Relocating Production to Vietnam for US Businesses: What You Need to Know

- Vietnam has emerged as one of the top locations in Southeast Asia for US investors looking to relocate or supplement their China operations.

- Vietnam boasts of a stable political and business environment, low wages, and a growing economy despite the pandemic.

- Vietnam Briefing highlights why US businesses should choose Vietnam to locate their operations in light of the US-China trade war and COVID-19.

As manufacturing in China contracts, Vietnam is experiencing continued and unprecedented growth relative to other low-cost countries. Foreign investors are increasingly choosing Vietnam as a China plus one destination to combat rising costs in China and other unpredictable scenarios, such as trade shocks.

This strategy has acquired new value amid the US-China trade war and most recently, the COVID-19 outbreak, which have both impacted manufacturers in China and their supplies to global markets. Such events are not entirely unforeseen but have a global fallout. Naturally, it makes sense that investors diversify to better manage their risks.

In this context, foreign investors are choosing to supplement Chinese operations with low-cost inputs sourced from production facilities in alternate markets, such as Vietnam. In addition to its geographic proximity to China, Vietnam offers several advantages for manufacturers planning to move outside China.

How to plan a supply chain shift

Vietnam is not without its share of challenges. In the short-term, manufacturers may find the production shift daunting as supply chains have to realign. Companies often struggle to decide what to relocate, how they plan to enter the Vietnamese market, and where they will establish operations within the country.

Those that understand these issues will have a leg-up over their competition – they will be able to make more informed decisions that are vital for their operations to stabilize in the short- to medium-term and expand if required.

There is no one size fits all. Each industry, market, and location is different and thus a tailor-made approach is required for each business as per their specific requirements. Foreign businesses should conduct thorough due diligence before embarking on the relocation process and are advised to seek professional help when considering a supply chain shift.

Dustin Daugherty, Head of North American Desk for Dezan Shira & Associates notes, “Vietnam’s uniquely strong advantages as an investment destination for US companies rise steadily over the past half-decade or so, it’s important to remember that it is still a rather unfamiliar market for new investors. Vietnam enjoys a high degree of regional diversity, and the North, Center, and South all have particular competitive advantages for different industries and types of businesses. In the Ho Chi Minh City area, a prospective investor will find a vibrant commercial center with a deep and diversified supply chain, whereas the Center of the country can provide cost advantages unmatched by either North or South.”

Processes that should be considered during a relocation include:

- Market study;

- Initial screening;

- Preliminary due diligence and long-list locations;

- Detailed due diligence;

- Comparison model development;

- Final site selections; and

- Organizing a visit.

Step 1: Choose production elements to relocate

Companies should approach Vietnam with a clear understanding of the production that they intend to carry out in this market. For most companies, an alternative location is chosen because of their lower costs, which are well suited for basic manufacturing and assembly.

Those targeting more complex manufacturing operations should conduct a thorough review of Vietnam’s available labor force, sourcing networks, and infrastructure to ensure that this production will prove feasible.

Step 2: Pick your entry strategy

Vietnam provides several options for market entry – below we outline the most common forms of corporate structure options for US investors.

Representative office

A representative office (RO) offers a low-cost entry for companies seeking to gain a better understanding of the Vietnamese market. As such, this option is among the most common for first-time entrants to the Vietnamese market and often precedes a larger presence within the country. Currently, ROs are permitted to engage in the following activities:

- Conducting market research;

- Acting as a liaison office for its parent company;

- Promoting the activities of its head office through meetings and other activities that leads to business at later stages.

Vietnam’s Ministry of Planning and Investment (MPI) does not currently specify the required capital for ROs. While the MPI does not impose specified capital requirements, companies will be required to show that their capital contributions are sufficient to fund the activities of their operations. As a result, potential investors should prepare to commit a minimum of US$10,000 to fund their operations. ROs can be set up in between six to eight weeks.

Branch office

A branch office (BO) can conduct business activities in Vietnam with the parent company’s business scope. To set up a BO, a parent company must have conducted business in its home country for at least five years. BOs are limited to certain types of service businesses, such as finance and banking. BOs can hire staff directly, make it easier to do contracts between the parent company and Vietnamese companies, and serve in similar ways to a liaison office.

