Temu Enters Vietnam’s E-Commerce Market: Takeaways for Newcomers

The Vietnam e-commerce landscape witnessed the entry of Chinese online giant Temu in late 2024, drawing legal scrutiny. This article explores the reasons behind this and offers strategic considerations for global online sellers and platform operators.

Vietnam’s e-commerce sector is experiencing remarkable growth, solidifying the country’s position as a key player in Southeast Asia’s digital economy. However, recent legal challenges faced by international platforms such as Temu, Shein, and 1688 reflect heightened scrutiny from local authorities. This serves as a reminder for prospective entrants to prioritize transparency and adopt a meticulous approach to market entry.

Temu’s unique operational model: Why has it raised scrutiny?

The Vietnam market continues to attract global e-commerce giants, particularly from China. Temu, launched by Pinduoduo in late September, gained substantial traction among local shoppers, offering competitive discounts, fast delivery, and compelling affiliate programs. Its entry into Vietnam forms part of a broader strategy to expand across Southeast Asia.

What sets Temu apart from other foreign and local players is its direct-to-consumer (D2C) model, connecting Vietnamese consumers directly with Chinese manufacturers. This allows the platform to offer low-cost goods by bypassing intermediaries and lowering prices. Temu has partnered with two logistics players (Ninja Van and Best Express), offering shorter shipping times of around 4-7 days by leveraging the close proximity between Guangzhou province and Vietnam.

During its launch, the platform also gained significant attention from local buyers by frequently running flash sales (up to 50 percent or even 80 percent off) and daily deals, where users can purchase deeply discounted products for a limited time. Temu also operates referral programs, allowing users to earn rewards by referring to friends. This strategy helps expand the user base while providing existing users with additional savings.

However, the platform is now facing potential regulatory scrutiny in Vietnam, particularly regarding compliance with local regulations. As of November 10, 2024, the Ministry of Industry and Trade announced that it would work closely with Shein and Temu to register their operations in Vietnam. The government also set a deadline by the end of November 2024 for these platforms to complete the registration process. The announcement urged these platforms to comply with Vietnamese regulations promptly and register their activities within the specified timeframe.

While supporting cross-border e-commerce activities, local officials are concerned about the operations of unregistered platforms leading to tax violations and hampering fair and transparent competition in the e-commerce environment. Therefore, there are ongoing efforts by the government to place more stringent management over the market.

Temu’s problems relate to its operational practices and potential impact on local e-commerce and consumers, including:

- Non-compliance with local regulations: Despite launching sales in late September, the platform only officially registered its operations on October 24. The delayed registration has potentially violated Decree 52/2013, requiring foreign e-commerce entities to comply with local regulations. Furthermore, the platform’s discount-driven strategy potentially conflicts with Article 6 of Decree 81/2018/ND-CP, which limits promotional values to 50 percent of a product’s sale value.

- Potential tax evasion:

- Pricing strategy: Temu has implemented a minimum purchase requirement of US$35-US$40 for Vietnamese users, seemingly to cover shipping costs while circumventing import tax regulations.

- Financial reporting: Despite initiating sales at the beginning of September, Temu reported no revenue in Vietnam for Q3 2024. This discrepancy has drawn regulatory scrutiny from local authorities.

- Potential for unfair competition: Temu’s aggressive pricing strategies could be perceived as an attempt to undermine local competition. By offering goods at deeply discounted prices and often subsidizing these products to attract customers, Temu might create a price war that existing companies cannot sustain, potentially leading to market instability.

These concerns have been strongly emphasized by the Deputy Minister of Industry and Trade, Mr. Nguyen Sinh Nhat Tan, highlighting the need for vigilant monitoring of the long-term impact of Temu and other foreign platforms, such as Shein, that are not complying with local regulations. The government’s proactive initiatives underscore the importance of balancing foreign investment and ensuring fair competition between local businesses and new entrants as the e-commerce landscape evolves.

