NVIDIA Expansion into Vietnam: Potential for AI Sector Growth

NVIDIA, a leading American artificial intelligence (AI) computing company, has recently shown strong interest in the Vietnam market alongside other technology giants expanding into Southeast Asia. These developments reflect the Vietnamese government’s proactive technology development strategy and the country’s significant economic potential.

We examine how this investment could shape Vietnam’s tech sector growth and opportunities for companies in the AI evolving landscape.

NVIDIA’s commitment to Vietnam’s AI growth

On December 5, NVIDIA signed a Memorandum of Understanding (MOU) with the Ministry of Planning and Investment to establish two cutting-edge AI centers in Vietnam: NVIDIA’s third global AI research hub—the Vietnam Research and Development Center (VRDC)—and an AI Data Center.

This partnership between the Vietnamese government and the US chip giant aims to foster technological breakthroughs while strengthening the country’s technology infrastructure and talent pool.

NVIDIA further demonstrated its strong commitment to Vietnam by acquiring VinBrain, a Vingroup subsidiary specializing in AI-integrated medical solutions. Founded by former Microsoft developer Steven Truong, VinBrain has developed DrAid—an AI-powered diagnostic tool now used in major hospitals in Vietnam and internationally—and gained recognition through the NVIDIA Inception program.

This is not the first local company that NVIDIA has tied up with. Prior to this partnership, in April 2024, it formed a strategic alliance with IT leader FPT Corporation to create a US$200 million one-stop AI factory in Hanoi, powered by NVIDIA’s latest technologies. The collaboration extends beyond technology to education, encompassing curriculum development, training programs, and lab facilities for 30,000 prospective AI talents at both universities and high schools. The first FPT AI factory began operations in November 2024, with profitability expected from 2025.

NVIDIA also partnered with GreenNode, an AI GPU provider under VNG Corporation. According to Nikkei Asia, GreenNode began offering NVIDIA-integrated AI and software services in April, with its data hub in Tan Thuan Export Processing Zone being among the first facilities equipped with NVIDIA graphics processing units.

These initiatives mark key milestones in Vietnam’s technological transformation and development of a future-ready workforce, establishing the country as a trusted destination for high-tech foreign investment.

NVIDIA investment: A strategic catalyst for Vietnam’s tech growth

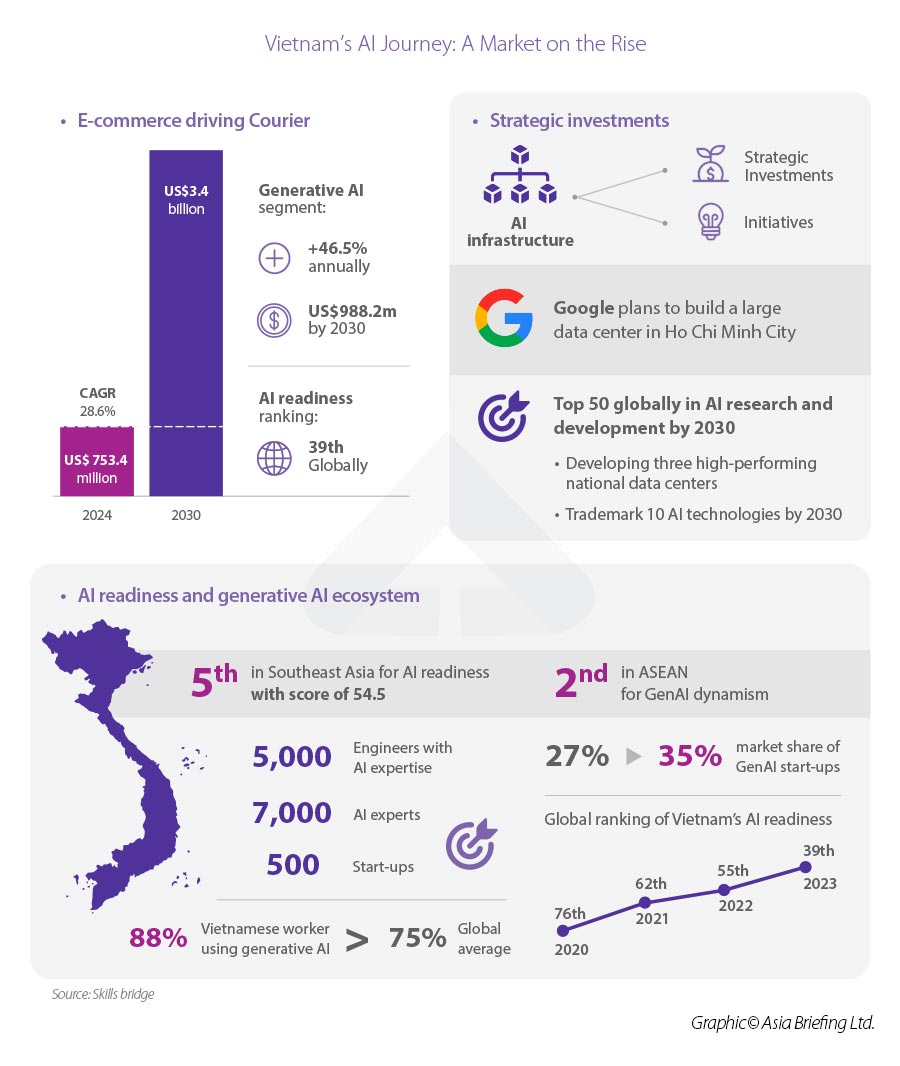

Vietnam is emerging as a prominent player in Southeast Asia’s AI landscape. According to Statista, the country’s AI market is projected to reach US$753.40 million in 2024, at a compound annual growth rate (CAGR) of 28.36 percent from 2024 to 2030. This growth aligns with the region’s pace of 28.53 percent, demonstrating Vietnam’s capacity to keep pace with global technological transformation driven by foreign investment.

