Political Considerations When Choosing Your China+1 Alternative: Thailand and Vietnam

- Thailand and Vietnam are ideal destinations for investors looking to relocate or supplement their China operations.

- Businesses however need to consider several factors such as the political environment when looking to invest or relocate.

- We focus on the political environment and highlight the pro and cons to help make you an informed decision based on the circumstances at this time.

Doing business in a foreign country requires awareness, consideration, and evaluation of risks that are unique to its environment. This involves knowledge of politics, economics, legislation, as well as social and cultural traits of the community.

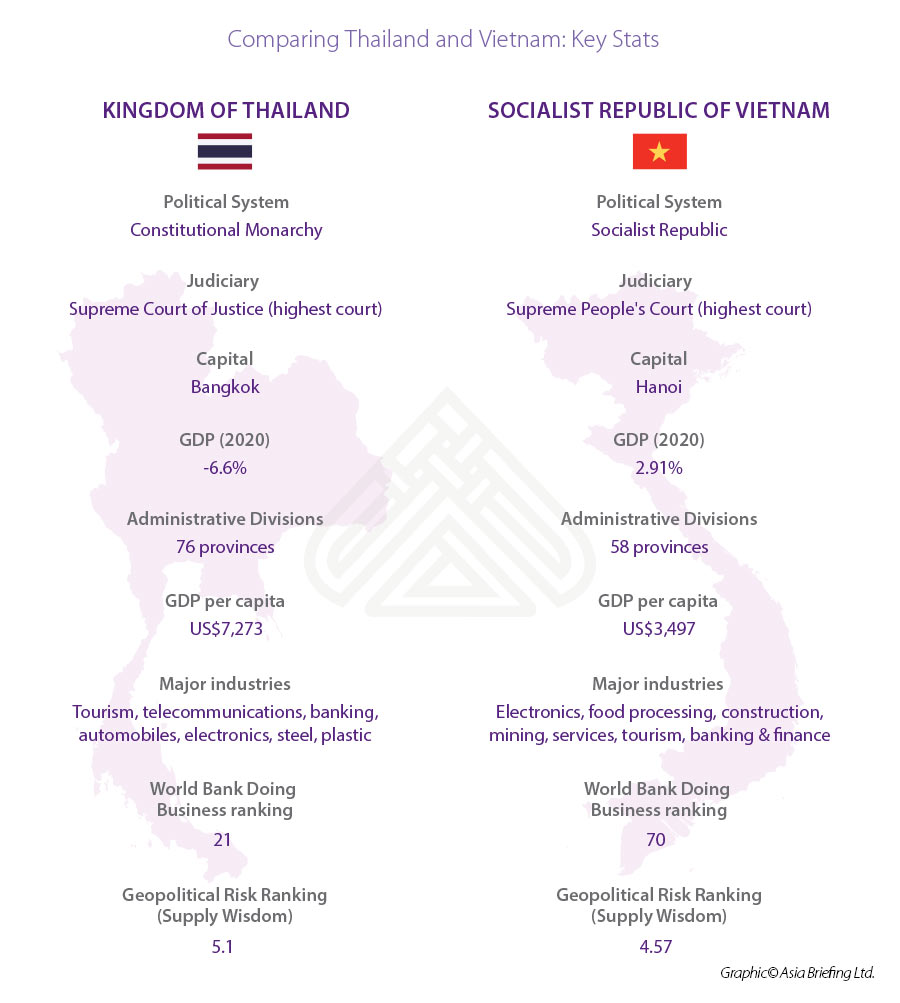

2021 looks promising. ASEAN has performed better on the economic front than many developed countries and has emerged as a region to watch out for. In fact, Vietnam, while recording its lowest GDP year in years still recorded a net positive growth of 2.91 percent in 2020. Thailand however, significantly affected by a lack of tourists shrunk by 6.5 percent, though its economy is expected to bounce back between 3.5 and 4.5 percent.

With supply chains disrupted, and the COVID-19 pandemic still very much present despite rising vaccinations, investors are increasingly concerned about their investments. While there are several factors that need to be considered while doing business in a country, a significant factor is the country’s political climate and government support. This has become even more important in the aftermath of the military coup in Myanmar. Media reports have indicated that several foreign investors are concerned and have already re-routed investments to neighboring countries in the region.

In this context, we examine the political climates of Vietnam and Thailand and how this bodes for foreign investors. Both countries are ideal destinations for investors looking to relocate or supplement their China operations and have attractive business environments. Nevertheless, navigating geopolitical landscapes can be a challenge for most businesses.

To illustrate this, we take an in-depth look at Thailand and Vietnam and the following political factors if planning to move operations to either of these potential candidates.

