Ho Chi Minh City’s Thu Thiem: A Global Urban Development Gem

By Keith Hilden, Squawkonomics

During our last trip to Vietnam, we were tasked by our crowdfunding clients to find a veritable investment opportunity worth pursuing. We developed some new economic metrics that would better explain the economic phenomenon we encountered in Vietnam.

In November 2014, we documented what struck us as a market phenomenon. In this age of global urbanization, this video shows you how close Vietnam’s tallest skyscraper is to utterly empty fields; surely a phenomenon that will not be around, perhaps anywhere in our world, in 10 years or less.

The mere absence of developed land so close to the Bitexco Financial Tower is of little meaning and value with the proper analytical context, so we at Squawkonomics sought to find a metric that would better be able to measure the market potential of this expanse of land. We came up with a metric, the Land to Skyscraper Index. The land to skyscraper index (or LS Index) simply takes each country’s predominant commercial city’s highest skyscraper, and measures that in turn with the closest occurrence of undeveloped land. What we found was simply striking.

![]() RELATED: Vietnam’s Real Estate Market Set for Growth in 2015

RELATED: Vietnam’s Real Estate Market Set for Growth in 2015

Below are the results we had when we looked at the major commercial cities in Asia. We used a 250 meter standard legend in all of our maps to ensure comparability and integrity of output results.

