Payroll in Vietnam: A Guide to Compensation, Bonuses, and Benefits

Foreign employers that want to attract and retain the best talent need to ensure they understand payroll in Vietnam and coordinate salary structures with HR management. Here, Vietnam Briefing explains the payroll basics and some best practices for employers in the country.

In recent years, foreign direct investment (FDI) flows into Vietnam have been on the rise as greater numbers of foreign companies decide to establish businesses in the country. Employers, however, need to develop a good understanding of how human resources work in the country. For many, salary structures are usually a beginning point, particularly as they rationalize wages and motivate staff.

Compensation

For Vietnamese employees who work in foreign companies in Vietnam, compensation is determined through negotiations between the two parties. However, the compensation should be no lower than the minimum monthly salary rates stipulated by the government.

The monthly minimum wage rates in Vietnam, updated in July 2024, are as immediately below.

|

Region (*) |

From July 1, 2022, |

Changes (6%) |

From July 1, 2024 |

|||

|

VND |

US$ |

VND |

US$ |

VND |

US$ |

|

|

1 |

4,680,000 |

192.33 |

280,800 |

11.54 |

4,960,000 |

196 |

|

2 |

4,160,000 |

170.96 |

249,600 |

10.26 |

4,410,000 |

175 |

|

3 |

3,640,000 |

149.59 |

218,400 |

8.98 |

3,860,000 |

153 |

|

4 |

3,250,000 |

133.56 |

195,000 |

8.01 |

3,450,000 |

137 |

(*) Regional administrative units in Vietnam, which include:

- Region I: Urban and rural areas of Hanoi, Ho Chi Minh City, Hai Phong, and the provinces of Quang Ninh, Hai Duong, Dong Nai, Binh Duong, Ba Ria-Vung Tau, and Long An.

- Region II: Remaining rural districts of the municipalities in Region I, urban districts of Can Tho City, urban and rural areas of Da Nang City, and various other provinces.

- Region III: Remaining provincial cities, rural districts of Can Tho City, and some rural areas of various provinces.

- Region IV: All other subregions.

The above minimum wage rates are only for Vietnamese employees who conduct the most basic work in normal working conditions. Employees who have passed vocational training courses (i.e., company training courses) typically have wage rates that are at least seven percent higher than those mentioned above.

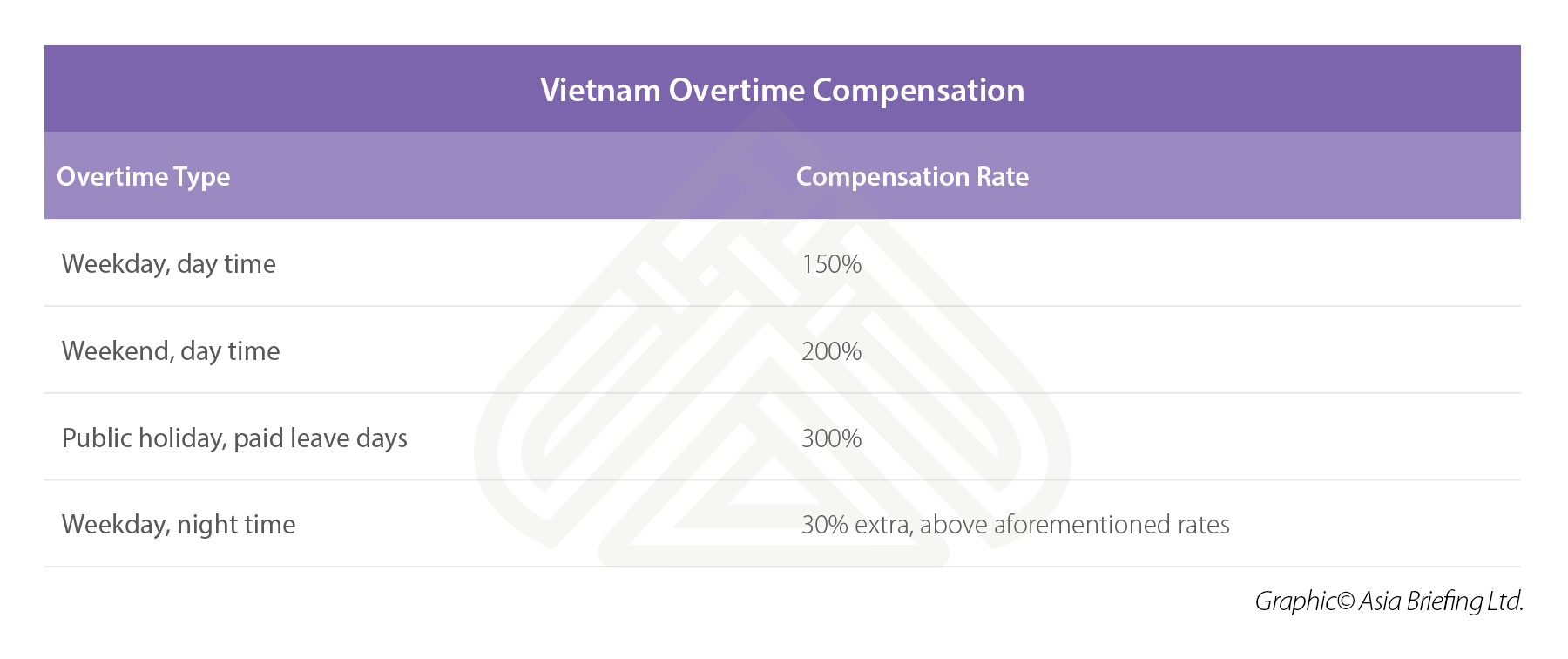

Employees who work extra hours are also paid for those extra hours based on their current hourly wages, as immediately below.