BOs are permitted to engage in the following activities:

- Rent offices;

- Lease or purchase the equipment and facilities required for operations;

- Recruit local and foreign employees;

- Remit profits abroad;

- Purchase and sell goods and commercial activities per licensing;

- Set up accounting, marketing, and HR departments to represent the parent company.

The BO will need to obtain an establishment license and have a seal with the name of the parent company. The BO will also need to appoint a branch manager who is a Vietnam resident.

Foreign companies may appoint a manager from their countries of origin; however, this employee must get a Vietnam work permit to be hired as a BO manager.

The Ministry of Industry and Trade approves the registration of the BO after the company submits all the documents with the process typically taking 20 working days.

100 percent foreign-owned enterprise

A 100 percent foreign-owned enterprise (FOE) in Vietnam can operate under the following structure:

- Joint-stock companies;

- Limited liability companies.

Limited liability companies (LLC) are the most common form of investment for foreign investors due to their reduced liability and capital requirements.

LLCs can be broken down into single-member LLCs, where there will only be one owner, and multiple-member LLCs, where there will be more than one stakeholder. These owners can be private individuals or companies, depending on the requirements of a given investor.

The setup time for a 100 percent FOE ranges between two to four months on average.

Joint venture

A joint venture (JV) entails the partnership of companies or individuals for a specific business purpose. JVs are not a unique corporate structuring option; partners usually establish an LLC for standard JVs and a joint-stock company (JSC) if there is a desire to list on Vietnam’s stock exchanges.

For investors purchasing stakes in state-owned enterprises equitized on Vietnam’s exchanges, the JSC structure is required. When entering the Vietnamese market, foreign investors can choose to enter into joint ventures as a majority (ownership more than 50 percent) or minority (ownership less than 50 percent) stakeholder.

The capital requirements for JVs are the same as for 100 percent FOEs. Unconditional sectors are not subject to specified capital requirements. However, Vietnam’s MPI does apply industry-specific capital requirements in many cases.

The percentage of ownership, and thus the amount of capital contributed, is the more important metric to use when evaluating the capital requirements for JVs in Vietnam. At present, statutory guidelines impose a foreign contribution floor of 30 percent for JVs, as well as a ceiling in specific conditional sectors. The government also mandates minimum contributions for domestic investors on an industry-specific basis. Set ups for JVs take about two to four months.

Public-private partnership

A public-private partnership (PPP) entails a partnership between a foreign or domestic enterprise and the government for the completion of key infrastructure projects. Vietnamese authorities are aggressively pursuing PPPs for a variety of infrastructure projects as a means of filling gaps left by the reduced role of state-owned enterprises, rising population, and increasing urbanization. The five types of PPPs are Build-Transfer-Operate (BTO), Build Transfer (BT), Build-Operate-Transfer (BOT), Build-Own-Operate (BOO) and Build, Transfer, and Lease (BTL).

Mergers and acquisitions

Mergers and acquisitions (M&As) are an increasingly popular route for foreign investors looking to begin operations in Vietnam. With an M&A, investors can enjoy pre-existing access to consumers, locations, and distribution channels. This local knowledge can prove critical to successful operations within Vietnam’s vibrant but rapidly changing investment environment.

Investors that find it challenging to enter the Vietnamese market may find that the M&A route provides a unique solution to several obstacles.

Investors need to weigh the pros and cons of whether merging or acquiring complements their business strategy. A merger is when two companies join to form one company by transferring assets, rights, obligations, and interests to the merged company and therefore terminating the two separate companies.

Acquisitions require a change in ownership and are typically in the form of existing share purchases or new shares but also involve acquiring assets. For non-public companies, liability mainly stems from the failure to meet with the provisions set out in the agreement.

Investors that are interested in this route should recognize the legal foundation for M&As, and understand the procedures and restrictions associated with acquisitions.

Step 3: Identify an optimal location for investment

Vietnam has three key economic regions (KERs) that host the majority of foreign investment and industrial activity within the country. Each KER provides a unique set of production conditions that lend themselves to different investment strategies. Companies should develop a clear understanding of each zone, the specific provinces within this zone, and where industrial activity is carried out.

Four-step set up guide

Step 1: Pre-investment approval

For some types of investment, companies need to seek the approval of Vietnamese authorities prior to starting establishment procedures. As a result, it is important to understand if an investment will require approval and if so, preparing requisite documentation and working against the application processing times.

