Processing Contracts in Vietnam: What Are They and How to Use Them

- Processing contracts are ideal for foreign investors looking to manufacture their products in Vietnam without setting up an entity.

- As Vietnam looks to emerge as a leading China plus one manufacturing destination, companies are increasingly looking to diversify their supply chains balancing costs and taking advantage of free trade agreements.

- Still, investors should involve thorough due diligence to see whether setting up an entity or using a local manufacturer suits their business operations and strategy.

While Vietnam has several legal structures that can be used as a necessary building block to a successful Vietnam sourcing strategy, it can often be difficult for companies (particularly those new to Vietnam) to decide on the optimal solutions needed to support their mainland sourcing activities.

With so many quality control and trading agents available offering one-stop sourcing services and business-to-business (B2B) online platforms that allow direct contact with suppliers, many will argue that it could be just as effective to utilize a subcontracting agreement and intermediate parties to get the job done.

Many foreign investors diversifying their supply chains are choosing Vietnam to manufacture and export their products. However, these supply chain shifts can bring new challenges to a business, including labor problems, poor factory conditions, or product quality issues.

This is especially true for brands that manufacture in Vietnam and export their products using unreliable suppliers or factories. It is imperative for businesses to evaluate suppliers to prevent any supply chain issues that may affect business as normal.

Why having the right contract matters

Foreign investors looking to manufacture in Vietnam should also ensure they have proper contracts in place to avoid business disruptions down the line. There are various types of contracts depending on the business purpose of the foreign company.

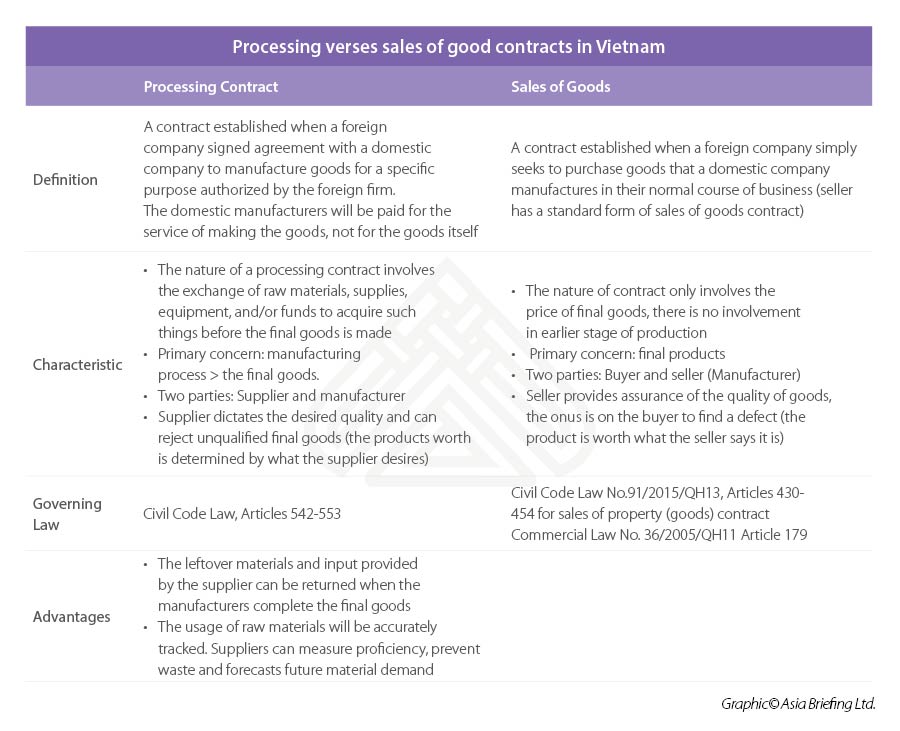

For example, a sales of property (goods) contract may be appropriate for an investor buying goods from a domestic company during normal business operations. However, a processing contract may be more appropriate for a foreign company that wants to import raw materials to Vietnam for processing and manufacturing and re-exporting to another market. The foreign company or supplier pays the local manufacturer for services of manufacturing or processing the product.

A processing contract is ideal for investors looking to use a domestic entity (rather than setting up their own facility) to manufacture or process goods to export to another country, their home country or sell to another entity.

What is a processing contract?