Vietnam’s booming e-commerce landscape

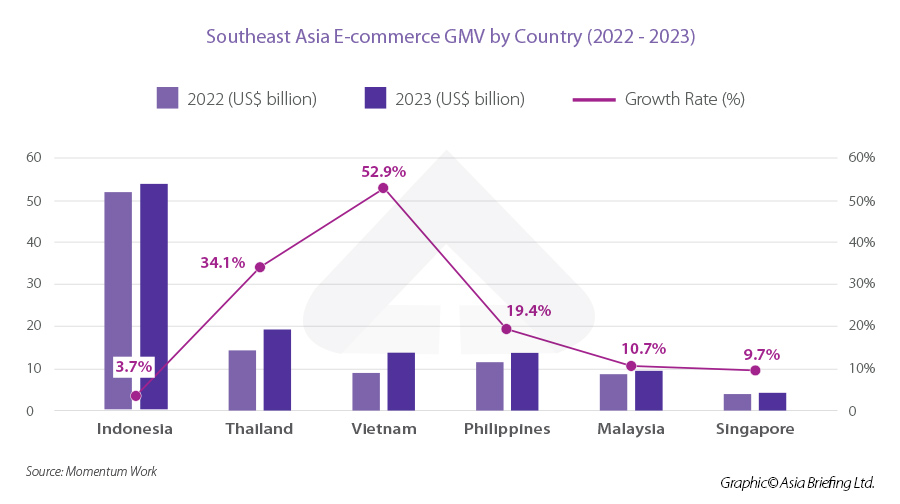

Vietnam’s e-commerce has shown impressive expansion in recent years. Although being a relative latecomer to the internet, Vietnam has emerged as the fastest-growing market in the region. Momentum Work, a Singapore-based market research company, reports that the total gross merchandise value (GMV) of the top eight e-commerce platforms hit US$13.8 billion in 2023, marking a 52.9 percent increase from the previous year. This rapid growth has enabled Vietnam to surpass the Philippines, becoming the third-largest e-commerce market in Southeast Asia.

E-commerce activities in Vietnam are primarily concentrated in two major hubs: Ho Chi Minh City and Hanoi. These cities, with their strategic locations and supportive infrastructure, have attracted significant investments from logistics providers in large-scale warehouses and logistics centers.

(GMV estimates include all paid orders (including canceled, returned, and refund orders) on Shoppee, Lazada, Tokopedia, Tiktok Shop, Bukalopek, Tiki, Blibli, and Amazon)

Despite the impressive growth, e-commerce still accounts for only 8 percent of Vietnam’s total retail sales, indicating significant room for expansion. Anymind, a Singapore-based technology and marketing company, describes Vietnam’s market as being in an emergent era characterized by rapid growth of online stores, expansion of online products and services, and strong government support in infrastructure development.

The internet economy: Fueling e-commerce growth

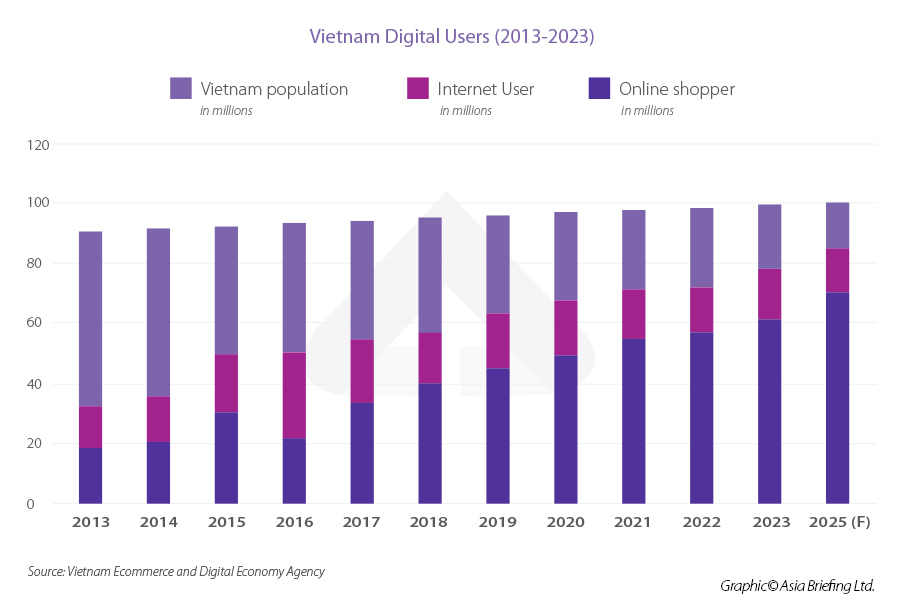

According to the Vietnam E-commerce and Digital Economy Agency (iDEA), Vietnam’s internet economy is thriving due to rapidly growing internet and smartphone penetration. As of early 2024, Vietnam boasted 78.44 million internet users, representing 79.1 percent of the population. On average, Vietnamese users spend over 6 hours daily online, indicating a high level of digital engagement.

