Vietnam Construction Material Sector: Growth Drivers and Challenges

A surge in infrastructure projects is boosting the demand for construction material in Vietnam. Here’s what construction firms need to know to take advantage of this opportunity.

Public investment is a major driver of Vietnam’s economic growth and is expected to positively impact various industries, including the building stone sector. However, challenges such as a sluggish real estate market and the suspension of projects could hinder the sector’s expansion.

According to Statista, Vietnam’s hardware and building materials market is projected to generate US$13.19 billion in revenue in 2024, with an annual growth rate of 2.57 percent from 2024 to 2028. Additionally, data from Mordor Intelligence estimates that the Vietnam construction market will be valued at US$69.20 billion in 2024 and is expected to grow to US$102.20 billion by 2028, achieving a CAGR of 8.10 percent during the forecast period (2024-2028). Vietnam’s market growth is driven by rising urbanization and infrastructure development.

In this article, we will explore the factors driving demand in the construction materials industry, how foreign enterprises can benefit from this demand, and the challenges they may encounter in this sector.

Demand for construction stones in Vietnam

According to the Ministry of Transport, 21.5 million m3 of construction stone will be needed between 2023 and 2025 for key infrastructure projects. Specifically, it is anticipated that Ho Chi Minh City’s Ring Road 3, Bien Hoa-Vung Tau highway, and Long Thanh airport projects alone will need a collective 8 million m3, a volume equivalent to more than 3,000 Olympic-sized swimming pools.

It may come in even higher than that too. The National Expressway Master Development Plan, approved in 2016, and the Road Network Development Plan for the period 2021-2030, with a vision to 2050, approved in 2021, if realized, could see a vast expressway system developed in the central and southern regions between 2022 and 2030. This will require huge volumes of construction stone, too.

Vietnam policy on mineral extraction for construction materials

On July 24 this year, the Prime Minister of Vietnam issued Decision 711/QD-TTg, implementing the ‘Planning for Exploration, Exploitation, Processing, and Use of Minerals for Construction Materials for the Period 2021-2030, with a Vision to 2050’ (hereinafter, “Decision 711”).

According to this decision, the mineral extraction strategy must adhere to national and land-use plans. Approximately 73,629 hectares of land are estimated to be utilized for mineral exploration and exploitation for construction materials nationwide until 2050, implemented in two phases:

- The land use for the period 2021-2030 is 52,505 hectares.

- The land use for the period 2031-2050 is 21,124 hectares.

The Ministry of Natural Resources and Environment will lead the land use plan implementation in cooperation with ministries, ministerial-level agencies, provincial people’s committees, and other competent authorities.

Per Decision 711, the land use plan must be implemented under the following principles:

Prompt and impact-free execution: Mineral exploitation projects must be executed promptly to return the land fund for other socioeconomic development projects and to minimize the impact of mining areas on local land use plans.

Adjustment for unique purposes in specific mineral areas: In particular mineral areas, the progress of mineral exploration and exploitation projects and their land use plans will be adjusted at the request of provincial people’s committees for specific purposes. These purposes include the execution of urgent and essential projects, such as:

- Public investment and infrastructure projects for national and public interests;

- Projects that mobilize social resources; and

- Renovating and upgrading infrastructure projects serving local socioeconomic development.

The adjustment must proceed based on protecting and developing public assets, ensuring the recovery and protection of mineral resources, and complying with legal provisions.

Specific mineral areas eligible for these adjustments must have large reserves and a wide distribution area and be suitable for exploitation by the open-pit method, such as white sand, minerals for cement, stone for paving, etc.

Regulations

The Law on Minerals

According to Article 30 of the Law on Minerals, organizations and individuals engaged in mineral mining activities must use environmentally friendly technology, equipment, and materials. They must also bear all costs associated with damage to the environment. In this light, before they start mining, they are required to make a deposit for environmental rehabilitation and restoration.

Per this law, foreign investors that want to conduct mining activities in Vietnam must be granted a mineral mining license.

To do so, they must satisfy the following conditions:

- They must have an investment project in the area where reserves have been explored and approved.

- The project must have a plan for human resources, equipment, and appropriate mining methods.

