Due Diligence in Vietnam: Legal and Financial Aspects in the M&A Process

Mergers and Acquisitions (M&A’s) are an increasingly popular route for foreign investors looking to begin operations in Vietnam – and due diligence is a key component of the M&A process.

While there are several aspects to consider in a due diligence – such as the company’s reputational profile, strategic position in the market, and assets – we focus on legal and financial due diligence because they represent the starting point for most investors.

Before commencing due diligence on a target company, the acquiring company typically signs an agreement such as a Memorandum of Understanding (MoU) with the target company. The acquiring company may also make a deposit to confirm that the deal is serious enough for the target company to spend time to prepare and release documents needed for the due diligence.

Legal and financial due diligence may take several months, depending on the size of the company being acquired, as well as the location where it is based. This work is typically conducted by a third-party professional services firm.

Foreign investors should seek to select a firm that has an office in-country with staff fluent in both Vietnamese and the language spoken at the investors’ headquarters. This profile will help ensure your service provider can work more efficiently during both on-site visits and communication with overseas managers.

Legal due diligence of a target company

During the legal due diligence process, service providers may ask to review the target company’s documents, certificates, qualifications, and licenses. These may include:

- Business licenses;

- Approval certificate;

- Company charter;

- Meeting minutes of Board of Management (BoM); and

- Shareholders and capital contribution of shareholders.

Ownership

The percentage of foreign ownership to the target company based on applicable local laws, World Trade Organization (WTO) and other free trade agreements (FTAs) where Vietnam is a member will also need to be determined before the acquisition.

Contracts

Commercial contracts, loan agreements, MoUs, and non-disclosure agreements signed by the owners of the target company.

Litigation

Any ongoing litigation of the target company may affect its value. A thorough review of the litigation status is recommended.

Financial due diligence of a target company

Financial due diligence allows the investor to audit the target company and analyze the company’s earnings, its working capital needs, as well as sales and operating expenses.

