Choosing the Right Location for Your Business in the Asian Market

Investors should utilize a multi-country benchmarking service to accurately identify the most advantageous destinations to set up in the Asian market. This will allow them to evaluate the comparative strengths and weaknesses of respective countries based on their enterprise’ business undertaking, sector focus, and unique requirements.

Investors looking to invest in Asia are often faced with challenges and unfamiliarity with the region. South Asia or Southeast Asia stand out as compelling options. The proximity to China, relatively low costs, and preferential policies can make these regions particularly attractive, especially if you are coming from the more established Chinese market or setting up a China-complementary (i.e. ‘China-plus-one’) facility. But how does one go about selecting the ideal location or locations for their next investment destination?

Over the past few years, Vietnam has been gaining in popularity for China-plus-one investors. Increased costs in China and trade tensions with the US have forced several international businesses to complement their China operations by shifting production to other countries in the region.

The reason why Vietnam then features high on the radar for foreign businesses scaling up or choosing alternate sites outside China is its success in creating an adaptable production base—one that is also geared towards higher valued manufacturing.

It’s not just a China-plus-one, but a ‘China-plus-many’ strategy

But it isn’t just Vietnam, other countries, such as Indonesia, Thailand, India, Malaysia, and Bangladesh are also high on the radar for foreign companies as they look to diversify their production.

While China still offers myriad strategic advantages, such as comprehensive supply chains, highly developed infrastructure, and a wealth of talent, expertise, and know-how, other countries in the region offer lower costs, better trade integration and stable political environments.

Investors are thus choosing to supplement Chinese operations with low-cost inputs sourced from production facilities in places like India, Indonesia, and Vietnam to minimize risks of trade and supply chain disruption. Thus many investors are restructuring their supply chains that operate under a China-plus-many scheme as fleshed out in this article by my colleague Marco Förster.

Rather than a China-plus-one, we’re seeing a China-plus-many, where global supply chains are being structured with production happening in several countries to reduce costs and hedge risks.

The countries poised to benefit are typically those that provide low-cost operations and labor, while also boasting relatively developed infrastructure and supply chains integrated with the wider region and the end market. For companies seeking to maintain operations in Asia, potential candidates include Vietnam, Indonesia, India, and Malaysia among others.

While these countries provide low-cost alternatives to China, markets like South Korea and Japan may also serve as ideal destinations for high-value production and technological innovation. Western countries, in particular, can benefit from close trade and political ties with these countries.

How to choose the ideal location?

Navigating Asia’s business landscape is difficult for most foreign firms. This is more so when they have to consider moving business activity out of China.

Every country in Asia has a different set of strengths in so far as the manufacturing process goes, and many factors will be considered when rebuilding supply chains outside of China.

But not only this, natural disasters, geopolitical tensions, trade disputes, pandemics, or economic downturns in a market can disrupt the supply chain and lead to production delays or shortages. We saw this happen with the COVID-19 pandemic. While it is challenging to anticipate unexpected shifts, diversifying your operations can reduce the impact that such disruptions may have on your business.

Each country’s political system, labor market, infrastructure, and regulatory environment, for example, is very different. This complexity makes it quite challenging to decide which market best aligns with your business needs and will help your business thrive.

To make such decisions, investors should do their research and due diligence to ensure they pick the right location or several locations for their business expansion or restructuring. Without the right information, businesses can suffer losses, missed opportunities, and unnecessary roadblocks.

