Stuck in Traffic: Opportunities for Urban Infrastructure Development in Ho Chi Minh City

By Mike Vinkenborg

As Ho Chi Minh City battles growing traffic congestion, municipal authorities are considering a range of measures to improve transportation in the bustling city of over eight million. The city is currently debating altering work hours to spread out traffic during peak hours and trimming sidewalks to create more space for vehicles, while also building several new overpasses. These are just a few of the many proposed measures to tackle the gridlock issue that is becoming increasingly problematic.

These are all short-term solutions that fail to tackle the root of the problem, however. Every day, an estimated of 1,000 new motorbikes and 180 new cars are registered in Ho Chi Minh City. In total, 8.5 million motorbikes and 627,000 cars are currently registered in the city, the latter indicating a 500 percent increase compared with the year 2000. And as Vietnam is set to cut tariffs on ASEAN car imports in 2019, thereby reducing car prices by 42 percent, these numbers are poised to increase even more in the future. As a result, cars on major roads didn’t exceed an average of eight kilometers per hour during afternoon rush hours as of 2010, and the situation has not improved since then.

To be able to handle this increase in traffic, the municipal Transport Department speculated that road surface needs to be doubled by 2020. Several elevated highways and metro lines are currently already planned, but the Ho Chi Minh City Finance and Investment State-owned Company (HFIC) estimates that the city needs about VND 1 quadrillion (US$44 billion) for infrastructure projects from 2015 to 2030.

Metro development plans

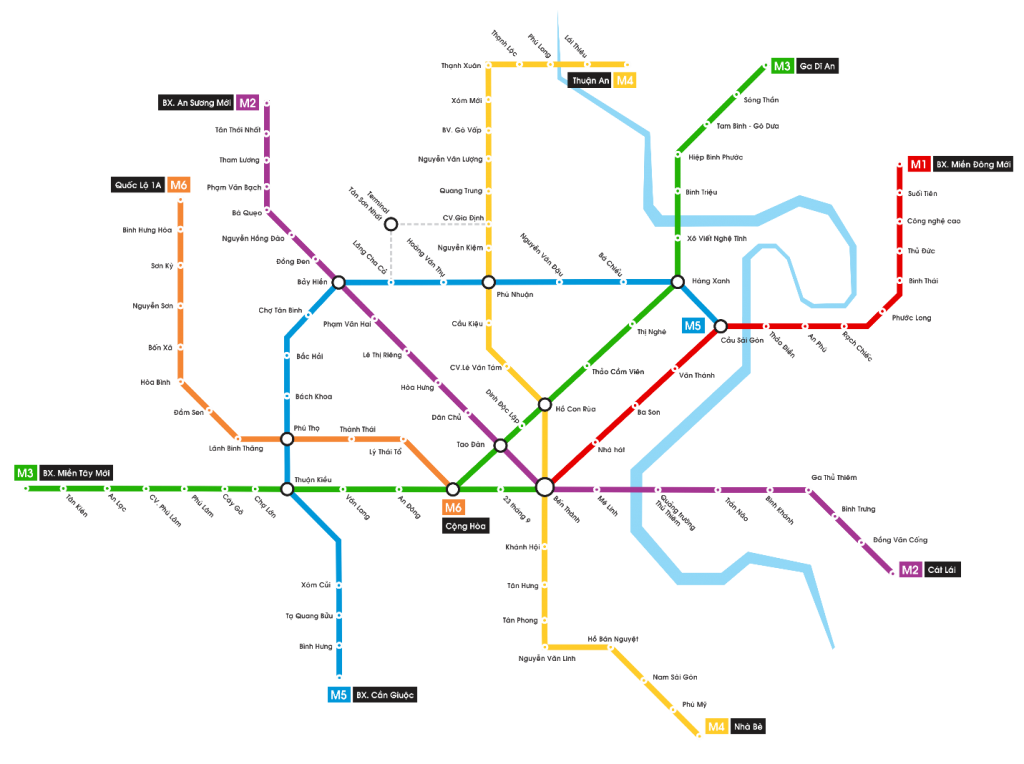

The most sustainable long term solution to tackle congestion in Ho Chi Minh City is not building more roads, but reducing the amount of existing traffic through the development of an extensive metro system. Currently, the city plans to build a total of six metro lines, plus one tramway line and two monorail lines. Of these, construction on line 1 and 2 has started, and are scheduled for completion in 2020. Line 5 is scheduled for completion in 2025, while the other lines are still in the planning phase and require more investments.