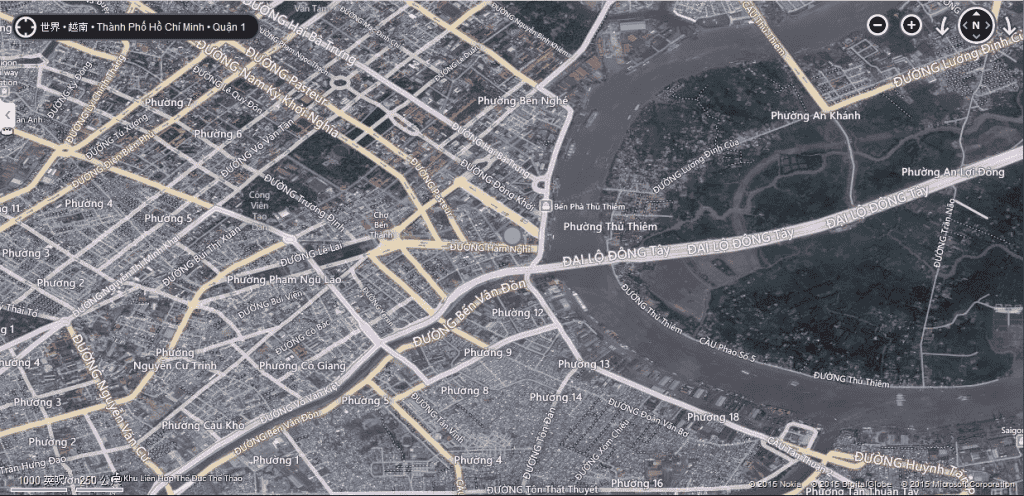

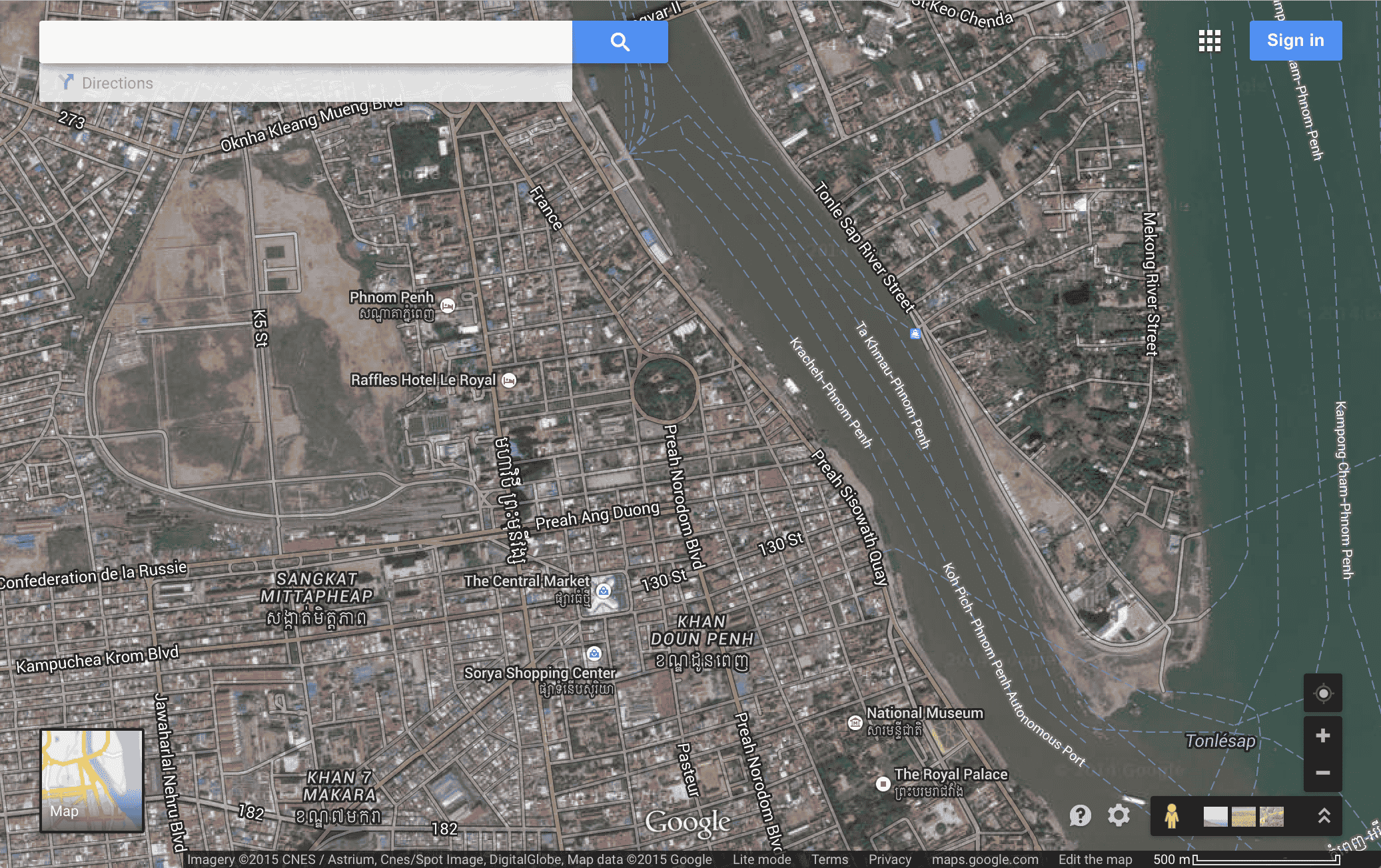

#1: Ho Chi Minh City, Vietnam

You can see very clearly we have selected Ho Chi Minh City as it is the predominant commercial city in Vietnam, and the tallest building is the Bitexco Financial Tower, represented by the blue dot. Very clearly we see a stark contrast between the epicenter of Vietnam’s financial hub and the undeveloped land in eyeshot of the symbolic tower.

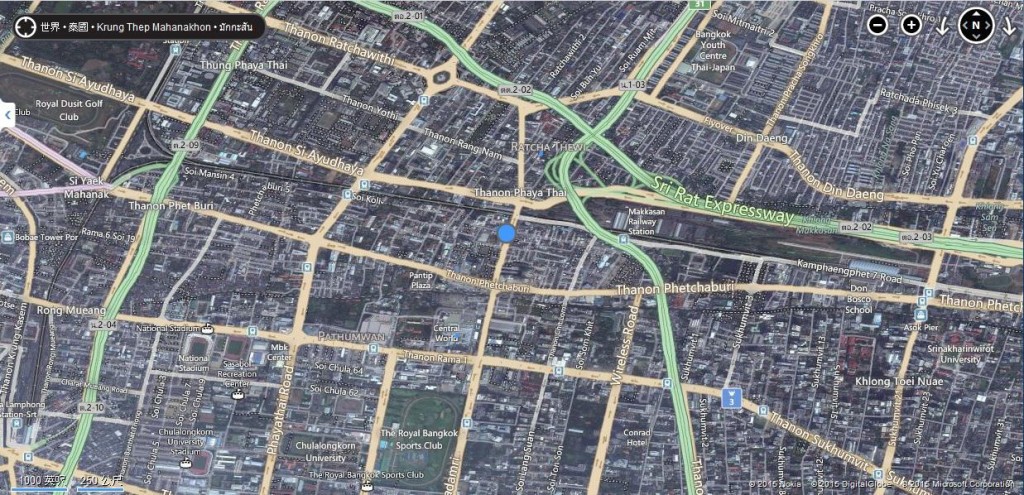

#2 Bangkok, Thailand

Below here, we see the surroundings of Bangkok’s Baiyoke Sky Tower, and we see a highly developed urban area, while the open expanses of land we do see are comprised of sport clubs and golf courses. There is very little to no undeveloped land around the Tower.

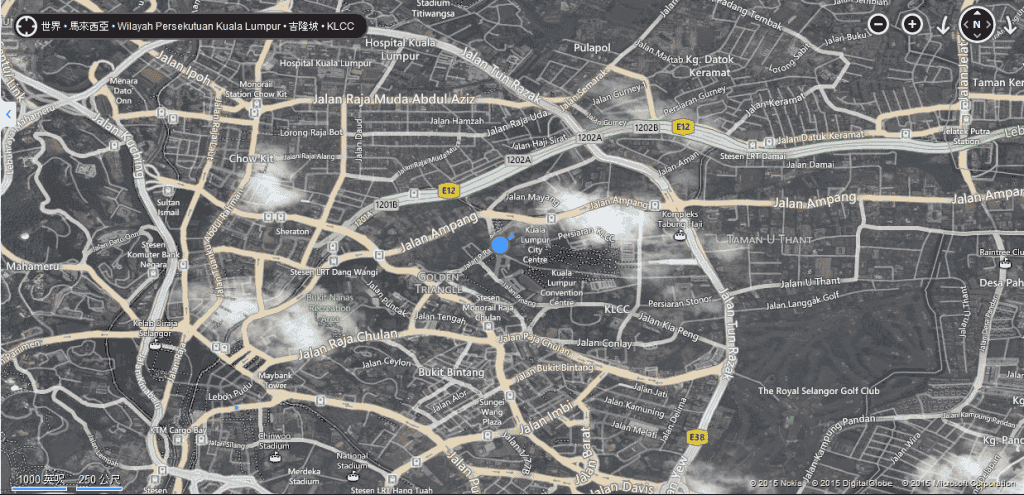

#3 Kuala Lumpur, Malaysia

Around Kuala Lumpur’s Petronas Twin Towers, we can see a moderate level of development around the towers, while to the Southeast corner, the wide expanse of land we see another golf course. Notice that the only open land is already developed and already designated for a variety of uses.

