New Minimum Basic Salary, Social Insurance Rates in Vietnam

Vietnam will introduce new regulations on the minimum basic salary for social insurance. The government’s Decree 38/2019/ND-CP on minimum basic salary will take effect from July 1, 2019.

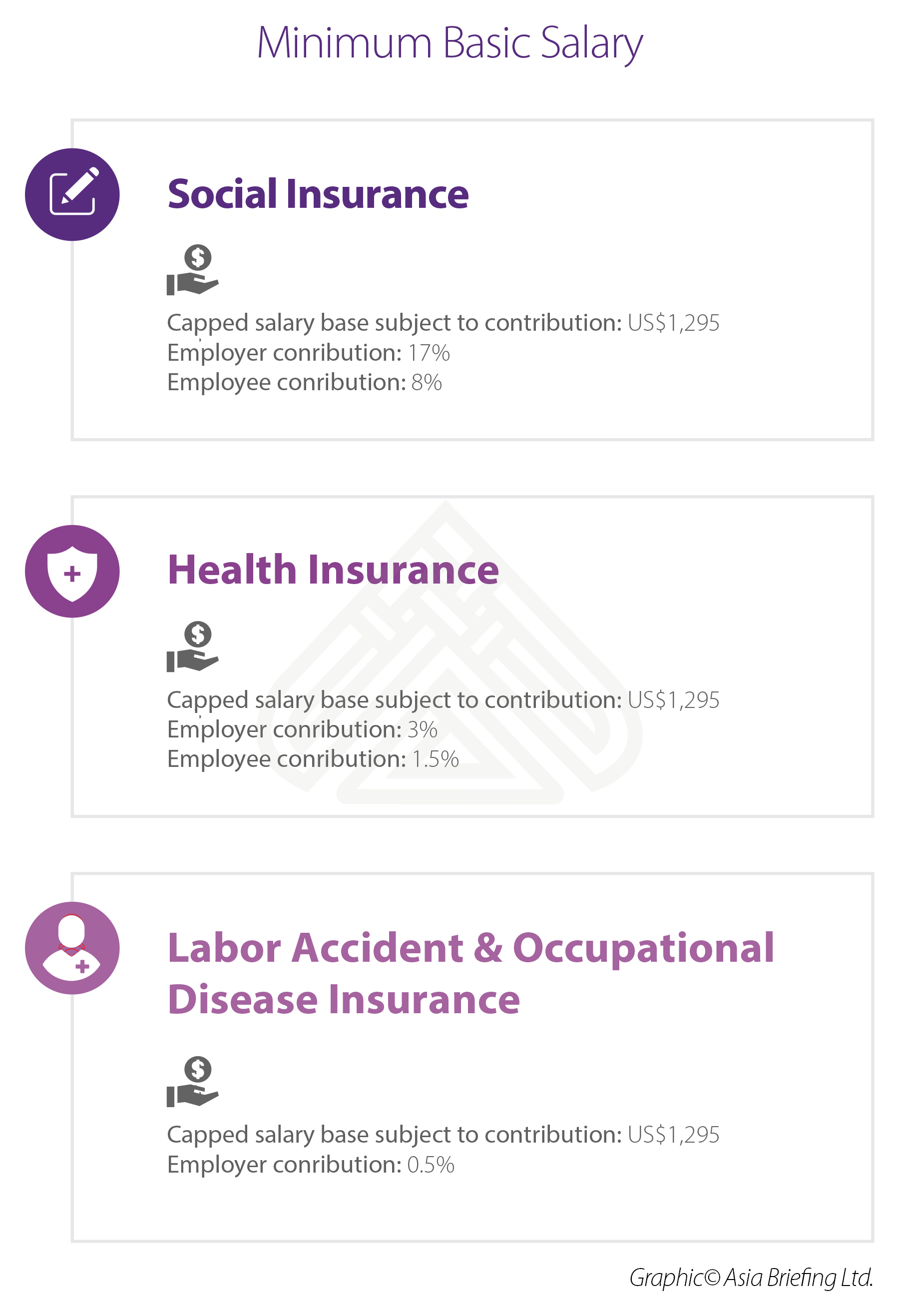

As per the new law, the minimum basic salary cap for social insurance will be raised to US$1,295 (29,800,000 VND) from the current US$1,208 (27,800,000 VND) per month. This means that the mandatory social insurance contribution for both employer and employee will increase from July 1.

Social insurance includes coverage for sickness, maternity, occupational diseases and accidents, as well as retirement and death.

