The Footwear Market in Vietnam: Trends and Opportunities

The footwear market in Vietnam is on a steady growth trajectory, driven by an expanding customer base, growing middle-class population, and evolving preferences. We discuss the key market trends and Vietnam consumer outlook to 2030.

Introduction

Vietnam’s footwear market is on a growth trajectory, driven by an expanding customer base and evolving preferences. With increasing urbanization and a rising middle-class population, both local and international brands are seizing new opportunities. This article will discuss and explore key trends and the outlook for the footwear market in Vietnam in the coming years.

Vietnam general consumer market

Large consumer market

By 2030, Vietnam is expected to rank as the world’s 11th largest consumer market, with a population of 80 million consumers, marking a 34 percent rise from 2024. HSBC Bank forecasts that Vietnam is set to rise further, becoming the 10th largest consumer market by 2030, surpassing countries like Germany and the UK. Moreover, the bank predicts that between 2021 and 2030, the number of people in Vietnam earning more than US$20 per day, adjusted for constant purchasing power parity (PPP), will increase significantly.

|

The Top 20 Largest Consumer Markets in 2030 |

|||

|

Region |

Country |

Growth rate (year-on-year %) |

Consumer market (US$ million) |

|

Asia |

China |

+ 15 |

1100 |

|

Asia |

India |

+ 46 |

773 |

|

Asia |

Indonesia |

+ 27 |

158 |

|

Asia |

Japan |

-3 |

118 |

|

Asia |

Pakistan |

+3 |

99 |

|

Asia |

Bangladesh |

+ 59 |

87 |

|

Asia |

Vietnam |

+ 34 |

80 |

|

Asia |

Philippines |

+ 35 |

66 |

|

Asia |

Thailand |

+ 10 |

58 |

|

Asia |

Iran |

+ 11 |

55 |

|

Europe |

Russia |

+ 0 |

127 |

|

Europe |

Germany |

+ 0 |

80 |

|

Europe |

Türkiye |

+ 8 |

80 |

|

Europe |

France |

+ 3 |

68 |

|

Europe |

Italy |

– 1 |

56 |

|

North America |

US |

+ 4 |

348 |

|

Central America |

Mexico |

+ 9 |

92 |

|

South America |

Brazil |

+ 9 |

136 |

|

South America |

Egypt |

+ 25 |

68 |

Source: World Data Lab (2023) & Visual Capitalist (2024)

Urbanization

Projections suggest that by 2040, more than half of Vietnam’s population will reside in urban areas, expected to reach approximately 65.71 million by 2050. This growth is predominantly fueled by the expansion of economically influential metropolitan areas, particularly Ho Chi Minh City, Hanoi, and their neighboring regions. Moreover, compared to other countries in the region, such as the Philippines, Indonesia, and Thailand, Vietnam has achieved a sharp and remarkable decline in its slum-dwelling population. Urbanization is expected to bring with it a host of benefits combined with the sharp decrease in slum populations, which further points to improved living conditions for many, paving the way for the emergence of a growing middle class and a rise in the number of consumers who can afford and buy more goods and services in Vietnam.

