TPP Perceptions in Vietnam: Insights from Indochina Research

By: Erasmo Indolino

Based on survey results by Indochina Research (Vietnam) ltd.

In February 2016, the Trans-Pacific Partnership (TPP) was signed in Auckland, New Zealand. In total, the agreement brings together 12 contracting countries: Australia, Brunei, Canada, Chile, Malaysia, Mexico, New Zealand, Japan, Peru, the United States, Singapore and Vietnam. Experts consider TPP to be one of the largest trade agreements ever concluded, and its negotiations alone have taken more than seven years to reach an agreed upon text.

If ratified by all members, the TPP could come into force as early as Q1 2018. To facilitate transparent discussions prior to ratification by respective member states, the agreement’s full text was published in November 2015. Since then, Vietnam has rapidly emerged as the agreements’ prime beneficiary, with experts touting the many ways that TPP’s least developed economy can tap demand of larger members.

Despite its publicly available text – like many trade agreements – concerns remains about the awareness as well as level of support of populations within TPP member states. Helping to bridge this gap, Indochina Research presents some of the first in depth survey data on Vietnamese citizens’ understanding and support for the agreement. Conducted in Hanoi and in Ho Chi Minh City, this survey involves a sample of 600 people aged between 15 and 64 years. For details and full copy of the report click here

Awareness Linked to Household Income

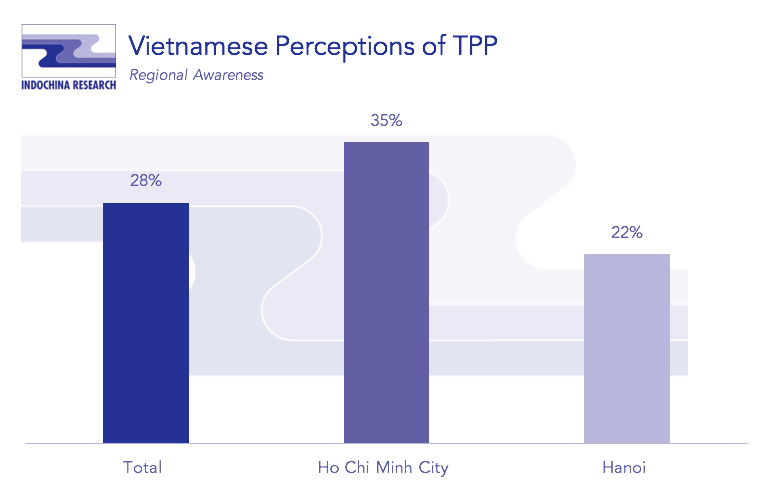

The first figure found is a low level of knowledge about the Trans-Pacific Partnership. When asked about which important agreement was going to be signed in the near future, only 28 percent of respondents spontaneously named the Trans-Pacific Partnership.

Breaking these figures down, awareness is shown to be much higher in Ho Chi Minh City, where the TPP was cited by 35 percent of the representative sample. In contrast, only 22 percent of respondents in Hanoi were able to name the TPP. Interestingly, the lack of awareness continues to be widespread despite the TPP being a massively covered issue by the Vietnamese media.

One possible explanation may lie in Vietnam’s continued progress towards economic development. If the sample is broken down by income, rather than to geographical origin, Indochina Research notes that the awareness of TPP is directly proportional to levels of household income. For example, 40 percent of respondents with a household income of more than VND 15 million per month expressed awareness of the agreement – a 42 percent increase over the national average.

Support Levels Remain Strong

The second fact recorded by the survey concerns the opinions of the Vietnamese population regarding TPP. Indochina Research‘s findings indicate that, despite low level of awareness, the vast majority of the sample was broadly in favor of the TPP and saw the agreement as a net positive for Vietnam. 71 percent of those responding to the survey indicated support for the agreement, with figures rising to 75 percent for active professionals.

A significant factor for Vietnam’s overwhelming support for TPP seems to lie in the outlook of the Vietnamese population on their national prospects within the agreement. When surveying respondents as to the distribution of gains within the TPP, Indochina Research finds that for the Vietnamese population, Vietnam is thought to be the country that could benefit the most from the agreement. Among respondents, 66 percent chose Vietnam as the primary beneficiary of the agreement followed by the United States (65 percent) and at some distance, Japan (indicated by 49 percent of respondents).

With public opinion so widely supportive of the agreement, there is likely to be little opposition, and possibly even an added incentive, towards the ratification of the Trans-Pacific Partnership by Vietnamese authorities.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

Annual Audit and Compliance in Vietnam 2016

In this issue of Vietnam Briefing, we address pressing changes to audit procedures in 2016, and provide guidance on how to ensure that compliance tasks are completed in an efficient and effective manner. We highlight the continued convergence of VAS with IFRS, discuss the emergence of e-filing, and provide step-by-step instructions on audit and compliance procedures for Foreign Owned Enterprises (FOEs) as well as Representative Offices (ROs).

Navigating the Vietnam Supply Chain

Navigating the Vietnam Supply Chain

In this edition of Vietnam Briefing, we discuss the advantages of the Vietnamese market over its regional competition and highlight where and how to implement successful investment projects. We examine tariff reduction schedules within the ACFTA and TPP, highlight considerations with regard to rules of origin, and outline the benefits of investing in Vietnam’s growing economic zones. Finally, we provide expert insight into the issues surrounding the creation of 100 percent Foreign Owned Enterprise in Vietnam.

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

This edition of Tax, Accounting, and Audit in Vietnam, updated for 2016, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate Vietnam’s complex tax and accounting landscape in order to effectively manage and strategically plan their Vietnam operations.

- Previous Article Trends in Vietnams E-Commerce Markt jetzt wirksam umsetzen

- Next Article Vietnam Regulatory Brief: Foreign Specialist Tax Exemptions and Slated Issuance of International Driving Permits

Indochina Research Ltd.

Indochina Research Ltd.