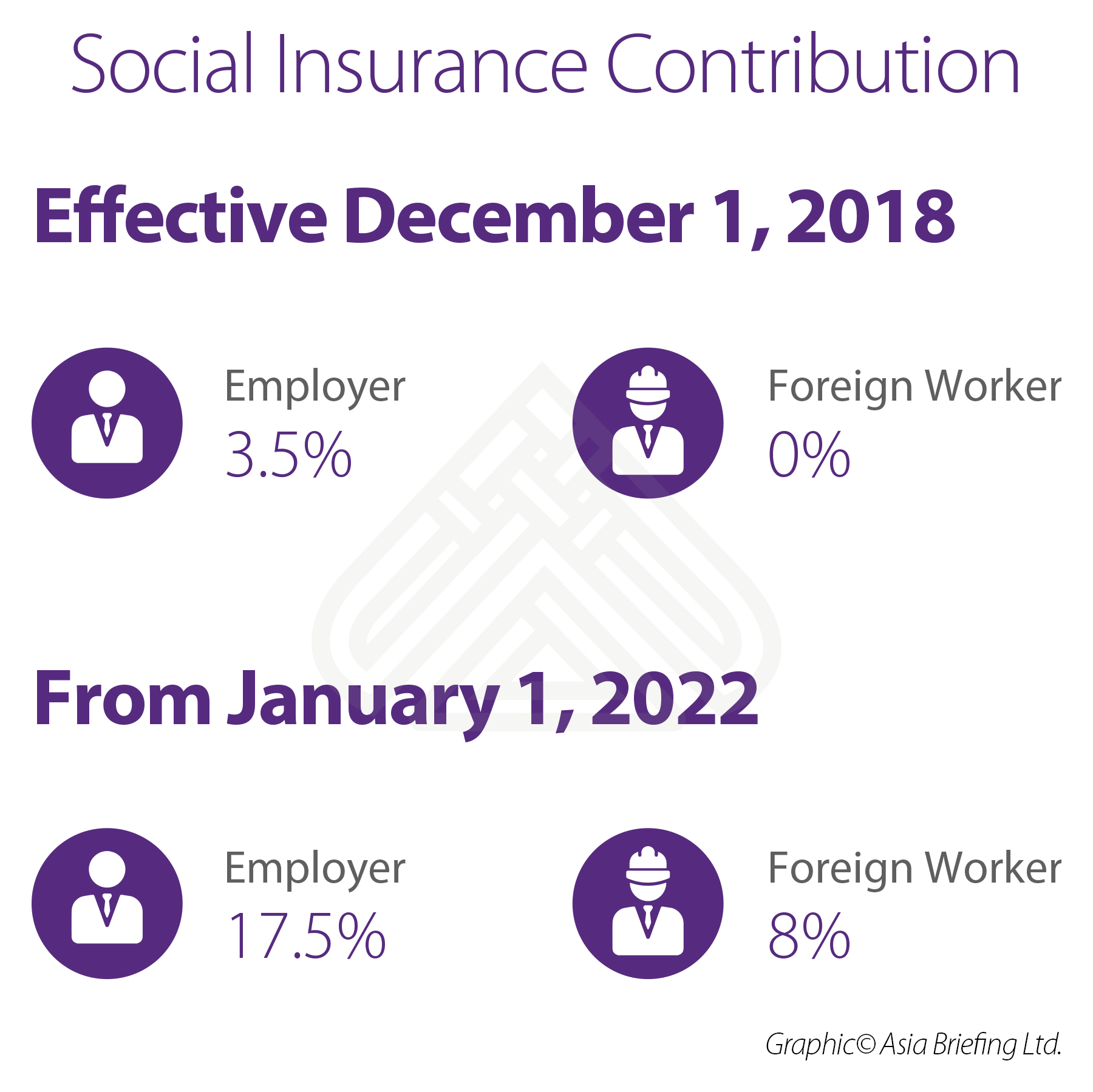

This, however, does not affect foreign workers at the moment. It should be noted that under the Ministry of Labour, Invalids and Social Affairs (MOLISA), social insurance contribution was made mandatory for all working foreigners as of December 1, 2018 under Decree 143/2018/ND-CP.

What is the criteria for social insurance contribution for foreign workers in Vietnam?

MOLISA subsequently clarified the criteria for social insurance contribution for foreign workers. In brief, foreign workers will be subject to mandatory social insurance contribution when they meet all the following conditions:

- Working in Vietnam with a work permit;

- Employed under a Vietnamese labor contract with an indefinite or definite term of one year or more;

- Below 60 years of age for men or 55 years of age for women; and

- Are not an intra-company transferee (must be a manager/executive/expert/technician employed by the overseas entity for at least 12 months before being assigned to the company’s operations in Vietnam).

To ease the transition, the government has gradually increased social insurance contributions for both employers and employees as shown in the table below.

The salary subject to social insurance contribution is what is defined as per the labor contract, but this is capped at 20 times the minimum salary for social insurance contributions set by the government.

At present, the minimum salary for the social insurance contributions is US$1,200, but this will be increased to US$1,295 by July 1 as discussed earlier.

Once a foreign worker’s employment in Vietnam expires, the foreign worker can claim a one-off payment on the contributed amount from the social insurance agency in the following circumstances:

- Reach retirement age, but have not contributed social insurance for the full 20 years;

- Suffer from a fatal disease such as cancer, polio, HIV or other diseases regulated by the Ministry of Health;

- Satisfied conditions for pension, but are not living in Vietnam anymore; and

- Their employment contract is terminated or work permit expires without renewal.

The recent regulations will further bridge the divide between local and foreign workers. According to MOLISA there are around 85,000 foreigners working in Vietnam with 73 percent of them coming from Asian countries, followed by foreigners that originated in Europe and the US.

The move also puts Vietnam in line with Thailand and the Philippines. However, many business leaders have said that the law would increase their costs with foreign workers, who often complain that they are already subject to social insurance premiums in their home countries.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Labor Outsourcing in Vietnam: 5 Key Reforms from Decree 29

- Next Article How to Terminate an Employee in Vietnam