Rising middle-class population

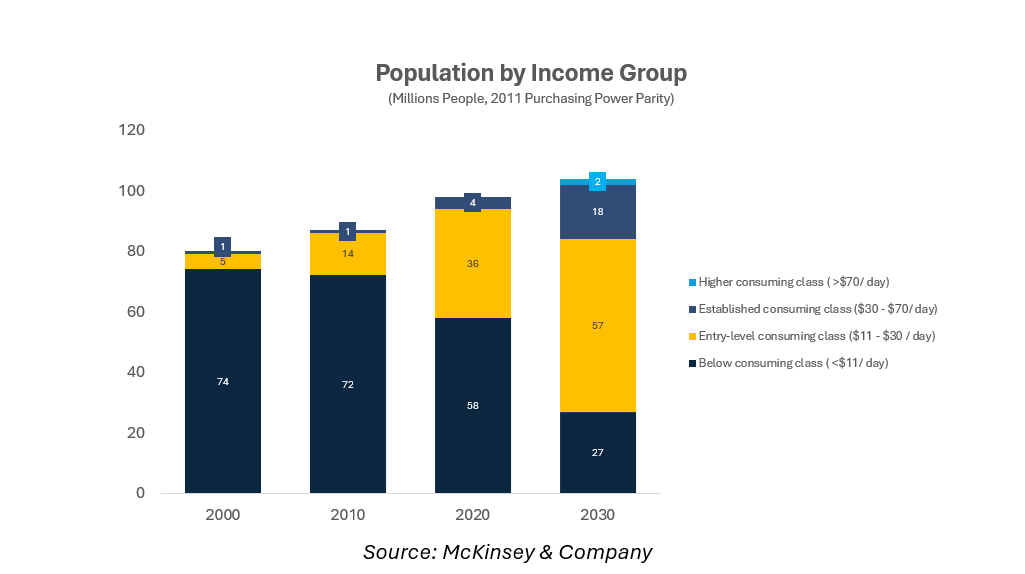

In addition to the growing number of consumers, Vietnam is highlighted to be one of the fastest-growing nations for middle-class expansion. With 23.2 million people expected to join this demographic, reaching a total of 56 million people by 2030, Vietnam is ranked seventh among the nine nations experiencing the fastest middle-class growth over the next decade. According to global consultancy McKinsey, Vietnam’s consumer class has experienced rapid growth and transformation since 2020. In 2022, 58 million people were part of the “below consumer class”, spending less than US$11 daily. However, by 2030, this figure is projected to decrease by over 50 percent, dropping to just 27 million people. In contrast, the entry-level consumer class is expected to see significant growth, increasing from 36 million in 2020 to 57 million in 2030—nearly a 50-percent rise. Furthermore, the established and high consumer classes, who spend more than US$30 per day, are also forecast to grow.

Vietnam footwear market

Market size and growth

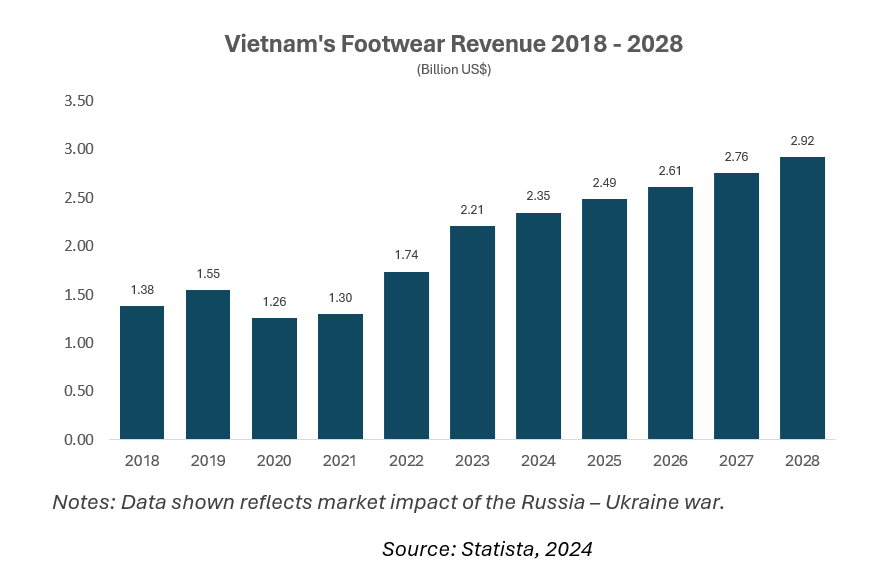

Vietnam’s footwear market is rapidly growing, driven by low labor costs, a skilled workforce, and favorable trade agreements. By the end of 2021, around 2,200 footwear manufacturing enterprises were operating in Vietnam, with a strong concentration in Ho Chi Minh City. In 2024, the market’s revenue is projected to reach US$2.35 billion, with a 2.5 percent increase expected in 2025, bringing the total to US$2.49 billion. By 2028, this figure is forecasted to climb to US$2.92 billion, reflecting a compound annual growth rate (CAGR) of 5.58 percent for 2024-2028.