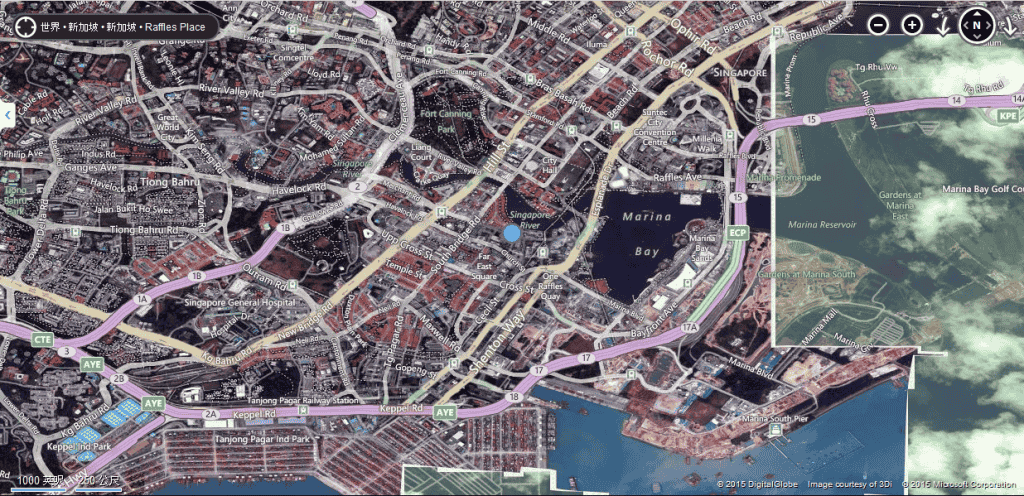

#4 Singapore, Singapore

We see that around Singapore’s UOB Plaza building an assortment of parks, but no undeveloped land around the towering icon.

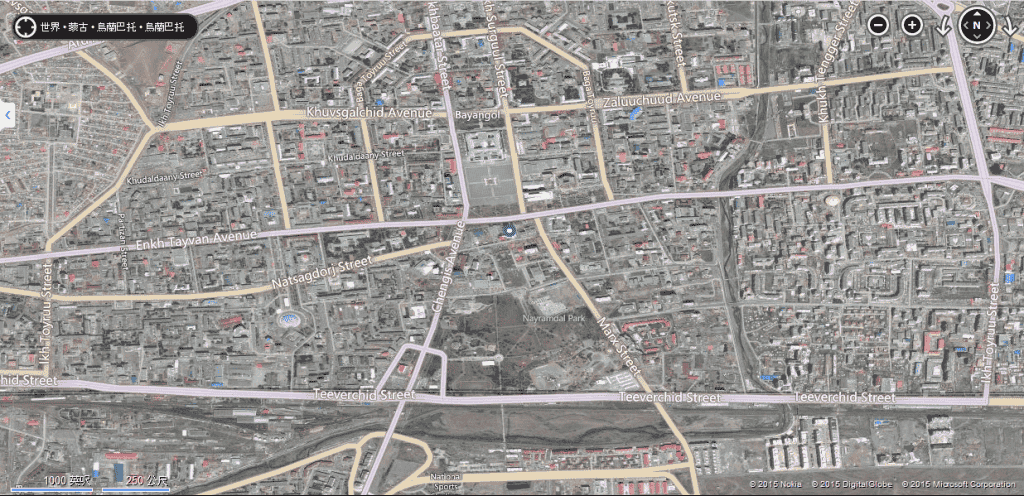

#5 Ulaanbaatar, Mongolia

Ulaanbaatar’s Blue Sky Tower is again around a generally very well developed area. That open space to the south of the Tower is the country’s National Amusement Park. And that brown area to the south of the main street towards the bottom of the image we find railroad tracks. Hardly a case of particularly underutilized land.

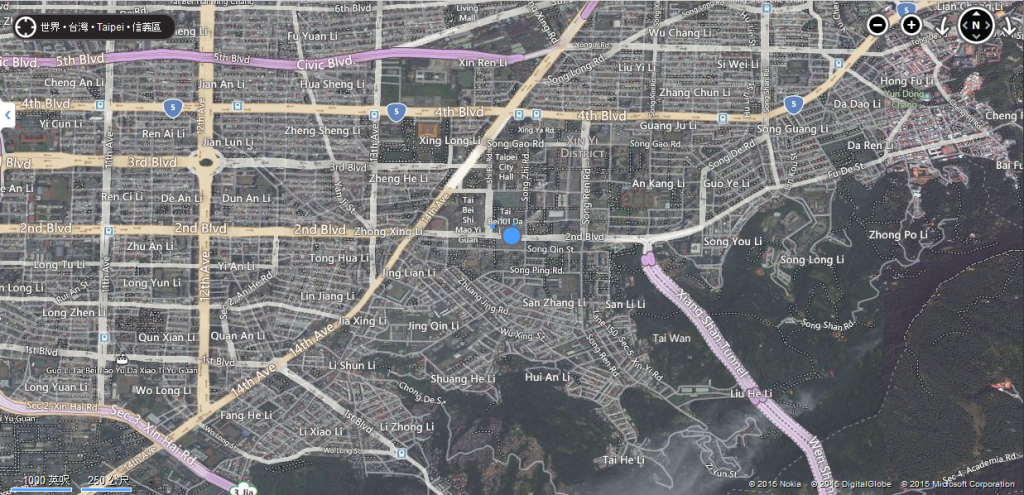

#6 Taipei, Taiwan

Around the Taipei 101, we see a wide open spot to the Southeast, but that land is undeveloped for good reasons: it’s part of Elephant Mountain, with little flat land to encourage large development projects.