Thailand’s political climate

Thailand’s political system is a constitutional monarchy. King Maha Vajiralongkorn, son of King Bhumibol Adulyadej was coronated in May 2019. The king has direct powers under the constitution and yields significant political influence and, in some cases, absolute power.

The National Assembly is bicameral, consisting of the House of Representatives (the lower house) and the Senate (the upper house). Major political parties are the Phalang Pracharat Party (PPRP), the Puea Thai Party, the Democrat Party, Thai Raksa Chart, Bhumjathai Party, Chartthaipattana, and Chart Pattana parties.

Following a military coup in 2014, General Prayuth Chan-ocha led a military junta. After elections were held in March 2019, the first since the coup, Prayuth was appointed prime minister by the military-backed ruling PPRP. Opposition parties including the Puea Thai Party – which won the most seats in the election – complained that the system was rigged against them, especially as the military had chosen all members of the Senate.

The army has traditionally played an important role in politics and there have been at least 18 attempted military coups – nine of them successful – since 1932, when absolute monarchy ended. In 2006, populist prime minister Thaksin Shinawatra (2001-2006) was also ousted in a coup.

Thailand’s government remains committed to FDI and has competed with Vietnam and Myanmar in this respect. The government has launched several infrastructure projects including the Eastern Economic Corridor (EEC) to obtain investment. The government also supports specific high-tech industry such as smart electronics and next-gen automotive and has promoted tax incentives to attract investment

In September 2019, it introduced a stimulus package named ‘Thailand Plus’ with a variety of measures to attract foreign investment.

Protests and social unrest

The government remains committed to FDI, however recently, Thailand has seen several protests in support of democratic reforms. These have involved violence in Bangkok as well as other cities. The protests have also resulted in disruption to transport including the closure of roads and the Skytrain. While the authorities are typically able to quell such protests, the systematic political instability could be a deterrent to foreign investors in the medium term.

Much of Thailand’s protests and economic downturn has been caused due to the pandemic with borders closed and virtually no tourists. Investors looking at relocating their operations may benefit from Thailand’s world-class infrastructure but may have apprehensions about the constant political disturbances compared to Vietnam which is far more stable. In the long-term Thailand will need to find a lasting resolution to the youth-led protests or risks further instability in the future.

Vietnam’s political climate

Vietnam is a socialist republic. The Communist Party of Vietnam (CPV) is the only party in the country. Candidates who wish to compete in elections for the unicameral legislature, the National Assembly, have to obtain the approval of the CPV. Non-CPV candidates can run for assembly elections provided that they are approved by the party. The prime minister and president are elected internally by the National Assembly from among its ranks to serve five-year terms. Selections for these posts are usually made at the CPV’s Party Congress, which is held every five years, the most recent one being held in January 2021.

Following the 13th National Party Congress, Nguyen Phu Trong was re-elected as the CPV secretary-general, which is the most powerful political position in the country, at the same congress. Trong was also reelected in a rare third term. Trong will remain president, meaning he holds both posts simultaneously until the National Assembly determines the presidential candidate in April.

Protests and social unrest

Widespread unrests and the scale of protests as compared to Thailand are uncommon in Vietnam and as such is controlled. Nevertheless, in recent years there have been sporadic protests related to land seizures, environmental issues, or demand to increase wages and improve working conditions. The most recent major protests occurred in May 2014 and involved three days of unrest. Protestors targeted Chinese-owned industrial facilities in response to a maritime territorial dispute with China. While a repeat of such large-scale protests is unlikely, low-level protests or wildcat strikes at industrial zones and factories over wages and living conditions are likely to occur from time to time.

Recently reelected Trong is known for his anti-corruption stance and has endorsed Vietnam’s continued integration into the global economy. These policies are expected to continue and as such underlines Vietnam’s stable political environment which businesses have been drawn to.

The National Party Congress approved a 10-year socio-economic plan that calls for private companies to account for more than half of the economy by 2025 up from 42 percent at present. The plan also calls for doubling per capita GDP to US$4,000-5,000 by 2025 from US$2,750 at the end of 2020.

Both countries ideal investment locations but political climate needs consideration

Both Thailand and Vietnam are great options for foreign investment and an alternative as a China+1 location. Investors that decide on either location, however, need to do their due diligence and size up each market in the respective location to ensure they are prepared to meet challenges.

Geopolitically – Thailand has a history of coups and protests so it’s something that investors need to factor in, however, when compared to Vietnam that offers political stability and attractive investment incentives the choices are not as easy. Since the ‘Doi Moi’ market reforms in the 1980s, the Vietnamese government has focused on attracting FDI. The 13th National Party Congress reaffirmed these goals and this approach has been serving Vietnam well so far.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Why Vietnam is a Promising Contender for Investment Following Myanmar’s Coup

- Next Article Vietnam’s Free Trade Agreements – Opportunities for Your Business