FDI, Export Targets to Propel Sustainability Adoption in Vietnam’s Garment and Textile Sector

The stakes are high for Vietnam’s garment and textile sector as key exports markets and competing producer markets intensify their push for green targets, influencing brand appeal to consumers and sourcing decisions by global fashion retailers.

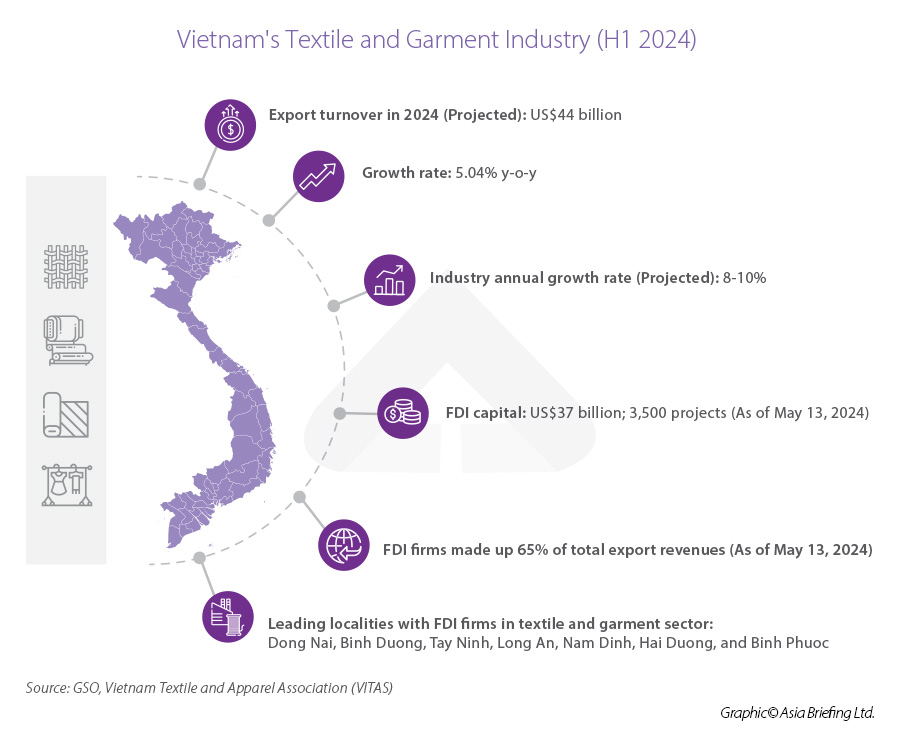

According to the Vietnam Textile and Apparel Association (VITAS), as of the end of May 2024, Vietnam’s textile and garment sector had attracted over US$37 billion in foreign direct investment (FDI). This substantial inflow underscores the sector’s potential, particularly as global markets shift towards sustainable development.

Vietnam textile and garment businesses are now compelled to strategize a green transition to ensure they retain competitiveness in the global fashion and textile market, which has doubled down on the pivot to sustainability. Maintaining unrestricted market access may hinge on adopting green practices and improving the environmental, social, and governance (ESG) profiles of suppliers.

READ: ESG Strategy a Key Focus Area for Foreign Businesses in Vietnam

Vietnam’s textile and garment sector: Overview and challenges

After a year of negative growth in 2023, Vietnam’s textile and garment sector is showing signs of recovery. The General Statistical Office (GSO) reported a 4.6 percent increase in the sector’s export value, reaching US$16.5 billion in the first half of 2024. The month of June alone recorded a 2 percent monthly rebound to US$3.16 billion, driven primarily by the recovery of the US market.

The growth in the prices of various fibers and the value of imported fabrics are key indicators for improving order volumes.

Additionally, Vietnam’s purchasing managers index (PMI) in June had spiked to 54.7 points, another optimistic sign for manufacturing activities going into the second half of 2024.

Despite these positive trends, the garment and textile sector face challenges. Currency depreciation among key competitors like Bangladesh, Indonesia, and Mexico is hampering Vietnam’s price competitiveness. Additionally, a 6 percent increase in the minimum wage from July 2024 is expected to pressure company profit margins, as sales prices remain stagnant.