Step 2: Investment registration certificate application

The first step in the Vietnamese corporate establishment process is an application for an Investment Registration Certificate (IRC). This is required of all 100 percent foreign-owned investment projects and establishes the right of the foreign enterprise to invest within Vietnam.

To apply an investor must submit:

- Application for implementation of investment project (this should include details of the project in Vietnam);

- Proposal of investment project (should include the details of the investment project, including lease agreements or land use needs); and

- Financial statements (to be provided for the last two years of a company’s operation; additional information may be required to prove financial capacity).

Timeframe: 15 days from the date when documents are submitted.

Step 3: Enterprise registration certificate application

The Enterprise Registration Certificate (ERC) is required for all projects that seek to set up new entities within Vietnam. When obtained, the ERC will be accompanied by a number that will double as the tax registration number of the entity.

As part of the application process, the following information should be prepared:

- Application for enterprise registration;

- Company charter;

- List of all board members;

- List of legal representatives; and

- Letters of appointment and authorization.

Any foreign documents or supporting information provided will need to be notarized, legalized by consular officials, and translated into Vietnamese by competent authorities.

Timeframe: Three days from the date when documents are submitted. It should be noted that applications for the ERC and IRC can be processed concurrently; both can be obtained within 15 days when applied concurrently.

Step 4: Post licensing procedures

Once the IRC and ERC have been issued, additional steps must be taken to complete the procedure and start business operations. This includes:

- Seal carving;

- Bank account opening;

- Labor registration;

- Business license tax payment;

- Charter capital contribution; and

- Public announcement of company establishment.

Taxes

All taxes in Vietnam are imposed at the national level; there are no local, city, or provincial taxes. Enterprises should pay tax in localities where they are headquartered or have duly registered branches.

Most companies and foreign investors in Vietnam are subject to the following six major taxes:

- Business license tax;

- Corporate income tax;

- Value-added tax;

- Special consumption tax;

- Foreign contractor tax; and

- Customs duties.

Industries primed for relocation

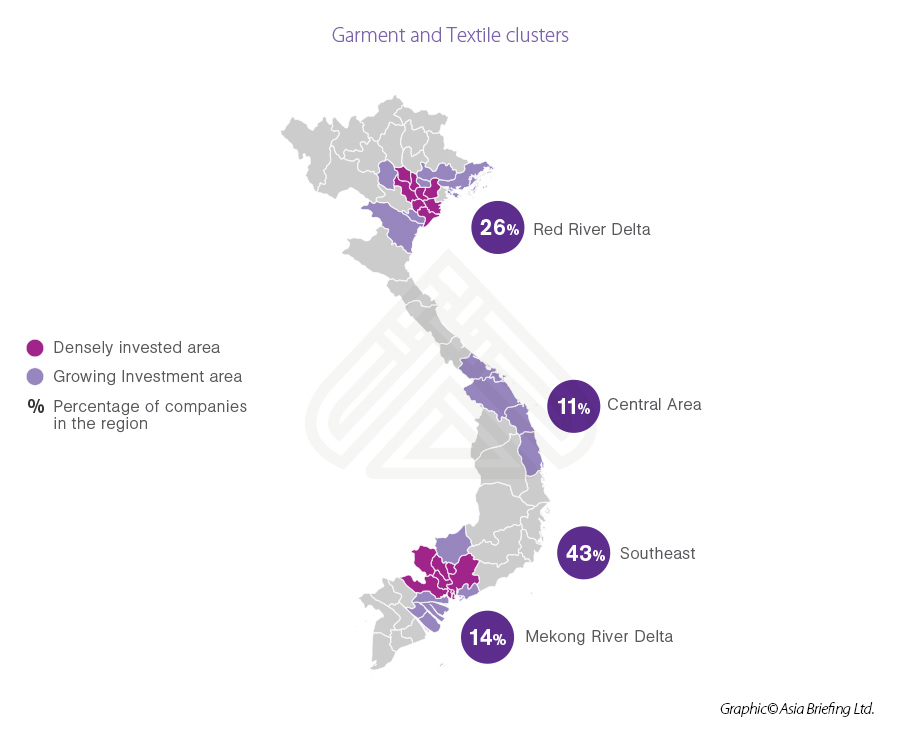

Textiles and garments

The textiles and garments sector are two of Vietnam’s major areas of export. For example, Vietnam is the second-largest textile and garment supplier to South Korea after China. Industry observers also anticipate that Vietnam will soon take the top spot.