As per Vietnamese law, a processing contract is an agreement between parties whereby a processor carries out work to create products at the request of a supplier and the supplier receives the products and pays the relevant fees.

Suppliers or the foreign investor would supply the raw material including the agreed quantity, equipment, including documents, and instructions on how to manufacture the product.

Processing contracts involve the exchange of raw materials, supplies, equipment, and/or funds to be acquired before the final product is made.

A processing contract also has provisions for the return of excess raw materials and therefore the raw materials can be tracked accurately allowing the supplier or investor to ensure a return on their investment.

In addition, the manufacturing party is not allowed to hold materials, supplies or equipment as ransom in exchange for payment if they do not fulfill the service as per the processing contract. This removes a lot of ambiguity that is found in a general supply contract making it easier for the foreign investor to be assured of their investment.

The supplier thus gains more control over what the finished products are as they can reject the goods if they are not made as per the quality desired. In this case, the supplier owns the goods, raw materials, materials and pays the local manufacturer for the service which is either processing or manufacturing the product.

Processing contract requirements

A processing contract must be made in writing and at a minimum must include:

- Name and address of contracting parties and the direct processor;

- Names and quantities of products to be processed;

- Processing price;

- Payment time limit and mode;

- List, quantities, and values of imported raw materials, auxiliary materials and supplies and home-made raw materials, auxiliary materials and supplies (if any) for processing; use norms of raw materials, auxiliary materials, and supplies; norms of supplies consumption and wastage rates of raw materials in processing;

- List and value of machinery and equipment (if any) hired, borrowed or donated for processing;

- Measures to treat waste materials, scraps and faulty products and principles of disposal of hired or borrowed machinery and equipment and unused raw materials, auxiliary materials and supplies after the termination of the processing contract;

- Place and time of goods delivery;

- Trademarks and appellations of origin of goods; and

- The validity duration of the contract.

Tax implications

Thang Vu, Associate Manager, Tax at Dezan Shira & Associates’ Ho Chi Minh City office notes that there are no customs duties on imports of imported materials for performing processing services. The local processing or manufacturing facility will also be entitled to zero percent Value-Added Tax (VAT) for processing the exported goods.

However, customs authorities must be notified with the following declaration forms:

- Export Processing Enterprise (EPE): Form E11 for importing materials and form E42 for exporting the final product;

- Ordinary local processing facility: Form E21 for importing materials and form E52 for exporting the final product.

The local manufacturing facility can claim a refund of creditable input VAT on the portion of their exporting income under certain conditions.

In a sale of goods contract, the Vietnamese processing or manufacturing facility must purchase and import the raw materials using form E31 which is also exempt from customs duty and VAT on imports. However, imports under such forms are subject to stringent checks by customs authorities. In addition, the markup cost for the final products can be higher for foreign investors.

Set up local manufacturing facility or use a local manufacturer?

Foreign investors that set up a local manufacturing facility are eligible for certain tax incentives and benefits depending on the industry and location. Nevertheless, investors should do a cost-benefit analysis to see whether setting up a manufacturing facility or using a local manufacturer is feasible.

Investors that do set up a local facility are eligible to the following benefits:

- Corporate Income Tax (CIT) incentives for certain business sectors as well as certain geographic conditions. If the processing facility is established in certain locations which undergo socioeconomic difficulties, investors may be eligible for up to four years of CIT exemption and nine years of reduced CIT;

- VAT refund for new investment projects;

- VAT refund for creditable input VAT, apportioned by exporting income under certain conditions;

- Exemption of customs duties and VAT on imports for imported materials, which is processed into exported products;

- Zero percent VAT on export revenue; and

- Exemption of customs duties and VAT for EPEs, but these are subject to stringent checks by customs authorities.

Global manufacturing shifts

Globalization has led to sharp rise in cross border production, with an associated increase in the value of goods sent abroad for processing.

The production process for several industries such as oil, garments and textiles, electrical goods, and motor vehicles is increasingly spreading to more than one country to reduce costs and to take advantage of government incentives as well as free trade agreements.

In the context, Vietnam appears to be a promising manufacturing destination regardless of whether investors set up their own manufacturing facility or use a local manufacturer to process their goods.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Vietnam’s Social Insurance Reduction: Decree 58 on Occupational Diseases and Accidents

- Next Article Vietnam’s New PPP Law Set to Take Effect January 2021