In cases where an employee works extra hours at night, they are paid extra in accordance with the applicable regulations. Furthermore, employees who are given time off in compensation for working extra hours will need to be paid the difference between their wages during normal working hours and overtime work. Finally, employees who work night shifts should be paid at least 30 percent higher than normal.

Salaries paid to Vietnamese staff working for foreign companies must be denominated in Vietnamese Dong. Foreign employers may base salary rates in either Vietnamese Dong or US Dollars, but salaries that are based in US Dollars must be converted into Vietnamese Dong.

In general, an employee’s typical monthly salary package includes their gross salary and mandatory insurance contributions. Personal income taxes (PIT) will be levied on the balance after mandatory insurance contributions have been deducted.

Types of bonuses

Bonuses are given to employees based on company earnings and performance and as a way of boosting company morale and productivity. There are various kinds of bonuses that a company may grant its employees throughout the year.

For example, a 13th month’s salary is usually given as a kind of “annual bonus” by both local and foreign companies in Vietnam to employees who have worked with the company for at least one year. Employees who have worked at a company for less than one year are typically given a bonus that is prorated and based on their actual employment period.

In addition, there is also a special bonus called the “Lunar New Year” bonus (or “Tet Bonus”) that is often paid to employees prior to their leaving for the Lunar New Year holiday.

The amount of any Tet Bonus will be dependent on both company and employee performance, but the bonus typically ranges from smaller amounts of money (up to an entire month’s salary) to larger amounts of money (up to an entire year’s salary) depending on the company progress and goals.

Apart from the larger annual bonuses mentioned above, employees may also be given smaller bonuses for public holidays or other special days (e.g., International Labor Day or National Day).

Senior management and other valued employees may be given bonuses during these days as well, including in the form of share certificates with a vesting period, for which the corresponding stock can be sold only after the employee has worked for the company for a certain amount of time.

All salaries and bonuses in Vietnam are subject to PIT.

Allowances and benefits

In addition to salary and bonuses, employees may be eligible for various allowances and benefits aimed at retaining staff. According to Vietnam’s regulations, the allowances and benefits for employees include:

- Funeral and wedding expenses for the employee and their family;

- Vacation expenses and support for medical treatment;

- Financial assistance for additional learning at training facilities;

- Support for employees’ families affected by natural disasters, wars, accidents, or illnesses;

- Rewards for employees’ children who achieve academic excellence;

- Travel expense support for employees during holidays and Tet (Vietnamese Lunar New Year);

- Expenses for accident insurance, health insurance, and other voluntary insurance for employees (excluding costs for purchasing life insurance or voluntary retirement insurance); and

- Other welfare expenses.

Note: The total amount of these welfare expenses must not exceed one month’s average actual salary for the relevant tax year.

Condition for deduction

Allowances and benefits that are deductible when calculating the Corporate Income Tax (CIT) must meet the following conditions:

- The total employee welfare expenses must not exceed one month’s average actual salary for the tax year of the enterprise.

- Expenses must be supported by sufficient legal invoices and documentation, which include:

- For travel-related expenses – invoices for accommodation, meals, and transportation from the travel company, hotel, or restaurant, along with a list of participating employees.

- For education or training expenses – a tuition invoice.

- For medical examination and treatment expenses – hospital invoices and medical records.

- There must be a receipt for each purchase of goods and services valued at VND 20 million or more (prices inclusive of Value-Added Tax (VAT)). Additionally, payments must be documented through non-cash payment methods.

Foreigners who work in Vietnam are also exempted from Personal Income Tax (PIT) on various benefits such as relocation allowances for moving into the country, airfare to their home country, and education fees for their children.

Vietnamese Accounting Standards

Local and foreign-invested companies that conduct business in Vietnam are required to comply with Vietnamese Accounting Standards (VAS) when recording their financial transactions. Additionally, foreign companies can choose to manage two different sets of accounting records: one that is based on the VAS and another compiled specifically for its overseas head office.

Fulfilling the relevant VAS requirements may prove to be a challenging task for foreign small and medium-sized enterprises that work with limited resources and choose to enter the country to save on manufacturing costs. The VAS requires that accounting records abide by the following:

- All documents must be translated into Vietnamese;

- The Vietnamese Dong must be used as the accounting currency;

- All records must comply with Vietnam’s chart of accounts; and

- Several accounting reports must be printed on a monthly basis (as specified by relevant VAS regulations).

The above documents must be signed by the General Director of the company and affixed with the company seal prior to submission.

The Vietnamese authorities have been working toward strengthening Vietnam’s corporate accounting system, yet enforcement has been relatively lax when it comes to implementing full VAS compliance.

However, it is important to note that provincial tax authorities may cite VAS non-compliance as a basis for collecting additional taxes and recovering paid value-added tax (VAT) refunds.

The tax authorities can also penalize companies for non-compliance in the following ways:

- Disallowing input VAT credits;

- Revoking any corporate income tax incentives; and

- Changing the methods and applicability of corporate income tax collection.

As such, companies are advised to double-check their accounting systems, taking precautions to spot possible VAS non-compliance issues.

Note: This article was first published in June 2013, and has been updated to include the latest developments.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Q&A: Personal Income Tax Finalization in Vietnam

- Next Article Working in Vietnam as an Expat: A Quick Guide