In recent years, multinational retail giants, such as Nike and Adidas, have broadened their manufacturing bases to Vietnam because of cheaper labor costs. Nike began to manufacture more of its product line in Vietnam than China starting in 2009, and Adidas soon followed in 2012.

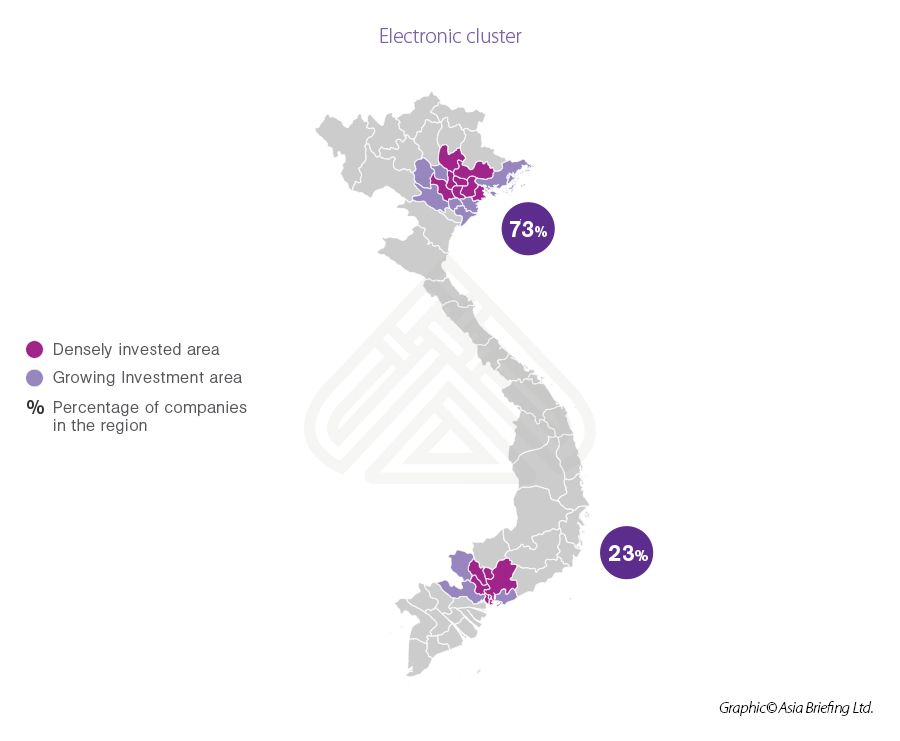

Electronic equipment

Vietnam’s high-tech boom in recent years has paved the way for the country to begin producing more higher-end goods. This is seen in the recent trend of electronics goods factories making the shift to Vietnam.

Most notably, China’s Goertek – the assembler for AirPods, Apple’s wireless headphones – has confirmed plans to shift production into Vietnam. Amid global tensions due to the uncertain outcome of the US-China trade war, in addition to the hefty tariffs placed on high technology, Vietnam has become a leading alternate manufacturing choice.

Most recently, Google announced that it would manufacture its Pixel series phones in Vietnam, while Microsoft would move its production of surface tablets due to the COVID-19 outbreak.

Major electronics firms, such as Cheng Uei, a Taiwanese firm that specializes in manufacturing equipment for iPhones and Petragon – an assembler of iPhone equipment – are also scaling up their options outside of China, with Vietnam as one of the leading alternate countries.