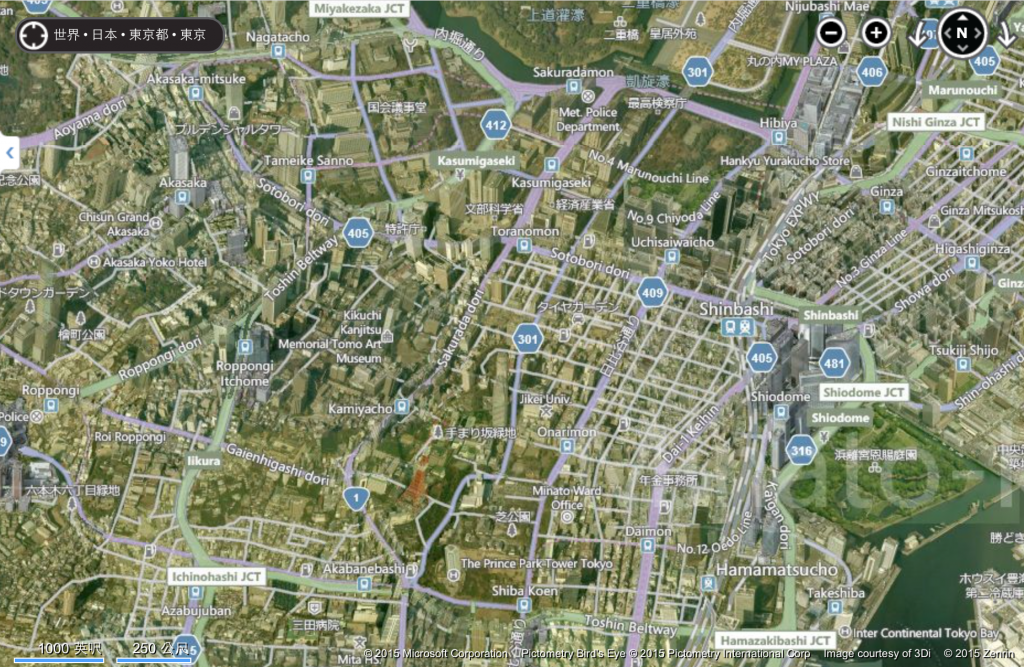

#7 Tokyo, Japan

Tokyo, not surprisingly, is highly dense with open spaces near to the Toranamon Hills building being parks and historical sites such as the space at the north of the map, the Three Palace Sanctuaries, and the Hamarikyu Gardens to the east.

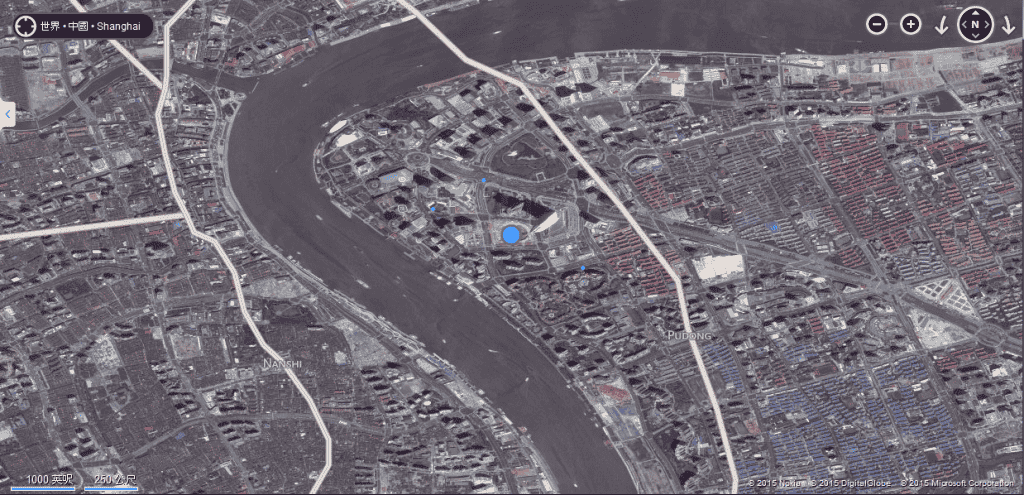

#8 Shanghai, China

Around the Shanghai Tower, we see similarly to Tokyo that all opportunity for commercial development is already snapped up, as the area around the tower is pretty much all filled.

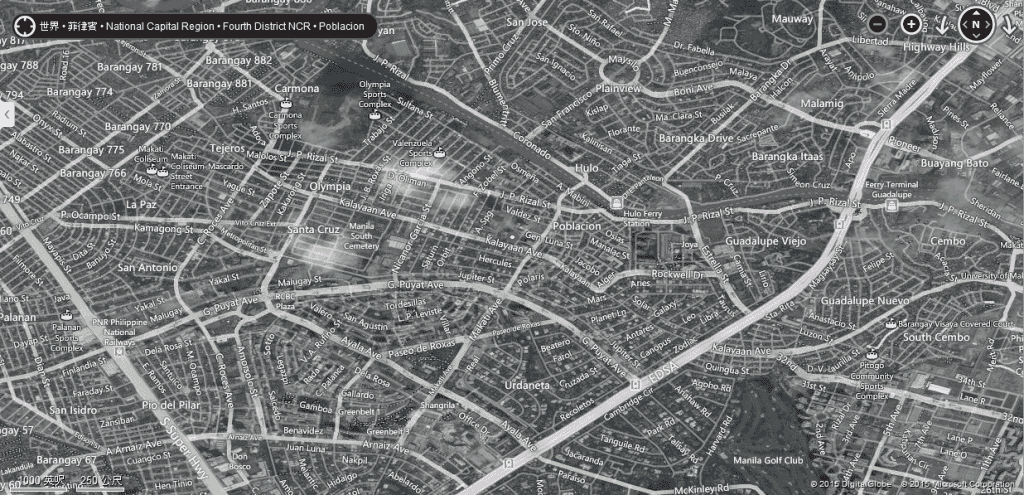

#9 Manila, Philippines

Notice again how Manila’s Gramercy Residences only open spaces are clearly public designated lands such as golf clubs and running tracks.