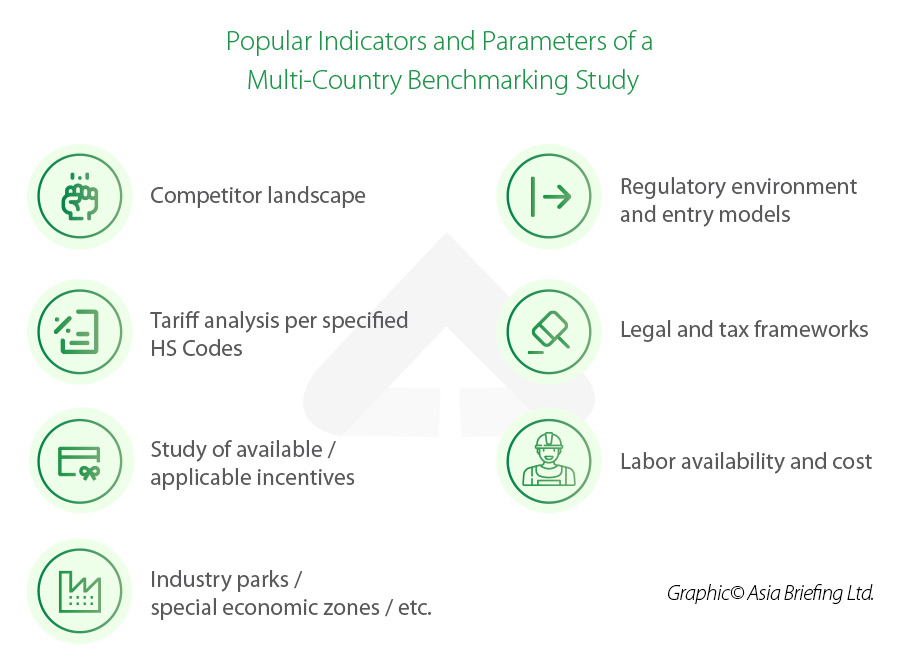

To make an informed decision, clients often use our Business Intelligence’s Multi-Country Benchmarking services. When embarking on such benchmarking projects, investors may have a country in mind that they would like to invest in, but after they do the required research, they may find that the country in question is not as suitable as they thought, or that another country is strong in another area.

While each study is tailor made to the client requirements, we outline several parameters that are typically used when embarking on a benchmarking study as explained below.

Political landscape

A country’s political environment and stability can significantly impact the ease of doing business, investment opportunities, and overall business growth. For instance, a stable government with a strong, dominant party may indicate a long-term commitment to certain investment attitudes and priorities. Conversely, any signs of domestic unrest can adversely affect a businesses’ operations. Moreover, it’s important to examine non-tariff barriers that may exist and complicate operations, such as bureaucratic measures, domestic subsidies linked to populist policies, and so on.

Economic environment

Examining the economic environment and key economic indicators is crucial for understanding the current and future potential of a market. These factors directly influence the opportunities and challenges your business may encounter. For instance, currency volatility can make it challenging to accurately predict cash flow, as sudden price drops may decrease your profit margin while your costs remain constant.

Legal and regulatory environment

A favorable legal and regulatory framework can greatly impact your ability to operate smoothly and minimize risks. Analyzing current frameworks offers a comprehensive overview of regulatory and administrative procedures in different countries. This understanding allows you to assess how your operations will be treated and the extent of regulatory risks you may encounter in the target markets.

Structuring analysis

This analysis explores how you can capitalize on the optimal options for setting up your business. Researching available options, the processes involved, any special licensing requirements, and methods for repatriating profits back to headquarters is essential. These details offer a good understanding of the potential setup timeline and the feasibility of establishing your presence in the target country. You don’t want to be caught off guard by unexpected requirements that could derail your plans and other operations dependent on them. Additionally, it’s crucial to select the right entity for your business needs—one that allows legal operation and is structured to minimize costs.

Locations for manufacturing

Significant regional variations exist within each country, with specific locales or areas better suited for particular industries. When considering this parameter, it is important to compare manufacturing areas within the target countries that fit your sector. Gather and analyze data to assess the country’s overall suitability compared to others. You may even choose a more granular approach, comparing selected economic zones or regions in one country against those in another for a deeper analysis.

Labor review

Labor laws in each country vary significantly, and companies must carefully consider which laws and regulations may apply. It’s also important to ensure you can find enough (or the right) skilled labor for your sector and investigate best practices to protect yourself and your employees while encouraging retention.

Logistics review

Logistical infrastructure in each country can vary significantly. Businesses must carefully assess logistic costs and capabilities. A logistics review looks at existing networks and associated costs within target countries to help you understand the costs and time required to transport goods within and between markets.

Tax and tariffs

This is an important one. Tax regimes can be complex and vary significantly from country to country. Investors should examine existing policies to understand the extent of their tax exposure in various countries. While many countries in South and Southeast Asia have adopted appealing tax regimes to attract foreign investment, investors will still need to understand if the tax environment will allow them to run and grow their business. Reviewing the tax regimes can also help grasp how to structure the entity to minimize the tax burden. However, it is advisable to speak to a tax professional to fully understand how to structure the investment before market entry and take advantage of all available tax efficiencies.

While the above list is not comprehensive, it provides a general overview of the parameters that are typically used in a country benchmarking study.

Choose a professional services provider to conduct a multi-country benchmarking study

It goes without saying that without proper due diligence, the risk of your investment failing is higher. Thus, it is strongly advised that businesses and investors consult a professional service provider with on-the-ground experience to guide and navigate the complexities of setting up in the Asian market.

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, China, and India. For editorial matters, contact us here and for a complimentary subscription to our products, please click here. For assistance with investments into Vietnam, please contact us at vietnam@dezshira.com or visit us at www.dezshira.com.

Dezan Shira & Associates assists foreign investors throughout Asia from offices across the world, including in Hanoi, Ho Chi Minh City, and Da Nang. We also maintain offices or have alliance partners assisting foreign investors in China, Hong Kong SAR, Dubai (UAE), Indonesia, Singapore, Philippines, Malaysia, Thailand, Bangladesh, Italy, Germany, the United States, and Australia.

- Previous Article ¿Es Vietnam una economía de mercado? EE.UU. estudia mejorar su estatus

- Next Article Vietnam’s Latest Draft Decree on Sanctions for Cybersecurity Violations