- For hazardous minerals, written permission must also be obtained from the prime minister.

- They must have an environmental impact assessment report or a commitment to protecting the environment.

- They must have equity capital equal to at least 30 percent of the total investment capital of the project.

Organizations and individuals exploiting minerals, including foreign investors, also have the following obligations:

- To pay fees for mineral mining rights, fees for the issuance of mineral mining licenses, taxes, and other financial obligations.

- To protect natural resources, and to implement occupational safety and environmental protection measures.

- To, on the closure of the mine, restore the environment and land to its natural state.

Market access restrictions

There are several conditions that limit foreign firms from entering the market. For example, according to the CPTPP, foreign investment in the mining sector will only be approved if the Vietnamese authorities find the project brings a net benefit to Vietnam. This includes considerations like:

- The impact of the investment project on economic activity in Vietnam, including the impact on jobs and the use of equipment, components, and services made in Vietnam and exported from Vietnam.

- The impact of the project on productivity, economic efficiency, technology development, and product innovation.

- The impact of the project on competition in the same industry or sectors in Vietnam (see also: Vietnam’s Competition Law: Notes for M&A Transactions).

Law on Environmental Protection Tax

The Law on Environmental Protection Tax 2010 provides for a tax on heavily polluting sectors and industries. For mineral resources, the environmental protection tax is collected only on coal. However, Vietnam’s environmental protections are expanding and construction could be impacted at a later date if it were to expand to include construction stone.

Key construction stone quarries in Vietnam

Tan Cang

According to a 2023 report on construction stone in Vietnam produced by SSI Securities, the Tan Cang quarry is likely to be the main source of construction stone for the Long Thanh Airport project, Ring Road 3, and several other projects. This quarry is licensed by Dong Nai province with mining firms permitted to exploit a total area of 400 hectares. Construction stone reserves are estimated at more than 160 million m3. There are currently 10 businesses licensed to operate in the area.

SSI estimates that the demand at Tan Cang’s quarries will increase 28 percent year-on-year as a result of these major projects. The price of construction stone is expected to increase by 8 percent year-on-year at the same time.

Thanh Phu quarries

This area is a key source of construction stone for Vietnam’s southwest region. There are currently nine quarries in the Thanh Phu area. SSI also estimates that demand at the Thanh Phu quarries will increase by 15 to 16 percent year-on-year due to major projects such as the Can Tho – Hau Giang and Hau Giang – Ca Mau expressways. Construction stone prices are expected to increase by 7 percent year-on-year, as well.

Barriers to growth for the construction materials sector

The construction materials sector, alongside the real estate and construction industries, forms a complete value chain that is highly sensitive to economic cycles, often dominating Vietnam’s GDP structure. Despite various efforts from stakeholders following the downturn in late 2022, Vietnam’s real estate market faced significant challenges in 2023.