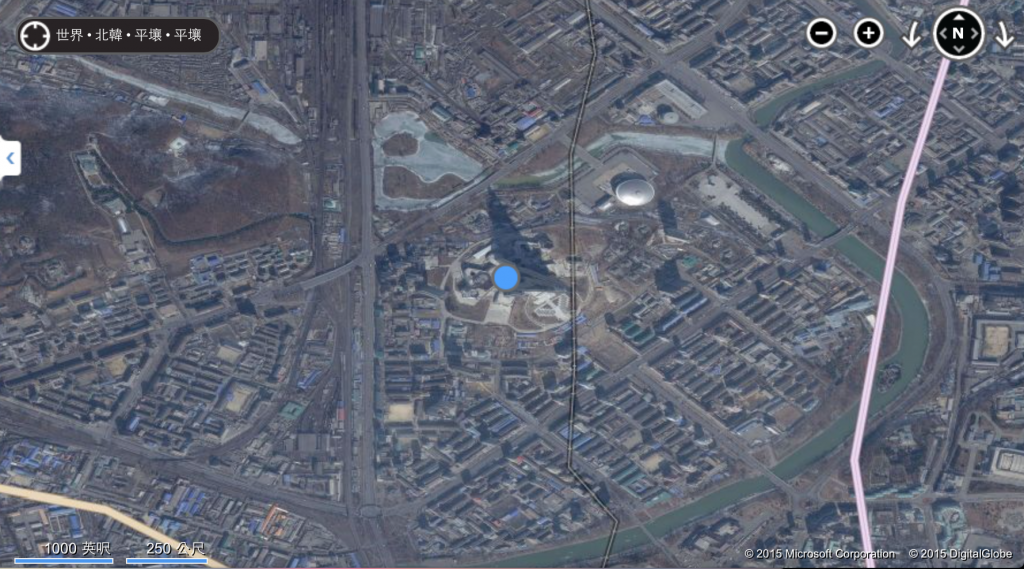

#10 Pyongyang, North Korea

Pyongyang’s Ryugyong Hotel at first glance appears to be an outlier when the map shows a forest region to the Northwest. Upon a closer look, the rectangular inlet into the forest is actually the National Defense Commission military building, essentially North Korea’s Pentagon. So Kim Jong Un would probably want some undeveloped land and forest around that building: a scant opportunity for property developers there.

#11 Jakarta, Indonesia

Jakarta’s Wisma 46 is surrounded by moderate development. The space is encircled by odd small pockets of relatively undisclosed land. While the area is pocketed with various tiny plots, all large plots are, again, part of a park, or other public designated spaces, generally falling in line with the land to skyscraper index results for almost all of the other cities in the world.

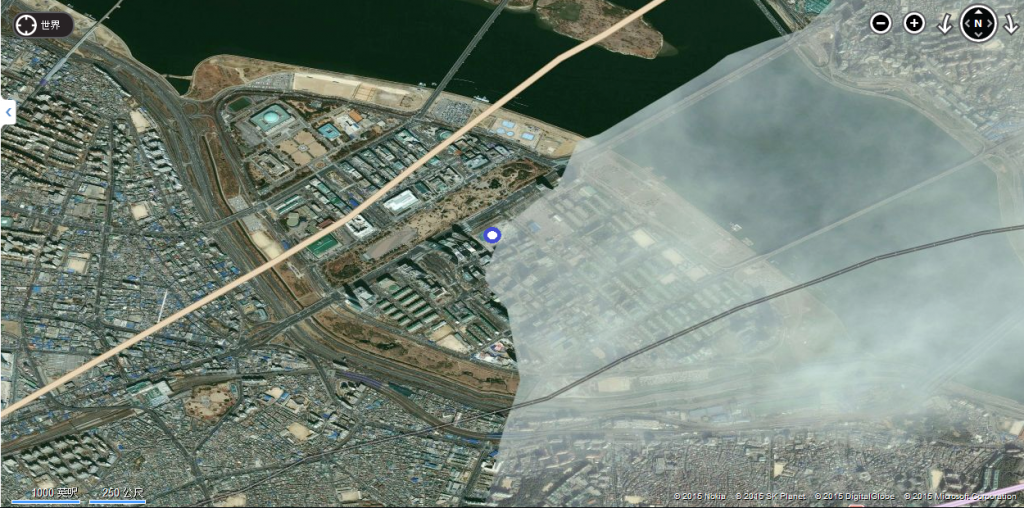

#12 Seoul, South Korea

Seoul’s Three International Finance Centre is surrounded by a vigorous and creative use of the land around the skyscraper, with the brown space around the island being a unique ringed park. Notice besides the park space, there is no instances of undeveloped land anywhere.

#13 Vientiane, Laos

Around Vientiane’s Don Chan Palace in Laos, we see the map pretty much filled up with various development and real estate. That is, except for the sparse southwest corner— past the Mekong River border, which is part of Thailand.