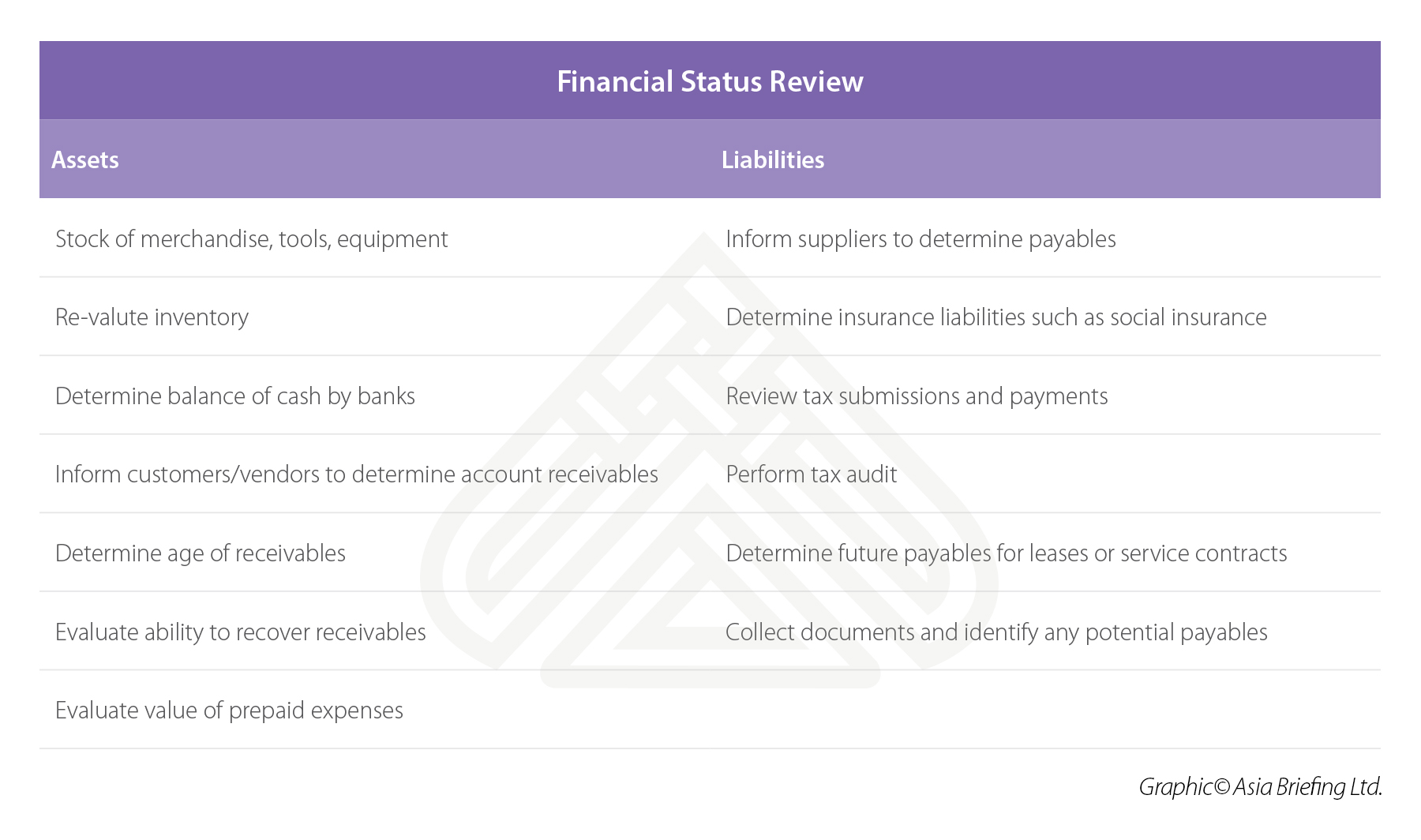

Financial diligence can be broken down in two parts: assets and liabilities.

Internal financial statements

Review all of the target company’s documents related to revenue, expenditure and other accounts. This should be done to ensure the documents are factual and to identify any discrepancies.

Internal and tax reports

Analyze the target company’s internal and tax documents to see if there are any discrepancies between internal reports and tax reports. This review should evaluate relevant risks due to any discrepancies between the tax declaration and the actual status.

Other items that may need to be reviewed are capital contribution, cash on hand, cash flows and any other key financial indicators.

Timeframe and reporting

Once all the documents have been reviewed by the service provider, it submits a report, with details outlining to see if the target company is in compliance with all the rules and regulations in Vietnam.

At this stage, the third party can advise on any issues that need to be resolved between the acquiring and target company. Typically, the entire process of legal and financial due diligence in Vietnam can up to three months or more.

Additional M&A considerations

The acquiring company should also prepare to have their registered business lines reviewed to see if they comply with applicable local laws and regulations. In Vietnam, this could apply to specific products such as automobile parts, pharmaceuticals, etc.

It is also advisable to consider reviewing the target company’s business lines for a cost-benefit analysis, any intellectual property (IP), and the company’s online profile for reputational risk profiling.

The acquisition company may also consider studying tax incentives that could be available for an investment while conducting a due diligence against the target company.

An M&A can be a complex process. But according to Dezan Shira & Associates Business Advisory Services Manager Tam Nguyen , “investors can manage their risks and determine whether the potential acquisition will be fruitful with the right due diligence.”

While investors can choose different market entry options to enter Vietnam, the M&A gives investors access to consumers, locations, and distribution channels. This is also a suitable option for investors that may be time-constrained and without needing to set up a company in Vietnam.

In addition, an M&A can provide a strategic advantage for the investors.

For example, factories are increasingly being sold out as investors move operations to Vietnam. A foreign company acquiring a domestic one which already has factories and machinery would give it an edge over competitors. This may also give the foreign company access to a local network as well as a trusted supplier network.

All of these factors are likely to keep the M&A space busy in the medium term as Vietnam continues to attract record amounts of FDI.

About Us

Vietnam Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Hanoi and Ho Chi Minh City. Readers may write to vietnam@dezshira.com for more support on doing business in Vietnam.

- Previous Article Made in Vietnam: Draft Regulations on Rules of Origin

- Next Article Vietnam Cuts Enterprise Registration Fees