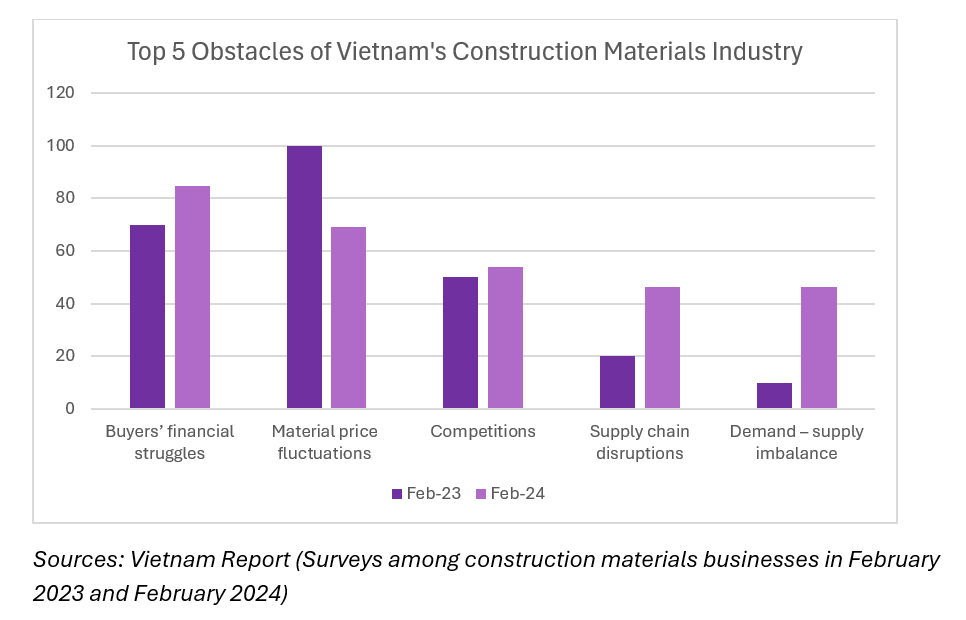

The Vietnam Report, released in February 2024, highlights a notable shift in business perceptions regarding the most significant obstacles in the construction materials sector, as reflected in the Top 10 Construction Material Businesses for 2024. Researchers at the Vietnam Report observed changes in respondents’ opinions on key obstacles to their business this year, with concerns over buyers’ financial health surpassing price fluctuations. The report identified five primary challenges in the construction materials industry for 2024, which we briefly discuss below.

Buyers’ financial struggles

According to the Vietnam Report survey, buyers’ financial constraints due to slow economic growth increased by 14.6 percent in 2024 compared to 2023. With a modest economic recovery, reflected by a growth rate of just 5.05 percent in 2023, there was a lack of improvement in demand, leading to slow payments for real estate and construction materials. In the survey findings, buyers’ poor financial health overtook material price fluctuation as the top obstacle in the construction materials sector, rising to 84.6 percent from 70 percent last year.

Price increase despite subdued market

Although concerns about fluctuations in raw material and construction material prices decreased to 69.2 percent in 2024 from 100 percent last year, construction material prices continue to rise. According to the report, this year’s increased prices are not demand-based but are driven by higher transport costs and fewer production facilities. The high price of construction materials directly affects the cost of construction projects, causing real estate prices to surge. The constant fluctuation of material prices also disrupts construction progress due to capital increases, forcing investors and contractors to recalculate their costs.

Competition

The survey’s respondents recognized competition as their third-placed concern. However, the perception of this challenge remained relatively stable compared to other difficulties, with an increase of only 3.8 percent to 53.8 percent from last year.

Disruption of domestic and international supply chains

The percentage of respondents concerned about disruptions in domestic and international supply chains more than doubled this year, with a 26.2 percent increase to 46.2 percent. The leading causes were geopolitical tensions, disruptions and delays in freight shipments, slumps in transported goods, and potentially doubling shipping rates. Additionally, export taxes on some goods and strict environmental protection standards in developed markets will become barriers, posing even greater difficulties for Vietnam’s construction material export activities.

Imbalance in demand and supply

The imbalance between supply and demand significantly affects construction material prices, with the largest increase rate of 36.2 percent, from 10 percent in 2023 to 46.2 percent in 2024. While there was an oversupply in cement and clinker, the steel industry struggled to catch up with new demand from other sectors outside of construction, such as automobile production.

Sector outlook

Public investment has been the primary driver for the construction materials market since the last months of 2023. The Vietnamese government has launched several key transport infrastructure projects and approved plans for numerous industrial and urban infrastructure developments.

However, the demand for construction materials from public investment alone cannot compensate for the excess supply. Therefore, companies must focus on expanding their domestic market while seeking new export markets to boost product consumption and navigate through this challenging period.

Growth drivers

Need for urban housing

According to the Ministry of Construction, Vietnam’s urban population is currently over 40 percent and is projected to reach 45 percent by 2030, necessitating an additional 70 million square meters of housing annually. This growth will drive high demand for housing units in major cities and industrial zones over the next few years, boosting both the residential construction segment and the overall construction market. The pandemic’s impact on industrial real estate has attracted new investors, including both domestic developers like Vinhomes and Thanh Cong Group, and foreign developers such as JD.com, Fraser, and ESR. Investment funds have also joined, with entities like Actis investing in local industrial park operators.