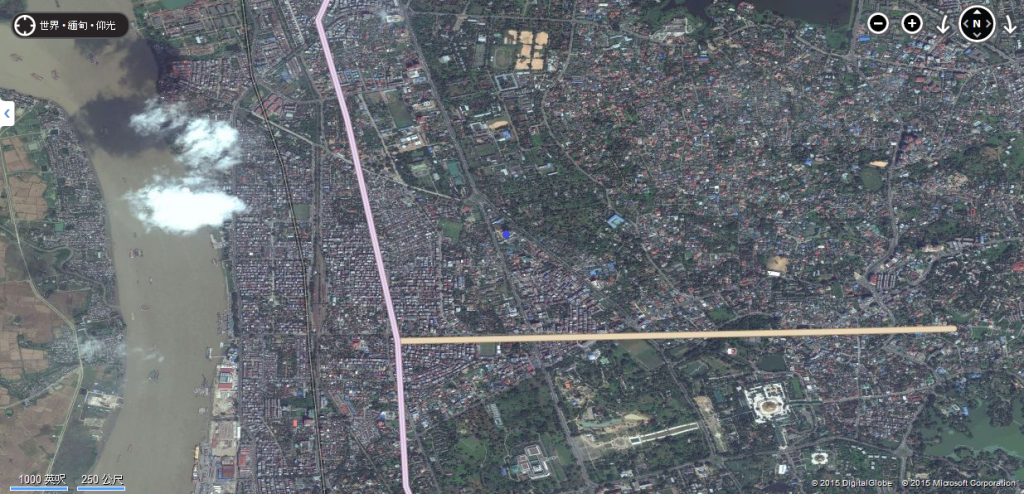

#14 Yangon, Myanmar

We find the Pyay Garden Condominiums in Yangon is a slight exception, because the area west of the building is entirely farmland with little else. There is very little to no economic incentive to build significantly out at the west end of the map or beyond, when there is virtually nothing developmentally material to the west of Yangon, with no significant development all the way until the coast at the Bay of Bengal.

