FDI in Vietnam: A Year in Review and Outlook for 2021

- Despite the effects of COVID-19, Vietnam’s GDP grew at 2.91 percent and recorded positive growth in key areas of industrial activity.

- In the first 11 months of 2020, foreign investors invested US$17 billion in Vietnam with a significant portion of these projects targeted at manufacturing, processing, real estate, and electricity production and distribution.

- Efficiency gains and consumer demand were key components of Vietnam’s investment attractiveness. Going forward, these could be supplemented by an expanding digital economy as well as Vietnam’s participation in multiple regional and global trade agreements.

Despite the negative socio-economic consequences of COVID-19, Vietnam is one of the few countries that recorded positive economic growth in 2020. As per the General Statistics Office (GSO) Vietnam’s GDP increased by 2.91 percent in 2020. This reflects two key factors: the relative success in containing the health and business risks of the pandemic, and the ability of the country to keep investor confidence high.

As per the GSO, industrial activity in 2020 expanded by 3.3 percent. Sub-sectors such as construction, utilities, and manufacturing all recorded positive growth rates. On the other hand, services were negatively impacted by mobility constraints and reduced spending. For instance, the transportation and hospitality sector contracted by 1.8 percent and 14.6 percent respectively. Therefore, in 2020 the economic growth of 2.91 percent was asymmetrically distributed.

Apart from asymmetric gains, another key component of Vietnam’s 2020 economic growth has been the role of foreign capital in the country. FDI project value in the first 11 months of the year was estimated at US$17 billion, bringing the total accumulated FDI stock value to US$382 billion across 32,915 projects.

Throughout the year, the activity of foreign investors reflected three key trends in 2020 that are likely to carry forward into 2021:

1. Trade-intensity of FDI

Across the global economy, the COVID-19 pandemic negatively affected trade through low demand, and supply chain disruptions. Despite these effects, Vietnam’s export and import turnover (goods trade) was US$543 billion, a 5 percent annual rise. Exports were particularly significant in this increase, with an estimated export value of US$281 billion.

Alongside this increase in export-import activity, the trade intensity of FDI also increased for the first time in ten years. Foreign firms played a significant role in the export and import of goods and services. In goods trade, for instance, the FDI sector accounted for 72 percent of total export turnover and 63 percent of import turnover. This most likely reflects FDI preference for trade-intensive sectors such as manufacturing and crude oil and positive effects from numerous trade agreements signed recently including the EU-Vietnam free trade agreement (EVFTA) and the UK – Vietnam FTA.

2. Efficiency gains and consumer demand: Pillars of Vietnam’s investment attractiveness

As the table below shows, the manufacturing and processing sector accounts for 48 percent of total registered investment capital in the country. This position is followed by US$60 billion in real estate, US$28.7 billion in electricity production and distribution, and US$ 12 billion in accommodation and food services. Other notable FDI sectors include construction, wholesale, transport, mining, education, and information technology.

This wide range of sectors indicates a wide range of possible sources of Vietnam’s FDI competitiveness. The domination of the manufacturing and processing sector reflects the efficiency gains offered by Vietnam to foreign firms. An increasing number of firms have shifted their manufacturing operations to Vietnam or have adopted a China + 1 model. Recently, the government has focused investment attraction in supporting industries in some regions, given the importance of supply chain efficiency in attracting manufacturing sector FDI. If this trend is to continue, sources of inefficiency such as infrastructure bottlenecks, and land availability will need to be addressed.

Additionally, a number of sectors in the aforementioned list are consumer-facing. Examples include food services, retail, transportation, and education. Consumer demand growth is reflected in the 3.2 percent annual increase in the consumer price index in 2020. With a population of over 96 million, the majority of whom are under the age of 35, it is expected that the middle-class in Vietnam could double by 2026. This indicates future opportunities for foreign investors in consumer-facing sectors.