Concurrently, the government also acknowledges the crucial role of sustainable construction in its long-term development and has taken action to implement it. By issuing guidelines for green building certification, the Ministry of Construction (MoC) has promoted sustainable practices among developers, leading to an increase in green buildings across the country. According to the MoC, Vietnam’s housing demand is projected to surge by 70 million square meters yearly, equivalent to 17,500 buildings of 30 floors by 2030. The number of green building projects under construction is 381 and is projected to increase to 582 by 2030.

Infrastructure development

In September 2021, Vietnam’s government approved a road development plan for 2021-2030, aiming to expand its expressway network to nearly 5,000 kilometers by 2030, up from 3,841 kilometers in 2021. The plan includes constructing 172 national highway routes totaling 29,795 kilometers, an increase from 5,474 kilometers in 2021, and building 3,034 kilometers of coastal roads to connect 28 cities and provinces.

Meanwhile, changes in policies are also expected to initiate additional demands for some building materials. For instance, the Ministry of Transport has directed investors to increase the use of reinforced concrete overpasses for expressway projects in the design stage, especially in areas requiring flood drainage, weak soil areas, and areas lacking roadbed materials.

Top 10 construction materials business of 2024

This year’s list of Vietnam Report names leading firms across segments of the construction materials business, showing Vietnam’s strong portfolios with a wide range of products:

- Hoa Phat Group: Steel production is the core of Hoa Phat’s business, accounting for 90 percent of its It is one of the largest steel producers in Southeast Asia with a capacity of 8.5 million tons of crude steel per year.

- Viglacera Corporation: Viglacera’s main business sectors are real estate and building materials (building glass, tiles, sanitary ware, terracotta, etc.). Its products are exported to over 40 countries worldwide.

- VICOSTONE Quartz Surfaces: VICOSTONE is a pioneer in manufacturing quartz-based engineered stones in Asia. With a global distribution network, VICOSTONE Quartz Surfaces are now available on all continents.

- Tien Phong Plastic JSC: The company provides PVC, HDPE, and PP-R pipe with TQM Quality Management System and gets quality management standards following ISO 9001:2000.

- An Cuong Wood Working JSC: An Cuong is a manufacturer and supplier of materials, solutions, and industrial wood furniture. The company’s main strength is its wood products, which it exports to its key markets, including ASEAN, Australia, Canada, Europe, Japan, and the U.S.

- Hoa Sen Group: The group manufactures and trades steel sheets and is the leading exporter of steel sheets in Southeast Asia. Hoa Sen currently owns a 10-factory system nationwide that produces and supplies steel sheets, galvanized steel, steel pipes, hot-dip galvanized pipes, and plastic pipes.

- Binh Minh Plastics JSC: The company gains its reputation in the plastic material industry, with the capability to produce 140,000 tonnes of plastic pipes and fittings annually.

- Siam City Cement (Vietnam) Limited. – INSEE Vietnam: A member of Siam City Cement Public Company Limited (SCCC), it manufactures cement, construction mortar, and conwood and provides leading waste management services in the South of Vietnam.

- Vicem Ha Tien Cement JSC: VICEM Ha Tien owns two manufacturing plants and three grinding terminals. Its total production capacity includes over 4.5 million tonnes of clinker and 7,780 million tonnes of cement per year, which contributes 45 percent of Southern Vietnam’s demand.

- Ton Dong A Corporation: The company manufactures and distributes cold rolled coil, galvanized (GI), pre-painted galvanized (PPGI), steel pipe, galvalume (GL), pre-painted galvalume (PPGL) for construction, infrastructure, and home appliances.

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, China, and India. For editorial matters, contact us here and for a complimentary subscription to our products, please click here. For assistance with investments into Vietnam, please contact us at vietnam@dezshira.com or visit us at www.dezshira.com.

Dezan Shira & Associates assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. We also maintain offices or have alliance partners assisting foreign investors in China, Hong Kong SAR, Dubai (UAE), Indonesia, Singapore, Philippines, Malaysia, Thailand, Bangladesh, Italy, Germany, the United States, and Australia.

- Previous Article Regulation of Vietnam’s Real Estate Market: New Laws in Effect from August 1, 2024

- Next Article Northern Vietnam Industrial Parks: Benefits and Challenges