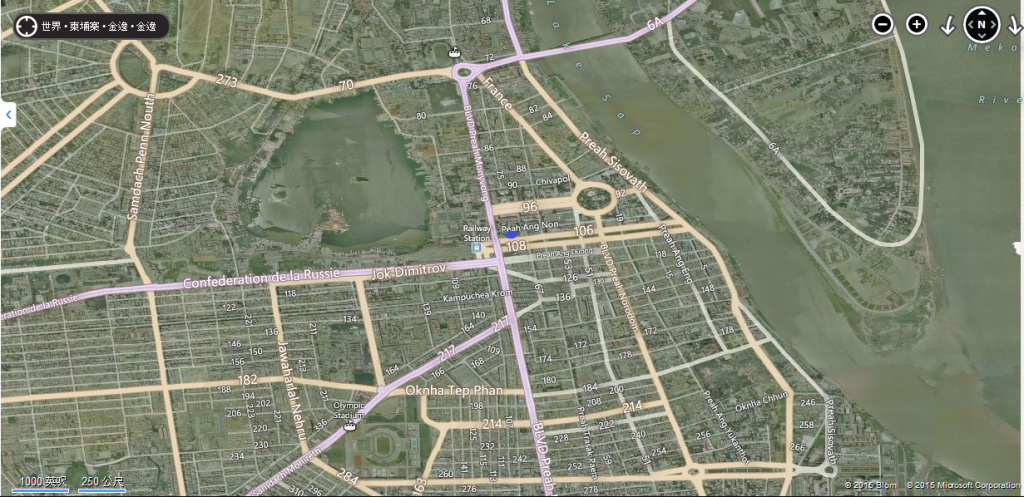

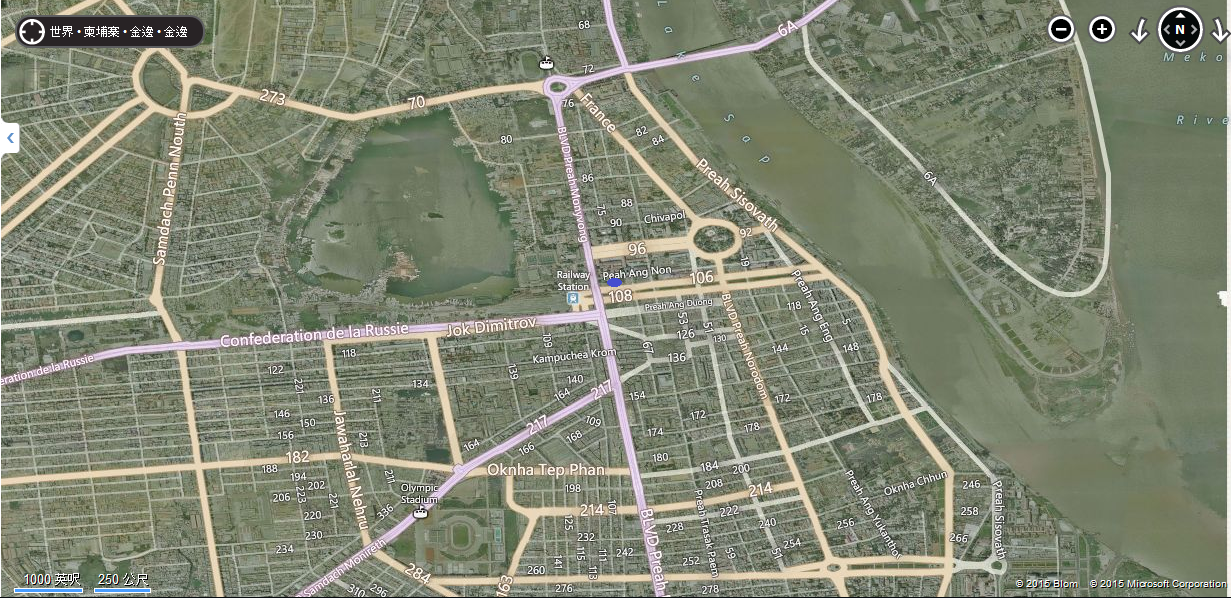

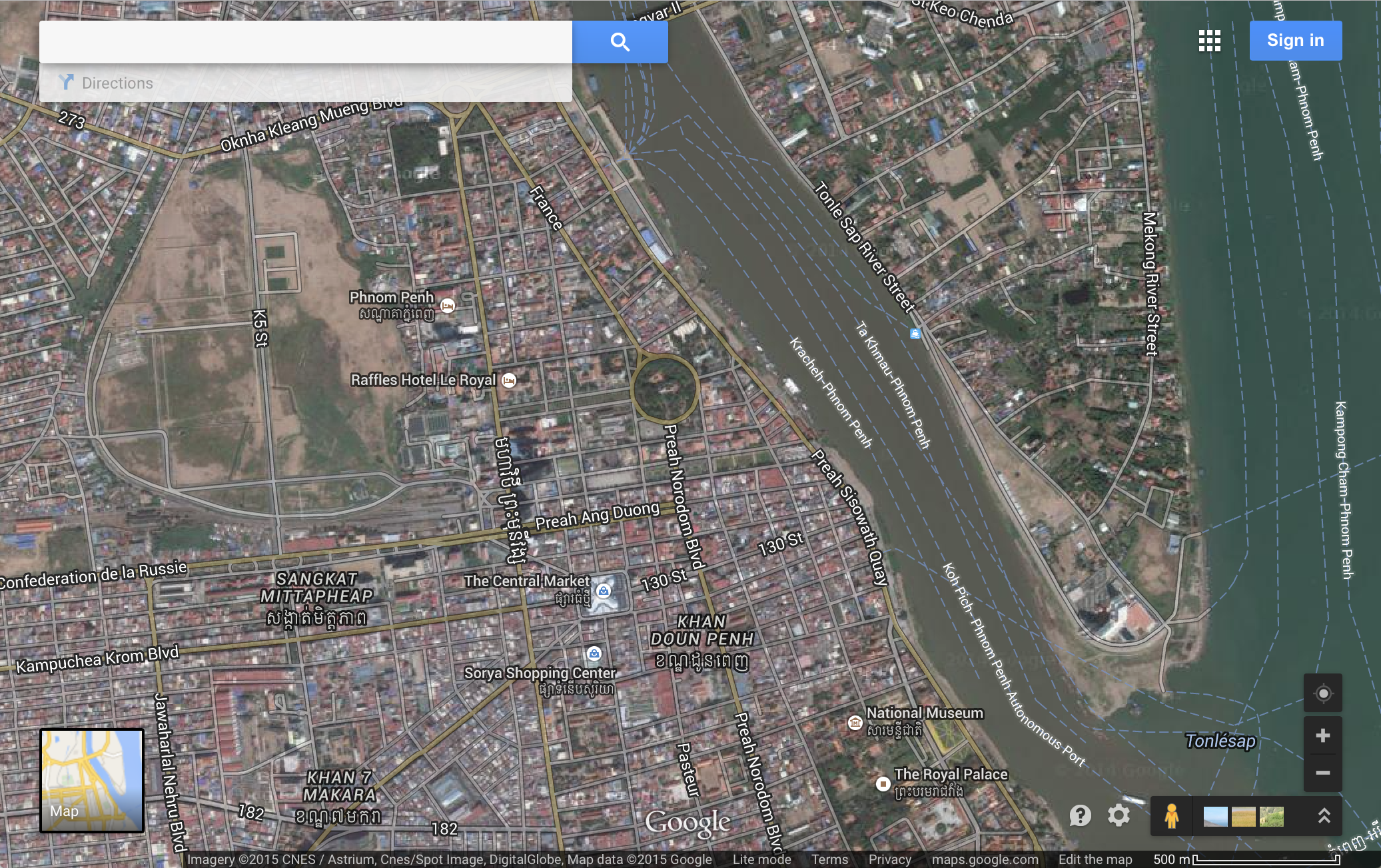

#15 Phnom Penh

The area around Phnom Penh’s Vattanac Capital building is interesting because we do this time see a big space in the middle of the city that appears to be a lake from Bing satellite images. Actually, from the Google Maps satellite image below we can see that the lake is now called the Former Boeung Kak Lake area, and it too, is a very temporary market anomaly as it will most certainly be filled with development projects of many sorts in the few years to come.

Phnom Penh has some small areas of relatively undeveloped land on the peninsula island to the East, but the largest residential project ever designed in Phnom Penh is being built right now, called The Bay, a symbol of the city’s ongoing modernization projects.

Click here for more investment information about The Bay.

Source: Google Images

![]() RELATED: State Bank of Vietnam Credit Supports Housing Market

RELATED: State Bank of Vietnam Credit Supports Housing Market

Results

Since there appeared to be an almost universal correlation between the tallest building and no instance of undeveloped land within close proximity of a skyscraper in Asia, upon closer inspection, we discovered that this correlation with skyscrapers and lack of empty land proved also to be true in South Asia, Oceania, North America, South America, Middle East and almost all of Europe and Africa. Please refer to the Squawkonomics website to see our full research methodology and detailed results.