Rapid enforcement of sustainable policies worldwide

The global shift towards prioritizing sustainable growth is accelerating, with enterprises and industrial organizations advocating for greener business models and governments issuing relevant green policies.

The EU: Transition from voluntary to mandatory compliance

As of the end of 2023, the European Union alone discussed up to 16 laws related to fashion and textiles, which are expected to be effective from 2024. These legal documents will regulate the entire fashion value chain from products to marketing designs, impacting consumers and companies globally.

These efforts indicate the shift from voluntary policies to mandatory obligations on the part of businesses and supply chain vendors with regards to sustainable development within the EU. Textile and garment manufacturers selling to the EU should monitor potential changes in EU regulations to better approach this market:

- EU Strategy for Sustainable and Circular Textiles: It was introduced in June 2023 to achieve climate neutrality. The strategy concerns producing and consuming textiles while recognizing the sector’s importance. It implements commitments made under the European Green Deal, the Circular Economy Action Plan, and the European industrial strategy.

- Digital Product Passport (DPP): The DPP is a regulatory framework for implementing transparency on product information and accelerating the transition to a circular economy. It will be mandatory for most end-use and intermediate products sold in the EU by 2030, meaning all firms selling products in the EU will be affected by the DPP.

- EU Green Claim Directive: The directive aims to prevent greenwashing by requiring companies to reinforce their environmental commitments with evidence verified by independent bodies.

- Waste Framework Directive (WFD): Extended producer responsibility (EPR) schemes were proposed in the 2023 revision to the directive. EPR will apply mandatory fees for EU fashion brands and textile producers to fund the collection and treatment of textile waste. Effective 30 months after WFD comes into force, the EPR’s fee structure will be based on the circularity and environmental performance of textile products (known as eco-modulation). EU ministers have agreed to include microenterprises in their scope.

- Corporate Sustainability Reporting Directive (CSRD): Companies must report social and environmental information using the CSRD’s standardized framework. Non-EU companies that generate over €150 million (US$163 million) in the EU market will also have to report.

US sustainability regulations

In the US, several states have enacted sustainability regulations:

California Senate Bill No. 253 (passed)

Senate Bill No. 253 was approved by the California governor and filed with the Secretary of State on October 7, 2023. This bill adds Section 38532 to the Health and Safety Code, relating to greenhouse gases, and makes an appropriation for its implementation. The section is officially known as the Climate Corporate Data Accountability Act. It requires businesses operating in California with annual revenues exceeding US$1 billion to report their greenhouse gas emissions across all three scopes:

- Scope 1 emissions: Direct greenhouse gas emissions from sources owned or directly controlled by the reporting entity, including but not limited to fuel combustion activities.

- Scope 2 emissions: Indirect greenhouse gas emissions from the consumption of purchased electricity, steam, heating, or cooling, regardless of location.

- Scope 3 emissions: Indirect upstream and downstream greenhouse gas emissions not included in Scope 2, from sources not owned or directly controlled by the reporting entity. This includes, but is not limited to, emissions from purchased goods and services, business travel, employee commutes, and the processing and use of sold products.

New York Sustainability and Social Accountability Act (proposed)

Also known as the New York Fashion Act, Senate Bill S4746B proposes that fashion sellers in New York be held accountable to standardized environmental and social due diligence policies and establish a fashion remediation fund. Any apparel or footwear company doing business in New York with an annual global revenue of US$100 million is subject to this bill.

As of July 2024, the bill lies with the Senate Committee on Consumer Protection. Versions of the bill have been stuck in legislation for two years.

Business actions for a greener textile and garment sector

The Fashion Industry Charter for Climate Action, an initiative spearheaded by UN Climate Change, aims to guide the fashion sector towards achieving net-zero greenhouse gas emissions by 2050. As of February 22, 2023, 99 signatories, including 68 brands and retailers and 31 manufacturers, have pledged their support, surpassing previous industry-wide commitments. The charter aims for a 30 percent reduction in greenhouse gas emissions by 2030 and sets out a plan for achieving decarbonization within the fashion industry by 2050.