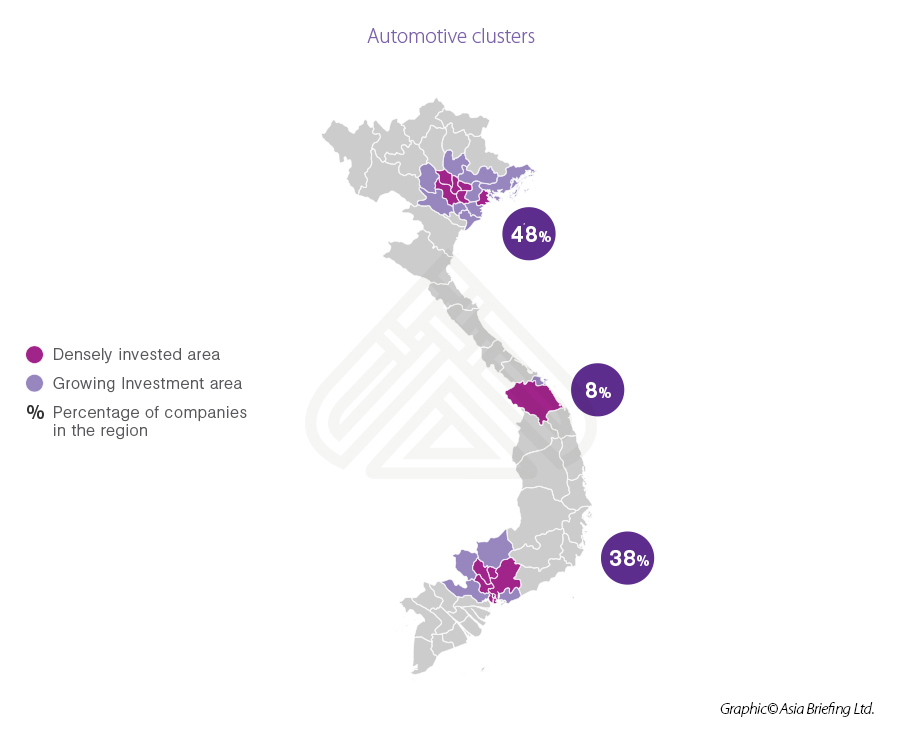

Automobiles

The automotive cluster has been growing at a rate of 10 percent. This is a non-resource industry for domestic local consumption. The automotive clusters are dominated by foreign players such as Ford, Honda, and Toyota with tier-2 suppliers delivering to these global companies.

The Red River Delta region, such as Hanoi and Haiphong cater to original equipment manufacturer (OEM) suppliers. In the central region, Quang Nam province has seen an increase in auto parts production. In the south, automotive clusters are concentrated in Dong Nai province and surrounding areas. Investors should watch out for strict regulations in the industry as the government is protective of the local industry and wants to help domestic players grow.

