briefing, we discuss the advantages of the Vietnamese market over its regional competition and highlight where and how to implement successful investment projects. We examine tariff reduction schedules within the ACFTA and TPP, highlight considerations with regard to rules of origin, and outline the benefits of investing in Vietnam’s growing economic zones. Finally, we provide expert insight into the issues surrounding the creation of 100 percent Foreign Owned Enterprise in Vietnam.

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

This edition of Tax, Accounting, and Audit in Vietnam, updated for 2016, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate Vietnam’s complex tax and accounting landscape in order to effectively manage and strategically plan their Vietnam operations.

- Previous Article Managing Contracts and Severance in Vietnam – Latest Issue of Vietnam Briefing Magazine

- Next Article An Introduction to Doing Business in Vietnam 2017 – New Publication from Dezan Shira & Associates