3. Regional sources of investment

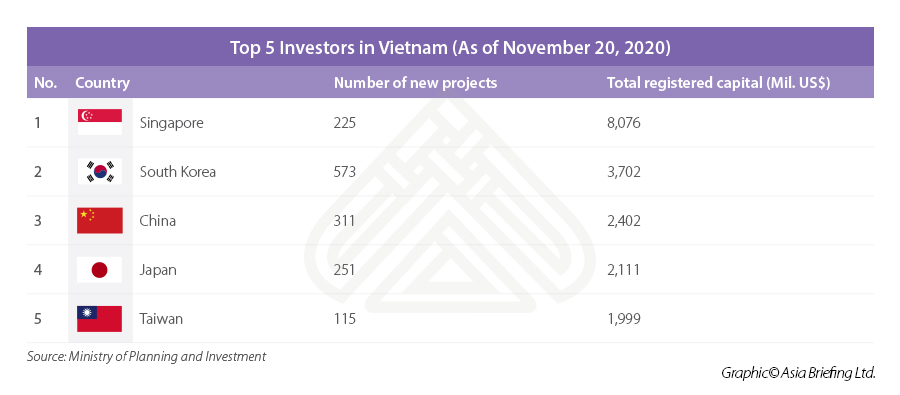

As of November 2020, there were 109 countries and territories with investments in Vietnam. Singaporean firms have invested US$8 billion in the country, the largest, beating South Korea from last year. South Korean firms came second (invested capital US$3.7 billion), followed by China (investment capital US$ 2.4 billion). In addition, multiple firms from Japan, Thailand, and Taiwan are also active in the country.

In recent years, Asian countries have risen to represent a bulk of Vietnam’s FDI. In 2020, China’s rise as an FDI partner is particularly noteworthy. In early 2020, Chinese firms negotiated and gained approval for major projects despite tense relations between the two countries. Japanese MNCs such as Toyota, Honda, Canon, and Sumimoto have historically had a presence in Vietnam.

A new set of Japanese firms such as AEON, Uniqlo, and Mizuho have recently expanded their presence in the Vietnamese market. A recent survey found that Japanese firms rated Vietnam as the most promising FDI destination in 2020. Similarly, Thai firms registered twice as many projects in 2020 than they did in 2019 attracted by the investment climate and Vietnam’s participation in multiple regional trade agreements.

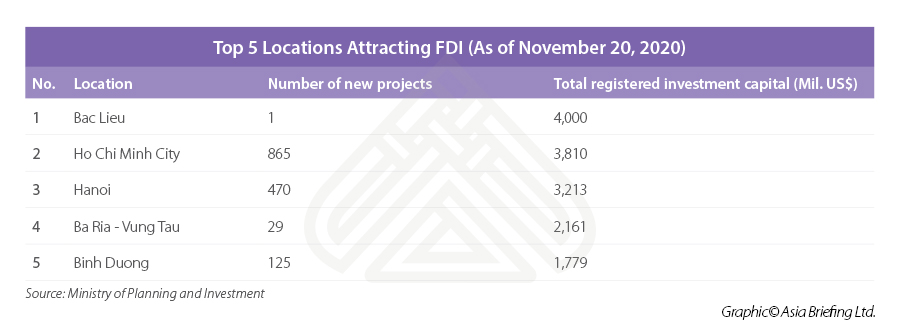

Bac Lieu province continued to be the largest receipt of FDI due to a significant liquified natural gas-fired power plant project worth approximately US$4 billion. However, Ho Chi Minh City came second followed by Hanoi taking the latter’s title.

Outlook for 2021

While these trends are likely to continue into 2021, the year ahead could also lead to structural shifts and changes in investment patterns.

For example, the rise of consumer-facing FDI is contingent on the growth outlook for consumer spending and the return of mobility particularly in sectors such as hospitality. In addition, Vietnam’s rapidly evolving digital business landscape could impact consumption trends.

By 2025, Vietnam’s digital economy could expand to US$52 billion. Sub-sectors of the digital economy such as e-commerce, digital banking, and online gaming represent nascent and high-growth areas of consumer demand that investors could target. Therefore, while the Vietnamese consumer remains a driver of FDI, it is possible that the routes foreign firms need to take to reach the consumer could change.

The trade intensity of FDI is also likely to expand. In the case of Japanese and Thai firms, trade agreements and access to external markets is a top priority for FDI participants. Vietnam’s export and import industries both in the goods and services sectors could become lucrative targets for investors. In addition, agreements with countries beyond Asia could attract a new set of investors. For example, research suggests that 72 percent of EuroCham members are of the view that the EU-Vietnam FTA could lead to a surge in European firms investing in Vietnam.

For the year ahead, Vietnam remains a strong candidate for investment from ASEAN and beyond. Given its investor-friendly policies, relative economic and political stability, cost efficiency, and consumer demand prospects, Vietnam is likely to continue gaining from supply chains restructuring in Asia in addition to attracting a new range of investors in terms of geography and sectors.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article How Our Business Matchmaking Services Can Help Your Vietnam Market Strategy

- Next Article Investing in Vietnam’s Quang Nam Province – 3 Competitive Factors