Lang Son And Guangxi: Picking Your China+1 Destination

Vietnam’s Lang Son province has emerged as a promising location for investors looking to diversify or complement their China manufacturing. Manufacturing hubs in Vietnam and China have a different set of strengths and often play a complementary role in the production process. Vietnam Briefing profiles Lang Son and China’s Guangxi and factors that need to be considered when planning a supply chain shift.

The COVID-19 pandemic and the US-China trade war, have disrupted global supply chains forcing businesses to diversify production or seek alternate suppliers while hedging raw inputs. This has been further accentuated as the world’s factory China faces lockdowns and blockades due to a zero covid approach.

While several countries have benefitted from such diversification, Vietnam, which borders China offers immense benefits as the country is well-known for political stability, ideal location, and business-friendly policies.

In this context, Vietnam’s northern Lang Son province is on the rise to become an attractive spot for investors wishing to supplement or diversify their business operations from China.

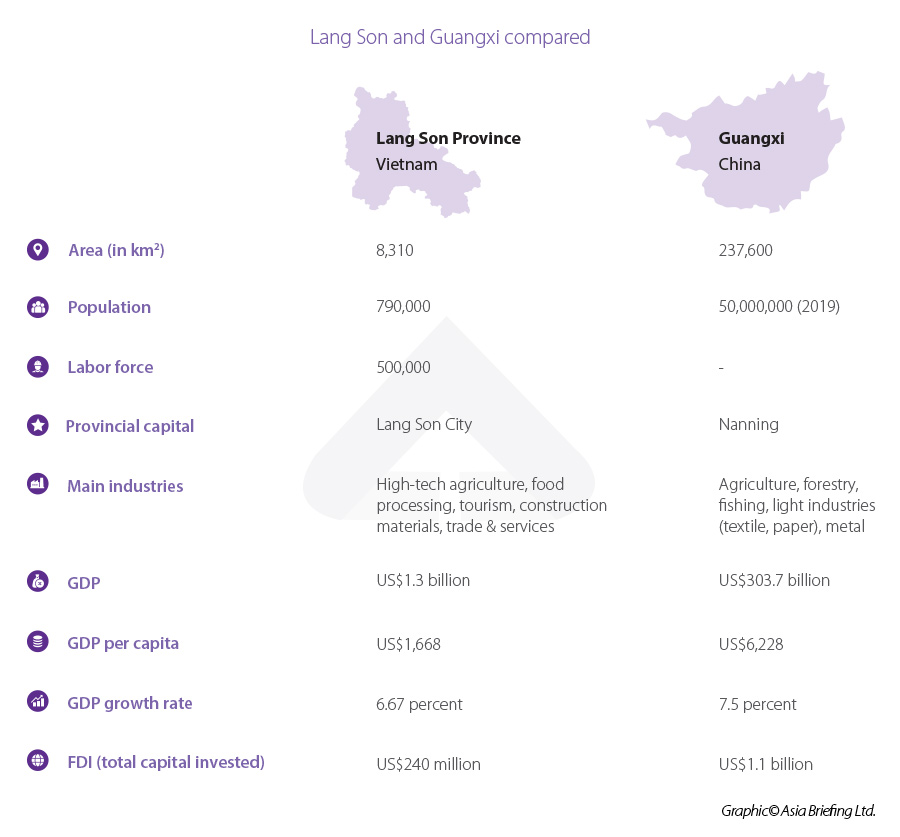

To illustrate this we examine Lang Son and China’s Guangxi which both show significant growth potential, although they have distinct characteristics that should be taken into consideration.

An introduction to Lang Son province

Located in the northeastern mountainous regions of Vietnam, Lang Son province covers an area of 8,310 square kilometers and borders one of Vietnam’s economic centers, Quang Ninh province to the west and Guangxi to the Northeast. Lang Son is known as a cross-border trade hub in the North and a gateway that connects Vietnam with China’s Guangxi and the wider ASEAN region.

As per the People’s Committee of Lang Son due to its railway network and road system connecting economic hubs in Vietnam, the province has emerged as a cargo transshipment gateway to the Chinese market and ASEAN countries.

It has a population of approximately 790,000 and its demographic is dynamic with different ethnic groups inhabiting the province.

Lang Son’s economy has shown noticeable signs of growth, from 8 to 9 percent for the 2011-2018 period and a further 6 to 7 percent projected for 2022 onwards. Three major industries making up the province’s economy include:

| Agro-forestry | Industry-construction | Services |

| 20.3% | 19.7% | 49.7% |

It is worth noting that Lang Son scored well on the Provincial Competitiveness Index (PCI), ranking 36, up 13 places compared to 2020 with a competitive overall point of 63.92. PCI scores of Lang Son have improved extensively year after year (lower scores indicate improvement):

| 2017 | 2018 | 2019 | 2020 | 2021 |

| 53 | 50 | 50 | 49 | 36 |

Lang Son sub-index scores are no less impressive, with the majority of the criteria scoring above 6, most notably the four criteria of time costs, informal changes, proactivity, and law & order:

| Time costs | 7.82 |

| Informal changes | 7.55 |

| Proactivity | 7.60 |

| Law & Order | 7.39 |

Lang Son province’s performance can not be underrated as according to the official report, the 2021 (PAR INDEX) of Lang Son reached 87.11 percent, standing at the 23rd position out of 63 provinces, up 13 places compared to 2020, proving the province’s transparency in legal aspects.