Investment Implications

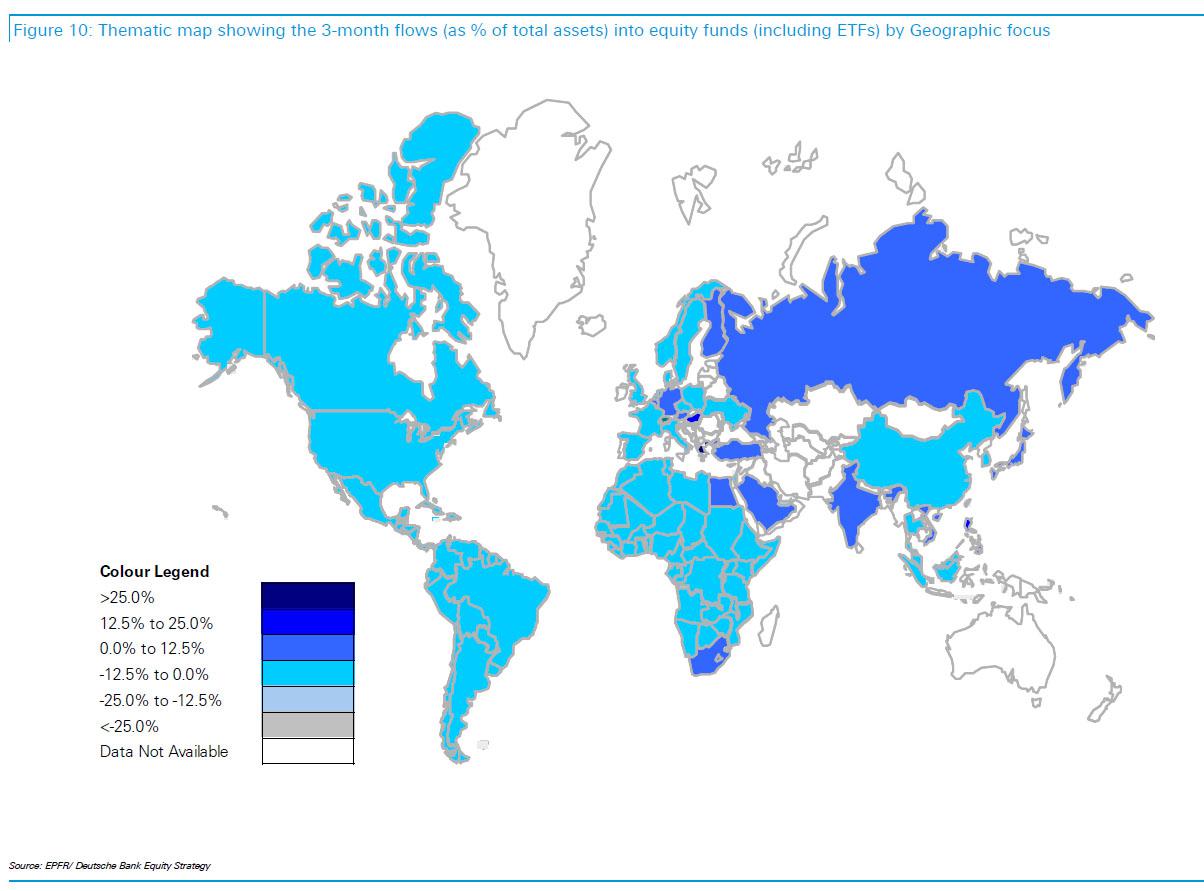

We can confirm that good land has become extremely precious and a rarity in almost all major commercial cities in the world. Therefore, what we see in Ho Chi Minh City, and to a lesser degree, in Phnom Penh, is a true market alpha anomaly derived from our land to skyscraper index, and a major market signal to invest in these development areas has surfaced accordingly. Equity investors are already sensing this in a macroeconomic sense, as Vietnam is at the front of the pack of the Asia Pacific region in money flows in previous months.

Source: Zero Hedge

![]() RELATED: Vietnam Loosens Housing Laws for Foreign Investors

RELATED: Vietnam Loosens Housing Laws for Foreign Investors

Indeed, the market senses a winning play with Vietnam for inward equity flows, and the business leaders that are in charge of transforming Vietnam into a modern economy are not blind to the cards they hold. And the first major foreign investors have moved in, such as Korean giant Lotte partnering with Toshiba and Mitsubishi to build a $2 billion dollar Eco Smart City construction project, launched this March.

![]() RELATED: Dezan Shira & Associates’ Pre-Investment and Entry Strategy Advisory

RELATED: Dezan Shira & Associates’ Pre-Investment and Entry Strategy Advisory

Changes in Vietnam’s legislature and administration of government are going to ensure that this market opportunity will not remain for much longer. Vietnam’s Housing Law has already been legislated into action, and slated to start July 2015. Foreigners will soon be able to directly participate in the development of Vietnam’s newest megacity district, in an area in immediate proximity to Ho Chi Minh’s tallest skyscraper.

Foreigners will also be able to participate by purchasing Vietnamese stocks in the form of the local developers that will be handling this massive modernization transition for Vietnam’s commercial hub. There is also the option of investing in the international companies such as Lotte stepping up to the plate to help build the next economic chapter of Vietnam’s development, and there is always the broader option of investing in a Vietnam ETF such as VNM. There are more surface level events as well as behind the scenes developments going on in the Thu Thiem development area of Ho Chi Minh City, so be sure to keep this area, and its upcoming developments, on your investment radar regarding your Vietnam portfolio.

|

Squawkonomics is a team of experienced researchers with extensive travel experience in frontier market countries. Clients have relied upon us to get the real bottom line on sectors such as agriculture, mining, real estate, and manufacturing, to name a few. We have delivered on client requests regarding emerging sectors and technologies in frontier markets such as next generation logistics, drone farming, and Bitcoin. Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

E-Commerce in Vietnam: Trends, Tax Policies & Regulatory Framework

E-Commerce in Vietnam: Trends, Tax Policies & Regulatory Framework

In this issue of Vietnam Briefing Magazine, we provide readers with a complete understanding of Vietnam’s e-commerce industry. We begin by highlighting existing trends in the market, paying special attention to scope for foreign investment. We look at means for online sellers to receive payment in Vietnam, examine the industry’s tax and regulatory framework, and discuss how a foreign retailer can actually establish an online company in Vietnam.

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

The Asia Sourcing Guide 2015

The Asia Sourcing Guide 2015

In this issue of Asia Briefing, we explain how and why the Asian sourcing market is changing, compare wage overheads, and look at where certain types of products are being manufactured and exported. We discuss the impact of ASEAN’s Free Trade Agreements with China and India, and highlight the options available for establishing a sourcing and quality control model in three locations: Vietnam, China, and India. Finally, we examine the differences in quality control in each of these markets.

- Previous Article State by State: Vietnam and Minnesota Trade

- Next Article ASEAN Rules of Origin To Be Key In China – Vietnam Trade