May 2016 cost estimates for lines 1 to 6 are (in US$) 2.49, 2.07, 3.69, 4.45, 4.47, and 1.25 billion, respectively, totaling over US$18 billion. To finance this, Vietnam is actively seeking foreign investments. The governments of Japan, Germany, Spain, and South Korea, as well as the Asian Development Bank (ADB), are already involved in the development of metro lines 1, 2, and 5 by providing official development assistance (ODA).

![]() RELATED: Pre-Investment, Market Entry Strategy Advisory from Dezan Shira & Associates

RELATED: Pre-Investment, Market Entry Strategy Advisory from Dezan Shira & Associates

Opportunities avail for private investors as well, in particular through Public Private Partnerships (PPP), the workings of which are outlined in Vietnam Briefing’s two-part series here and here. Before 2020, Vietnam hopes to attract FDI for metro line number 6 adding up to US$1.25 billion through the Build-Operate-Transfer (BOT) and Build-Transfer (BT) methods. For the two monorail lines and ground tram line, these numbers add up to US$1.12 billion and US$250 million, respectively, using similar investment models.

Ho Chi Minh City’s planned metro system

Additional opportunities

Besides public transportation, investments in several overpasses are also available through the BOT model, currently adding up to US$2.46 billion for three projects, while new overpasses are being proposed as well. Ultimately, Ho Chi Minh City hopes to have a network of elevated highways in place to help ease congestion on main roads throughout the city.

Furthermore, the establishment of metro stations brings new opportunities for transit-oriented development (TOD). Plans for a shopping mall underneath the first metro station, including walking streets, a square, and other infrastructure developments, has already been proposed by Japanese investors, offering opportunities to retailers wanting to leverage the amount of passengers passing through the newly built metro stations. And as more metro lines are being built, more opportunities for the development of TODs will arise in the city.

That being said, investors should always keep restrictions in mind when investing in public development projects in Vietnam. However, the current development plans in Ho Chi Minh City are encouraging. In order to help solve its congestion problems, Ho Chi Minh City encourages foreign investment in its infrastructure sector, opening up numerous opportunities for foreign companies with the relevant expertise.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email vietnam@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Annual Audit and Compliance in Vietnam 2016

In this issue of Vietnam Briefing, we address pressing changes to audit procedures in 2016, and provide guidance on how to ensure that compliance tasks are completed in an efficient and effective manner. We highlight the continued convergence of VAS with IFRS, discuss the emergence of e-filing, and provide step-by-step instructions on audit and compliance procedures for Foreign Owned Enterprises (FOEs) as well as Representative Offices (ROs).

Navigating the Vietnam Supply Chain

Navigating the Vietnam Supply Chain

In this edition of Vietnam Briefing, we discuss the advantages of the Vietnamese market over its regional competition and highlight where and how to implement successful investment projects. We examine tariff reduction schedules within the ACFTA and TPP, highlight considerations with regard to rules of origin, and outline the benefits of investing in Vietnam’s growing economic zones. Finally, we provide expert insight into the issues surrounding the creation of 100 percent Foreign Owned Enterprise in Vietnam.

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

Tax, Accounting and Audit in Vietnam 2016 (2nd Edition)

This edition of Tax, Accounting, and Audit in Vietnam, updated for 2016, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate Vietnam’s complex tax and accounting landscape in order to effectively manage and strategically plan their Vietnam operations.

- Previous Article Industry Spotlight: Vietnam’s Renewable Energy Market

- Next Article Managing Contracts and Severance in Vietnam – Latest Issue of Vietnam Briefing Magazine