How to Terminate an Employee in Vietnam

Terminating an employee can be challenging for foreign investors in Vietnam. Vietnamese labor law is generally considered employee friendly and the termination process must be based on statutory grounds, subject to formal requirements and procedures.

The Vietnamese labor law applies to all employers working in Vietnam under labor contracts regardless of whether such employees are Vietnamese or foreign nationals.

However the law does not apply to foreign national working in Vietnam via an internal company transfer under a foreign labor contract.

To mitigate the risks associated with labor retrenchment and to maximize flexibility in hiring, it is of significant importance for employers in Vietnam to understand the circumstances under which termination of contracts can be achieved as well as the financial obligation that may arise in these situations.

What are the contract termination triggers?

Following the establishment of a labor contract between an employer and an employee, there are a number of events which can trigger, or be used to trigger, the contract’s termination. The following are some of the most widely seen contract termination triggers currently outlined in Vietnam’s labor code:

- The labor contract expires;

- The work stated in the contract has been completed;

- Both parties agree to terminate the labor contract;

- The employee reaches the legal age of retirement;

- The employee is sentenced to prison;

- The employee dies;

- The employee is ruled to have lost the capacity to act in a civil capacity;

- Layoffs related to economic conditions or structural changes to the company including merger, acquisition, consolidation, or division;

- Unilateral termination on the part of the employee; or

- Unilateral termination on the part of the employer

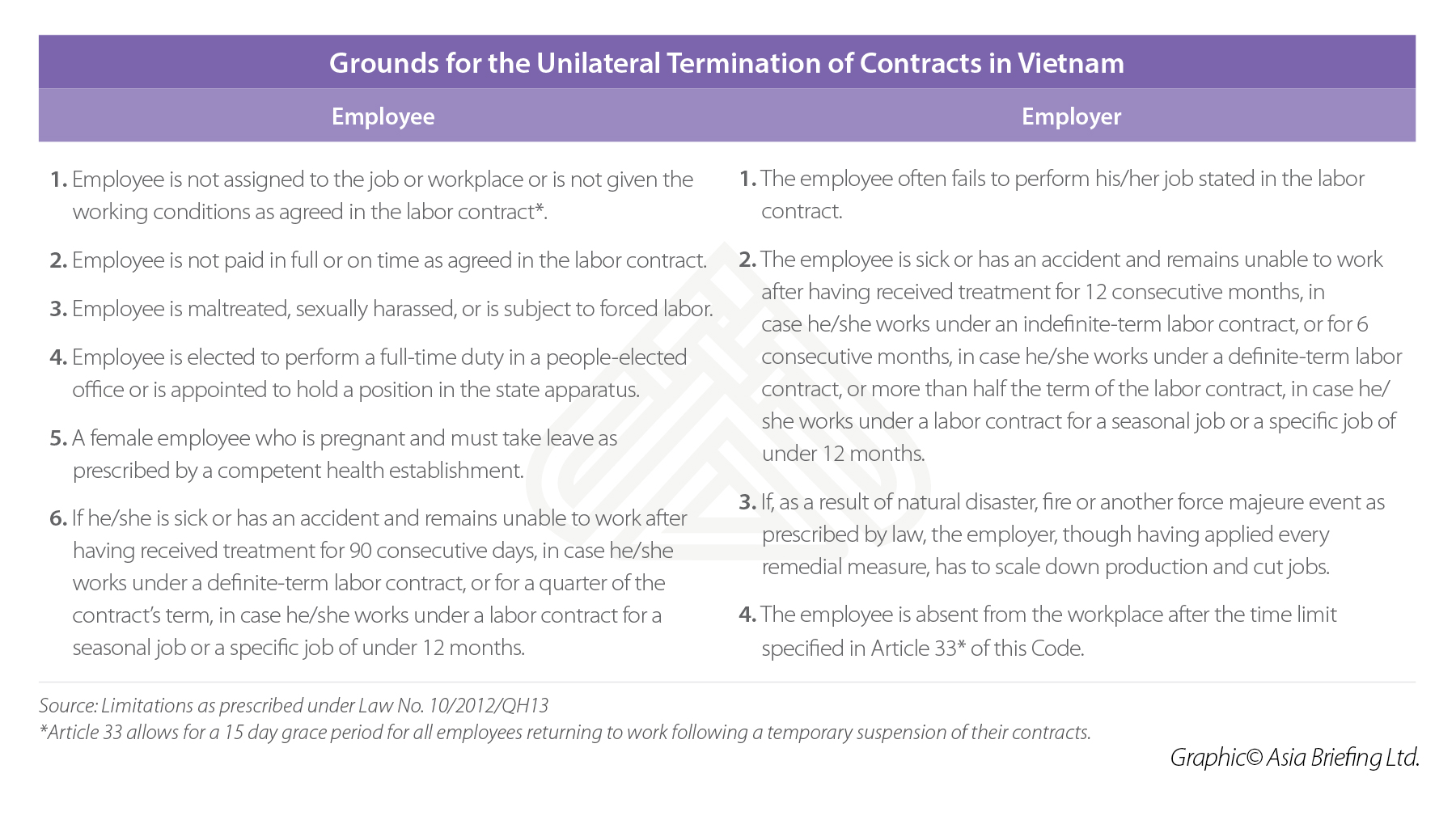

Grounds for unilateral termination

Of all the categories of termination that are listed above, unilateral termination of contracts should be watched closely. Primarily to protect operations from turnover, but also to maximize staffing opportunities, it is important for employers to understand the circumstances under which unilateral termination of work contracts – both from an employer and employee perspective – may occur.

Notice

Both employers and employees are required to give notice to their counter party if they wish to terminate a labor contract pursuant to one or more reasons listed above. The length of the notice period differs slightly between employers and employees and is dependent on the type of contract that both parties are signatories.

Severance and payment in Vietnam

If a labor contract is terminated, employers may be liable for severance payment to the employee in question. The nature of severance payment is dependent on the salary of a given employee, the amount of time that the employee in question has been working in their current position, and the amount of time the employee has been covered under social insurance.

Termination compliance for employers

When terminating employees, employers will be required to notify the employee in question in accordance with the schedule that is outlined above. As indicated above, at least 15 days’ notice must also be given to workers whose services will no longer be engaged following the expiry of a definite term labor contract.

Following the last day of an employee’s work at the company in question, the employer will have seven days to make any and all payments pursuant to severance or job loss benefits outlined below.

Severance triggers and eligibility

Eligibility for severance payments is open to all employees who have been working for a company for 12 months or longer. Severance payments will be required in instances where an employer or employee can prove that one or more general termination triggers or unilateral termination provisions have occurred during employment.

Under the Vietnamese Labor Code, severance compensation shall amount to half a month’s wages for every year that the employee has been working. For example, an employee that had been with a company for three years would be eligible for one and a half months’ pay.

Calculating wages

The level of pay that is to be paid to the employee will be calculated by looking at the payments during the preceding six months that are outlined in the labor contract.

Social insurance deductions

It should be noted that employers may be eligible to deduct social insurance payments from the total severance payout. To ascertain the conditions and specifics surrounding these deductions, it is recommended that officials and seasoned investment professionals be consulted for information on the latest official guidance on the issue.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article New Minimum Basic Salary, Social Insurance Rates in Vietnam

- Next Article 越南政府对中小企业的激励措施——两份新通告