The market is primarily dominated by the textile and other footwear segments, which holds a value of US$0.76 billion, followed by leather footwear and sneakers. Additionally, the average volume per capita in Vietnam’s footwear market is anticipated to be 1.43 pairs in 2024. Further, by 2028, the total market volume will reach 157.7 million pairs.

Competition

The Vietnamese footwear market is primarily divided into three categories: local brands, well-known international brands, and unbranded footwear. There is intense competition between local and global brands, with both sides focusing on enhancing quality, responding to customer needs, and keeping up with market trends to attract a broader audience. Prominent domestic brands include Bitis, Juno, Vina Shoes, Vascara, and VinaGiay. Meanwhile, top international brands in Vietnam, such as Nike, Adidas, Acis, Jordan, ALDO, and Converse, appeal to consumers seeking prestige, distinctive designs, and superior quality, with a willingness to pay mid-to-high prices for shoes. Additionally, unbranded footwear caters to customers who favor fast fashion and make frequent purchases.

Trends in Vietnamese consumer preferences

As more than half of Vietnam’s population is expected to join the global middle class by 2035, the resulting increase in disposable income is driving a growing preference for high-quality imported goods, especially from Europe and the U.S. This shift in consumer interest is also fueled by the perception that products from developed markets are superior to those from domestic or developing markets. Additionally, there is a rising trend in sustainable footwear as Vietnamese consumers become more conscious, selective, and inclined toward sustainable choices. The market share for sustainable footwear grew from 2.3 percent in 2018 to 3.4 percent in 2024, with forecasts predicting it will reach 4 percent by 2026.

Conclusion and recommendations

Vietnam’s consumer market presents a bright future, fueled by a rapidly expanding consumer base. The combined effects of increasing urbanization and a rising, affluent middle class are expected to create numerous valuable opportunities. This growing consumption power is capturing the interest of businesses and investors alike, making Vietnam an appealing destination for future investments and market expansion.

Specifically in Vietnam’s footwear market, there has been a notable surge in revenue, with forecasts predicting continued growth in the years ahead. The expansion of the middle class and their increasing purchasing power present substantial opportunities for international and high-quality brands. However, to meet evolving consumer preferences, brands should also consider sustainability product lines. Domestic brands must also stay competitive by enhancing their presence, focusing on innovative designs, improving product quality, and building strong brand recognition to compete with foreign competitors.

(With inputs from Nguyen Thuy Tien.)

Asia’s dynamic economic growth offers vast opportunities for foreign investment, but navigating its regulatory and consumer landscape can be challenging. Dezan Shira & Associates provides comprehensive market entry support, leveraging local expertise and strong connections to facilitate successful business ventures in the region. For more information and business support, please reach our experts at Vietnam@dezshira.com

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, China, and India. For editorial matters, contact us here and for a complimentary subscription to our products, please click here. For assistance with investments into Vietnam, please contact us at vietnam@dezshira.com or visit us at www.dezshira.com.

Dezan Shira & Associates assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. We also maintain offices or have alliance partners assisting foreign investors in China, Hong Kong SAR, Dubai (UAE), Indonesia, Singapore, Philippines, Malaysia, Thailand, Bangladesh, Italy, Germany, the United States, and Australia.

- Previous Article Samsung’s US$1.8 Billion Investment to Boost Vietnam’s OLED Manufacturing Capacity

- Next Article Insights into the Vietnam Workforce in 2024: Key Takeaways for Businesses