The province has risen to position itself as the next hub for investments in Vietnam. Lang Son currently enjoys more than 40 FDI projects with total investment capital adding up to US$240 million. Lang Son’s authority recently approved a decision promoting 37 investment projects, calling for another US$1.9 billion worth of investment for the 2019-2025 period.

In 2019, Lang Son held an investment promotion conference, namely ‘Lang Son – a successful destination for investors’ on ensuring the most transparent and favorable business environment for investors. As per the Department of Planning and Investment, Lang Son offers tax reductions and exemptions, and business-friendly land rent, in compliance with the government’s laws.

In terms of infrastructure, Lang Son’s upcoming Dong Dang (Lang Son province) – Tra Linh (Cao Bang province) expressway (115 km in length) as well as the improvement of the highway 4B linking to Quang Ninh province can be a strong push for the province’s logistic industry and supply chain, in parallel with the cargo transshipment site project, attracting new investment plans.

Remarkably, Lang Son province is the chosen destination for the construction of three wind power plants by the German-based BayWa r.e. in three districts: Van Quan, Cao Loc, and Loc Binh.

Lang Son is also known for its extensive economic zones. The Dong Dang-Lang Son border-gate economic zone covers an area of 394 km2 and two other industrial parks cover another 761,7 hectares. It is projected that 10 more industrial parks will be established by 2030.

With a business-friendly environment and the geographical advantage of proximity to China, Lang Son bodes well to become an appealing destination for businesses looking for a location.

An introduction to Guangxi

Located in the Southern part of China, Guangxi is bordered by Guangdong province to the east, Yunnan province to the west, and Vietnam to the southwest.

Guangxi is home to the famous Huashan Cliff Paintings, a UNESCO World Heritage Site.

While Guangxi is among China’s less-developed provinces it shows great growth potential as it has partnered with two regional initiatives including the Greater Mekong Subregion Economic Cooperation Program (GMS) and the PRC-Association of Southeast Asian Nations Free Trade Area.

In terms of infrastructure, Guangxi enjoys both deep-water seaports and land ports at its international borders. The region also has an extensive expressway system that links Guangxi’s seaport with Yunnan, Guizhou, and its land ports at the border with Vietnam.

The region’s pilot free trade zone (FTZ) has been a magnet for foreign investments. Up to 194 foreign-funded enterprises were established, 40 of which were from the pilot FTZ in 2019. The contractual foreign investment was worth US$ 2.68 billion in 2019, an increase of 56.4 percent year on year. Guangxi pilot FTZ is projected to become a world-class economic playground that promotes China and ASEAN partnership in trade.

Guangxi’s economy is dependent on three major zones, each focusing on specific industries:

- Nanning Area: Modern service sectors such as financing, intelligent logistic, culture, and media;

- Qinzhou Port Area: Industries such as port logistics, international trade, eco-friendly chemicals, components for new energy cars; and

- Chongzuo Area: Cross-border trade/logistics/financing/tourism/labour service.

According to government statistics, in 2021, Guangxi’s profits of industrial enterprises reached 106.5 billion yuan, up 41.2 percent year on year.

Lang Son and Guangxi – Deciding your China+1 destination

It is noteworthy that in February, leaders from Vietnam’s northern provinces of Cao Bang, Lang Son, Quang Ninh, and Ha Giang signed a memorandum of understanding (MoU) with Guangxi authorities on future partnerships for the 2022-2026 period. This will generate a favorable environment for businesses operating in Guangxi looking to supplement their business operations in Vietnam. As mentioned earlier, with China and Vietnam in different stages of development, the business relationship is complementary rather than competitive.

Lang Son province is also the first point of Vietnam in the Nanning-Lang Son-Hanoi– Hai Phong and the Nanning-Lang Son-Hanoi-Ho Chi Minh City-Moc Bai economic corridors, which facilitates business operations of foreign investors, making the province an attractive option for a China+1 location.

Thanks to abundant and competitive labor rates as well as a stable political environment, Vietnam’s Lang Son province is a promising location to be considered for businesses looking to diversify their operations from manufacturing hubs in China.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

We also maintain offices or have alliance partners assisting foreign investors in Indonesia, India, Singapore, The Philippines, Malaysia, Thailand, Italy, Germany, and the United States, in addition to practices in Bangladesh and Russia.

- Previous Article Vietnam’s Dong Nai Province: Investment Hub of the South

- Next Article Vietnams Handelsdiversifizierung und die China Plus One-Strategie