Social Security in Vietnam: Understanding Your Obligations

One of the key obligations that an employer has in Vietnam is the payment of social security. In order to ensure smooth operations while in the country, it is crucial that foreign companies fully understand the legal framework which provides for the rights and obligations of employers and employees with respect to social security.

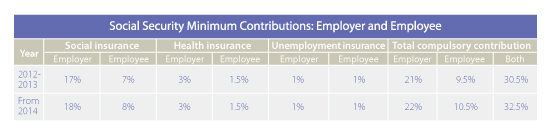

While the total minimum employer social security contribution was 21 percent of the employee’s monthly salary for 2012-2013, this has risen to 22 percent in 2014. There are three types of mandatory social security: social insurance, medical insurance, and unemployment insurance:

- Social insurance covers employee benefits including sick leave, maternity leave, allowances for work-related accidents and occupational diseases, pension allowance, and mortality allowance.

- Health insurance entitles employees to medical examination and inpatient and outpatient treatments at authorized medical establishments.

- Unemployment insurance, which takes the place of severance pay, is paid out to employees in quantities depending on the period of time for which they and their previous employers contributed. The monthly unemployment allowance is equal to 60 percent of the persons’ average salary of the last six months of employment.

Mandatory minimum contributions are required of both the employer and employee. All domestic and foreign companies operating in Vietnam are required to make social insurance payments for all employees under labor contracts with a definite term of over three months or labor contracts with indefinite terms.

The mandatory employer contribution to the State Social Insurance Fund is typically 18 percent of gross employee income, and the mandatory employee contribution is typically eight percent of gross income (applied from January, 2014). For employees working under an employment contract that is less than three months in duration, the social insurance contribution amount should be included in their salary, and the employees will be responsible for paying their own social insurance.

It is important to note that social and unemployment insurances are compulsory only for Vietnamese staff, while health insurance applies to both Vietnamese and foreign staff employed in accordance with Vietnam’s Labor Code. Contribution amounts are based on the employee’s monthly salary or wage as stated in the labor contract, and are capped at 20 times the legal standard minimum salary.

What about personal income tax (PIT)?

In general, a typical monthly salary package in Vietnam will include gross salary and mandatory social security. Personal income tax (PIT) will be levied on the balance after deducting mandatory social insurance contributions. Companies conduct PIT finalization on behalf of their employees at the beginning of the year for taxable income arising from the previous year.

In Vietnam, the declaration and payment of Personal Income Tax (PIT) is carried out on a withholding basis. Employers are required to collect taxes on employee income for both foreign and local Vietnamese employees, and ensure the timely submission of their employees’ tax declarations. Employers must withhold the required percentage of their employees’ personal income, and deposit the monthly amount with the State Treasury.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Vietnam: A Guide to HR in Asia’s Next Growth Market – New Issue of Vietnam Briefing Magazine

- Next Article A Guide to Understanding HR Trends in Vietnam