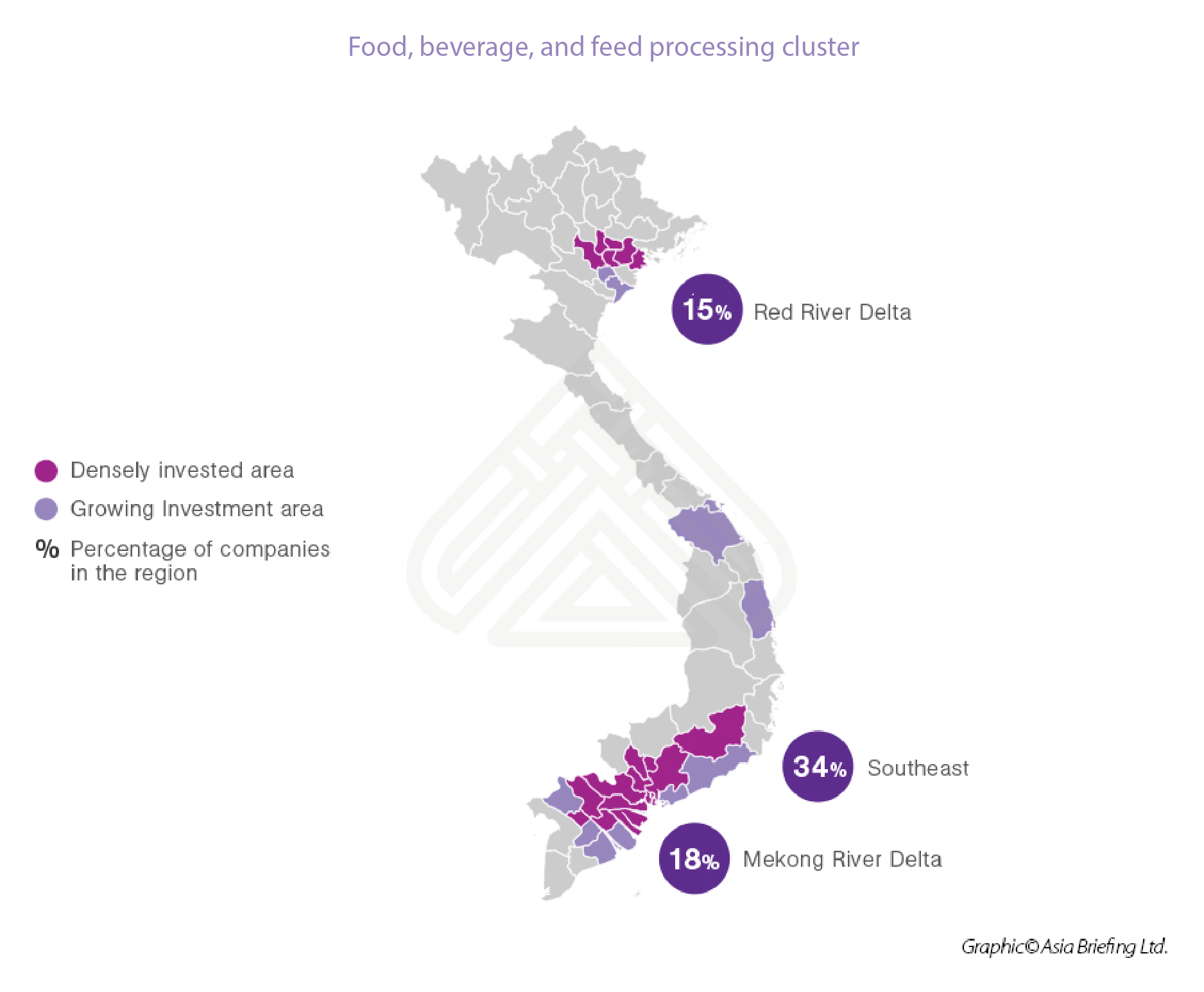

Food, beverage, and feed processing

The food beverage and feed processing industry is dominated by small businesses. The industry consists of about 5,500 companies. The sector is natural resource-based with manufacturing for local and international consumption and export. Vietnam is a leading exporter of rice, coffee, and seafood. We have also seen high demand for dairy, confectionery, and meat processing. However, companies should be located in close proximity to raw materials to source inputs and high populated areas to cater to demand.

We advise that investors should do research on the market supply of raw materials. Due to an increase in demand, some companies can find it challenging to source inputs.

Apart from the aforementioned sectors, US investors can find significant opportunities in the healthcare and machinery sectors.

Healthcare

Vietnam is currently undergoing economic and demographic transformations that provide great potential for its healthcare industry. In 2019, Vietnam’s healthcare expenditure was approximately US$17 billion, equivalent to 6.6 percent of its GDP, according to Fitch Solutions. The firm also expects that healthcare spending will reach US$23 billion in 2022 at a compound annual growth rate (CAGR) of 10.7 percent.

The COVID-19 outbreak certainly dampened economic activity in Vietnam, but it is unlikely to reverse ongoing socioeconomic changes. Rather, health stands firmly as the top priority and concern for both the Vietnamese people and the government. Vietnam’s fast-growing middle class and an aging population are drivers for growth along with its expanding health insurance and hospital system.

To help it shoulder the burden of rising healthcare costs, the government is increasingly looking at investment from the private sector and international firms. These changes mean that there will be more business opportunities in the healthcare sector in Vietnam in the upcoming years.

The medical equipment industry is expected to grow at a rate of 18 to 20 percent while the recently enacted EU-Vietnam FTA is expected to further boost the pharmaceutical industry in Vietnam.

Machinery

Most machinery that is used in the local Vietnamese market is imported from other countries. As Vietnam’s industrial sector integrates globally, demand for machinery is booming. To compete and meet the demands of foreign customers, Vietnam will have to invest in machinery to process products.

As Vietnam expands as a manufacturing hub, it relies on imported machinery mainly from China. However, analysts have warned that the country may become a landfill for outdated machinery. To combat this, the government passed a regulation banning the use of imported used machinery and equipment and production line technology that is more than 10 years old, from June 15, 2019.

This presents significant opportunities for investors. Particularly as Vietnam moves towards high-tech manufacturing, the demand to develop this type of machinery is set to increase. The government has also been proactive, organizing machinery and industry fairs to support enterprises.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article The EVFTA and Vietnam’s Pharmaceuticals Market: An Overview

- Next Article Trends und Möglichkeiten im Online-Gaming: Die vietnamesische Gaming-Industrie auf das nächste Level bringen