This digital immersion has catalyzed a significant shift towards online shopping. The number of online shoppers has grown exponentially, from 18.5 million in 2013 to 61 million in 2023, a 12.69 percent increase. This trend is driven by widespread smartphone adoption and continuous improvements in digital infrastructure.

The impact of this shift is evident in consumer behavior. In 2023, the average Vietnamese consumer spent US$336 on online shopping, a 10.84 percent increase from 2013. In major urban areas, households allocate approximately one-fifth of their income to online purchases.

Notably, in 2024, online purchase frequency has doubled to about 4 times per month, with consumers in Vietnam dedicating around 8.2 hours weekly to online shopping. On average, each Vietnam digital consumer uses 3.2 different platforms for online shopping instead of being loyal to just one. This multi-platform approach requires companies to utilize various platforms to effectively capture customers strategically.

Dominant e-commerce platforms and consumer behavior

The e-commerce landscape in Vietnam is dynamic and competitive, with a mix of foreign and local players. The market is dominated by five key platforms: Shopee, TikTok Shop, Lazada, Tiki, and Sendo, with foreign players holding the majority of market share.

Shopee leads the e-commerce landscape, commanding over 60 percent of the current market share. TikTok Shop, despite being a newcomer (launched in 2022), quickly secured the second position with a 23.2-percent market share. TikTok Shop showed impressive growth in both sales and product offerings during Q2 2024, while platforms such as Lazada, Tiki, and Sendo have experienced negative growth.

|

Name |

Operation Launch in Vietnam |

Origin |

Major Shareholder |

Main Product Categories |

Market Share (2023) |

% Sale Growth (H1/2024) |

% Product Growth (H1/2024) |

|

Shoppee |

2016 |

Singapore |

Tencent |

Fashion items, fashion accessories, beauty care, toys |

67.90% |

65.97% |

65.97% |

|

Tiktok Shop |

2022 |

China |

Tiktok |

Beauty care products, Women’s Fashion, Grocery – Food. |

23.20% |

150.54% |

242.00% |

|

Lazada |

2012 |

Singapore |

Alibaba |

Engineering, electronics, assembly accessories |

7.60% |

-43.81% |

-37.12% |

|

Tiki |

2010 |

Vietnam |

JD.com |

Books, study supplies and gift items. |

1.30% |

-48.55% |

-51.37% |

|

Sendo |

2012 |

Vietnam |

FPT |

Fashion and non-tech, electronics. |

n/a |

-70.56% |

-70.56% |

Source: VnEconomy, 2024

Takeaways for e-commerce players

As Vietnamese authorities work to ensure the competitiveness of the country’s expanding e-commerce market, prospective online sellers and platform developers must adopt strategic approaches to maximize their business potential while ensuring legal compliance. Key strategic considerations include:

- Regulatory compliance: Prioritize adherence to local regulations, including proper business registration and operational compliance, even for cross-border trading.

- Balanced pricing strategies: While competitive pricing can attract customers in Vietnam’s price-sensitive market, strategies should be aligned with local regulations to maintain fair market practices.

- Market adaptability: Continuously monitor and adapt to Vietnam’s dynamic e-commerce landscape, focusing on evolving consumer preferences and market conditions.

- Focus on R&D: As competition intensifies, businesses are encouraged to prioritize product quality, after-sales service, and logistics improvements to stay competitive. Investing in local warehousing, promoting free shipping or discounts, and highlighting the strength of Vietnamese brands could help regain consumer trust.

Conclusion

Vietnam’s e-commerce sector is experiencing rapid growth, strongly driven by increasing internet penetration, shifting consumer preference to online shopping, and a competitive platform landscape. As the sector continues to evolve, it will be crucial for online businesses to stay agile and adapt to the unique characteristics of the Vietnamese market.

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com

- Previous Article 越南制造业追踪报告:2024-2025

- Next Article Vietnam’s Strategic Push into the Middle East Halal Market