The charter aligns with the three scopes of emissions outlined in the Greenhouse Gas Protocol Corporate Standard:

- Scope 1: Direct greenhouse gas emissions from sources owned or controlled by the company.

- Scope 2: Indirect emissions from the generation of purchased electricity consumed by the company.

- Scope 3: Other indirect emissions resulting from the company’s activities but occurring from sources not owned or controlled by the company. Scope 3 includes 15 optional reporting categories that cover all other indirect emissions.

Signatories to the charter are increasingly reporting their “operational emissions” data under Scope 1 and 2 and are verifying this data through third-party verification. Additionally, there has been a 20 percent increase in signatories committing to disclose their Category 1 (purchased goods and services) emissions within Scope 3. In 2022, 77 percent of signatories provided their Scope 3 estimates through the corporate carbon footprint platform (CDP).

Prospects in Vietnam’s textile and garment industry

According to VITAS, Vietnam hosts approximately 3,500 foreign-invested textile and garment projects with a combined value of US$37 billion. These projects are crucial for boosting the sector’s production capacity and significantly enhancing the country’s export turnover. Foreign-invested enterprises play a vital role in Vietnam’s textile and garment industry, contributing to 65 percent of the sector’s total export revenue.

Major investors in this sector come primarily from South Korea, Taiwan, Hong Kong, and China, with South Korea being the largest foreign investor. The expansion of FDI has accelerated the growth and capacity of the local textile and garment sector. Vietnam, now the world’s third-largest textile and garment exporter, trails only China and Bangladesh.

To stay competitive, especially as major export markets like the EU and the U.S. impose higher environmental and sustainability standards, Vietnam is increasingly pressured to implement sustainability practices within its garment and textile sector. This creates huge potential for green investments—from adopting industry best practices that focus on the circularity of textile products and EPR protocols to upgrading key infrastructure to address waste collection and treatment and recycling.

Notable developments in Vietnam’s textile and garment industry

Gaining a competitive edge with high-value products

A recent survey by the US Fashion Industry Association (USFIA) has highlighted Vietnam’s competitive edge over China and Bangladesh in producing high-value products, attributed to investments in advanced machinery and skilled labor. Vietnamese firms are also noted for their ability to quickly produce a wide range of products, thanks to their substantial investments in both technology and workforce expertise.

Germany supports Vietnam’s pilot projects on green technology

On June 18, 2024, the Green Tech Landing Pad initiative, supported by the German government, unveiled five pilot projects focused on green technology in Vietnam’s textile and garment industry. The German Corporation for International Cooperation GmbH (GIZ) has been collaborating with the National Innovation Center (NIC) and Vietnam’s Ministry of Planning and Investment to advance this initiative.

These pilot projects demonstrate a strong commitment to sustainable practices aligned with European market standards. The technologies include IoTeamVN’s energy management solution, Enedig Kft’s cloud-based labor cost calculation tool timeSSD®, Hoang Ha’s waste heat recovery system, ECOSOI’s pineapple-based fabrics and fibers, and BlockTexx’s recycling solutions for polyester and cellulose.

Conclusion

Vietnam’s textile and garment sector is globally competitive, as the country has become a prime base for businesses and investors seeking access to high-value markets like the EU and U.S. Yet, several major export markets have begun to prioritize lowering greenhouse gas emissions and promoting extended producer obligations to promote less waste and a more circular economy.

Vietnam’s increasing commitment to a green transition in the textile and garment sector is a testament to these shifts towards sustainability, which is crucial for maintaining its global appeal.

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, China, and India. For editorial matters, contact us here and for a complimentary subscription to our products, please click here. For assistance with investments into Vietnam, please contact us at vietnam@dezshira.com or visit us at www.dezshira.com.

Dezan Shira & Associates assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. We also maintain offices or have alliance partners assisting foreign investors in China, Hong Kong SAR, Dubai (UAE), Indonesia, Singapore, Philippines, Malaysia, Thailand, Bangladesh, Italy, Germany, the United States, and Australia.

- Previous Article Prospects for Environmental Technology Investors in Vietnam

- Next Article Tax Audits for Representative Offices in Vietnam