|

Major Technology Investor Announcements in Southeast Asian Markets: 2023-2024 |

|||||

|

NVIDIA |

Microsoft |

|

AWS |

Open AI |

|

|

Malaysia |

December 2023: Announced the partnership with YTL Power for US$4.3 billion AI data center projects |

May 2024: Announced a US$2.2 billion investment in cloud computing & AI services |

May 2024: Announced its investment of US$2 billion on its first data center project in the region |

August 2024: Plan to invest more than US$6.2 billion in establishing a cloud region over the next 14 years |

|

|

Singapore |

June 2024: Invested US$5 billion in the 4th data centers and cloud facilities expansion |

May 2024: Plan to expand and strengthen cloud and AI adoption with a US$12 billion investment |

October 2024: Set up 2nd Asia office in Singapore |

||

|

Thailand |

May 2024: Announced it will build the first Thailand data center |

September 2024: Announced US$1 billion project to build a data center and cloud infrastructure |

May 2024: Announced investment worth US$5 billion for the Bangkok-based operation over 15 years |

||

|

Vietnam |

December 2024: Plan to build two AI research hubs and acquire Vinbrain |

June 2023: Partnered with Viettel to jointly deploy cloud computing technology |

August 2024: Consider setting up a large data center in Vietnam |

June 2024: Announced an investment of US$230 million for startups in the field of generative AI |

|

|

Indonesia |

April 2024: Plan to establish US$200 million AI Center with Indosat Ooredoo Hutchison |

April 2024: Plan to invest US$1.7 billion over the next 4 years into cloud and AI infrastructure |

|||

Among Southeast Asia’s AI and cloud infrastructure investments, NVIDIA’s R&D center development is particularly significant as Vietnam transitions from low-tier manufacturing to linking up with global innovation networks. This evolution will strengthen Vietnam’s position in global supply chains, creating distinct competitive advantages for businesses operating within and from Vietnam.

As Washington, D.C., intensifies its restrictions on China’s technology ambitions, Southeast Asian markets are poised to attract a surge of foreign investments in the technology sector. This development has sparked policy competition among prominent regional players, including Vietnam, Malaysia, Singapore, and Indonesia, as they position themselves as attractive destinations for technology manufacturing, data centers, and emerging AI hubs. – Melissa Cyrill, Asia Briefing

Understanding Vietnam’s potential in the AI sector

According to the UK-based Oxford Insights’ research on AI readiness, which evaluates government digital capacity, technological capabilities, and data infrastructure, Vietnam ranks 39th out of 139 countries, moving up 19 places from the previous year. Within Southeast Asia, Vietnam ranks among the top five countries, with over 5,000 engineers, 7,000 AI experts, and approximately 500 startups in the sector.

Below we list some factors contributing to Vietnam’s tech growth:

Below we list some factors contributing to Vietnam’s tech growth:

- A cost competitive, young, and dynamic workforce: The workforce is young and dynamic, with a 96.6-percent literacy rate and displaying eagerness to study STEM subjects (science, technology, engineering, and mathematics). The average monthly wage was US$331 as of June 2023, 4.2 times lower than China and 14.5 times lower than the US. Labor productivity per hour has doubled over the past decade, increasing from US$4.8 in 2014 to US$10.3 in 2023.

- Emerging local tech unicorns and startups: Vietnam ranks third in Southeast Asia in terms of investment deals and total startup investment. The country is also home to about 3,000 innovative startups, of which three companies have a value of over US$1 billion and 11 at over US$100 million. In recent years, many domestic technology unicorns and startups have operated successfully in the country’s AI field.

- Strategic geographical position: Vietnam occupies a strategic location in Southeast Asia, with proximity to China and India, facilitating connections to key potential markets.

- Government efforts in maintaining economic growth and innovation-friendly business environment: The national government has demonstrated a strong commitment to advancing the digital economy and promoting high-technology adoption across socio-economic sectors, particularly in liberalizing foreign investment in the data center sector. The Vietnam government maintains open-door policies, strategic trade agreements, and strong FDI frameworks that create a fertile environment for foreign businesses.

Conclusion

NVIDIA’s strategic investment in Vietnam marks a transformative shift in the country’s emergence as Southeast Asia’s future AI innovation hub. The establishment of two AI centers, alongside partnerships with key local players like VinBrain and FPT Corporation, demonstrates Vietnam’s growing prominence in the global AI ecosystem. The convergence of Vietnam’s strategic advantages—including its young, skilled workforce, thriving startup ecosystem, location, and supportive government policies—creates an ideal environment for continued technological advancement and foreign investment.

As Vietnam seeks to transition from low-tier manufacturing to innovation-based high-value production, these developments signal a promising future for both domestic and international stakeholders in the country’s AI sector.

About Us

Vietnam Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Hanoi, Ho Chi Minh City, and Da Nang in Vietnam. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China, Hong Kong SAR, Indonesia, Singapore, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Vietnam Briefing’s content products, please click here. For support with establishing a business in Vietnam or for assistance in analyzing and entering markets, please contact the firm at vietnam@dezshira.com or visit us at www.dezshira.com

- Previous Article Driving Growth: Business Opportunities in Vietnam’s North-South High-Speed Railway Project

- Next Article Vietnam’s 2024 VAT Law: Key Provisions and Changes to the VAT Regime